- Home

- »

- Biotechnology

- »

-

miRNA Sequencing And Assay Market Size Report, 2030GVR Report cover

![miRNA Sequencing And Assay Market Size, Share & Trends Report]()

miRNA Sequencing And Assay Market (2023 - 2030) Size, Share & Trends Analysis Report By Product & Service (Library Preparation Kits), By Technology, By Workflow, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-394-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

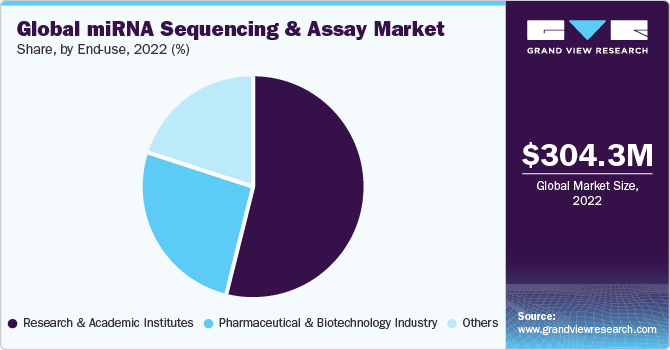

The global miRNA sequencing and assay market size was valued at USD 304.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.3% from 2023 to 2030 . The expansion of technologically advanced sequence analysis platforms, increasing funding for geoscience research, and escalating applications of miRNA is anticipated to fuel market growth. miRNA sequence analysis enables the discovery of previously non-characterized miRNAs and assists in miRNA isoforms examination and the study of disease associations, along with tissue-specific expression patterns.

The market is being driven by the rising use of miRNA sequencing in the healthcare industry. According to numerous research studies, miRNAs can be effectively utilized as biomarkers in diagnosing and prognosis cancers (ovarian, cervical, and breast), sepsis, cardiac diseases, and nervous system conditions. As a result, miRNA sequence analysis is widely used for clinical illnesses to analyze how genes are regulated. For instance, a Frontiers publication in March 2022 on molecular neuroscience claimed that connecting brain-based miRNA expression with blood-based miRNA indicators may be possible.

The COVID-19 pandemic positively impacted the miRNA sequencing market. miRNAs play an important role in the immune response regulation against infectious diseases, exhibiting early changes at the onset of disease and before the pathogen detection. For instance, according to an article published in the National Center for Biotechnology Information (NCBI), in July 2021, early-stage diagnosis of COVID-19 may be identified with 99.9% accuracy by measuring miRNA (miR-195-5p, miR-23a-3p, and miR-423-5p). These potential applications of miRNA in diagnosing the COVID-19 virus have contributed to market growth.

Next-generation sequencing is usually preferred over microarrays for miRNA sequence analysis since it provides a superior signal-to-noise ratio and enables effective sequencing. Additionally, short RNAs such as miRNA, piRNA, and siRNA have a role in the differentiation, development, and RNA-mediated epigenetic regulation of cellular processes such as death and gene expression. Small RNA sequence analysis makes finding novel miRNAs and other small RNAs easier and determines whether these nucleic acids are expressed differently in various samples. The method effectively identifies variants such as isomiRs with single-base resolution and analyzes miRNAs without knowledge of their secondary structure or sequence in advance.

Furthermore, the growing use of sequencing analysis techniques has led to considerable investments by key market players. As a result, a large product line has grown rapidly in the market. Most of these products are advancements over currently available biotechnology products. This has allowed competitors to launch and develop products faster than new entrants. Firms such as Ultima Genomics and Deep Genomics are obtaining sizeable funding for their systems for sequencing and artificial intelligence discoveries. Despite this development, a lack of knowledge and computational capacity may impede the miRNA sequencing market.

End-use Insights

Based on end use, the market is segmented into the pharmaceutical & biotechnology industry, research and academic institutes, and others. The research and academic institutes segment dominated the market and accounted for the largest revenue share of over 50% in 2022. miRNA sequencing techniques and products are widely used in several research and academic institutes' research studies. Therefore, many research studies are expected to drive the market for miRNA sequencing and assay products. For instance, in June 2020, researchers from the Indian Institute of Technology Madras discovered an over-expressed specific miRNA called 'miR-155' in tongue cancer.

The pharmaceutical and biotechnology industries segment is expected to grow significantly during the forecast period. These industries deal with extensive research to develop therapeutics for several diseases. Major factors that drive the segment include an increase in R&D funding, the high adoption rate of high throughput sequencing technologies with advanced features, and a rise in the number of comparative and evolutionary genomic studies in the research and development department. Biopharmaceutical companies are increasingly searching for new therapeutic molecules that can act as new drugs, further driving the market for microRNA. Several miRNA-based candidates are under clinical trials, such as anti-miR compounds and specific inhibitors for miRNAs, which can act as potential therapeutic solutions. Hence, RNA therapeutics is considered a trending investment area that will lead to the development of profitable drugs.

Technology Insights

Based on technology the market is segmented into sequencing by synthesis, sequencing by oligonucleotide ligation and detection (SOLiD), nanopore sequencing, sanger sequencing, and single molecule real-time (SMRT) sequencing. The sequencing by synthesis segment dominated the market with the largest revenue share of over 32% in 2022 owing to its simple workflow, highest data accuracy, and wide range of applications. The ongoing research and study in miRNA sequencing by synthesis has contributed to the market growth. According to a study published in January 2021, researchers from China, Germany, and the U.S. assessed the standard SBS and the methods used for this. The study stated that SBS improved more annotated miRNAs and generated more novel miRNAs.

The sequencing by oligonucleotide ligation and detection (SOLiD) segment is expected to grow at the fastest CAGR of 13.7% over the forecast period 2023 to 2030. It is majorly used to identify variations in resequencing, targeted resequencing, and transcriptome sequencing. Currently, systems accessible in the market have 30 G per run of data output with 99.99% accuracy.

Regional Insights

North America dominated the market and accounted for the largest revenue share of around 45% in 2022, owing to key players such as PerkinElmer, Inc. and Thermo Fisher Scientific, who have increased their R&D activities for novel diseases. Companies operating in this region are developing new products to expand their product portfolio. For instance, in 2020, Illumina, Inc. invested USD 682 million in R&D to advance its existing technology and develop new sequence analysis technology. These factors are further promoting regional growth.

A novel miRNA point-of-care testing for cancer diagnosis was created in February 2022 by researchers from the University of Illinois at Urbana. Nanoparticles are used in the test to isolate tumor-specific microRNAs from human serum. In a similar vein, in March 2021, DiamiR and Interpace Biosciences decided to buy a Clinical Laboratory Improvement Amendments (CLIA) accredited laboratory in New Haven, Connecticut. DiamiR aims to develop better and market its microRNA-based assays to facilitate early recognition, differential diagnosis, progression prediction, and tracking brain health and other disorders through this acquisition.

Asia Pacific is expected to grow at the fastest CAGR of 15.4% during the forecast period owing to the presence of numerous organizations and associations that are making efforts to educate young scientists in this region. For instance, APBioNet, an Asia Pacific bioinformatics network, aims to exchange data and information, track the growth of the bioinformatics infrastructure, and host conferences, workshops, and training sessions. In February 2021, researchers from China identified blood microRNA (miRNA) as potential biomarkers for pyrrolizidine alkaloids-induced hepatic sinusoidal obstruction syndrome (HSOS) by using microarray-based miRNA profiling. In addition, the study also involved various computational microRNA-target tools for predicting the relationship between miRNA and their target mRNA.

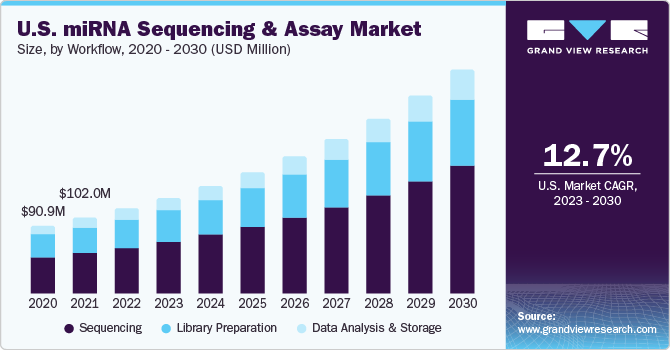

Workflow Insights

On the basis of workflow, the market is segmented into library preparation, sequencing and data analysis & storage. The sequencing segment dominated the market with the largest revenue share of over 50% in 2022 and is expected to grow at the fastest CAGR of 14.1% over the forecast period. The sequencing workflow helps to identify and analyze a complete range of miRNA and small RNA species. Moreover, it assists in determining how post-transcriptional regulation influences phenotype and in the discovery of novel biomarkers, which have broad applications in the research of cancer and other complex diseases. The most commonly used platforms for miRNA sequencing include MiSeq and HiSeq offered by Illumina Inc.

In June 2022, PerkinElmer, Inc. launched three sample preparation kits for research purpose only, which include PG-Seq Rapid Kit v2, NEXTFLEX Small RNA-Seq Kit v4, and NEXTFLEX Rapid XP V2 DNA-Seq Kit. All these factors along with increasing R&D activities in the sequencing market will continue to boost the market growth.

Application Insights

Based on application, the market is segmented into cancer, polyglutamine diseases, autoimmune disease, schizophrenia, and others. The cancer segment dominated the market and accounted for the largest revenue share of over 35% in 2022, owing to the increasing prevalence of cancer globally. A gradually growing prevalence of cancer warrants using the latest technology to enable oncologists better to understand the mechanics of cancer and tumor cells. The aberrant expression of miRNAs shows great potential as innovative diagnostic and prognostic cancer biomarkers with high sensitivity and specificity. According to the article published in the NCBI in March 2022, miRNA molecules can help in the development of screening for early detection of tumors by accessing the level of risk, which is a major challenge in the period of personalized medicine. miRNA can significantly enhance the effectiveness of treatment for cancer patients.

The polyglutamine diseases segment is expected to grow at the fastest CAGR of 13.8% during the forecast period. Potential biomarkers for the prognosis and diagnosis of polyglutamine disease are specific miRNA expression patterns in the brain parenchyma and circulatory fluids.

Product & Service Insights

The products segment dominated the market with the largest revenue share of around 80% in 2022 due to the significant application of sequencing in the healthcare sector. Furthermore, major competitors in this market offer a wide selection of cutting-edge items. For instance, Illumina Inc. provides a wide selection of library preparation, sequencing, accessories, consumables, software, and informatics for miRNA sequence analysis. Similarly, HTG Molecular Diagnostics, Inc. offers HTG EdgeSeq miRNA assay that utilizes next-generation sequencing. It enables users to assess the expression of 2,083 human miRNA transcripts (NGS). These product offerings would further boost the market growth.

In addition, continued in-depth research to create novel products is expected to boost the sector's market throughout the forecast period. For instance, scientists from the Université de Lyon created the BrumiR method, which can exclusively and directly find miRNAs from sRNA-seq data. This toolkit's results were determined to be substantially quicker and more effective.

The services segment is expected to grow at the fastest CAGR of 14.0% during the forecast period. Companies such as Novogene Co., Ltd.; Eurofins Genomics; Arraystar Inc.; and Creative Biolabs provide a broad workflow for sequencing. Additionally, companies such as Norgen Biotek Corp. provide service and a kit for miRNA sequencing. For instance, in December 2021, InteRNA Technologies announced the Investigational New Drug clearance from U.S. FDA for its Phase I clinical trial with lead miRNA candidate in patients with advanced solid tumors. Such factors are anticipated to fuel the growth of the service segment.

Key Companies & Market Share Insights

Thermo Fisher Scientific, Inc. and Illumina, Inc. are key market players. Broader product & service portfolios offered by these companies have resulted in the growth in revenue generation for miRNA sequencing and assay. Moreover, the companies’ wide distribution network has significantly boosted the growth.

In addition, several market players are expanding their miRNA product portfolio to increase their global presence. For instance, in October 2021, MiRXES Pte Ltd. expanded its product offering by adding new PCR tests to detect cardiovascular, infectious, metabolic, and cancer at an early stage. The company is also developing assays for breast, colorectal, liver, and ovarian cancers using biomarkers during discovery. Continuous advancements by key players would further boost the market growth during the forecast period.

In January 2022, Allogene Therapeutics and Antion Biosciences jointly announced a partnership to advance multiplex gene silencing to enable the creation of allogeneic CAR-T products of the future. The collaboration will use Antion's miRNA technology (miCAR) as an additional tool to improve the efficacy and security of allogeneic CAR-T therapy.

Key miRNA Sequencing And Assay Companies:

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- QIAGEN

- PerkinElmer, Inc.

- Abcam plc

- New England Biolabs

- Takara Bio Inc.

- Lexogen GmbH

- Norgen Biotek Corp.

- Maravai LifeSciences

- HTG Molecular Diagnostics, Inc.

- Meridian Bioscience, Inc.

- System Biosciences, LLC

miRNA Sequencing And Assay Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 343.3 million

Revenue forecast in 2030

USD 823.5 million

Growth rate

CAGR of 13.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa ;UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; PerkinElmer, Inc.; Abcam plc; New England Biolabs; Takara Bio Inc.; Lexogen GmbH; Norgen Biotek Corp.; Maravai LifeSciences; HTG Molecular Diagnostics, Inc.; Meridian Bioscience, Inc.; System Biosciences, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global miRNA Sequencing And Assay Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global miRNA sequencing and assay marketon the basis of product & service, technology, workflow, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Library Preparation Kits

-

Sequencing Consumables

-

Instruments

-

-

Service

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing By Synthesis

-

Sequencing By Oligonucleotide Ligation and Detection (SOLiD)

-

Nanopore Sequencing

-

Sanger Sequencing.

-

Single Molecule Real-time (SMRT) Sequencing

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Library Preparation

-

Sequencing

-

Data Analysis & Storage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Polyglutamine Diseases

-

Autoimmune Disease

-

Schizophrenia

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Industry

-

Research and Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global miRNA sequencing and assay market size was estimated at USD 304.3 million in 2022 and is expected to reach USD 343.2 million in 2023.

b. The global miRNA sequencing and assay market is expected to grow at a compound annual growth rate of 13.32% from 2023 to 2030 to reach USD 823.5 million by 2030.

b. North America dominated the miRNA sequencing and assay market with a share of 45.53% in 2022. This is attributable to presence of key players such as PerkinElmer, Inc., Thermo Fisher Scientific and others have increased their R&D activities for novel diseases. Moreover, companies operating in this region are engaged in new product development to expand their product portfolio.

b. Some key players operating in the miRNA sequencing and assay market include Thermo Fisher Scientific, Inc; Illumina, Inc.; QIAGEN N.V.; PerkinElmer, Inc.; Abcam plc; New England Biolabs; Takara Bio Inc.; Lexogen GmbH; Norgen Biotek Corp; Maravai LifeSciences; HTG Molecular Diagnostics, Inc.; Meridian Bioscience, Inc.; and System Biosciences, LLC.

b. Key factors that are driving the market growth include the expansion of technologically advanced sequence analysis, the introduction of new technology and the launch of various techniques to assess the miRNA sequence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.