- Home

- »

- Catalysts & Enzymes

- »

-

Middle East Polyethylene Terephthalate Catalyst Market Report, 2033GVR Report cover

![Middle East Polyethylene Terephthalate Catalyst Market Size, Share & Trends Report]()

Middle East Polyethylene Terephthalate Catalyst Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Antimony-Based, Aluminum-based), By Application (Packaging, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-709-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Polyethylene Terephthalate Catalyst Market Summary

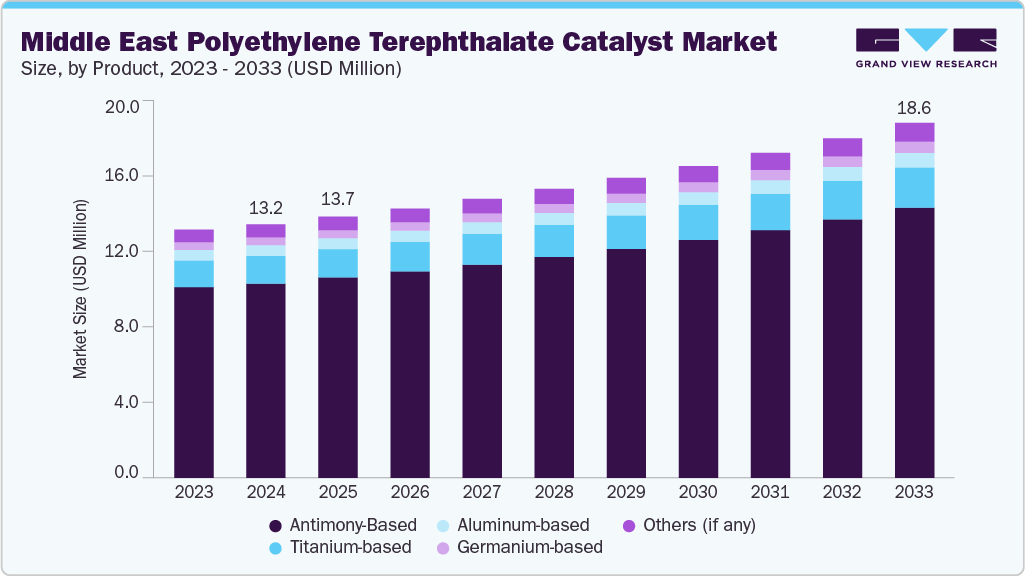

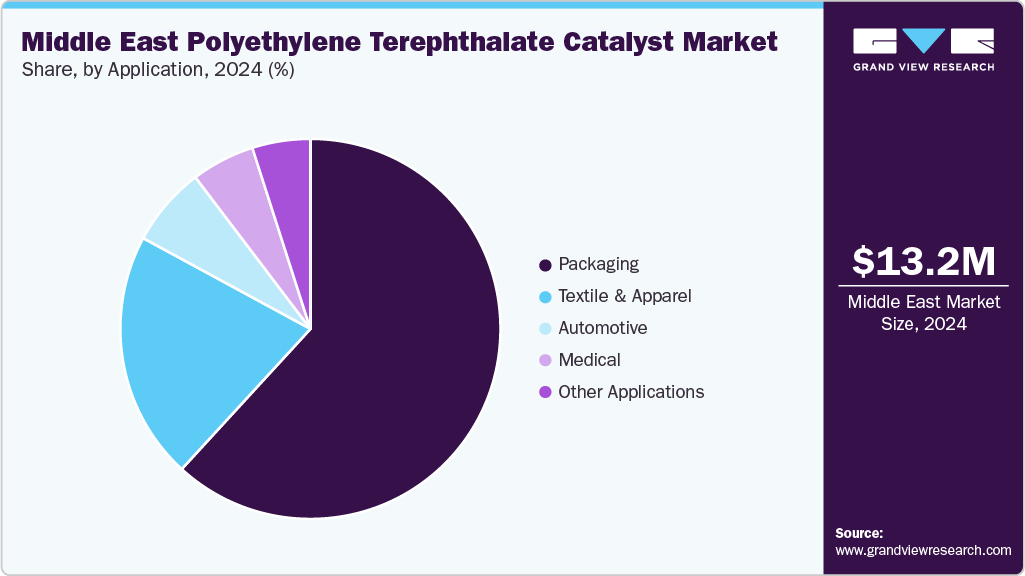

The Middle East polyethylene terephthalate catalyst market size was estimated at USD 13.2 million in 2024 and is projected to reach USD 18.6 million by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The market is driven by increasing demand for sustainable, high-performance plastic packaging across food, beverage, and consumer goods industries.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East polyethylene terephthalate (PET) catalyst market with the largest revenue share of 58.8% in 2024.

- The Middle East polyethylene terephthalate (PET) catalyst market is projected to grow at a CAGR of 3.9% from 2025 to 2033.

- By application, textile & apparelMiddle East polyethylene terephthalate (PET) catalyst market is expected to witness the fastest growth of 4.2% from 2025 to 2033.

- By application, packaging segment dominated the market with a revenue share of 61.8% in 2024.

- By product, antimony based dominated the Middle East polyethylene terephthalate (PET) catalyst market with a revenue share of 76.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.2 Million

- 2033 Projected Market Size: USD 18.6 Million

- CAGR (2025-2033): 3.9%

- Saudi Arabia: Largest market in 2024

- UAE: Fastest growing market

The region’s expanding food & beverage sector, coupled with rising urbanization and disposable incomes, is fueling demand for PET-based bottles, containers, and thermoformed trays, particularly due to their lightweight, durability, and recyclability. In addition, stringent product regulations and corporate sustainability commitments are accelerating the shift toward recycled PET (rPET), supported by advancements in catalyst technologies that enhance polymerization efficiency and material quality. The MEA region’s strategic investments in petrochemical infrastructure, particularly in Saudi Arabia, UAE, and South Africa, further bolster PET production capacity, while growing consumer preference for transparent, tamper-proof packaging strengthens PET’s dominance over alternatives like PVC and PP.

The market is witnessing robust growth in the MEA automotive sector, driven by the increasing adoption of PET-based materials for interior components, safety systems, and under-the-hood applications. Key demand drivers include stringent product regulations promoting recycled PET usage, the need for lightweight materials to improve fuel efficiency, and PET's superior durability and cost-effectiveness compared to conventional alternatives. Expanding automotive manufacturing hubs across Morocco, South Africa, and Turkey further accelerates demand for high-performance PET in seat belts, airbags, and noise-reducing interior panels. Technological advancements in PET catalysts enable the production of materials with optimal strength and thermal stability, supporting the shift toward sustainable automotive textiles and composites. With automakers increasingly prioritizing eco-friendly and high-performance materials, the PET catalyst market is poised for sustained growth as a critical enabler of next-generation automotive manufacturing in the MEA region.

The growing demand for polyethylene terephthalate (PET) sheets in the Middle East and Africa (MEA) construction sector is driven by several key factors. Sustainability and recyclability are major market drivers. PET sheets offer an eco-friendly alternative to traditional materials like PVC, aligning with the region’s increasing focus on green building practices. In addition, cost-effectiveness plays a crucial role. PET sheets provide superior mechanical strength, weather resistance, and long-term durability at a competitive price, making them an attractive choice for large-scale infrastructure projects and increasing the demand for PET catalysts in the MEA region. However, while showing strong growth potential, the market faces several constraints that may hinder its expansion. Stringent regulations across the region, particularly regarding emissions control and wastewater management in polymer production, increase compliance costs for manufacturers.

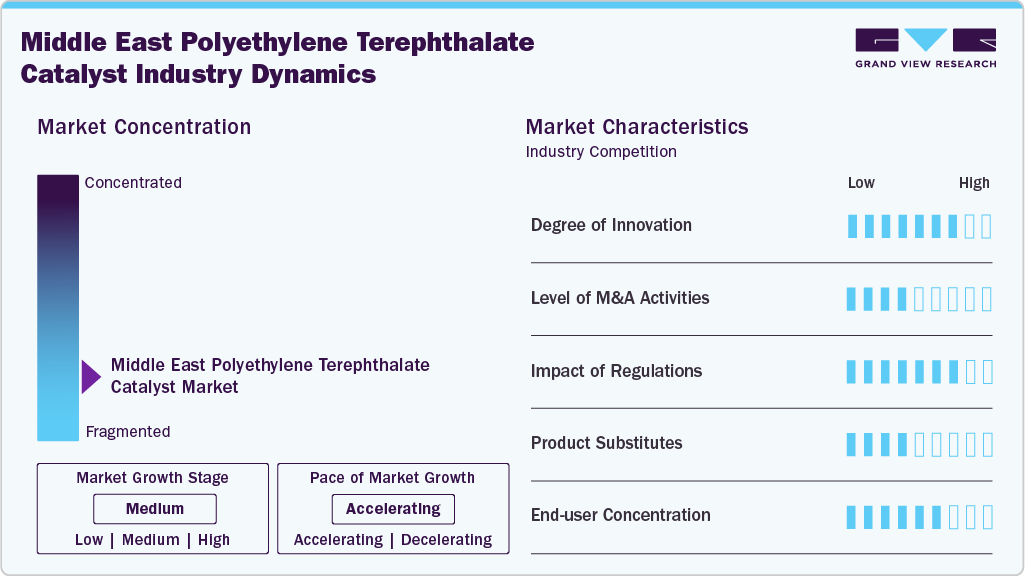

Market Concentration & Characteristics

The Middle East polyethylene terephthalate (PET) catalyst industry is moderately fragmented, with a few dominant players holding substantial market share due to their extensive vertical integration and scale of operations. These leading companies leverage control over the entire value chain, from raw material sourcing and catalyst production to distribution, which enables them to achieve cost efficiencies, maintain consistent product quality, and ensure reliable supply. Their integrated infrastructure, strong regional distribution networks, and advanced technological capabilities allow them to effectively serve key industries such as packaging, textiles, and consumer goods. This strategic positioning also supports adherence to stringent regional regulatory standards and enhances their capacity to meet the growing demand for sustainable, high-performance PET products across the Middle East.

At the same time, emerging players across the Middle East region are gradually expanding their presence by leveraging regional advantages such as growing industrialization, increasing demand in packaging and textiles, and investments in advanced production technologies. These newer entrants focus on cost-effective catalyst manufacturing and cater to key sectors including flexible packaging, bottles, and films, targeting both domestic consumption and export markets. This evolving landscape, characterized by the coexistence of established dominant players and agile regional companies capitalizing on local resources and market needs, is reshaping the competitive dynamics of the PET catalyst market in the Middle East.

However, the PET catalyst market in the region also faces several challenges, including supply chain disruptions, fluctuating raw material prices, and regulatory pressures related to product sustainability. Climate-related factors such as rising temperatures, water scarcity, and extreme weather events threaten industrial operations and raw material availability. These Product and regulatory challenges underscore the urgent need for innovation and adaptation within the PET catalyst industry to ensure resilient and sustainable growth in the Middle East region.

Product Insights

The antimony-based segment dominated the market and accounted for the largest revenue share of 76.8% in 2024, driven by the widespread use of antimony trioxide as a primary catalyst in PET production. PET is extensively used in food and beverage packaging due to its transparency, lightweight nature, and barrier properties. Antimony catalysts remain in the PET resin, which is crucial in polymerization. Despite concerns about antimony migration from PET bottles into bottled water and other beverages, the levels generally comply with regulatory limits set by authorities such as the European Union and the US Product Protection Agency. Moreover, in the MEA region, where climatic conditions often involve higher temperatures, understanding the migration behavior of antimony is essential to ensure product safety and regulatory compliance. Moreover, the growing demand for PET packaging in the region’s expanding food and beverage sector drives the market for efficient and cost-effective antimony-based catalysts.

The titanium based segment is expected to grow fastest with a CAGR of 4.5% from 2025 to 2033 during the forecast period, driven by the unique advantages that titanium offers in catalyst design and performance. Titanium’s distinct electronic structure, high stability, and redox activity enhance catalytic efficiency during PET polymerization. Titanium-based catalysts also provide superior thermal and chemical stability compared to traditional catalysts, improving the quality and durability of PET products. Furthermore, titanium catalysts facilitate better control over polymer properties such as molecular weight and crystallinity, critical for producing PET with desirable mechanical and barrier characteristics. These benefits, combined with increasing demand for high-performance and sustainable PET applications in packaging, textiles, and films, accelerate the market adoption of titanium-based PET catalysts. Furthermore, ongoing research in synthesis methods and structural optimization of titanium catalysts continues to enhance their effectiveness and expand their practical applications, making them a promising choice for the evolving PET industry.

Application Insights

Packaging by application dominated with a revenue market share of 61.8% in 2024, due to the growing demand for PET catalysts in packaging, particularly for sheets and films, which is driven by PET’s versatile properties and wide-ranging applications. PET films and sheets offer excellent tensile strength, high barrier performance, and superior chemical resistance, making them ideal for flexible packaging, advertising displays, insulation, and various industrial uses. Their lightweight, durability, and cost-effectiveness enable manufacturers to produce reliable, recyclable packaging solutions such as stand-up pouches, refill packages, and protective sheets. These advantages fuel the need for advanced PET catalysts that enhance the production efficiency and quality of PET films and sheets in the packaging industry.

The textile & apparel market segment is expected to grow fastest with a CAGR of 4.2% from 2025 to 2033 during the forecast period due to the wide use of PET as a synthetic fiber, valued for its affordability, strength, durability, and resistance to shrinking, stretching, and wrinkling. These properties make PET an essential material in the textile and apparel industry, extensively used for clothing, home furnishings, and various industrial applications. One notable trend is using recycled PET (rPET), commonly sourced from plastic bottles, in producing fleece garments and blankets, supporting sustainability efforts within the sector. In addition, PET is often blended with natural fibers such as cotton to create polycotton fabrics, which are lightweight, breathable, and widely favored for shirts, blouses, and everyday apparel. The versatility and cost-effectiveness of PET fibers have significantly contributed to the rise of fast fashion, characterized by rapid production cycles, evolving trends, and shorter garment lifespans. This fast-paced demand places a continuous need for efficient and sustainable manufacturing processes, driving market growth. Catalysts play a crucial role in PET fibers' polymerization and recycling processes, enhancing production efficiency and enabling the large-scale manufacture of high-quality fibers tailored for the textile industry.

Regional Insights

Middle East Polyethylene Terephthalate (PET) Catalyst Market Trends

The Middle East Polyethylene Terephthalate (PET) Catalyst market held a substantial share in 2024, driven by rapid textile and apparel industry growth, particularly in polyester fiber production. Countries such as Egypt, South Africa, and Ethiopia are experiencing expanding textile manufacturing capabilities, fueled by government initiatives, foreign investments, and rising domestic consumption. PET catalysts play a crucial role in producing high-quality polyester fibers widely used in clothing, home furnishings, and industrial textiles. This growth is further supported by the region’s access to raw materials, cost-competitive labor, and increasing exports to global markets, positioning PET catalysts as a key enabler of industrial and economic development in the MEA textile sector. For instance, in April 2025, Egypt launched two major recycling projects in Kafr El-Dawar to produce 30,000 tonnes of recycled polyester fiber annually, boosting the synthetic textile sector in the MEA region. This growth drives demand for efficient PET catalysts essential for recycling processes. This large-scale production of recycled polyester fiber highlights the growing synthetic textile sector in the Middle East and Africa region, driving the demand for efficient PET catalyst systems essential for depolymerization and repolymerization processes in recycling. These developments reflect the region's strategic shift toward circular economy practices and present a significant market opportunity for PET catalyst suppliers to support sustainable textile manufacturing in MEA.

Saudi Arabia Polyethylene Terephthalate (PET) Catalyst Market Trends

The polyethylene terephthalate (PET) catalyst market in Saudi Arabia held a market revenue share of 58.8% in 2024, strongly driven by the rapid expansion of the country’s food and beverage packaging sector, particularly in bottled water, carbonated soft drinks, and packaged foods. PET is widely favored in Saudi Arabia’s packaging industry due to its excellent water and moisture barrier properties, chemical resistance at high temperatures, and suitability for direct food contact applications. Its versatility allows it to be used in packaging films, thermoformed trays, bottles, and containers, with water and soft drink bottles accounting for a significant share of PET usage. PET offers numerous advantages that are particularly important for Saudi Arabia’s beverage and food producers, including its lightweight yet strong nature, resistance to breakage, and transparency that showcases the product to consumers. Compared to glass, PET bottles drastically reduce packaging weight, making transportation more cost-effective and energy-efficient, and improving safety during filling, handling, and distribution. In addition, PET’s gas barrier properties help maintain carbonation and freshness, while its recyclability supports Saudi Arabia’s increasing focus on sustainable packaging solutions.

Oman Polyethylene Terephthalate (PET) Catalyst Market Trends

The polyethylene terephthalate (PET) catalyst market in Oman is expected to grow fastest with a CAGR of 4.2% from 2025 to 2033 during the forecast period due to PET's widespread adoption across the electronics and electrical (E&E) industry, driven by the material’s excellent insulation, thermal stability, and mechanical strength. PET is extensively used in flexible printed circuits (FPCs), insulating films, wiring & cables, and PCB packaging, where high dielectric strength and chemical resistance are critical. The growing demand for miniaturized, lightweight, and high-performance electronic components further accelerates PET’s usage, particularly in flexible displays, wearable devices, and energy-efficient lighting systems. Advancements in PET catalyst technologies enhance polymerization efficiency, enabling the production of high-purity PET with superior thermal endurance and electrical insulation properties, ideal for heat-resistant insulating films and circuit boards.

Key Middle East Polyethylene Terephthalate Catalyst Company Insights

Some key players operating in the market include SABIC and Honeywell International Inc.

- SABIC, headquartered in Riyadh, Saudi Arabia, is a dominant and mature player in the Middle East Polyethylene Terephthalate (PET) Catalyst market in the Middle East (MEA) region. As one of the world’s largest diversified chemical companies, SABIC holds a strong position across the PET value chain, from catalyst development and production to polymer manufacturing and downstream applications in packaging, textiles, and industrial products. The company operates an extensive network of manufacturing plants, R&D centers, and technical service hubs strategically located across the MEA region, enabling it to efficiently serve domestic and export markets. SABIC’s catalyst operations are a critical part of its petrochemical leadership, with significant investments aimed at localizing advanced catalyst production under Saudi Vision 2030. Through initiatives like the Shareek program, SABIC establishes dedicated catalyst manufacturing facilities, including plants for polymer-related catalysts vital in PET production. This vertical integration strengthens supply chain resilience, reduces import dependence, and supports the regional push toward industrial self-sufficiency.

Albemarle Corporation and GRACE are emerging market participants.

- Albemarle Corporation, headquartered in Charlotte, North Carolina, is an emerging and innovative player in the Middle East Polyethylene Terephthalate (PET) Catalyst market within the Middle East (MEA) region, with a strong emphasis on advanced catalyst technologies and sustainable chemical solutions. Leveraging its global expertise in specialty chemicals, Albemarle is steadily strengthening its MEA PET value chain footprint by providing high-performance catalyst systems that enhance polymerization efficiency, product quality, and process sustainability for regional PET producers. The company’s product portfolio includes proprietary catalyst formulations designed to optimize reaction rates, reduce energy consumption, and enable consistent PET resin clarity and intrinsic viscosity, as well as key application parameters in beverage bottles, packaging films, and engineering plastics. Albemarle’s MEA strategy focuses on strategic collaborations with regional polymer manufacturers, technical service support, and capacity expansion initiatives that align with the region’s growing PET production capabilities. The corporation is also investing in R&D to develop next-generation catalysts with lower Product impact, reduced heavy metal content, and improved recyclability compatibility.

Key Middle East Polyethylene Terephthalate Catalyst Companies:

- SABIC

- Clariant

- BASF SE

- Arkema

- GRACE

- Albemarle Corporation

- Honeywell International Inc.

- Indorama Ventures Public Company Limited.

- LyondellBasell Industries Holdings B.V.

- KMA SA MARKETING (PTY) Ltd.

Recent Developments

-

In May 2025, Johnson Matthey Plc (JM) announced an agreement to sell its Catalyst Technologies (CT) business to Honeywell International Inc. for £1.8 billion (enterprise value, cash- and debt-free). CT is a global leader in licensing process technologies and supplying catalysts, including those relevant to Polyethylene Terephthalate (PET) production. The deal gives Honeywell access to CT’s portfolio of more than 150 sustainable technology projects, strong market presence, and expertise in high-performance catalysts for polymer production. This acquisition significantly broadens Honeywell’s capabilities in PET catalyst technology, supporting its growth strategy in advanced materials and sustainable packaging solutions.

-

In March 2023, SABIC announced a strategic catalysts manufacturing project under Saudi Arabia’s Shareek program. The initiative aims to transform the Kingdom into a hub for specialized materials in line with Saudi Vision 2030. It focuses on localizing catalyst production to reduce reliance on imports, enhance energy sector competitiveness, and strengthen industries linked to oil, gas, and petrochemicals.

Middle East Polyethylene Terephthalate Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.7 million

Revenue forecast in 2033

USD 18.6 million

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Middle East

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel

Key companies profiled

SABIC, Clariant, BASF SE, Arkema, GRACE, Albemarle Corporation, Honeywell International Inc., Indorama Ventures Public Company Limited, LyondellBasell Industries Holdings B.V., KMA SA MARKETING (PTY) Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Polyethylene Terephthalate Catalyst Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East polyethylene terephthalate catalyst market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Antimony-Based

-

Aluminum-Based

-

Titanium-based

-

Germanium-based

-

Other Catalysts

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Packaging

-

Textile & Apparel

-

Automotive

-

Medical

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

-

Frequently Asked Questions About This Report

b. The Middle East polyethylene terephthalate catalyst market size was estimated at USD 13.2 million in 2024 and is expected to reach USD 13.7 million in 2025.

b. The Middle East polyethylene terephthalate catalyst market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2033 to reach USD 18.6 million by 2033.

b. The antimony-based Middle East polyethylene terephthalate (PET) catalyst segment led the market and accounted for the largest revenue share of 76.8% in 2024, driven by the widespread use of antimony trioxide as a primary catalyst in PET production. PET is extensively used in food and beverage packaging due to its transparency, lightweight nature, and barrier properties.

b. Some of the key players operating in the Middle East polyethylene terephthalate catalyst market include SABIC, Clariant, BASF SE, Arkema, GRACE, Albemarle Corporation, Honeywell International Inc., Indorama Ventures Public Company Limited., LyondellBasell Industries Holdings B.V., KMA SA MARKETING (PTY)Ltd

b. The growth in Middle East polyethylene terephthalate (PET) catalyst market is attributed to increasing demand for sustainable, high-performance plastic packaging across food, beverage, and consumer goods industries

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.