- Home

- »

- Next Generation Technologies

- »

-

Military Robots Market Size & Share, Industry Report, 2030GVR Report cover

![Military Robots Market Size, Share & Trends Report]()

Military Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Land Robots, Airborne Robots, Marine Robots), By Mode Of Operation (Autonomous Robots, Semi-Autonomous Robots), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-578-4

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Military Robots Market Summary

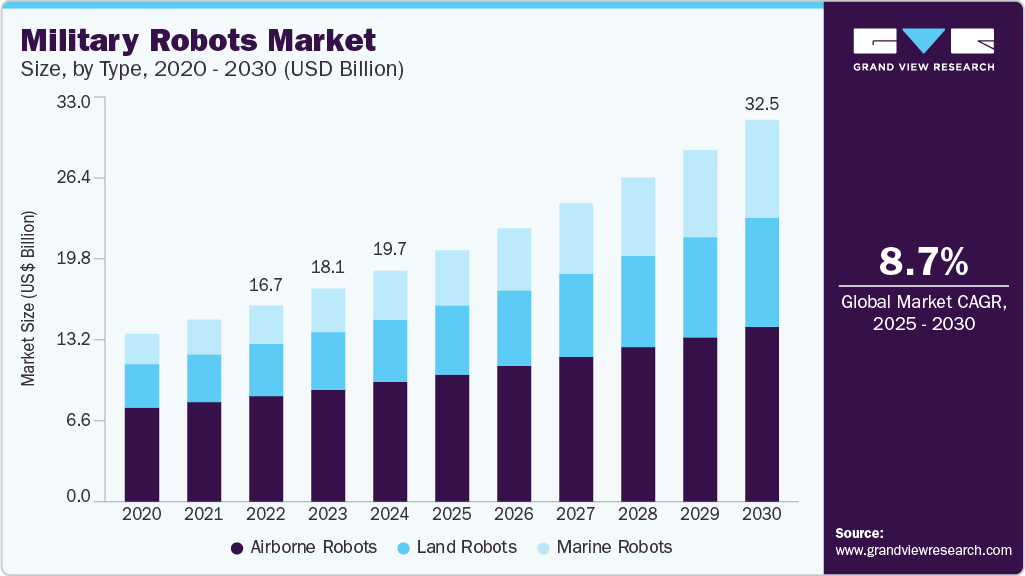

The global military robots market size was estimated at USD 19.68 billion in 2024 and is projected to reach USD 32.50 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The market is witnessing increased adoption driven by the growing need for autonomous systems supporting a wide range of defense operations.

Key Market Trends & Insights

- The North America generated the highest revenue share, accounting for over 40% in 2024.

- The Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030.

- Based on type, the airborne robots segment captured highest market share of over 51% in 2024.

- Based on application, the intelligence, surveillance, and reconnaissance (ISR) segment captured the highest market share in 2024.

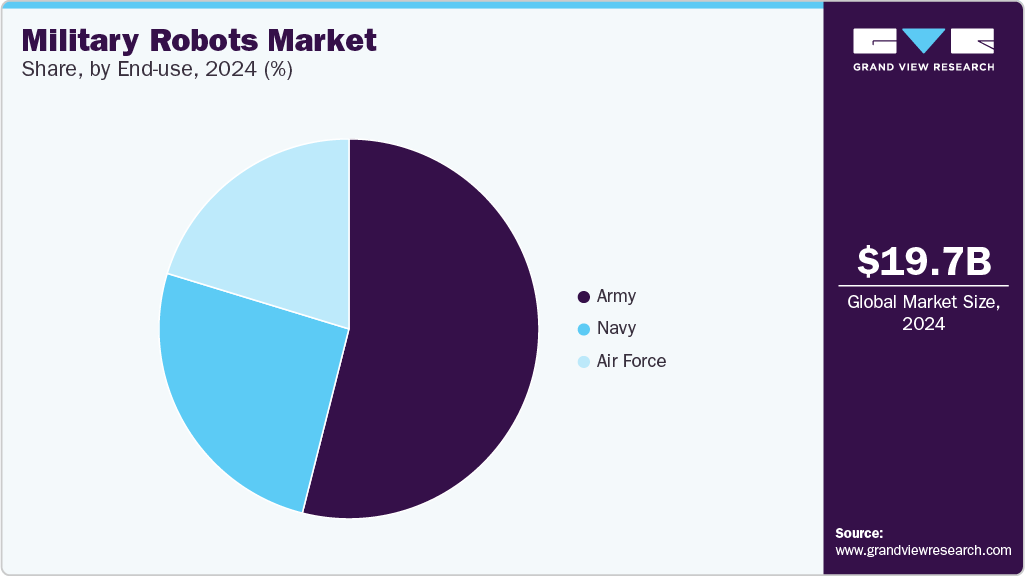

- Based on end use, the army segment captured the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.68 Billion

- 2030 Projected Market USD 32.50 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These robots are designed to perform tasks such as surveillance, reconnaissance, logistics, and combat support, aiming to enhance operational efficiency and reduce personnel exposure in high-risk situations environments. Featuring advanced navigation, AI-enabled decision-making, and integrated sensor technologies, these systems are increasingly being deployed across varied terrains and mission profiles. Collaborative efforts between defense organizations and commercial robotics platforms.

The market’s growth is supported by the emphasis on force modernization, cost-efficiency, and the need for scalable autonomous solutions within contemporary and future military frameworks. Moreover, the military robots industry is experiencing a transformative shift with the integration of artificial intelligence (AI) and machine learning (ML) into robotic platforms, significantly enhancing autonomous decision-making and operational effectiveness. These technologies support real-time pattern recognition, adaptive responses to fluid combat scenarios, and the autonomous execution of mission-critical tasks with minimal human intervention. Early pilot deployments have shown accelerated target acquisition and improved mission success, driven by onboard AI capabilities. As algorithmic accuracy advances, defense organizations are increasingly prioritizing software-defined architectures that offer rapid system updates and heightened operational resilience. In this evolving landscape, AI-driven functionalities are becoming a key competitive edge for players in the military robots industry.

The rising demand for resilient performance in GPS-denied environments is prompting the military robots industry to invest heavily in next-generation navigation technologies. Advanced solutions such as high-resolution LiDAR, inertial measurement units (IMUs), and SLAM (Simultaneous Localization and Mapping) algorithms enabling accurate real-time mapping and autonomous localization. Quantum sensing is also emerging as a promising tool to reduce navigational drift during prolonged missions. In the naval sector, acoustic navigation is being incorporated to enhance underwater positioning. These cutting-edge capabilities are rapidly becoming standard prerequisites for the design and deployment of future unmanned systems within the military robots industry.

The growing demand for longer operational endurance in harsh and remote locations is driving technological innovation across the military robots industry. Manufacturers are prioritizing hybrid power systems that integrate high-energy-density batteries with fuel cells, significantly extending mission durations. Smart energy management software further enhances efficiency by reducing logistical dependencies. Complementary solutions like solar augmentation and rapid charging technologies are gaining momentum to support flexible and sustained operations. As a result, endurance is now a central benchmark in the procurement strategies of unmanned systems within the military robots industry.

The military robots industry in Latin America is witnessing a surge in demand for unmanned ground and aerial vehicles (UGVs and UAVs) tailored for rapid disaster response and humanitarian aid missions. Governments and humanitarian organizations are deploying robotic platforms capable of navigating hazardous terrains-such as flood-affected regions and collapsed infrastructure-to identify survivors and deliver critical supplies. Public-private collaborations are fueling the development of modular payloads like thermal imaging sensors and automated medical delivery units, designed specifically for regional emergency conditions. Joint training programs between defense forces and humanitarian agencies are also ensuring effective integration of robotics into disaster-response frameworks. With climate-induced emergencies on the rise, the humanitarian applications segment of the military robots industry is emerging as a strategic growth area in the region.

Type Insights

The airborne robots segment captured highest market share of over 51% in 2024. The airborne robots segment of the military robots industry is experiencing strong growth driven by the increasing demand for real-time intelligence and surveillance capabilities. Modern airborne robots, including UAVs, are now integrated with artificial intelligence, advanced imaging systems, and long-endurance capabilities, making them indispensable tools in defense operations. Armed forces are increasingly focusing on autonomous airborne systems to boost mission efficiency and reduce personnel exposure to danger. Ongoing investments in swarm robotics, stealth technologies, and international defense collaborations are positioning airborne robots as a key force behind the expansion of the military robotics market.

The marine robots segment is expected to witness a fastest CAGR of over 11% from 2025 to 2030, due to the growing demand for persistent underwater surveillance and mine countermeasure capabilities. Navies worldwide are increasingly deploying autonomous surface and underwater vehicles to strengthen maritime domain awareness in contested and high-threat environments. The integration of advanced sonar systems, AI-powered navigation, and underwater communication technologies is significantly enhancing the range, precision, and dependability of these platforms. Strategic partnerships between defense manufacturers and naval forces are fueling innovation in unmanned marine vehicles (UMVs), establishing this segment as a vital component of modern naval warfare and coastal security operations.

Mode Of Operation Insights

The remotely operated robots segment captured the highest market share in 2024. Defense organizations are increasingly favoring remotely operated robots with modular payload configurations to optimize multi-mission flexibility. These platforms can be outfitted with interchangeable tools such as robotic arms, surveillance sensors, and non-lethal or lethal payloads. This modularity enables faster mission turnaround and greater adaptability in dynamic battlefield conditions. It also supports cost-effective scaling by reducing the need for multiple specialized units.

The semi-autonomous robots segment is expected to witness the fastest CAGR from 2025 to 2030. Semi-autonomous military robots are gaining traction as armed forces seek a balance between human oversight and operational automation in complex missions. These systems leverage AI-driven decision support while allowing human operators to retain control over critical functions such as targeting and engagement. The combination enhances situational responsiveness and reduces cognitive burden on personnel during fast-paced combat scenarios. As militaries move toward trusted autonomy frameworks, investments in semi-autonomous systems are accelerating, particularly for reconnaissance, perimeter defense, and logistics support.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment captured the highest market share in 2024. Intelligence, Surveillance, and Reconnaissance (ISR) robots are becoming critical tools in modern military operations, offering real-time data collection and analysis capabilities in complex environments. These systems, equipped with high-definition imaging, thermal sensors, and AI-driven analytics, enable military forces to monitor large areas and identify threats with high precision. Their ability to operate autonomously or with minimal human input in hostile territories significantly reduces the risk to personnel while enhancing operational efficiency. As the demand for battlefield awareness and intelligence grows, defense agencies are investing heavily in ISR robotics to bolster their surveillance capabilities and enhance mission success rates.

The combat support robots segment is expected to witness the fastest CAGR from 2025 to 2030. Combat support robots are increasingly being deployed to enhance operational efficiency in high-risk environments, reducing the need for human involvement in dangerous tasks. These robots are equipped with advanced sensors, robotic arms, and payloads designed for logistics, explosives disposal, and battlefield recovery missions. By performing repetitive or hazardous duties such as resupply runs, mine clearance, and casualty evacuation, combat support robots improve mission continuity while minimizing human casualties. As military forces focus on maximizing the effectiveness of their ground forces, the combat support segment continues to see innovation in mobility, automation, and integration with other military platforms.

End Use Insights

The army segment captured the highest market share in 2024. The Army is increasingly relying on robotic systems to enhance battlefield effectiveness while reducing human risk in combat situations. Land Robots are being deployed for tasks such as reconnaissance, explosive ordnance disposal (EOD), and logistics support, allowing soldiers to focus on strategic objectives while these robots handle dangerous and time-consuming operations. With advances in AI, autonomous navigation, and rugged design, these robots can operate in challenging terrains, including urban environments and conflict zones, ensuring mission success with minimal human intervention. As the Army modernizes its approach to warfare, the growing use of robotic systems is set to play a key role in improving operational efficiency, enhancing force protection, and optimizing resource deployment.

The navy segment is expected to witness the fastest CAGR from 2025 to 2030. The integration of unmanned and autonomous systems in naval operations is transforming maritime defense strategies, with a growing focus on reducing crew risk and enhancing operational capabilities. Autonomous surface and underwater vehicles, such as Marine Robots, are increasingly utilized for intelligence gathering, mine detection, and surveillance missions, often in hostile or high-risk areas. These robots enable the Navy to conduct more precise and efficient operations while ensuring enhanced situational awareness and rapid response times. With advancements in stealth, AI-driven navigation, and communication systems, the Navy segment is positioning unmanned systems as vital assets for securing maritime territories and enhancing defense capabilities.

Regional Insights

The military robots market in North America generated the highest revenue share, accounting for over 40% in 2024. Robust defense budgets and consolidation among prime contractors are accelerating the deployment of advanced robotic solutions across North America. Public-private partnerships are driving R&D in autonomy, sensor fusion, and power systems to meet evolving multi‑domain operational requirements. The region’s mature industrial base and streamlined procurement pipelines underpin its continued leadership in military robotics innovation.

U.S. Military Robots Market Trends

The U.S. military robots market held a dominant position in 2024. The U.S. Department of Defense is prioritizing investments in AI‑enabled unmanned platforms to enhance force projection and C‑UAS capabilities. Rapid prototyping initiatives through DARPA and the Defense Innovation Unit are shortening development cycles for field‑ready robotics. Emphasis on open‑architecture frameworks is ensuring interoperability across legacy and next‑generation systems.

Europe Military Robots Market Trends

The Europe military robots market was identified as a lucrative region in 2024. European defense agencies are leveraging the European Defence Fund to standardize unmanned systems and scale cross‑border production. Strategic collaboration among EU member states is fostering modular design approaches and shared logistics infrastructures. Sustainability mandates are prompting adoption of hybrid power architectures and recyclable materials in robotics manufacturing.

Germany military robots market is growing due to Bundeswehr modernization roadmap emphasizes domestic robotics development under its Industrie 4.0 agenda. Partnerships between government research institutes and local SMEs are advancing autonomous ground vehicle trials for both logistical and reconnaissance missions. The focus on cybersecurity hardening and digital twin technologies is strengthening system resilience and lifecycle management.

The military robots market in UK is growing as country’s defence AI Strategy is channeling funds into autonomous maritime and aerial robotics for littoral and anti‑drone operations. Collaborative hubs in Belfast and Bristol are nurturing startups to prototype agile, software‑defined robotic platforms. Procurement policies are increasingly favoring scalable subscription models to improve cost predictability and rapid fielding.

Asia-Pacific Military Robots Market Trends

The military robots market in the Asia Pacific region is expected to grow at the highest CAGR of over 11% from 2025 to 2030. Rising geopolitical competition is driving Asia‑Pacific nations to expand indigenous robotics manufacturing capabilities and diversify supplier networks. Joint exercises and multinational R&D consortia are accelerating technology transfer and standardization across the region. Investment in unmanned maritime and border‑security robots is particularly strong among coastal states.

China military robots market is growing due to country’s defense budget growth is fueling large‑scale fielding of swarm drone systems for both reconnaissance and precision‑strike roles. State‑backed robotics firms are securing key PLA contracts to develop autonomous ground vehicles for logistics and C‑UAS applications. Heavy emphasis on vertically integrated supply chains is enabling rapid scaling and export competitiveness.

The military robots market in India is flourishing under the “Make in India” initiative, the Indian armed forces are partnering with DRDO and private startups to indigenize UGV and UAV production. Focused procurement for border surveillance and counter‑insurgency operations is driving adoption of rugged, low‑cost robotic solutions. Technology‑transfer agreements with Israeli and European primes are strengthening local design and manufacturing expertise.

Middle East & Africa Military Robots Market Trends

Heightened security challenges are prompting Middle East and African nations to invest in robotic systems for border control, C‑UAS, and counter‑terrorism missions. Regional defense clusters in the UAE and South Africa are co‑developing modular unmanned platforms tailored to desert and urban environments. Financing schemes and joint‑venture incentives are lowering entry barriers for domestic robotics producers.

Saudi Arabia military robots market is growing due to country’s Vision 2030 defense modernization plan allocates significant capital to autonomous robotics for coastal defense and base protection. Collaborations with U.S. and European defense firms are accelerating knowledge transfer and local assembly of unmanned systems. The kingdom’s sovereign wealth fund is also investing in homegrown AI startups to underpin future robotics innovations.

Key Military Robots Company Insights

Some of the key players operating in the market include BAE Systems and Lockheed Martin Corporation

-

BAE Systems is a mature leader in the military robotics market, providing a broad range of unmanned and autonomous systems for defense applications. The company specializes in delivering advanced robotics solutions for air, land, and sea, including autonomous vehicles, robotics for logistics, and surveillance drones. Their focus on enhancing military effectiveness through integrated robotic systems has solidified their position as a key player in the market.

-

Lockheed Martin Corporation is a well-established defense and aerospace company, specializing in military robotics for both tactical and strategic missions. Their robotics portfolio includes airborne robots, ground vehicles, and naval systems that enhance intelligence gathering, surveillance, and defense operations. The company focuses on innovation in autonomous systems to support mission-critical operations and improve force protection.

Ghost Robotics and Rebellion Defense are some of the emerging participants in the Military robots market.

-

Ghost Robotics is an emerging player specializing in autonomous quadrupedal robots designed for military and defense applications. Their flagship robot, the Vision 60, is an advanced, highly adaptable unmanned ground vehicle for surveillance, reconnaissance, and tactical operations. The company focuses on providing rugged, versatile robots capable of navigating challenging terrains such as urban environments and rough landscapes.

-

Rebellion Defense focuses on developing cutting-edge artificial intelligence and machine learning solutions for military robots, enhancing autonomous decision-making capabilities. Their robots specialize in intelligence, surveillance, and reconnaissance (ISR) missions, with a strong emphasis on improving operational efficiency and reducing human risk in conflict zones. Rebellion Defense's technology integrates AI to help military forces optimize mission planning and execution in real-time.

Key Military Robots Companies:

The following are the leading companies in the military robots market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Boston Dynamics

- Cobham Plc

- Elbit Systems Ltd.

- Endeavor Robotics (iRobot)

- General Dynamics Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Qinetiq

- Saab AB

- Textron Systems

- Thales Group.

Recent Developments

-

In March 2025, Applied Research Associates (ARA) partnered with Clemson University to improve the diesel-electric drivetrain of its autonomous robot as part of an initiative to support the U.S. Army’s Ground Vehicle Systems Center (GVSC) with advanced mobility solutions. The collaboration utilizes Clemson’s Virtual Prototyping of Autonomy-Enabled Ground Systems (VIPR-GS) Research Center at CU-ICAR, combining academic innovation with industry expertise to advance military autonomous vehicle technology. This initiative also offers Clemson students and faculty valuable real-world experience in developing systems that improve safety for both military and civilian applications.

-

In March 2025, Shield AI partnered with Singapore's Defence Science and Technology Agency (DSTA) and the Republic of Singapore Air Force (RSAF) to collaborate on the development of AI technologies for autonomous flight operations. The collaboration will leverage Shield AI's Hivemind Enterprise, an AI-driven autonomy software suite, to strengthen RSAF's operational effectiveness and improve its autonomous systems. This alliance underscores the growing need for scalable, intelligent, and resilient autonomy, further cementing the RSAF's status as one of Southeast Asia's leading technologically advanced air forces.

Military Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.41 billion

Revenue forecast in 2030

USD 32.50 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of operation, application, end use , regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

BAE Systems; Boston Dynamics; Cobham Plc; Elbit Systems Ltd.; Endeavor Robotics (iRobot); General Dynamics Corporation; Lockheed Martin Corporation; Northrop Grumman Corporation; Qinetiq; Saab AB; Textron Systems; Thales Group.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military Robots Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the military robots market report based on type, mode of operation, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Land Robots

-

Explosive Ordnance Disposal (EOD) Robots

-

Surveillance & Reconnaissance Robots

-

Combat Support Robots

-

Transportation & Logistics Robots

-

-

Airborne Robots

-

Small UAVs (Tactical Drones)

-

Medium UAVs (Strategic Drones)

-

Large UAVs (HALE/MALE Drones)

-

Combat UAVs (UCAVs)

-

-

Marine Robots

-

Unmanned Surface Vehicles (USVs)

-

Autonomous Underwater Vehicles (AUVs)

-

Remotely Operated Vehicles (ROVs)

-

-

-

Mode of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autonomous Robots

-

Semi-Autonomous Robots

-

Remotely Operated Robots

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Search & Rescue (SAR)

-

Intelligence, Surveillance, And Reconnaissance (ISR)

-

Logistics & Transportation

-

Combat Support

-

Others (Mine clearance, Explosive Ordnance Disposal (EOD), Firefighting)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Army

-

Navy

-

Air Force

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global military robots market size was estimated at USD 19.68 billion in 2024 and is expected to reach USD 21.41 billion in 2025.

b. The global military robots market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 32.50 billion by 2030.

b. The military robots market in North America generated the highest revenue share, accounting for over 40% in 2024, driven by the region’s mature industrial base and streamlined procurement pipelines underpin its continued leadership in military robotics innovation.

b. Some key players operating in the military robots market include BAE Systems, Boston Dynamics, Cobham Plc, Elbit Systems Ltd., Endeavor Robotics (iRobot), General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Qinetiq, Saab AB, Textron Systems, and Thales Group.

b. The key factors driving the military robots market include the growing need for autonomous systems capable of supporting a wide range of defense operations, the integration of artificial intelligence (AI) and machine learning (ML) into robotic platforms, and the rising demand for resilient performance in GPS-denied environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.