- Home

- »

- HVAC & Construction

- »

-

Mining Drilling Service Market Size, Industry Report, 2033GVR Report cover

![Mining Drilling Service Market Size, Share & Trends Report]()

Mining Drilling Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type, By Mining Method (Open-Pit Mining, Underground Mining), By Application (Coal Mining, Metal Mining, Mineral Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-735-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Drilling Service Market Summary

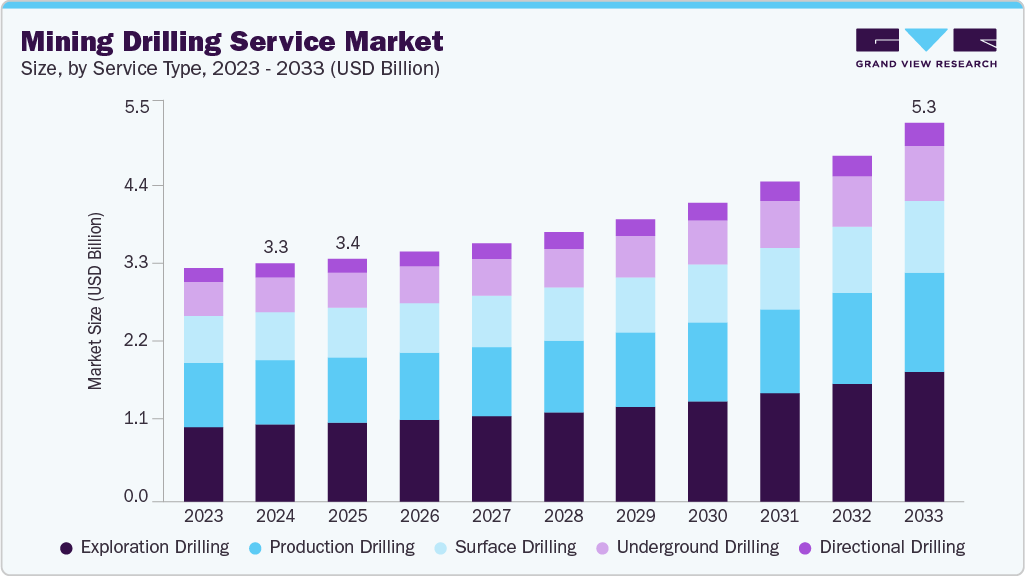

The global mining drilling service market size was estimated at USD 3,310.5 million in 2024, and is projected to reach USD 5,270.6 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is witnessing steady growth, driven primarily by the rising global demand for minerals, metals, and rare earth elements essential to industries such as construction, electronics, automotive, and renewable energy.

Key Market Trends & Insights

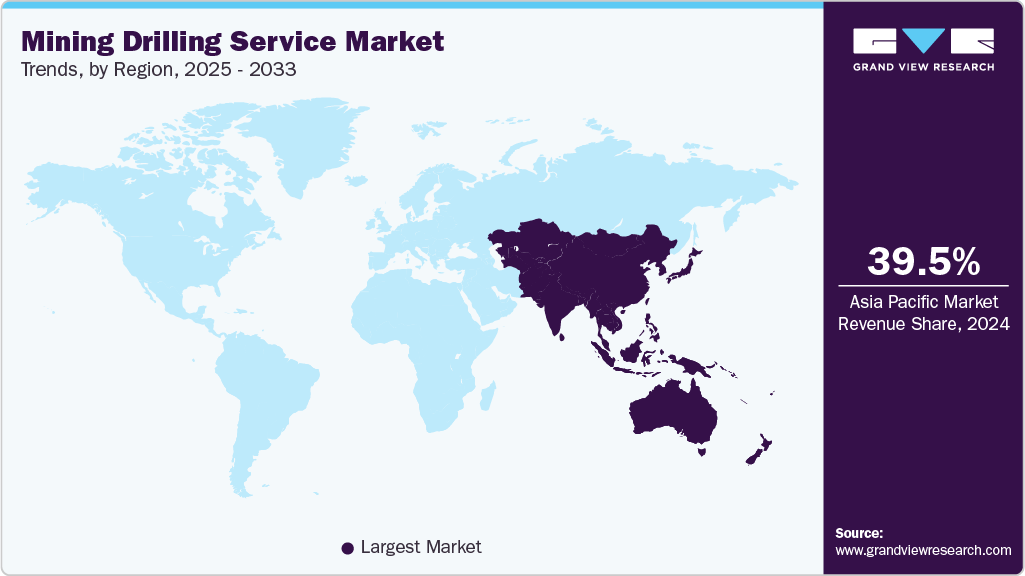

- The Asia Pacific mining drilling service market accounted for a revenue share of 39.5% share in 2024.

- The mining drilling service industry in China held a dominant position in 2024.

- By service type, the exploration drilling segment accounted for the largest share of 32.4% in 2024.

- By mining method, the open-pit mining segment held the largest market share in 2024.

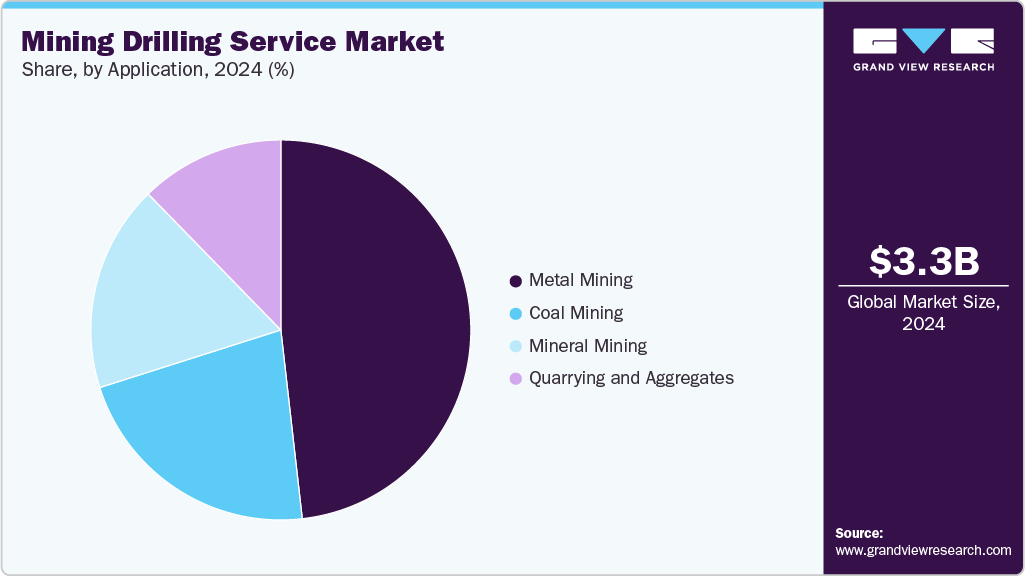

- By application, the metal mining segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,310.5 Million

- 2033 Projected Market Size: USD 5,270.6 Million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest Market in 2024

The increasing consumption of critical materials such as lithium, copper, and cobalt, particularly for battery production and electric vehicles, is fueling exploration and production activities worldwide. In addition, depletion of near-surface ore bodies is prompting mining companies to intensify drilling operations in remote and deeper locations, thereby boosting demand for both surface and underground drilling services. Emerging markets, especially in Latin America, Africa, and the Asia Pacific, are also contributing significantly to the market’s expansion through mineral-rich reserves and favorable mining policies.Technological advancement is transforming the mining drilling service industry, with automation, data analytics, and remote-control capabilities playing a pivotal role. Integration of real-time monitoring systems, GPS-enabled drilling rigs, and AI-driven predictive maintenance tools is enhancing drilling precision and reducing operational risks. Directional drilling and 3D seismic imaging are becoming more prevalent, particularly in complex geological terrains.

Investment in mining drilling services continues to rise, supported by strong commodity prices and increasing exploration budgets from mining companies. Governments and private firms are ramping up capital expenditure, especially for exploration projects targeting green minerals critical to the energy transition. Strategic collaborations between drilling service providers and technology firms are also on the rise, aimed at integrating advanced solutions into drilling fleets. For instance, partnerships focused on machine guidance systems and digital drilling platforms are enabling service providers to offer more value-added services and improve project outcomes.

The regulatory landscape for mining drilling services is becoming more complex and stringent, particularly with respect to environmental and safety standards. Governments are enforcing stricter permitting requirements, land use policies, and emissions regulations to mitigate the environmental impact of drilling activities. In several regions, local community engagement and social license to operate have become essential components of regulatory compliance. Compliance with international standards such as ISO 14001 for environmental management and adherence to occupational health and safety norms is now a critical expectation for drilling service providers.

Despite positive growth drivers, the mining drilling service industry faces several restraints. Fluctuating commodity prices can lead to inconsistent capital flows, affecting exploration and drilling project timelines. Environmental concerns and opposition from local communities can delay or halt drilling operations. In addition, the high capital cost of advanced drilling equipment and the shortage of skilled labor in remote mining regions can limit service capacity and profitability.

Service Type Insights

The exploration drilling segment accounted for the largest share of 32.4% in 2024. The global surge in demand for critical minerals and metals is fueling the growth of the segment. The clean energy transition fuels an unprecedented need for materials such as lithium, copper, cobalt, nickel, and rare earth elements, which are essential for electric vehicle (EV) batteries, wind turbines, solar panels, and other green technologies. As accessible reserves of these minerals become depleted, mining companies are investing heavily in exploration to discover new deposits.

The directional drilling segment is expected to grow at a significant CAGR during the forecast period. The cost efficiency and operational flexibility drive the segment’s growth. However, initially more capital-intensive, directional drilling can lead to significant long-term cost savings by reducing the need for multiple drill pads, minimizing excavation, and improving ore targeting accuracy. In addition, the ability to drill multiple intersecting holes from a single location offers operational flexibility, enabling better resource estimation and planning. This efficiency is particularly beneficial in exploration and pre-feasibility studies.

Mining Method Insights

The open-pit mining segment held the largest market share of 68.3% in 2024. High productivity and scalability drive the segment’s growth. Open-pit mining enables large-scale extraction of mineral resources, allowing for high-volume output. It facilitates the use of heavy-duty drilling and excavation equipment, which significantly boosts productivity. The method is also highly scalable, making it suitable for both short-term and long-term mining projects. The scalability and ability to handle massive volumes of overburden and ore contribute to sustained demand for surface drilling services such as blast hole drilling and production drilling.

The underground mining segment is expected to grow at the fastest CAGR during the forecast period. Access to high-value and deep ore deposits fuels the market growth. Underground mining enables access to deep-seated and high-value deposits, including gold, copper, zinc, nickel, and rare earth elements. Many of these deposits are located at depths that are impractical or uneconomical to exploit through open-pit mining. With directional and long-hole drilling techniques, underground operations can extract these resources more efficiently. This growing demand for deeper resource extraction directly fuels the need for advanced underground drilling services.

Application Insights

The metal mining segment dominated the mining drilling service market in 2024. The increasing global consumption of base metals such as copper, zinc, nickel, and aluminum, along with precious metals such as gold and silver, is driving the market growth. These metals are critical to infrastructure development, electrical grids, manufacturing, and consumer electronics. In addition, copper and nickel are vital components in electric vehicles (EVs), batteries, and renewable energy systems. As demand surges across industrial and clean energy sectors, mining companies are ramping up drilling efforts to locate and extract new metal reserves, directly boosting the need for drilling services.

The mineral mining segment is projected to grow at a significant CAGR of 5.8% over the forecast period. The growing global demand for agricultural fertilizers, particularly those based on phosphate and potash, fuels the growth. As the global population increases and food security becomes a central concern, countries are investing in enhancing agricultural productivity. This drives the need for large-scale extraction of fertilizer-grade minerals, requiring exploration and production drilling in mineral-rich areas such as Canada, Russia, and Morocco. Drilling services are essential for discovering new reserves and expanding existing operations to meet the rising demand.

Regional Insights

The North America mining drilling service market held a significant share in 2024. The market growth is driven by robust exploration and production activities, particularly in metal and mineral mining. The region is home to significant reserves of copper, gold, and lithium, which are in high demand for renewable energy technologies and electric vehicles.

U.S. Mining Drilling Service Market Trends

The U.S. mining drilling service industry held a dominant position in 2024 due to the renewed interest in domestic mining to reduce reliance on imported critical minerals such as rare earth elements, lithium, and copper. Government-backed initiatives aimed at strengthening supply chains for energy transition materials are encouraging greater investment in mineral exploration.

Europe Mining Drilling Service Market Trends

The Europe mining drilling service industry was identified as a lucrative region in 2024. The growth in the region is driven by increasing demand for strategic minerals needed in green energy and digital technologies. The European Union’s push for raw material security and sustainable mining practices has opened up new opportunities for drilling service providers.

The UK mining drilling service market is expected to grow rapidly in the coming years. In the UK, the focus on critical mineral exploration, such as lithium in Cornwall and rare earths in Scotland, is creating new demand for drilling services. As part of its net-zero goals, the UK is supporting domestic resource development to supply the battery and green technology sectors.

The mining drilling service market in Germany held a substantial revenue share in 2024. Germany is intensifying its efforts to secure critical minerals for its high-tech and automotive industries, which is driving investment in domestic and nearby mineral exploration. The country is also looking at repurposing former coal mining regions for rare earth and lithium extraction, creating opportunities for drilling contractors.

Asia Pacific Mining Drilling Service Market Trends

The Asia Pacific mining drilling service industry is anticipated to grow at a CAGR of 6.4% during the forecast period. The market is experiencing growth in the region due to expanding mining activities across both developed and developing nations. The region is a major global hub for coal, base metals, and industrial minerals, with substantial investments being made in exploration and mine development.

The India mining drilling service market is expected to grow rapidly in the coming years. India’s mining drilling services market is expanding steadily, supported by government initiatives to enhance domestic mineral production. The Make in India and Atmanirbhar Bharat programs are encouraging investment in mining projects for coal, bauxite, and rare earth elements.

The mining drilling service market in China held a substantial market share in 2024 due to its extensive mining industry and strong demand for minerals used in electronics, EVs, and construction. The country is a global leader in the production of rare earths, coal, and base metals, requiring continuous drilling activities for exploration and resource replenishment.

Key Mining Drilling Service Company Insights

Some of the key companies in the mining drilling service market include Boart Longyear, Sandvik AB, Ausdrill, Major Drilling, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Boart Longyear is a drilling services company, providing productivity-driven drilling equipment and performance tooling for the mining and drilling industries. With operations in 26 countries, the company serves customers on every continent, spanning commodities such as copper, gold, nickel, zinc, uranium, iron, and more. The company is known for its integrated exploration services, surface and underground coring, pump and rotary services, and advanced drilling technology, such as the revolutionary Q Wireline System. The company combines innovative engineering, decades of field expertise, and a commitment to safety and sustainability to support the world’s most challenging mineral exploration and development projects.

-

Sandvik AB is a global, high-tech engineering company specializing in providing innovative solutions that enhance profitability, productivity, and sustainability across the manufacturing, mining, and construction industries. It has operations in around 150 countries. It develops and manufactures cutting tools, mining equipment, tooling systems, advanced materials, and digital solutions aimed at improving operational efficiency and environmental performance.

Key Mining Drilling Service Companies:

The following are the leading companies in the mining drilling service market. These companies collectively hold the largest market share and dictate industry trends.

- Boart Longyear

- Sandvik AB

- Ausdrill

- Major Drilling

- Foraco International SA

- Orbit Garant Drilling Inc.

- Action Drill & Blast

- SWICK MINING SERVICES

- Drillcon Group

- Geodrill

Recent Developments

-

In May 2025, ArcelorMittal Mining Canada partnered with Sandvik Mining to enhance its rotary drilling fleet at its Mont-Wright iron ore mining complex in Québec. The agreement involves the supply of four advanced Sandvik DR412i rotary blasthole drills, with the first two already delivered and the remaining two scheduled by the end of Q3 2025. These intelligent drills, capable of both rotary and down-the-hole drilling, offer improved productivity through drilling depths of up to 75.5 meters and feature real-time operator feedback, advanced safety measures, and a centralized service center to streamline maintenance and reduce environmental impact.

-

In February 2024, Ausdrill, a drilling services provider, established a strategic alliance with SITECH WA, a technology solutions specialist for mining processes in Western Australia. This collaboration sees SITECH WA's Trimble Groundworks machine guidance technology integrated into Ausdrill's Rock Commander Fleet, representing a substantial leap in mining safety, precision, and operational efficiency. Together, the two companies aim to redefine industry standards in these areas, propelling the mining sector forward with advanced technological innovations.

Mining Drilling Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,386.3 million

Revenue forecast in 2033

USD 5,270.6 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report mining method

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, mining method, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Boart Longyear; Sandvik AB; Ausdrill; Major Drilling; Foraco International SA; Orbit Garant Drilling inc.; Action Drill & Blast; SWICK MINING SERVICES; Drillcon Group; Geodrill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

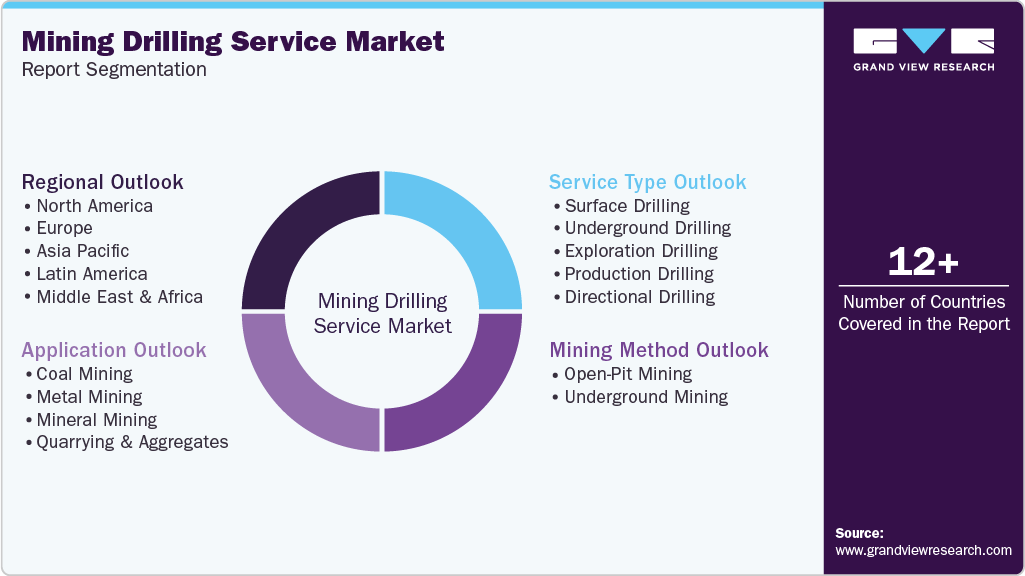

Global Mining Drilling Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mining drilling service market report based on service type, mining method, application, and region:

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface Drilling

-

Underground Drilling

-

Exploration Drilling

-

Production Drilling

-

Directional Drilling

-

-

Mining Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Open-Pit Mining

-

Underground Mining

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Coal Mining

-

Metal Mining

-

Mineral Mining

-

Quarrying and Aggregates

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining drilling service market size was estimated at USD 3,310.5 million in 2024 and is expected to reach USD 3,386.3 million in 2025.

b. The global mining drilling service market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 5,270.6 million by 2033.

b. Asia Pacific dominated the mining drilling service market with a share of 39.5% in 2024. The market is experiencing growth in the region due to expanding mining activities across both developed and developing nations.

b. Some key players operating in the mining drilling service market include Boart Longyear; Sandvik AB; Ausdrill; Major Drilling; Foraco International SA; Orbit Garant Drilling inc.; Action Drill & Blast; SWICK MINING SERVICES; Drillcon Group; Geodrill.

b. The mining drilling services market is witnessing steady growth, driven primarily by the rising global demand for minerals, metals, and rare earth elements essential to industries such as construction, electronics, automotive, and renewable energy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.