- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Plastics Market Size, Industry Report, 2033GVR Report cover

![Middle East Plastics Market Size, Share & Trends Report]()

Middle East Plastics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (PE, PP, PU, PVC, PET, PS, ABS, PBT, PPO), By Application (Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-706-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Plastics Market Summary

The Middle East plastics market size was estimated at USD 22.20 billion in 2024 and is projected to reach USD 28.44 billion by 2033, growing at a CAGR of 2.8% from 2025 to 2033. Growing domestic manufacturing and industrialization are increasing demand for polymers as governments and firms expand downstream capacity to capture more value locally.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East plastics market with the largest revenue share of 35.92% in 2024.

- The Middle East plastics market in UAE is expected to grow at a substantial CAGR of 3.3% from 2025 to 2033.

- By product, the epoxy polymers segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033 in terms of revenue.

- By application, the roto molding segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue.

- By end use, the automotive segment is expected to grow at a considerable CAGR of 3.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 22.20 Billion

- 2033 Projected Market Size: USD 28.44 Billion

- CAGR (2025-2033): 2.8%

This drives purchases of both commodity resins and higher margin engineered plastics and encourages investment in converters and local supply chains. Gulf producers are accelerating a strategic pivot from fuels to petrochemicals, creating a clear trend of upstream producers adding large scale polyolefin capacity and pursuing cross border consolidations to secure market share. This industrial reshaping is driving greater integration between feedstock owners and converters, while buyers increasingly demand higher specification engineering grades and recycled content. The net effect is a plastics sector that is becoming more capital intensive and vertically integrated, with companies prioritizing scale and portfolio differentiation.

Drivers, Opportunities & Restraints

Regulatory action and state led investments in waste management and recycling are a primary short to medium term driver for the region. Governments and sovereign investment vehicles are funding collection, sorting and chemical recycling projects and implementing phased bans on single use items, which is increasing the availability of recycled feedstock and changing procurement criteria among corporations. As regulators tighten standards and public procurement factors in sustainability, manufacturers must adapt product design and supply chains to remain competitive.

There is a significant commercial opening for players that can convert regulatory pressure into differentiated offerings. Producers with the capital to retrofit plants for mechanical and chemical recycling or to blend recycled content can capture premium contracts from retail, food and industrial customers who value compliant, lower carbon inputs. Strategic partnerships between petrochemical majors, technology providers, and national recycling platforms can unlock new export streams of higher value engineered polymers and recycled resins, improving margins beyond commodity polyolefins.

At the same time, the industry faces tightening regulatory constraints and reputational scrutiny that can depress demand for certain product segments and raise compliance costs. A wave of single use product restrictions, uneven recycling infrastructure and the potential for regional oversupply of basic polymers create margin pressure for undifferentiated commodity producers. Feedstock price volatility tied to global energy markets further complicates investment calculus, increasing the risk profile for greenfield capacity unless firms can secure long term offtake or pivot into higher margin specialties.

Market Concentration & Characteristics

The market growth stage of the Middle East plastics market is low, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as SABIC, Borouge PJSC, The National Petrochemical Industrial Company (NATPET), Advanced Petrochemical Company, Sahara International Petrochemical Company (Sipchem), National Industrialization Company (TASNEE), and Gulf Petrochemical Industries Company (GPIC) B.S.C., among others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The Middle East market is shifting from commodity processing toward technology-led value creation, with clear innovation in advanced recycling, bio-based polymers, and application-specific formulations. Large regional players are scaling chemical recycling and circular platforms while local startups are piloting plant based resins and tailored polymer blends to meet sustainability specifications.

Additive manufacturing and composite materials are being seeded into industrial uses, enabling faster prototyping and lighter parts for sectors such as construction and automotive. Collectively these moves are changing supplier economics by raising technical entry barriers and creating premium niches for certified low carbon inputs

Regulatory action across the Gulf and Levant is acting as a market shaping force that accelerates recyclability requirements, restricts single use products and raises compliance expectations for producers and converters. Policy steps from city level resolutions to national bans are redirecting demand toward recyclable formats and certified recycled content, forcing supply chains to adapt product design, traceability and procurement practices.

The uneven timing and scope of rules across jurisdictions increases operating complexity, but it also creates arbitrage for firms that can quickly certify and scale compliant alternatives. As a result, regulation both compresses margins for undifferentiated commodity players and creates commercial advantage for companies that can offer regulatory aligned, higher value solutions.

Product Insights

Polyethylene (PE) segment dominated the Middle East plastics market in terms of revenue, accounting for a market share of 24.31% in 2024, and is forecasted to grow at 1.8% CAGR from 2025 to 2033.PE remains the backbone resin for pipes, geomembranes, and low-cost packaging across the Gulf and Levant.

Rapid public and private infrastructure programs are sustaining steady off-take for HDPE and LLDPE grades while regional producers leverage advantaged feedstock to secure preferential supplies for converters. The immediate effect is robust baseline demand that supports brownfield upgrades and captive integration by producers.

The epoxy polymers segment is anticipated to grow at the fastest CAGR of 7.4% through the forecast period. Demand for epoxy systems is being driven by large scale construction, protective coatings for marine and infrastructure assets, and growing use of composites in specialist fabrication.

Owners and contractors are specifying higher performance, low volatile organic compound epoxy formulations for durability and lifecycle value, which is accelerating adoption of waterborne and specialty chemistries. This premium technical focus is creating openings for local formulators and international suppliers with rapid supply and certification capabilities.

Application Insights

Injection molding segment dominated the Middle East plastics market in terms of revenue, accounting for a market share of 42.15% in 2024, and is anticipated to grow at 2.3% CAGR over the forecast period. Policy led industrial expansion under national diversification programs is pushing OEMs to source locally, which lifts demand for injection molded components across appliances, electricals and packaging. That shift is prompting investment in modern injection machinery, automation, and toolmaking to improve part complexity and yield. As converters scale, buyers expect tighter quality, shorter lead times and greater value engineering from regional suppliers.

The roto molding segment is anticipated to grow at a significant CAGR of 4.7% through the forecast period. Rotational molding is benefiting from practical demand for large hollow parts such as water and chemical tanks, playground equipment and industrial housings that require low tooling cost and long service life. Infrastructure and water management projects across the region favour roto solutions for customization and durability, lifting order books for local fabricators who can supply engineered polyethylene grades at scale. The segment’s growth is therefore structural and project driven rather than commodity cyclical.

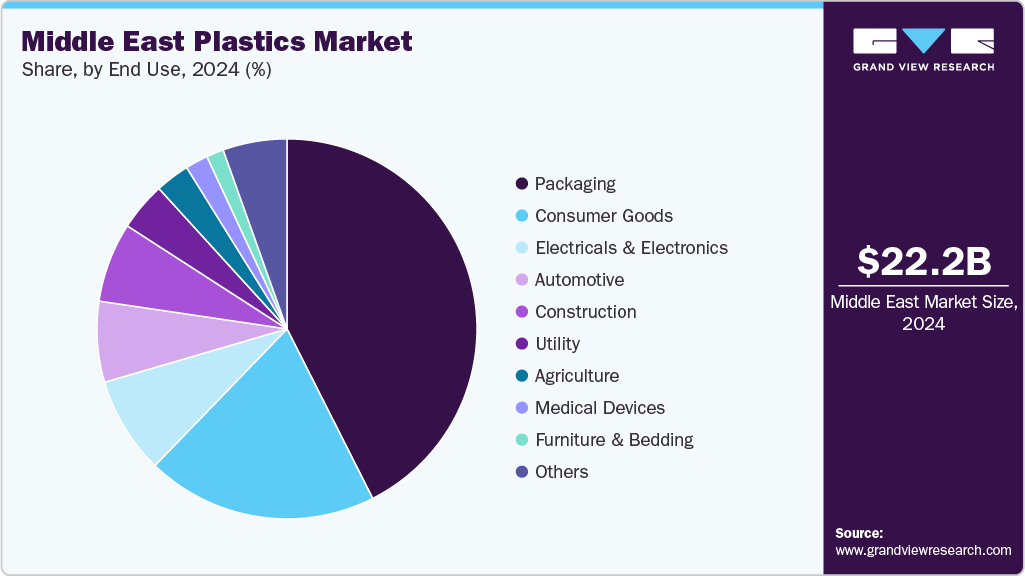

End Use Insights

Packaging dominated the Middle East plastics market across the end use segmentation in terms of revenue, accounting for a market share of 42.55% in 2024 and is anticipated to grow at 2.6% CAGR over the forecast period. A wave of single use plastic regulations and retailer sustainability procurement is reorienting packaging demand toward recyclable formats and higher recycled content.

At the same time expanding food service, hospitality and e-commerce volumes require flexible, lightweight packaging that meets both logistics and circularity criteria. Suppliers that can certify recyclability, offer closed loop takeback or supply compliant alternatives win premium shelf space and long term contracts.

The automotivesegment is expected to expand at a substantial CAGR of 3.9% through the forecast period.The region’s push to build domestic EV and component ecosystems is elevating demand for engineered plastics used in battery enclosures, thermal management parts and lightweight body components.

Sovereign fund backed programmes and new OEM projects are setting localization targets that create long lead windows for tier one suppliers and polymer compounders able to meet automotive qualification standards. This structural move is increasing the share of higher margin engineering resins in the regional plastics mix.

Country Insights

Saudi Arabia Plastics Market Trends

Saudi Arabia held the largest share of 35.92% in terms of revenue of the Middle East plastics market in 2024 and is expected to grow at the fastest CAGR over the forecast period. The kingdom’s dominant driver is its deliberate move to convert advantaged hydrocarbon feedstock into higher value polymers through large scale downstream projects and corporate consolidation.

Strategic expansions by national champions and international partners are increasing cracker capacity and locking in reliable resin supply for local converters, which shifts competition toward scale and forward integration. At the same time sovereign investment in waste management and recycling platforms is beginning to create domestic recycled feedstock pools, smoothing the pathway for converters to meet new sustainability procurement requirements. This combination of resource security, vertical integration and public sector recycling programs makes Saudi Arabia the principal demand and investment hub in the region.

UAE Plastics Market Trends

The UAE’s fastest growing profile is being driven by a policy and commercial ecosystem that pushes circularity while leveraging world class logistics and free zones to attract converters and brand owners. National measures to phase out single use items and the broader net zero agenda are creating immediate demand for recyclable formats and certified recycled content, which local producers and specialty compounders are racing to supply. At the same time strong public private collaboration and sustainability commitments by major industrial players are turning the UAE into a testing ground for new polymer formulations and closed loop solutions that can be exported across the Gulf and Levant.

Key Middle East Plastics Company Insights

The Middle East Plastics Market is highly competitive, with several key players dominating the landscape. Major companies include SABIC, Borouge PJSC, The National Petrochemical Industrial Company (NATPET), Advanced Petrochemical Company, Sahara International Petrochemical Company (Sipchem), National Industrialization Company (TASNEE), Gulf Petrochemical Industries Company (GPIC) B.S.C., Gulf Plastic Industry Company, Zamil Plastic Industries Co. (Zamil Plastic), National Plastic Factory LLC. The Middle East plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Middle East Plastics Companies:

- SABIC

- Borouge PJSC

- The National Petrochemical Industrial Company (NATPET)

- Advanced Petrochemical Company

- Sahara International Petrochemical Company (Sipchem)

- National Industrialization Company (TASNEE)

- Gulf Petrochemical Industries Company (GPIC) B.S.C.

- Gulf Plastic Industry Company

- Zamil Plastic Industries Co. (Zamil Plastic)

- National Plastic Factory LLC

Recent Developments

-

In July 2025, the Plastic Recycling Show Middle East & Africa (PRS ME&A) named the Circular Packaging Association (CPA) as its Official Knowledge Partner for the event’s third edition, held from September 15 to 17, 2025, in Dubai. This strategic collaboration aimed to accelerate the transition toward circular packaging systems and promote innovations that reduce waste, increase recycled content, and support sustainability agendas like the UAE’s Circular Economy Policy 2031.

-

In January 2025, Dubai expanded its ban on single-use plastic items, as part of its initiative to reach Net Zero Emissions by 2060. The move reflects Dubai's commitment to reducing plastic waste and its environmental impact in line with sustainable development goals.

Middle East Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.78 billion

Revenue forecast in 2033

USD 28.44 billion

Growth rate

CAGR of 2.8% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, country

Regional scope

Middle East

Country Scope

Saudi Arabia; UAE; Oman; Kuwait; Qatar; Bahrain; Israel; Turkey

Key companies profiled

SABIC; Borouge PJSC; The National Petrochemical Industrial Company (NATPET); Advanced Petrochemical Company; Sahara International Petrochemical Company (Sipchem); National Industrialization Company (TASNEE); Gulf Petrochemical Industries Company (GPIC) B.S.C.; Gulf Plastic Industry Company; Zamil Plastic Industries Co. (Zamil Plastic); National Plastic Factory LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Plastics Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East plastics market report based on product, application, end use, and country:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl chloride (PVC)

-

Polyethylene terephthalate (PET)

-

Polystyrene (PS)

-

Acrylonitrile butadiene styrene (ABS)

-

Polybutylene terephthalate (PBT)

-

Polyphenylene Oxide (PPO)

-

Epoxy Polymers

-

Liquid Crystal Polymers

-

Polyether ether ketone (PEEK)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Injection Molding

-

Blow Molding

-

Roto Molding

-

Compression Molding

-

Casting

-

Themroforming

-

Extrusion

-

Calendering

-

Others

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Packaging

-

Construction

-

Electricals & Electronics

-

Automotive

-

Medical Devices

-

Agriculture

-

Furniture & Bedding

-

Consumer Goods

-

Utility

-

Others

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The Middle East Plastics market size was estimated at USD 22.20 billion in 2024 and is expected to reach USD 22.78 billion in 2025.

b. The Middle East Plastics market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 28.44 billion by 2033.

b. Polyethylene (PE) dominated the Middle East plastics market across the product segmentation in terms of revenue, accounting for a market share of 24.31% in 2024 and is forecasted to grow at 1.8% CAGR from 2025 to 2033. PE remains the backbone resin for pipes, geomembranes, and low cost packaging across the Gulf and Levant.

b. Some key players operating in the Middle East Plastics market include SABIC, Borouge PJSC, The National Petrochemical Industrial Company (NATPET), Advanced Petrochemical Company, Sahara International Petrochemical Company (Sipchem), National Industrialization Company (TASNEE), Gulf Petrochemical Industries Company (GPIC) B.S.C., Gulf Plastic Industry Company, Zamil Plastic Industries Co. (Zamil Plastic), National Plastic Factory LLC

b. Growing domestic manufacturing and industrialization are increasing demand for polymers as governments and firms expand downstream capacity to capture more value locally. This drives purchases of both commodity resins and higher margin engineered plastics and encourages investment in converters and local supply chains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.