- Home

- »

- Clinical Diagnostics

- »

-

Middle East STD Diagnostics Market Size, Share Report 2033GVR Report cover

![Middle East STD Diagnostics Market Size, Share & Trends Report]()

Middle East STD Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments & Services, Consumables, Software), By Application, By Technology, By Location of Testing, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-713-8

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East STD Diagnostics Market Summary

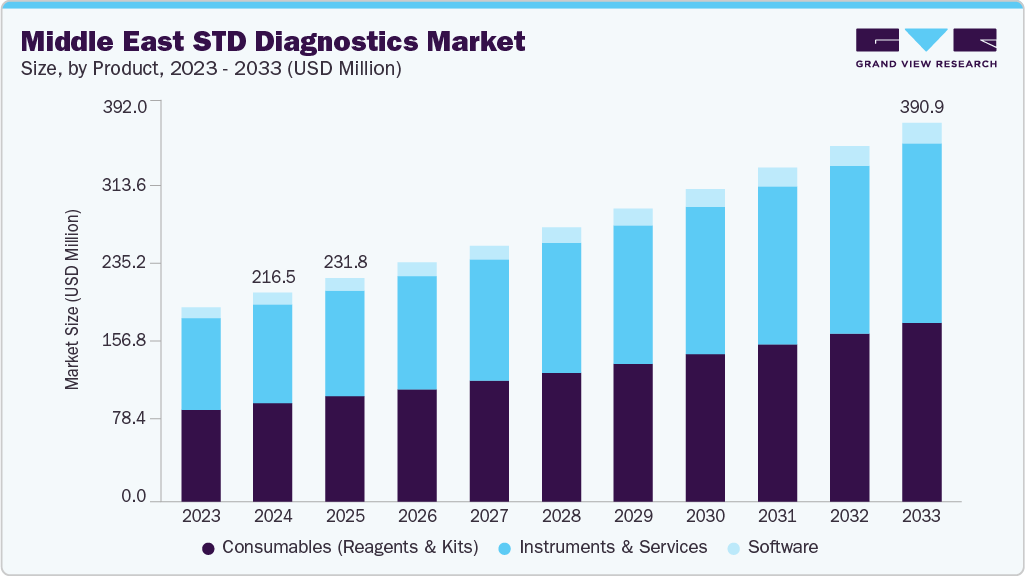

The Middle East STD diagnostics market size was estimated at USD 216.56 million in 2024 and is projected to reach USD 390.96 million by 2033, growing at a CAGR of 6.75% from 2025 to 2033. Rising incidence of sexually transmitted infections such as HIV, syphilis, gonorrhea, and chlamydia, along with limited early detection in some countries, is driving demand for accurate and timely diagnostic solutions in the region. Developments in molecular testing technologies, wider adoption of rapid and point-of-care testing, and improvements in multiplex assay platforms are supporting market expansion. In addition, national programs aimed at disease prevention, targeted screening campaigns, and healthcare investments in both public and private sectors are contributing to the growing demand for STD diagnostics.

Advances in nucleic acid amplification tests (NAAT), integration of automated platforms, and increased availability of self-testing kits are reshaping the STD diagnostics landscape in the Middle East. Regulatory bodies in countries such as Saudi Arabia and the UAE are updating in-vitro diagnostic (IVD) guidelines to streamline approval processes and ensure quality standards, which is expected to accelerate product availability. Growing awareness through public health campaigns, expansion of screening in antenatal and primary care settings, and collaborative initiatives with global health organizations are further supporting early detection efforts. These developments, combined with rising private healthcare expenditure and the presence of international diagnostic manufacturers, are creating opportunities for market growth across the region.

Surveillance data from the region indicate a sustained burden of sexually transmitted infections that continues to drive the need for improved diagnostics. In Saudi Arabia, the Tabuk Region recorded 290 notified STI cases up to 19 November 2024, with vulvovaginal candidiasis accounting for 35% (102 cases) and urethral discharge syndrome at 14.8% (43 cases)-almost two-thirds of cases were among females (64.8%) and Saudi nationals (88.4%). These figures reflect ongoing challenges in detection and timely treatment, particularly in community and primary care settings. Similar trends are being addressed in the UAE, Kuwait, Oman, and Qatar through targeted screening initiatives, integration of rapid testing in clinical workflows, and public health awareness campaigns aimed at reducing stigma and promoting early diagnosis.

Overall, innovation in the Middle East STD diagnostics market is centered on improving accessibility, accuracy, and speed of detection to address both clinical and public health needs. The combination of advanced molecular platforms, discreet self-testing options, and integration of rapid devices into primary care workflows is reshaping diagnostic pathways. Digital connectivity is enabling better surveillance and linkage to care, while portable solutions are extending testing capabilities to remote and underserved populations. These developments are not only enhancing diagnostic efficiency but also supporting national goals for early detection and disease control across the region.

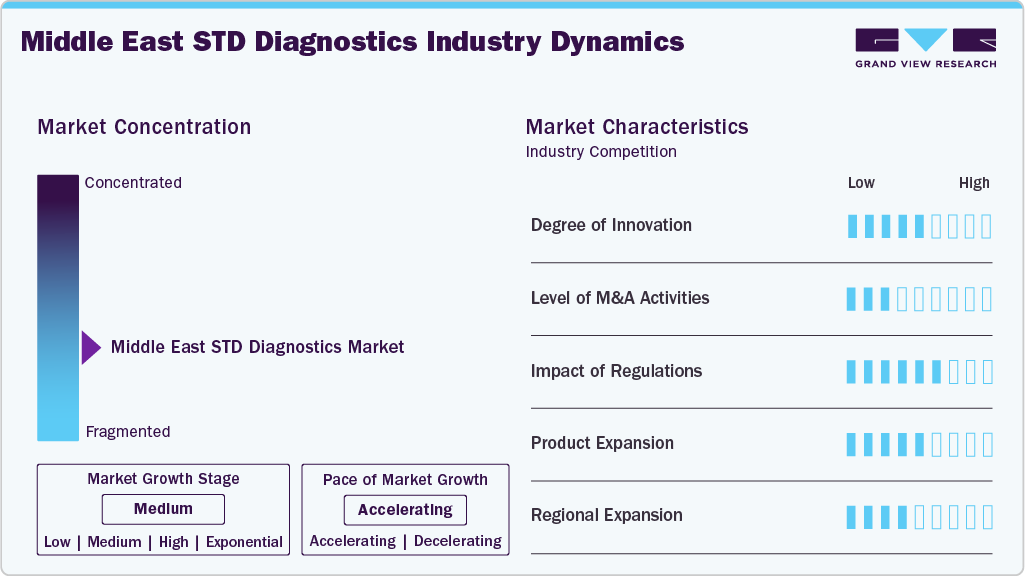

Market Concentration & Characteristics

Innovation is moderate in the Middle East STD diagnostics market, with efforts focused on improving early detection, accessibility, and discreet testing options. Developments in molecular testing, rapid point-of-care devices, and integration of digital platforms for result reporting are enhancing diagnostic reach and efficiency. While technologies such as multiplex NAATs and portable testing devices are gaining ground, large-scale adoption of advanced tools such as AI-powered data interpretation remains at an early stage in most countries. Expanding the use of self-testing kits for HIV and syphilis is a notable trend, addressing stigma and increasing testing uptake.

M&A activity is limited, with most strategic moves involving regional distributors and diagnostic kit manufacturers forming partnerships with international companies to introduce new products. Collaborations between diagnostic developers and local health authorities are also emerging, mainly to support public health screening campaigns. These initiatives aim to improve market penetration, expand product portfolios, and strengthen logistics for distribution in both urban and remote areas.

Regulatory frameworks in countries such as Saudi Arabia and the UAE are becoming more structured, with updated in-vitro diagnostic (IVD) guidelines that set clearer performance and validation requirements. Approval processes can be lengthy, but recent policy changes-such as Saudi Arabia’s 2025 guidance on in-house IVD development-are providing opportunities for locally manufactured diagnostic solutions. Compliance with quality standards and documentation requirements remains a key determinant for faster market entry.

Product expansion is steady, with new offerings focusing on rapid test kits, multiplex molecular panels, and portable analyzers suited for outreach programs. Automation in laboratory workflows and shorter turnaround times are improving operational capacity in hospitals and public health labs. Integration with electronic health records (EHRs) and mobile applications is beginning to take shape, supporting better patient follow-up and surveillance reporting.

Regional expansion is gradual, driven by partnerships with public health programs, hospitals, and private clinics in high-demand areas such as Saudi Arabia, the UAE, and Qatar. Government-backed awareness campaigns and targeted screening initiatives in antenatal care, migrant health programs, and high-risk groups are creating new avenues for adoption. While major urban centers have broader access to advanced diagnostics, remote and underserved areas are gradually being reached through mobile health units and portable testing devices.

Product Insights

Consumables dominated the Middle East STD diagnostics market with a share of 69.85% in 2024, propelled by repeated procurement patterns from laboratories, extensive public health screening drives, and escalating demand for multiplex testing solutions. This segment’s dominance is reinforced by its foundational role in virtually every diagnostic protocol-be it rapid or molecular-making reagents and kits indispensable across all testing workflows. A tangible regional development underlines this trend: in August 2024, Virax Biolabs secured a distribution agreement to supply CE-marked and UK MHRA-authorized RT-PCR Mpox virus detection kits across all GCC countries-including Saudi Arabia, UAE, Kuwait, Oman, and Qatar-highlighting expanding diagnostics access and bolstering consumables distribution networks in the region.

The Instruments & Services segment in the Middle East STD diagnostics market is expected to witness significant growth during the forecast period, driven by the adoption of advanced diagnostic platforms, improved laboratory infrastructure, and rising availability of point-of-care testing devices. Expansion of service offerings, such as specialized testing programs and integrated diagnostic solutions, is also supporting growth, with healthcare providers increasingly focusing on faster turnaround times and accurate detection to improve patient outcomes.

Application Insights

HIV testing dominated the Middle East STD diagnostics market in 2024, driven by extensive public health initiatives, growing awareness, and integration of rapid and accessible testing solutions. Strategic focus on early detection and viral suppression has reinforced its central role in national disease control efforts. For example, during World AIDS Day 2024, the WHO Regional Office for the Eastern Mediterranean (covering GCC countries including Saudi Arabia, UAE, Kuwait, Oman, and Qatar) launched a week-long HIV testing campaign from 1 to 7 December, promoting person-centered approaches such as self-testing, network-based testing, and digital outreach to encourage at-risk individuals to get tested.

The syphilis testing segment is anticipated to witness notable growth in the Middle East STD diagnostics market, driven by rising awareness campaigns, expansion of screening programs, and the integration of diagnostic services into public health initiatives. Efforts to improve early detection and treatment outcomes, coupled with the availability of advanced serological and rapid point-of-care testing methods, are supporting adoption across both urban and rural healthcare facilities.

Technology Insights

The immunoassay segment dominated the Middle East STD diagnostics market in 2024 due to its ability to deliver rapid, reliable, and cost-effective results. These tests are widely used in both laboratory and point-of-care settings, supporting timely diagnosis and management of sexually transmitted infections. The segment benefits from its adaptability to a range of STD pathogens, which makes it a preferred choice in screening programs and clinical diagnostics. Its integration into public health initiatives and hospital workflows has further strengthened its position in the market. Ongoing improvements in assay sensitivity and specificity, along with the development of automated platforms, continue to support the use of immunoassay technology. The growing demand for accessible and scalable testing solutions in urban and rural areas of the Middle East also contributes to its prominence. This technology’s ability to process high volumes of samples efficiently positions it as a reliable option for large-scale screening and routine testing in the region.

Molecular diagnostics is projected to record the fastest CAGR of 8.16% in the Middle East STD diagnostics market, supported by its high sensitivity, specificity, and ability to detect infections at early stages. This technology enables accurate identification of pathogens through nucleic acid amplification methods, which is particularly valuable for detecting asymptomatic cases and reducing transmission risks. Growing awareness among healthcare professionals, combined with expanding laboratory infrastructure and adoption of advanced diagnostic platforms, is contributing to the segment’s rapid growth across the region.

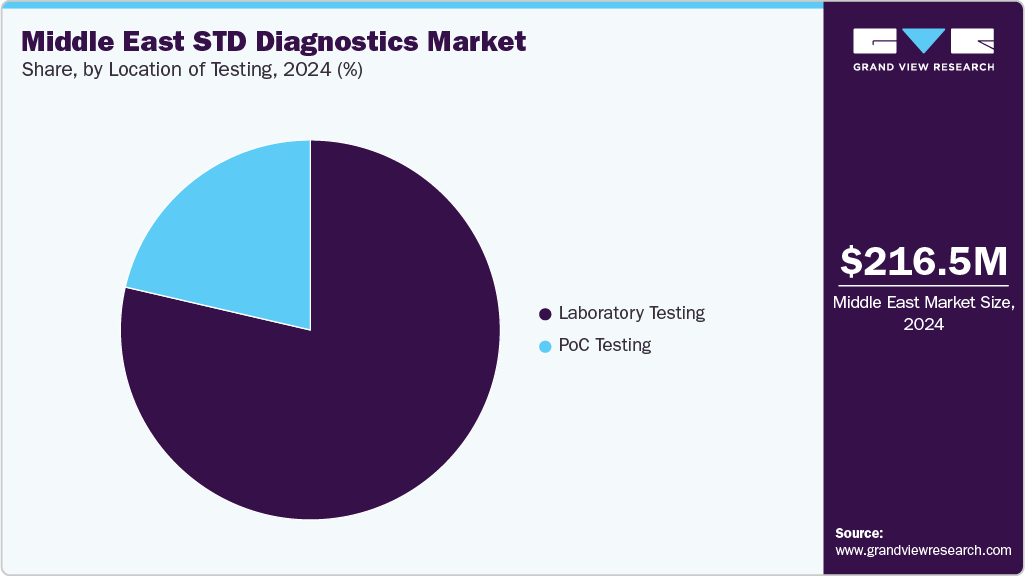

Location of Testing

Laboratory testing dominated the Middle East STD diagnostics market in 2024, driven by its capacity to provide accurate, reliable, and comprehensive results for a wide range of sexually transmitted infections. Centralized laboratories are equipped to handle high-throughput testing, including molecular and immunoassay-based diagnostics, making them essential for public health programs and hospital networks. The growing emphasis on quality assurance, standardized protocols, and integration with electronic health records has further reinforced the dominance of laboratory-based testing in the region.

Point-of-care (PoC) testing is expected to register the fastest CAGR in the Middle East STD diagnostics market, driven by the need for rapid, on-site results that support timely diagnosis and treatment. These tests are particularly valuable in remote or resource-limited settings, enabling healthcare providers to deliver immediate care and reduce disease transmission. Increasing adoption of portable molecular platforms, rapid immunoassays, and user-friendly kits is expanding the reach of PoC testing across clinics, community health centers, and outreach programs, contributing to its accelerated growth in the region.

Country Insights

Saudi Arabia STD Diagnostics Market Trends

Saudi Arabia led the market with a share of 35.21% in 2024 and has been actively enhancing its STD diagnostics infrastructure, particularly for HIV and syphilis. The Saudi AIDS National Program (NAP) has been leading initiatives to improve HIV awareness, prevention, and treatment across the country. In 2024, the Saudi Ministry of Health, through NAP, updated its national guidelines for HIV treatment, reflecting the latest advancements in antiretroviral therapy and expanding focus to include prevention, diagnosis, and management of HIV-related complications. These guidelines aim to improve the quality of care and treatment outcomes for individuals living with HIV in the country.

UAE STD Diagnostics Market Trends

The UAE STD diagnostics market is experiencing fastest growth, driven by government initiatives, technological advancements, and increasing public awareness. The Ministry of Health and Prevention (MoHAP) has been actively enhancing the country's healthcare infrastructure, focusing on improving diagnostic services for sexually transmitted diseases. In line with these efforts, MoHAP has been involved in various health campaigns aimed at raising awareness and promoting testing for STDs, including HIV and syphilis. These initiatives are part of the UAE's broader strategy to strengthen its healthcare system and ensure the well-being of its population. The government's commitment to healthcare excellence is evident in its proactive approach to disease prevention and control, positioning the UAE as a leader in the region's healthcare sector.

Kuwait STD Diagnostics Market Trends

Kuwait has made significant strides in combating HIV/AIDS, positioning itself as a regional leader in the Arab world. In November 2024, the Kuwaiti Minister of Health, Dr. Ahmad Al-Awadhi, highlighted the country's "exceptional" progress in fighting HIV, as reported by the Joint UN Programme on HIV and AIDS (UNAIDS). This acknowledgment underscores Kuwait's commitment to enhancing public health initiatives and improving access to HIV and STD diagnostics. The government's efforts include the implementation of comprehensive screening programs, public awareness campaigns, and the provision of confidential testing services, all aimed at early detection and prevention of sexually transmitted infections. These initiatives are part of Kuwait's broader strategy to strengthen its healthcare infrastructure and ensure the well-being of its population.

Oman STD Diagnostics Market Trends

Oman has made significant strides in sexually transmitted disease (STD) diagnostics, driven by government-led initiatives and advancements in testing technologies. The Ministry of Health has implemented a national policy of routine opt-out HIV testing in medical admission units since September 2022, aiming to address late HIV diagnoses. In addition, free HIV testing is available in all government health institutions and most private health institutions, conducted in a confidential manner. The country has also achieved the elimination of mother-to-child transmission of HIV and syphilis, becoming the first in the WHO Eastern Mediterranean Region to do so. These efforts are complemented by adopting rapid diagnostic tests and point-of-care testing, enhancing accessibility and early detection. Despite these advancements, challenges such as social stigma and limited awareness persist, potentially hindering the full utilization of testing services.

Qatar STD Diagnostics Market Trends

Qatar’s STD diagnostics market is driven by government initiatives and increasing emphasis on sexual health awareness. Widespread adoption of diagnostic protocols for HIV, syphilis, and other sexually transmitted infections in healthcare settings is supporting early detection and improved disease management. The market benefits from advancements in testing technologies, including rapid and point-of-care diagnostics, which enhance accessibility and efficiency. Social stigma and limited public awareness remain challenges, but ongoing efforts to promote sexual health education and expand testing access are expected to strengthen the overall uptake of STD diagnostic services in the country.

Key Middle East STD Diagnostics Company Insights

Key participants in the Middle East STD diagnostics market are focusing on strategies such as expanding their test portfolios, partnering with public and private healthcare facilities, and investing in advanced technologies such as nucleic acid amplification tests (NAAT) and rapid point-of-care diagnostics. These initiatives aim to improve diagnostic accuracy, increase access to timely STD testing, and align with evolving public health and clinical practices across the region.

Key Middle East STD Diagnostics Companies:

- BD

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Abbott

- Cepheid (Danaher)

- Qiagen

- OraSure Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Thermo Fisher Scientific, Inc.

- Seegene Inc.

- DiaSorin S.p.A

Recent Developments

-

In June 2025, Call My Doctor Health Care LLC, a DHA-licensed home healthcare provider, introduced its new at-home STD testing service in Dubai. Available 24/7, the service is designed for residents seeking convenient and confidential STD screening, delivering medical accuracy while adhering fully to Dubai Health Authority (DHA) regulations.

-

In February 2025, a study titled The Clinical Spectrum and Outcomes of Ocular Syphilis in Saudi Arabia: The Emergence of a Uveitic Masquerader highlighted ocular syphilis as a significant cause of uveitis, with over half of patients reporting unprotected sexual activity. The findings emphasized the need for improved STD diagnostic capabilities and awareness in clinical settings across the Middle East.

Middle East STD Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 231.85 million

Revenue forecast in 2033

USD 390.96 million

Growth rate

CAGR of 6.75% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, location of testing, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

BD; F. Hoffmann-La Roche Ltd.; Hologic, Inc.; bioMérieux SA; Abbott; Cepheid (Danaher Corporation); Qiagen; Seegene Inc.; Thermo Fisher Scientific Inc.; DiaSorin S.p.A.; OraSure Technologies Inc.; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East STD Diagnostics Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East STD diagnostics market based on product, application, technology, location of testing, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments & Services

-

Consumables (Reagents and kits)

-

Software

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chlamydia testing

-

Syphilis testing

-

PCR testing

-

Non-PCR testing

-

-

Gonorrhea testing

-

HSV testing

-

PCR testing

-

Non-PCR testing

-

-

HPV testing

-

HIV testing

-

Trichomonas

-

Ureaplasma + Mycoplasma

-

VZV

-

PCR testing

-

Non-PCR testing

-

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Molecular Diagnostics

-

Immunoassay

-

Others

-

-

Location of Testing Outlook (Revenue, USD Million, 2021 - 2033)

-

Laboratory Testing

-

Commercial/Private Labs

-

Public Health Labs

-

-

PoC testing

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle East STD diagnostics market size was estimated at USD 216.6 million in 2024 and is expected to reach USD 231.85 million in 2025

b. The Middle East STD diagnostics market is expected to grow at a compound annual growth rate of 6.75% from 2025 to 2033 to reach USD 390.96 million by 2033.

b. Consumables dominated the Middle East STD diagnostics market with a share of 69.85% in 2024, propelled by repeated procurement patterns from laboratories, extensive public health screening drives, and escalating demand for multiplex testing solutions.

b. Some key players operating in the Middle East STD diagnostics market include BD, F. Hoffmann-La Roche Ltd, Hologic Inc., Abbott, Cepheid (Danaher), Qiagen, OraSure Technologies, Inc., Bio-Rad Laboratories, Inc., bioMérieux SA, Thermo Fisher Scientific, Inc., Seegene Inc., DiaSorin S.p.A

b. Rising incidence of sexually transmitted infections such as HIV, syphilis, gonorrhea, and chlamydia, along with limited early detection in some countries, is driving demand for accurate and timely diagnostic solutions in the region

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.