- Home

- »

- Advanced Interior Materials

- »

-

Middle East Transformer Insulation Market Size Report, 2033GVR Report cover

![Middle East Transformer Insulation Market Size, Share & Trends Report]()

Middle East Transformer Insulation Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Solid Insulation Materials, Liquid Insulation Materials, Gaseous Insulation), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-705-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Transformer Insulation Market Summary

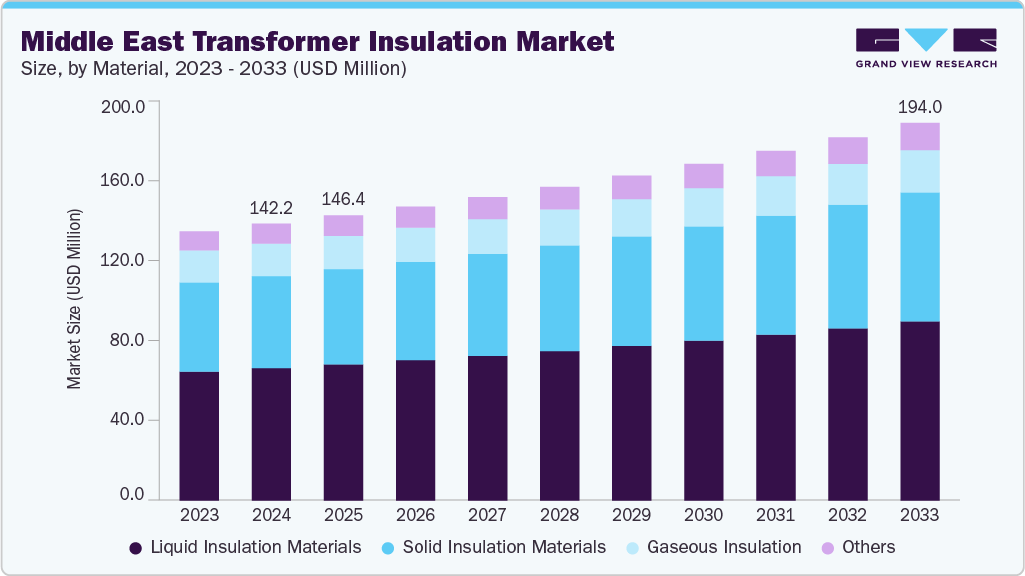

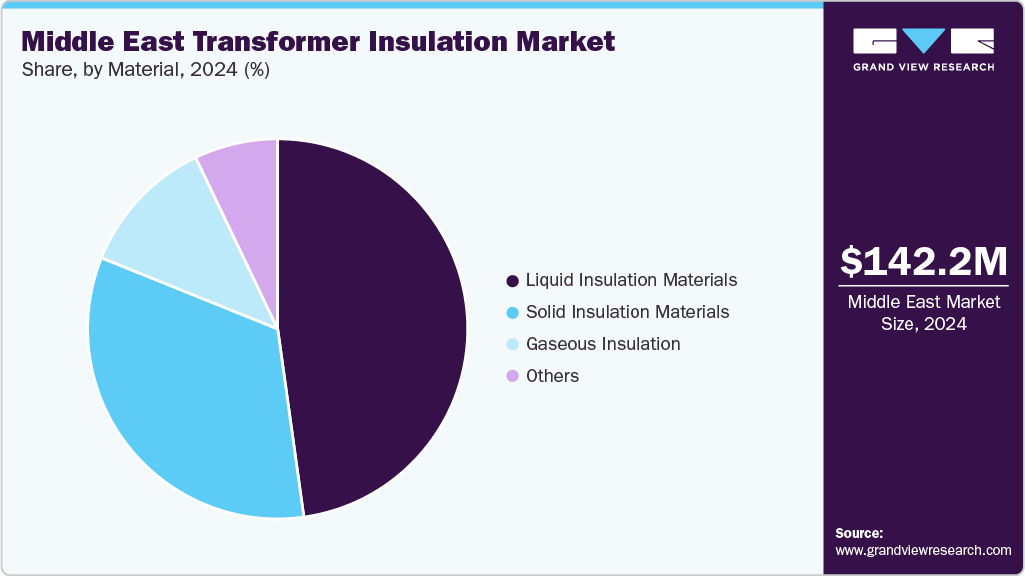

The Middle East transformer insulation market size was estimated at USD 142.2 million in 2024 and is projected to reach USD 194.0 million by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The rapid expansion of power generation and transmission infrastructure across the Middle East is contributing significantly to the demand for transformer insulation materials.

Key Market Trends & Insights

- Saudi Arabia dominated the transformer insulation market with the largest revenue share of 22.4% in 2024.

- By material, the solid insulation materials segment is expected to grow at the fastest CAGR of 3.9% from 2025 to 2033.

- The growth of the Middle East transformer insulation industry is driven by expanding power infrastructure, increasing integration of renewable energy, and the need for reliable performance in extreme environmental conditions.

Market Size & Forecast

- 2024 Market Size: USD 142.2 Million

- 2033 Projected Market Size: USD 194.0 Million

- CAGR (2025-2033): 3.6%

- UAE: Fastest market in 2024

Governments are investing heavily in electricity distribution to support industrial development and population growth. These infrastructure upgrades require reliable insulation systems to enhance the performance and safety of transformers. Rising adoption of renewable energy technologies, including solar and wind, is reshaping the region’s energy mix and driving the need for efficient grid integration. As renewable projects connect to national grids, the demand increases for transformers equipped with advanced insulation capable of handling fluctuating loads and varying environmental conditions. This transition is creating new opportunities for high-performance insulation materials.

Smart city initiatives and urban development projects in countries such as the UAE and Saudi Arabia are prompting the modernization of electrical infrastructure. The deployment of intelligent grids and automated systems relies on dependable power delivery, necessitating transformers with robust insulation systems that ensure operational reliability and energy efficiency.Harsh environmental conditions, including high temperatures, dust storms, and humidity, present unique challenges for electrical equipment in the region. To address these challenges, utilities and manufacturers are focusing on insulation solutions that offer superior thermal endurance and resistance to environmental stress. This focus on durability and performance is strengthening the demand for advanced transformer insulation technologies.

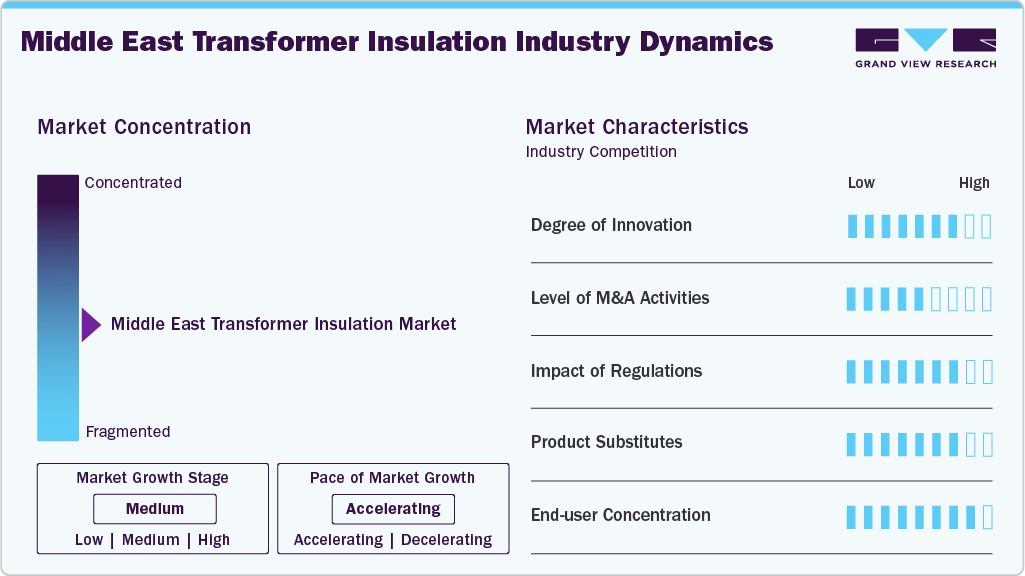

Market Concentration & Characteristics

The Middle East transformer insulation market exhibits a moderate to high level of market concentration, with a limited number of global and regional players holding significant market shares. Innovation is present but tends to be incremental, focusing primarily on improving thermal performance, environmental resistance, and sustainability of insulation materials. While major international firms introduce advanced technologies such as aramid-based or ester-filled insulation, local players often focus on cost-effective, standard solutions. The pace of innovation is also influenced by the operational demands of extreme climates, which shape the selection and formulation of insulation materials.

Mergers and acquisitions occur at a modest level, often involving global firms expanding regional presence or forming joint ventures with local partners to comply with government regulations and gain market access. Regulatory frameworks vary across countries but are increasingly focused on grid reliability, energy efficiency, and safety standards, which directly impact product specifications and material selection. The availability of substitutes such as air-insulated or gas-insulated systems remains limited in heavy-duty applications, preserving demand for conventional transformer insulation. End-user concentration is relatively high, with major utility companies and government-owned entities accounting for a large portion of procurement, shaping market dynamics and influencing supplier strategies.

Material Insights

The liquid insulation materials segment led the Middle East transformer insulation industry with the highest revenue share of 47.8% in 2024, driven by their extensive use in power and distribution transformers due to excellent cooling capabilities and strong dielectric performance. These materials, including mineral oils and ester-based fluids, ensure efficient thermal management and insulation under high-voltage conditions. Their cost-effectiveness, reliability, and suitability for large-scale grid applications further contribute to their dominance. Additionally, the growing adoption of eco-friendly and fire-resistant liquid insulation options is supporting continued market demand.

The solid insulation materials segment is expected to grow at the fastest CAGR of 3.9% over the forecast period, driven by the increasing adoption of dry-type transformers in urban, commercial, and environmentally sensitive areas. Solid insulation materials, such as aramid paper, pressboard, and fiberglass, offer enhanced mechanical strength, thermal endurance, and fire resistance. Their maintenance-free operation and compatibility with compact transformer designs make them ideal for modern power systems. The global push for safer and eco-friendly electrical infrastructure further supports the segment’s rapid growth.

Country Insights

Saudi Arabia Transformer Insulation Market Trends

The transformer insulation market in Saudi Arabia is expanding due to the country’s large-scale infrastructure and industrial development projects under Vision 2030. The ongoing construction of NEOM, renewable energy parks, and industrial zones has increased the demand for reliable power transmission systems. Additionally, the integration of renewable energy sources such as solar and wind requires transformers equipped with high-performance insulation capable of operating in harsh desert conditions. Government initiatives to modernize the national grid and reduce transmission losses are further accelerating the adoption of advanced insulation technologies.

UAE Transformer Insulation Market Trends

In the UAE, significant investments in smart cities, clean energy, and digital infrastructure are fueling the growth of the transformer insulation market. Projects like Masdar City and Expo 2020 legacy developments demand efficient and safe electrical systems, placing high emphasis on the performance of transformer components. The country’s increasing reliance on renewable energy-particularly solar-requires insulation materials that ensure thermal stability and long-term reliability. In addition, the focus on sustainability is driving interest in biodegradable and low-environmental-impact insulation products.

Egypt Transformer Insulation Market Trends

Egypt’s transformer insulation market is growing in response to its national electrification goals and the expansion of its power generation capacity. With projects like the Benban Solar Park and the Egypt-Sudan interconnection, the need for efficient and robust transformers has grown substantially. Aging grid infrastructure is also undergoing modernization, increasing demand for retrofitting with high-grade insulation materials. Furthermore, international funding for energy projects is supporting the adoption of globally compliant transformer technologies and insulation solutions.

Qatar Transformer Insulation Market Trends

Qatar’s focus on building a resilient and modern power infrastructure, particularly in preparation for hosting global events and expanding urban zones, is boosting the demand for quality transformer insulation. The rapid growth of its real estate, hospitality, and industrial sectors has led to higher electricity consumption, requiring efficient and safe power distribution systems. Additionally, the country’s push towards diversifying its energy sources, including solar energy initiatives, supports the use of thermally stable insulation in transformer systems designed for fluctuating load conditions.

Kuwait Transformer Insulation Market Trends

In Kuwait, the transformer insulation market is supported by government-led efforts to upgrade the aging electricity grid and meet rising energy demand from residential and commercial developments. The expansion of industrial facilities and the modernization of oil sector projects also require advanced electrical infrastructure, including reliable transformers. High ambient temperatures throughout the year demand insulation materials with superior thermal resistance. Kuwait’s commitment to enhancing energy efficiency and reducing transmission losses further supports the shift toward modern insulation technologies in both new installations and grid refurbishment programs.

Key Middle East Transformer Insulation Company Insights

Some of the key players operating in the Middle East transformer insulation industry include DuPont and Hitachi Energy Ltd.

-

DuPont is a global leader in material science and offers high-performance insulation solutions for transformers through its Nomex brand. These aramid-based papers and pressboards provide excellent thermal and electrical insulation for both liquid-filled and dry-type transformers. The company focuses on durability, fire resistance, and compact transformer designs to meet evolving grid requirements.

-

Hitachi Energy Ltd. specializes in power and automation technologies, including comprehensive transformer solutions. Its insulation product range includes pressboard, laminated wood, and customized insulation kits for high-voltage and ultra-high-voltage applications. The company supports grid reliability with advanced materials designed for efficiency and longevity.

Weidmann Electrical Technology AG and Elantas (Altana AG) are some of the emerging participants in the Middle East transformer insulation market.

-

Weidmann provides cellulose-based transformer insulation materials such as transformer board, paper, and spacers. The company supports both OEMs and utilities with engineering services, design consulting, and performance monitoring tools. Their focus lies in improving thermal management and extending transformer life cycles through high-quality insulation.

-

Elantas, part of the ALTANA Group, offers electrical insulation products including impregnating resins, varnishes, and flexible laminates. These materials are used to insulate coils and windings in transformer components. The company emphasizes thermal class stability, chemical resistance, and eco-friendly alternatives to traditional materials.

Key Middle East Transformer Insulation Companies:

- DuPont

- Hitachi Energy Ltd.

- Weidmann Electrical Technology AG

- Elantas (Altana AG)

- Cargill, Incorporated

- Siemens Energy

- Krempel GmbH

- Apar Industries

- M&I Materials Ltd.

Middle East Transformer Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 146.4 million

Revenue forecast in 2033

USD 194.0 million

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, country

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

DuPont; Hitachi Energy Ltd.; Weidmann Electrical Technology AG; Elantas (Altana AG); Cargill, Incorporated; Siemens Energy; Krempel GmbH; Apar Industries; M&I Materials Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Transformer Insulation Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East transformer insulation market based on material, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Solid Insulation Materials

-

Liquid Insulation Materials

-

Gaseous Insulation

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East transformer insulation market size was estimated at USD 142.2 million in 2024 and is expected to reach USD 146.4 million in 2025.

b. The Middle East transformer insulation market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 194.0 million by 2033.

b. Liquid insulation materials segment held the highest revenue market share of 47.8% in 2024, driven by their extensive use in power and distribution transformers due to excellent cooling capabilities and strong dielectric performance.

b. Some of the key players operating in the Middle East transformer insulation market include DuPont, Hitachi Energy Ltd., Weidmann Electrical Technology AG, Elantas (Altana AG), Cargill, Incorporated, Siemens Energy, Krempel GmbH, Apar Industries, and M&I Materials Ltd.

b. The key factors driving the Middle East transformer insulation market include increasing demand for reliable electricity transmission, growth in renewable energy integration, modernization of aging power infrastructure, and advancements in insulation materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.