- Home

- »

- Advanced Interior Materials

- »

-

Middle East Sandstone Market Size, Industry Report, 2033GVR Report cover

![Middle East Sandstone Market Size, Share & Trends Report]()

Middle East Sandstone Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Building & Construction, Monuments & Memorials Paving & Civil Engineering), By Country (Saudi Arabia, UAE, Qatar, Oman), And Segment Forecasts

- Report ID: GVR-4-68040-747-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Sandstone Market Summary

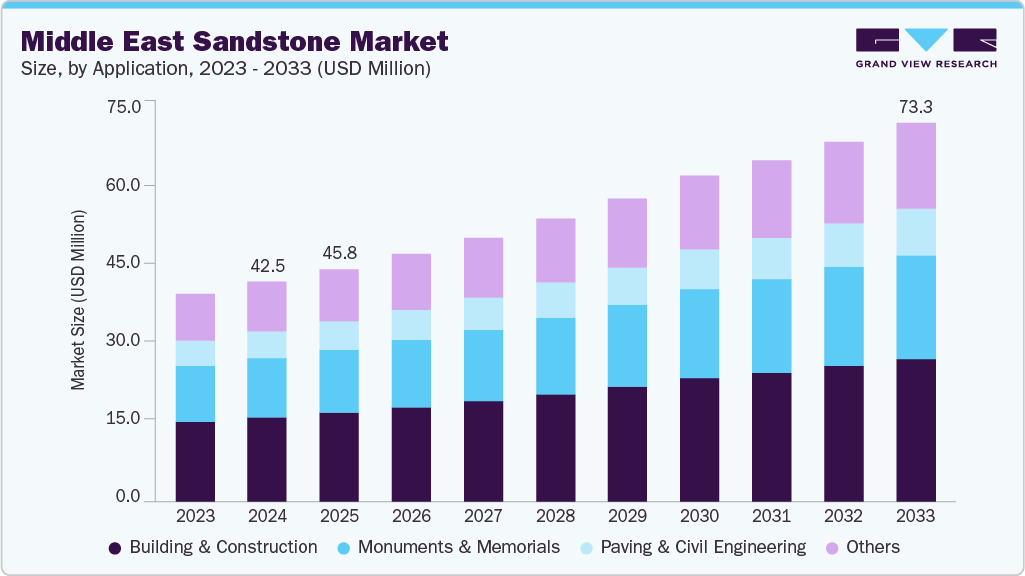

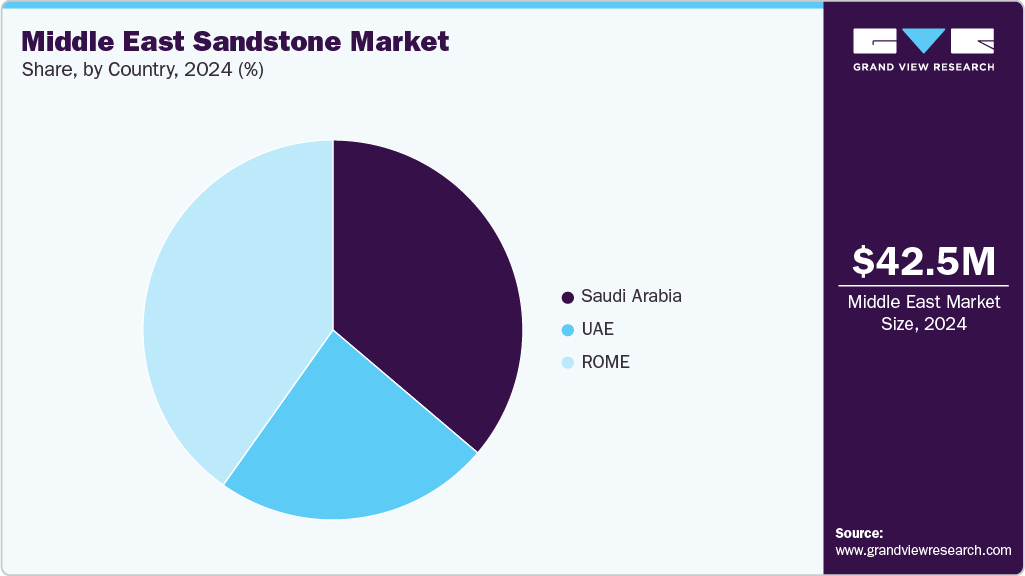

The Middle East sandstone market size was estimated at USD 42.5 million in 2024 and is projected to reach USD 73.3 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market is expanding steadily as construction activities gain momentum across the region. Large-scale infrastructure projects, urban development plans, and government-led initiatives create substantial demand for durable and aesthetically appealing building materials.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East sandstone market with the largest market revenue share of 36.2%.

- Sandstone market in UAE is expected to grow at a substantial CAGR of 6.6% from 2025 to 2033.

- By application, building & construction segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.5 Million

- 2033 Projected Market Size: USD 73.3 Million

- CAGR (2025-2033): 6.3%

Sandstone, known for its strength and weather resistance, is increasingly being chosen for flooring, wall cladding, and exterior applications in residential and commercial projects. The region’s rapid urbanization and population growth fuel construction investments, thereby supporting sandstone demand.Tourism development is another major driver of sandstone consumption in the Middle East. Countries such as Saudi Arabia, the UAE, and Qatar are investing heavily in cultural and heritage projects, luxury hotels, resorts, and entertainment hubs. Sandstone is widely used in landscaping, decorative facades, and heritage restoration because of its natural appearance and long-lasting properties. These projects aim to attract international visitors while preserving traditional architectural styles, further enhancing the adoption of sandstone across modern and traditional designs.

The growing trend of sustainable and natural construction materials drives sandstone demand in the Middle East. With increasing awareness around eco-friendly building solutions, sandstone is gaining preference over synthetic alternatives due to its minimal processing requirements and recyclability. Developers focus on green building certifications, and natural stone materials such as sandstone, which aligns well with these initiatives. This sustainability-driven shift is expected to create consistent long-term demand, particularly in urban centers where environmentally responsible construction is prioritized.

Rising investments in infrastructure related to religious, cultural, and governmental buildings also boost sandstone consumption. Due to its natural elegance and durability, sandstone has been a traditional choice for mosques, monuments, and civic structures. Governments in the Middle East are actively promoting architectural projects that highlight cultural identity while incorporating modern functionality. This blend of tradition with contemporary design strengthens sandstone’s role as a preferred material in the region’s expanding construction sector.

Expanding local quarrying and stone processing industries improves sandstone availability across Middle Eastern markets. Investments in quarrying technology, coupled with regional trade partnerships, are helping to reduce reliance on imports while ensuring a consistent supply. Countries with abundant stone reserves increasingly export sandstone to neighbouring nations, promoting regional self-sufficiency and trade growth. This improved accessibility, supported by cost competitiveness, further fuels sandstone adoption across multiple end-use sectors.

Drivers, Opportunities & Restraints

The Middle East sandstone market is primarily driven by large-scale regional construction and infrastructure development. Rapid urbanization, population growth, and government-backed initiatives in residential, commercial, and public infrastructure projects fuel demand for durable and visually appealing materials such as sandstone. Its use in flooring, cladding, landscaping, and heritage restoration projects further strengthens its adoption, especially in countries investing heavily in cultural and tourism infrastructure, such as Saudi Arabia, the UAE, and Qatar. The rising preference for natural and sustainable building materials supports sandstone’s growth trajectory.

Expanding quarrying and processing facilities within the region can reduce import dependency and enhance cost competitiveness. Increasing investments in smart cities, luxury hospitality projects, and religious tourism infrastructure create a favorable environment for sandstone suppliers. Moreover, the focus on sustainable construction and eco-friendly natural stone materials opens up new avenues for growth. Export potential to neighboring countries with growing construction sectors adds another opportunity for regional players.

Restraints include fluctuating raw material costs, high transportation expenses, and competition from alternative materials like granite, marble, and engineered stone. Environmental concerns linked to quarrying activities may also lead to stricter regulations, impacting supply and production costs. Furthermore, economic uncertainties and fluctuations in regional construction investments can slow down demand.

Application Insights

The building and construction segment represents the largest application area within the market. Mega developments across the region, including tourism, entertainment, and mixed-use projects in Saudi Arabia and the UAE, are creating a strong appetite for premium natural materials that convey durability and prestige. Government spending under national visions and city master plans channel steady demand into façades, plazas, and public buildings where sandstone is specified for its architectural character.

Monuments & memorials segment is anticipated to register the fastest CAGR over the forecast period. The monuments and memorials segment in the Middle East sandstone market is driven by a cultural emphasis on preserving heritage and showcasing national identity. Countries in the region are investing heavily in landmark structures, museums, and commemorative sites that highlight history and tradition. Sandstone’s natural beauty, durability, and historic association with iconic architectural marvels make it a preferred material for constructing monuments that embody cultural pride and long-lasting significance.

Country Insights

Saudi Arabia Sandstone Market Trends

The sandstone market in Saudi Arabia is witnessing strong growth due to the country’s large-scale infrastructure and urban development programs under Vision 2030. Mega projects such as NEOM, the Red Sea Project, and Qiddiya are driving significant demand for high-quality building materials, with sandstone gaining importance for its aesthetic appeal and durability. Government-led investments in tourism, residential, and commercial hubs are fueling construction activity, creating steady opportunities for sandstone suppliers and processors.

UAE Sandstone Market Trends

The sandstone market in the UAE is expanding rapidly due to the country’s ambitious infrastructure and real estate projects. Large-scale developments in Dubai and Abu Dhabi, including luxury hotels, mixed-use complexes, and cultural landmarks, are creating strong demand for premium natural stone. Sandstone is widely adopted for its versatility in façades, interiors, and landscaping, aligning with the UAE’s vision of building iconic urban spaces that attract global investors and tourists.

Key Middle East Sandstone Company Insights

Some of the key players operating in the market include Melange Stones, Saudi Marmo, and others

-

Melange Stones is a UAE-based company engaged in supplying and distributing premium quality natural stones for construction, interior design, and landscaping applications. The company has established a reputation for sourcing a wide range of materials from both local and international quarries, ensuring that clients receive high-quality products tailored to project needs. Its operations are centered around innovation in design, durability of products, and adherence to international quality standards, making it a trusted partner for architects, contractors, and developers across the region.

-

Saudi Marmo, part of the Al Ayuni Group, is a prominent stone manufacturer and supplier in Saudi Arabia with extensive quarrying and processing facilities. The company has built a strong presence in the regional natural stone industry by offering a wide selection of stones that meet domestic and international demand. Leveraging advanced machinery and a skilled workforce, Saudi Marmo ensures consistent product quality and the ability to undertake large-scale projects. Its commitment to quality and reliability has allowed it to supply materials for some of the most prestigious projects in the Kingdom and beyond.

Key Middle East Sandstone Companies:

- Al Tasnim Enterprises

- Art Stone International

- Fair Deal Marbles & Granite LLC

- Melange Stones

- National Quarries LLC

- Natural Stone Company

- Saudi Marble & Granite Factory Company (SMG)

- Saudi Marmo

- Steinart Group

Recent Development

-

In February 2024, the UAE inaugurated its first Hindu temple in Abu Dhabi, showcasing an impressive blend of traditional and modern architectural elements. A major highlight of the temple is its extensive use of pink sandstone sourced from northern Rajasthan, which forms the main backdrop for the intricate marble carvings and sculptures crafted by skilled Rajasthani artisans. Sandstone forms the core structural material supporting the temple’s grand facade and domes, providing durability and a distinct regional identity. Local motifs, including camels, are etched into the carvings, offering a sense of cultural harmony between Indian and Emirati heritage.

Middle East Sandstone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.0 million

Revenue forecast in 2033

USD 73.3 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Oman; Qatar

Key companies profiled

Al Tasnim Enterprises; Art Stone International; Fair Deal Marbles & Granite LLC; Melange Stones; National Quarries LLC; Natural Stone Company; Saudi Marble & Granite Factory Company (SMG); Saudi Marmo; Steinart Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Sandstone Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Middle East sandstone market report based on application and country.

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Building & Construction

-

Monuments & Memorials

-

Paving & Civil Engineering

-

Others

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East sandstone market size was estimated at USD 42.5 million in 2024 and is expected to reach USD 45.0 million in 2025.

b. The Middle East sandstone market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 73.3 million by 2033.

b. The building & construction segment dominated the market with a revenue share of 38.3% in 2024.

b. Some of the key players of the Middle East sandstone market are Al Tasnim Enterprises, Art Stone International, Fair Deal Marbles & Granite LLC, Melange Stones, National Quarries LLC, Natural Stone Company, Saudi Marble & Granite Factory Company (SMG), Saudi Marmo, Steinart Group, and others.

b. The key factor that is driving the growth of the Middle East sandstone market is driven by the increasing demand from the construction and infrastructure sectors, particularly for use in flooring, wall cladding, paving, and decorative applications due to its durability, aesthetic appeal, and availability in various textures and colors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.