- Home

- »

- Advanced Interior Materials

- »

-

Middle East Tungsten Market Size, Industry Report, 2033GVR Report cover

![Middle East Tungsten Market Size, Share & Trend Report]()

Middle East Tungsten Market (2025 - 2033) Size, Share & Trend Analysis Report By Form (Powder, Mill Products, Tungsten Carbide Components), By End Use (Aerospace & Defense, Construction, Automotive, Mining & Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-711-0

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Tungsten Market Summary

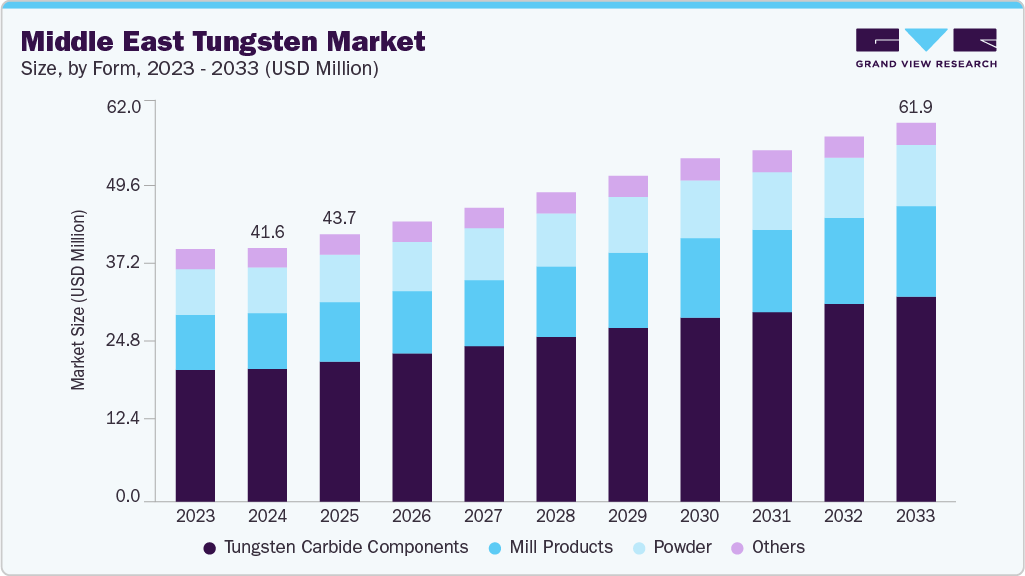

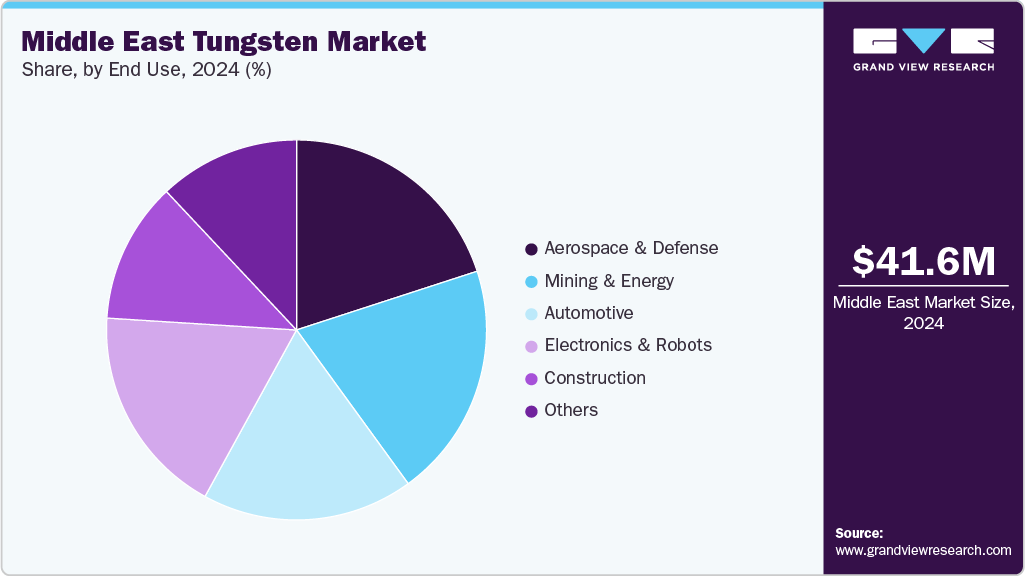

The Middle East tungsten market size was estimated at USD 41.6 million in 2024 and is projected to reach USD 61.9 million by 2033, reflecting a CAGR of 4.4% from 2025 to 2033. Market growth is underpinned by tungsten’s critical role in producing hard metals and precision tooling.

Key Market Trends & Insights

- The tungsten market in the Middle East is expected to grow at a substantial CAGR of 4.4% from 2025 to 2033.

- By form, the powder segment accounted for the largest revenue share of over 30.0% in 2024.

- By end use, the automotive segment is anticipated to register the fastest CAGR of 5.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 41.6 Million

- 2033 Projected Market Size: USD 61.9 Million

- CAGR (2025-2033): 4.4%

Tungsten carbide, an ultra-hard compound formed by combining tungsten with carbon, is extensively utilized in manufacturing cutting tools, drill bits, mining equipment, and high-performance industrial machinery components. Tungsten’s superior density, hardness, and high melting point make it indispensable in the Middle East’s defense and aerospace sectors. In 2024, increased defense budgets across Saudi Arabia, the UAE, and Qatar, alongside ongoing modernization programs, drove demand for tungsten-based armor-piercing projectiles, missile components, and aircraft counterweights. Regional ammunition production, supported by partnerships with global OEMs, increasingly incorporates tungsten carbide-based penetrators. The aerospace sector is also benefiting from tungsten demand growth, with the Middle East acting as a hub for aircraft maintenance, repair, and overhaul (MRO), and major carriers like Emirates and Qatar Airways expanding fleets. Global aircraft manufacturing gains in 2025, as Boeing and Airbus ramped up deliveries, further increased regional procurement of tungsten alloys for control surfaces, engine components, and balance weights.

In the automotive sector, particularly in high-performance and electric vehicles (EVs), tungsten usage is rising due to its exceptional thermal and wear resistance. While most EV manufacturing remains concentrated in China and Europe, the Middle East is becoming a growing consumer and re-export hub for premium EV brands. The GCC’s luxury car market, supported by rising disposable incomes and EV adoption incentives in the UAE and Saudi Arabia, is driving imports from Tesla, Porsche, BMW, and NIO, all of which are expanding their use of tungsten alloys in motor assemblies, battery connectors, brake systems, and turbochargers. This creates new opportunities for regional suppliers and aftermarket service providers to handle specialized tungsten-based components.

The oil & gas and mining industries are key pillars of tungsten demand in the Middle East. In 2024, with oil prices stabilizing and upstream exploration activity recovering, national oil companies such as Saudi Aramco increased procurement of tungsten carbide drill bits and wear parts to withstand extreme temperatures and pressures in deep drilling. Mining projects in Saudi Arabia, Oman, and Morocco, spanning phosphate, gold, and copper, rely on tungsten-based rock fragmentation and ore extraction tools. These activities have sustained steady demand for high-performance tooling, particularly from regional manufacturers and distributors in the UAE and Turkey.

Drivers, Opportunities & Restraints

The Middle East tungsten market benefits from strong demand across defense, aerospace, oil & gas, and manufacturing sectors. Defense modernization programs in Saudi Arabia, the UAE, and Qatar are increasing procurement of tungsten-based armor-piercing projectiles, missile components, and aerospace alloys due to the metal’s unmatched density, hardness, and heat resistance. In parallel, the oil & gas and mining industries, key regional economic pillars, rely heavily on tungsten carbide drill bits, wear parts, and cutting tools to operate in extreme conditions, particularly in deep drilling and mineral extraction projects. National industrial strategies, such as Saudi Arabia’s Vision 2030 and the UAE’s Operation 300bn, also stimulate demand for tungsten-based tooling and components in advanced manufacturing.

Emerging trends in the region present significant growth avenues for tungsten applications. Expanding electric and high-performance vehicle adoption in the GCC creates demand for tungsten components in braking systems, turbochargers, electrical connectors, and vibration-damping assemblies. The region’s increasing interest in additive manufacturing, particularly aerospace, defense, and oilfield equipment, offers a new market for tungsten powders and specialty alloys. There is also potential for the localization of tungsten carbide tooling production within the Middle East, reducing import dependence while positioning the region as a supply hub for Africa, Europe, and South Asia. Additionally, strategic stockpiling and supply security initiatives could open opportunities for storage, trading, and processing investments.

Despite the positive outlook, the Middle East tungsten industry faces notable challenges. The region has minimal primary tungsten production, making it heavily dependent on imports, particularly from China, which exposes it to global supply disruptions and export restrictions. Price volatility, influenced by policy changes and mining output fluctuations in major producing nations, can impact procurement budgets and project timelines. Moreover, specific industrial and tooling applications face competition from alternative materials such as ceramics, high-speed steels, and composites, which may limit tungsten’s growth in cost-sensitive segments. Lastly, establishing refining and carbide manufacturing facilities in the region requires substantial capital investment and advanced technological capabilities, which can be barriers for new entrants.

Form Insights

By form, the powder segment accounted for the largest revenue share of over 30.0% in 2024. The powder segment is experiencing stable demand, supported by its pivotal role as a foundational material for a wide range of downstream tungsten products. The powder is the primary feedstock for manufacturing tungsten carbide, heavy alloys, and other high-performance components, making it integral to aerospace, defense, electronics, mining, and oil & gas industries. Its fine particle size, high density, and excellent wear resistance enable precise formulation of advanced materials tailored to specific performance requirements. In the GCC, tungsten powder is increasingly utilized for producing cutting and drilling tools, wear-resistant coatings, and specialized electrical contacts. Its versatility allows manufacturers to customize composition and grain size for enhanced hardness, strength, and thermal stability, ensuring reliable performance in demanding environments and supporting the region’s growing industrial and engineering applications.

The tungsten carbide components segment is anticipated to register the fastest CAGR in the market over the forecast period. This growth is fuelled by the material’s unmatched hardness, wear resistance, and durability, making it particularly suited for the region's abrasive and high-stress industrial applications. Industries such as oil & gas drilling, mining, metal fabrication, and large-scale construction rely heavily on tungsten carbide drill bits, cutting tools, nozzles, and wear plates, as these outperform conventional steel tools in both lifespan and performance. As industrial operations in the Middle East increasingly prioritize efficiency, reliability, and reduced downtime, adopting tungsten carbide components is expected to accelerate, supported by ongoing infrastructure expansion and energy sector investments.

End Use Insights

By end use, the automotive segment is anticipated to register the fastest CAGR of 5.8% from 2025 to 2033. The automotive sector represents a significant end use industry for tungsten, supported by the metal’s exceptional density, hardness, heat resistance, and wear durability. Tungsten-based products, particularly tungsten carbide tools, are integral to the precision machining, cutting, and shaping of vehicle components. While the region is not a primary vehicle manufacturing hub compared to Asia or Europe, the sector benefits from the region’s growing automotive aftermarket, high-performance vehicle imports, and localized assembly operations in countries such as the UAE and Saudi Arabia.

Tungsten-based tools and components are essential for producing engine parts, transmission systems, and turbocharger assemblies, especially for the high-performance and luxury segments popular in the GCC. Regional investments in electric vehicle (EV) infrastructure and assembly further support the demand, which requires advanced tooling and materials to meet performance and efficiency standards.

Electronics & robotics is projected to be the fastest-growing end use segment in the Middle East tungsten industry over the forecast period. Tungsten is critical in producing smartphones, laptops, tablets, industrial robots, and display technologies. In particular, it is used in electrodes for LCDs and OLEDs and in X-ray targets for advanced imaging systems in medical and industrial applications. The rapid adoption of smart devices, increasing IoT penetration, and expanding manufacturing automation across the region drive this demand. Countries such as the UAE, Saudi Arabia, and Qatar actively invest in advanced electronics manufacturing, robotics for industrial automation, and AI-driven technologies, creating substantial growth opportunities for tungsten-based components.

Regional Insights

UAE Tungsten Market Trends

UAE accounted for the largest market revenue share of 18.9% in the Middle East in 2024. The Middle East tungsten market is experiencing steady growth, driven by increasing infrastructure development, industrial diversification, and strategic investments in the mining sector across key economies such as Saudi Arabia and the UAE. In parallel, Gulf nations are accelerating their economic diversification efforts under national transformation programs, which are creating strong demand for high-performance materials in defense, aerospace, oil & gas, and heavy manufacturing, all of which are key end use sectors for tungsten-based products.

Saudi Arabia Tungsten Market Trends

Saudi Arabia’s tungsten demand is underpinned by the country’s Vision 2030 industrial transformation strategy, which emphasizes the growth of advanced manufacturing, defense production, and energy sector equipment. The Kingdom’s focus on boosting local manufacturing capabilities, particularly in defense systems, drilling tools, and high-precision machining, is expected to drive increased use of tungsten carbide and alloys. Ongoing investments in mining exploration are also aimed at identifying domestic sources of tungsten, reducing reliance on imports, and strengthening supply chain security for strategic industries.

UAE Tungsten Market Trends

The UAE’s tungsten market growth is supported by its position as a regional hub for aerospace, automotive re-exports, and high-tech manufacturing. Demand is robust from the country’s rapidly expanding aerospace maintenance, repair, and overhaul (MRO) industry, which requires tungsten-based tools and wear-resistant components. Additionally, the UAE’s focus on robotics, industrial automation, and precision engineering drives the use of tungsten in advanced machinery and electronic components. Government-led initiatives to expand local manufacturing under “Operation 300bn” are expected to boost domestic consumption of tungsten-based materials over the coming years.

Key Middle East Tungsten Company Insights

Some of the key players operating in the market include Wolframcarb and TFI Co. Industrial Knife.

-

Wolframcarb Middle East is a UAE-based company specializing in the manufacturing and distribution of tungsten carbide products. Their key offerings include tungsten carbide inserts, rods, bars, tips, and tool holders, catering primarily to industrial sectors such as mining, oil and gas, and heavy machinery. Wolframcarb Middle East is known for its focus on quality, precision engineering, and timely delivery within the GCC market.

-

TFI Co. Industrial Knife is a Middle East-based manufacturer focused on producing high-quality tungsten carbide inlaid machine knives and scraper blades. Serving industries including paper, packaging, and recycling, TFI Co. is reputed for its durable and precise cutting tools designed to withstand heavy industrial use. The company maintains a strong regional presence across Saudi Arabia, the UAE, and neighboring GCC countries.

-

MB-Tungsten.Metals.Recycling Ltd. is a Dubai-based company specializing in the recycling and trading of tungsten and tungsten carbide scrap materials. It supports sustainable resource management in the Middle East by providing efficient tungsten recovery and resale services to mining, manufacturing, and industrial clients. MB-Tungsten.Metals.Recycling Ltd. is recognized for its environmentally conscious operations and commitment to circular economic principles.

Key Middle East Tungsten Companies:

- Wolframcarb Middle East

- TFI Co. Industrial Knife

- Leakend

- Saeed Juma Trading

- Jia Ur Rahaman

- Mohammad Abdat

- MB‑Tungsten.Metals.Recycling Ltd.

- Saleh Ishaq Trading Co. LLC

- Sealmech Trading LLC

- Alpha Standard Trading LLC

- Piping material.ae

- Nikash Group

Recent Development

-

In March 2025, Wolframcarb Middle East expanded its production capacity at its Dubai facility by adding a new high-precision tungsten carbide grinding line. This USD 15 million investment aims to enhance the company’s ability to supply advanced tooling components to the growing oil & gas and mining sectors in the GCC, reducing lead times and improving product quality.

-

In January 2025, TFI Co. Industrial Knife launched a new range of eco-friendly tungsten carbide blades designed for recycling and packaging industries in the Middle East. These blades offer extended lifespan and improved energy efficiency during operation, supporting clients' sustainability goals amid rising regional environmental regulations.

-

In December 2024, MB-Tungsten.Metals.Recycling Ltd. signed a strategic partnership with a major UAE-based mining firm to develop a tungsten recycling hub in Dubai. The project focuses on increasing tungsten recovery rates from industrial scrap and reducing import dependency, aligned with the UAE’s broader circular economy and resource security initiatives.

Middle East Tungsten Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.7 million

Revenue forecast in 2033

USD 61.9 million

Growth rate

CAGR of 4.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, end use, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman

Key companies profiled

Wolframcarb Middle East; TFI Co. Industrial Knife; Leakend; Saeed Juma Trading; Jia Ur Rahaman; Mohammad Abdat; MB‑Tungsten.Metals.Recycling Ltd.; Saleh Ishaq Trading Co. LLC; Sealmech Trading LLC; Alpha Standard Trading LLC; Pipingmaterial.ae; Nikash Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Tungsten Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Middle East tungsten market report on the basis of form and end use:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Mill Products

-

Tungsten Carbide Components

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Construction

-

Automotive

-

Mining & Energy

-

Electronics & Robots

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East tungsten market size was estimated at USD 41.6 million in 2024 and is expected to reach USD 43.7 million in 2025.

b. The Middle East tungsten market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033 to reach USD 61.9 million by 2033.

b. By form, the powder segment accounted for the largest market revenue share of over 30.0% in 2024.

b. Some key players in the Middle East tungsten market are Wolframcarb Middle East, TFI Co. Industrial Knife, Leakend, Saeed Juma Trading, Jia Ur Rahaman, Mohammad Abdat, and MB‑Tungsten.Metals.Recycling Ltd., Saleh Ishaq Trading Co. LLC, Sealmech Trading LLC, Alpha Standard Trading LLC, Pipingmaterial.ae, and Nikash Group.

b. The growth of the Middle East tungsten market is driven by the rising demand for hard metals and alloys in automotive, aerospace, defense, and industrial machinery applications, owing to tungsten’s exceptional hardness, high melting point, and superior durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.