- Home

- »

- Automotive & Transportation

- »

-

Middle East Secure Logistics Market, Industry Report, 2033GVR Report cover

![Middle East Secure Logistics Market Size, Share & Trends Report]()

Middle East Secure Logistics Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Static, Mobile), By Mode of Transport (Road, Rail, Air), By Application (Cash Management, Diamonds, Jewelry & Precious Metals), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-849-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Secure Logistics Market Summary

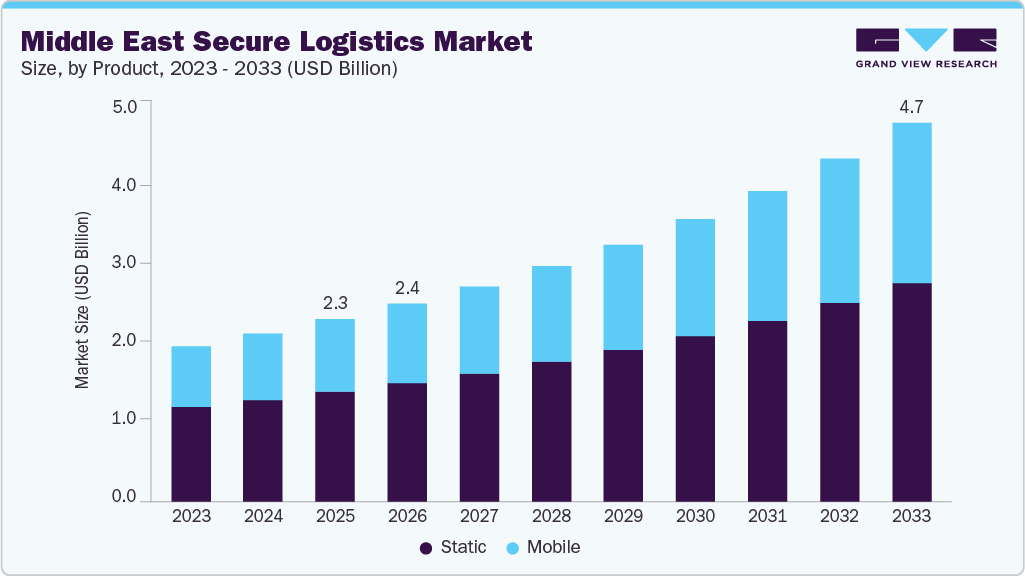

The Middle East secure logistics market size was estimated at USD 2.26 billion in 2025, and is projected to reach USD 4.70 billion by 2033, growing at a CAGR of 9.7% from 2026 to 2033. The market is witnessing steady growth, driven by the expansion of banking and ATM networks and sustained cash usage across retail and government transactions.

Key Market Trends & Insights

- The KSA secure logistics market accounted for a 45.9% share of Middle East in 2025.

- By type, the static segment accounted for the largest market share of 60.2% in 2025.

- By mode of transport, the road segment held the largest market share in 2025.

- By application, the cash management segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.26 Billion

- 2033 Projected Market Size: USD 4.70 Billion

- CAGR (2026-2033): 9.7%

- KSA: Largest market in 2025

- UAE: Fastest growing market

The rising cross-border movement of valuables and increasing security requirements for high-value sectors such as oil & gas, aviation, and large-scale infrastructure projects are other factors projected to drive the market growth. Additionally, regional investments in smart cities, airport modernization, and large public events are accelerating demand for professional cash-in-transit (CIT), bullion transport, and secure vaulting services, supporting long-term market expansion despite increasing digital payment adoption.

Government-led initiatives aimed at expanding formal banking access across the Middle East have led to a steady increase in ATM networks and physical banking touchpoints. Publicly available data from institutions such as the World Bank and the IMF Financial Access Survey highlight continued investments in cash access infrastructure, particularly in emerging Middle Eastern economies. Each addition to the ATM and branch network increases the operational requirement for cash replenishment, transportation, and secure handling, reinforcing the role of specialized secure logistics providers in maintaining system reliability and service continuity.

Cash remains a widely used transaction medium across several Middle Eastern economies, particularly in small retail and transport services, as well as in certain government-linked disbursements. Government-authorized datasets, including the World Bank Global Findex, indicate that a meaningful share of the population continues to rely on cash for daily transactions despite the availability of digital payment alternatives. This sustained cash circulation requires organized cash collection, sorting, storage, and redistribution, thereby supporting consistent demand for secure logistics services across the banking and commercial sectors.

National development plans and public infrastructure programs across the Middle East have increased the movement of high-value assets and sensitive materials. Government authorities overseeing aviation, transport, energy, and large public facilities require secure transport solutions for cash, critical documents, and valuables associated with operations and large-scale projects. These requirements have increased engagement with licensed secure logistics providers capable of meeting regulatory, insurance, and risk-management standards set by public sector entities.

Central banks and internal security authorities in the Middle East have implemented more structured regulatory frameworks governing cash handling and transportation activities. These frameworks define licensing requirements, armored vehicle specifications, personnel vetting processes, and operational security standards. As compliance expectations rise, banks and large commercial entities increasingly rely on professionally managed secure logistics providers rather than informal or internally managed transport arrangements, reinforcing the role of regulated service providers in the Middle East secure logistics industry.

Type Insights

The static segment accounted for the largest market share of 60.2% in 2025. The expansion of fixed cash management infrastructure, including bank vaults, cash processing centers, and secure storage facilities, supported higher adoption of static secure logistics solutions among banks, retail chains, and government institutions. Static deployments remain integral to currency storage, sorting, and verification activities, particularly in high-volume cash environments where centralized processing and regulatory oversight are required.

The mobile segment is expected to grow at the fastest CAGR during the forecast period. The rapid expansion of ATM networks, increased cash collection requirements from distributed retail outlets, and rising demand for secure point-to-point transportation of currency and valuables are driving greater adoption of mobile secure logistics services. The need for flexible routing, real-time tracking, and compliance with stricter security protocols across banking and commercial end users further supports the growth.

Mode of Transport Insights

The road segment held the dominating share of the Middle East secure logistics industry in 2025. The road segment remains the backbone of secure logistics in the region, due to its extensive reach across urban and semi-urban areas, flexibility in routing, and suitability for frequent cash-in-transit operations serving banks, ATMs, retail outlets, and government facilities. Road-based transport remains preferred for short- to medium-distance movements, where scheduled replenishment, controlled handovers, and compliance with local security regulations are required.

The air segment is expected to grow at the fastest CAGR during the forecast period. The segment is growing rapidly as the demand increases for time-sensitive and long-distance transportation of high-value assets, including currency, bullion, precious metals, and critical documents, particularly between major financial hubs and international trade corridors. Growth is further supported by expanding airport infrastructure, rising cross-border financial activity, and stricter security requirements for high-value shipments that favor controlled, high-speed air transport over surface alternatives.

Application Insights

The cash management segment dominated the Middle East secure logistics market in 2025. The segment is expanding rapidly as banks, retailers, and government institutions increasingly outsource currency handling activities such as cash collection, sorting, verification, storage, and reconciliation to specialized service providers in order to improve operational efficiency, reduce internal risk exposure, and comply with tightening regulatory and security requirements.

The manufacturing segment is projected to grow at the fastest CAGR over the forecast period. In the manufacturing segment, secure logistics services in the Middle East are vital for the controlled movement of high-value components, sensitive materials, and critical documents across production sites, warehouses, and export hubs, particularly in sectors such as electronics, pharmaceuticals, defense, and precision engineering. The increasing emphasis on inventory security, regulatory compliance, and traceability across regional and cross-border supply chains has led to greater reliance on specialized, secure logistics providers within manufacturing operations.

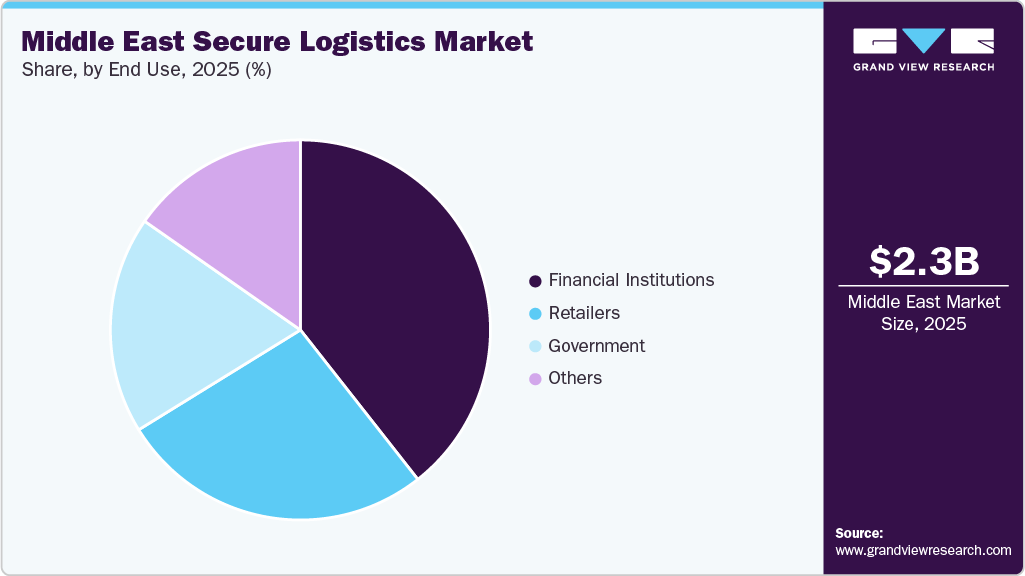

End Use Insights

The financial institutions segment dominated the Middle East secure logistics industry in 2025. Financial institutions continue to expand their use of secure logistics services to support cash-in-transit operations, ATM replenishment, vault management, and inter-branch currency movements while meeting stringent regulatory, security, and audit requirements imposed by central banks and financial authorities. The scale and frequency of cash handling activities within banks and non-banking financial institutions sustain consistent demand for professionally managed secure logistics solutions.

The government segment is expected to register the fastest CAGR over the forecast period. Government agencies increasingly rely on secure logistics services for the safe transport of currency, sensitive documents, election materials, and other high-value assets, while adhering to strict regulatory and security protocols. The expansion of public infrastructure projects, cash disbursement programs, and law enforcement operations across the Middle East has contributed to growing engagement with specialized secure logistics providers.

Country Insights

Kingdom of Saudi Arabia Secure Logistics Market Trends

The KSA led the Middle East secure logistics market, accounting for the largest share of 45.9% in 2025. This can be attributed to the country’s extensive banking and ATM network, high-volume cash handling across the retail and government sectors, and the need to secure the transportation of valuables and sensitive documents. The presence of large-scale infrastructure projects, oil and gas operations, and regulatory requirements for armored transport and vault management have further reinforced the demand for professional secure logistics services across the kingdom.

UAE Secure Logistics Market Trends

The UAE secure logistics market is expected to register the fastest CAGR over the forecast period. Strong growth is supported by the country’s position as a regional financial and trade hub, increasing demand for secure cash and valuables transport, expansion of retail and banking networks, and stringent regulatory standards for armored transport and vault management. Additionally, rising high-value transactions in tourism, aviation, and large-scale infrastructure projects have led government and private institutions to rely heavily on specialized, secure logistics providers.

Key Middle East Secure Logistics Company Insights

Some of the key companies in the Middle East secure logistics market include Al Futtaim Logistics, Agility Logistics, Aramex International, DHL Supply Chain / DHL Group, UPS Supply Chain Solutions, Brink’s Incorporated, G4S Limited (Allied Universal / G4S group), GardaWorld, Prosegur, and Securitas AB. Organizations in the region are focusing on expanding their service offerings and increasing their customer base to maintain a competitive advantage. To achieve this, key players are implementing strategic initiatives, such as mergers and acquisitions, partnerships with major companies, and regional network expansions, to strengthen operational capabilities and expand service coverage across the Middle East.

-

GardaWorld is an integrated security and cash logistics provider with an established presence across key Middle East markets. The company delivers secure logistics services including armored cash-in-transit, high-value asset transportation, physical security, vehicle and asset monitoring, crisis management, and risk consulting. GardaWorld supports a diverse customer base in the region comprising financial institutions, retail chains, and government entities, with operations aligned to regional regulatory frameworks and security compliance requirements.

-

Brink’s Incorporated operates as a secure logistics and cash management solutions provider serving Middle East markets. The company offers secure transportation and handling of cash and high-value assets, including precious metals, diamonds, jewelry, and sensitive documents. Brink’s Middle East operations are supported by armored transport fleets, secure vaulting and storage facilities, bonded logistics capabilities, and real-time shipment monitoring systems. Its service offerings cover end-to-end pickup, transit, and delivery management, risk assessment, insurance coverage, and compliance-driven logistics solutions for banks, retailers, government agencies, and commercial enterprises in the region.

Key Middle East Secure Logistics Companies:

- Al Futtaim Logistics

- Agility Logistics

- Aramex International

- DHL Supply Chain / DHL Group

- UPS Supply Chain Solutions

- Brink’s Incorporated

- G4S Limited (Allied Universal / G4S group)

- GardaWorld

- Prosegur

- Securitas AB

Recent Developments

-

In March 2025, Abu Dhabi sovereign investor ADQ moved to acquire a majority stake in Aramex, strengthening Aramex’s ties to the UAE and supporting the company’s ability to extend technology-enabled, compliance-oriented logistics services across the Middle East.

-

In March 2025, UPS signed an agreement to establish a new logistics facility at Dubai South’s Logistics District, improving UAE capacity for secure, time-sensitive international shipments and bolstering operational visibility and access control in the region.

Middle East Secure Logistics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.45 billion

Revenue forecast in 2033

USD 4.70 billion

Growth rate

CAGR of 9.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of transport, application, end use, region

Country scope

KSA; UAE; Turkey; Qatar

Key companies profiled

Al Futtaim Logistics; Agility Logistics; Aramex International; DHL Supply Chain / DHL Group; UPS Supply Chain Solutions; Brink’s Incorporated; G4S Limited (Allied Universal / G4S group); GardaWorld; Prosegur; Securitas AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Secure Logistics Market Report Segmentation

This report forecasts revenue growth at Middle East and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East Secure Logistics market report based on type, mode of transport, application, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Static

-

Mobile

-

-

Mode of Transport Outlook (Revenue, USD Billion, 2021 - 2033)

-

Road

-

Rail

-

Air

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cash Management

-

Diamonds, Jewelry & Precious Metals

-

Manufacturing

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Financial Institutions

-

Retailers

-

Government

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

Middle East

-

KSA

-

UAE

-

Turkey

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East secure logistics market size was estimated at USD 2.26 billion in 2025 and is expected to reach USD 2.45 billion in 2026.

b. The Middle East secure logistics market size is expected to grow at a significant CAGR of 9.7% to reach USD 4.70 billion in 2033.

b. KSA held the largest market share of 45.9% in 2025, driven by the country’s extensive banking and ATM network, high-volume cash handling across retail and government sectors, and the need for secure transportation of valuables and sensitive documents.

b. Some of the players in the market are Al Futtaim Logistics, Agility Logistics, Aramex International, DHL Supply Chain / DHL Group, UPS Supply Chain Solutions, Brink’s Incorporated, G4S Limited (Allied Universal / G4S group), GardaWorld, Prosegur, and Securitas AB.

b. The key driving trend in the Middle East secure logistics market is the rapid rise in demand for secure handling and transport of valuable assets, particularly driven by growth in cash-in-transit services, e-commerce expansions, and the increasing movement of high-value goods, coupled with strong investments in advanced security technologies and infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.