- Home

- »

- Electronic & Electrical

- »

-

Mobile Accessories Market Size, Share, Growth Report, 2033GVR Report cover

![Mobile Accessories Market Size, Share & Trends Report]()

Mobile Accessories Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Earphone/Headphone, Protective Cases), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-227-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Accessories Market Summary

The global mobile accessories market size was estimated at USD 105.45 billion in 2025, and is projected to reach USD 189.92 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. The market is expected to expand due to the increasing demand for smartphones as they are an effective means of communication around the globe is expected to drive the market in the forecast period.

Key Market Trends & Insights

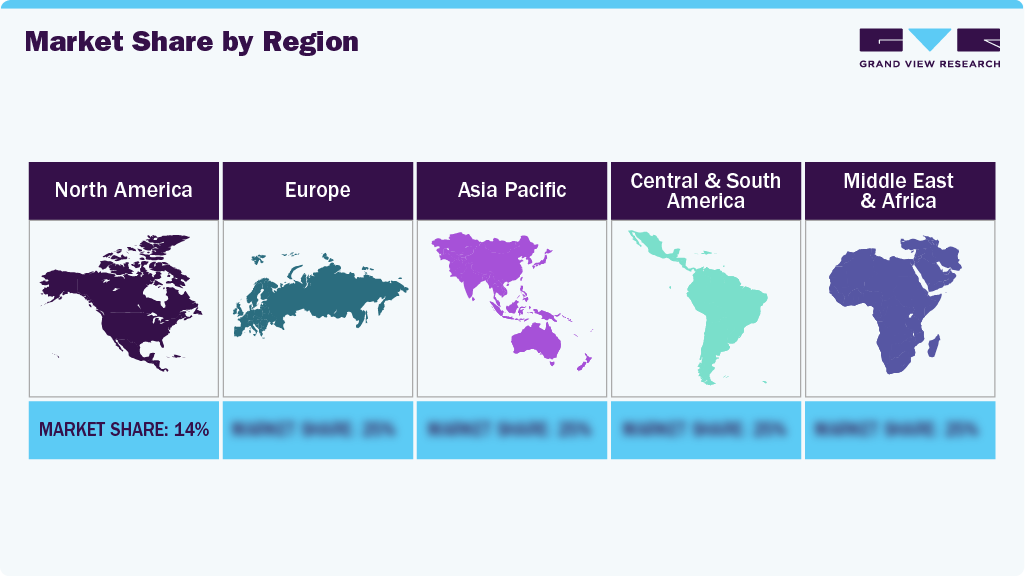

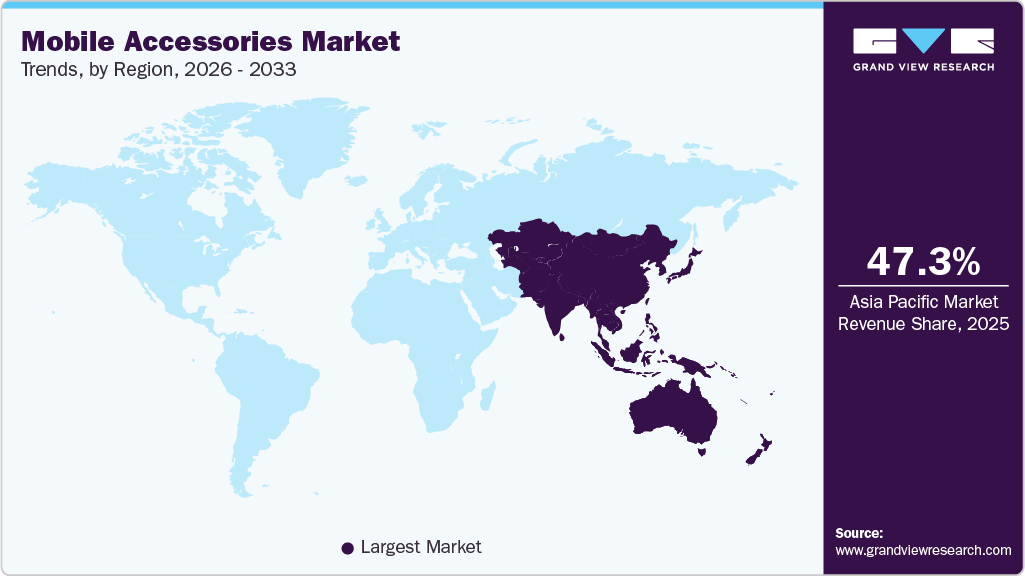

- By region, Asia Pacific led the market with a share of 47.3% in 2025.

- By country, China led the market with a share of 55.3% in 2025.

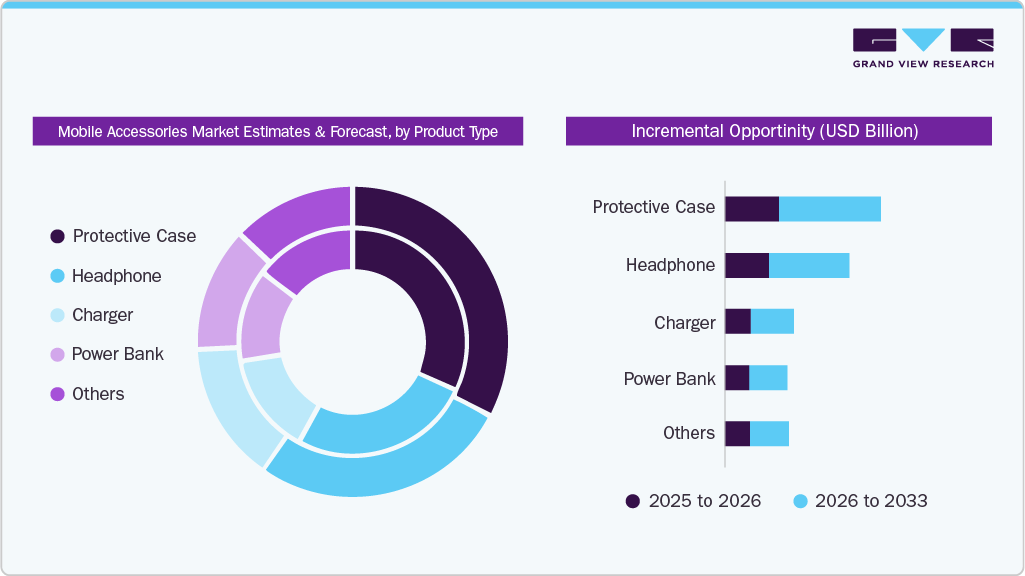

- By product, protective case segment led the market and accounted for a revenue share of 32.0% in 2025.

- By distribution channel, offline segment led the market and accounted for a revenue share of 68.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 105.45 Billion

- 2033 Projected Market Size: USD 189.92 Billion

- CAGR (2026-2033): 7.8%

- Asia Pacific : Largest market in 2025

Furthermore, the increasing demand for wireless devices is expected to drive the market in the near future. For instance, companies are developing the latest technologies, such as wireless headsets and speakers. This has boosted the market demand for the industry in recent times.In November 2025, Mophie launched four new Qi2-certified wireless charging stands, offering up to 15W fast charging for compatible devices, including iPhone, AirPods, and Apple Watch, with models ranging from single-device to 3-in-1 stands, priced between $44.95 and $99.95. The new lineup features MagSafe compatibility, a compact design, integrated cable management, and a two-year warranty.

Technological advancements in mobile accessories are also fueling growth in the market. The integration of new technologies, such as wireless charging, advanced noise-canceling capabilities, and modular add-ons, has attracted younger consumers who are eager to embrace the latest innovations. Accessories that enhance the audio experience, such as true wireless stereo (TWS) earbuds with active noise cancellation (ANC), are particularly popular among younger generations, catering their high expectations for sound quality in mobile gaming, music streaming, and video content consumption.

The rise of e-commerce has further accelerated the market's growth. Online platforms provide consumers with convenient access to a wide variety of mobile accessories, enabling brands to reach a global audience, including emerging markets. The ease of online shopping, coupled with the increasing availability of mobile accessories at competitive prices, has made it easier for consumers to purchase and replace accessories regularly. In many cases, the need to refresh accessories, such as phone cases or charging cables, occurs more frequently than the need to upgrade smartphones, creating a recurring demand.

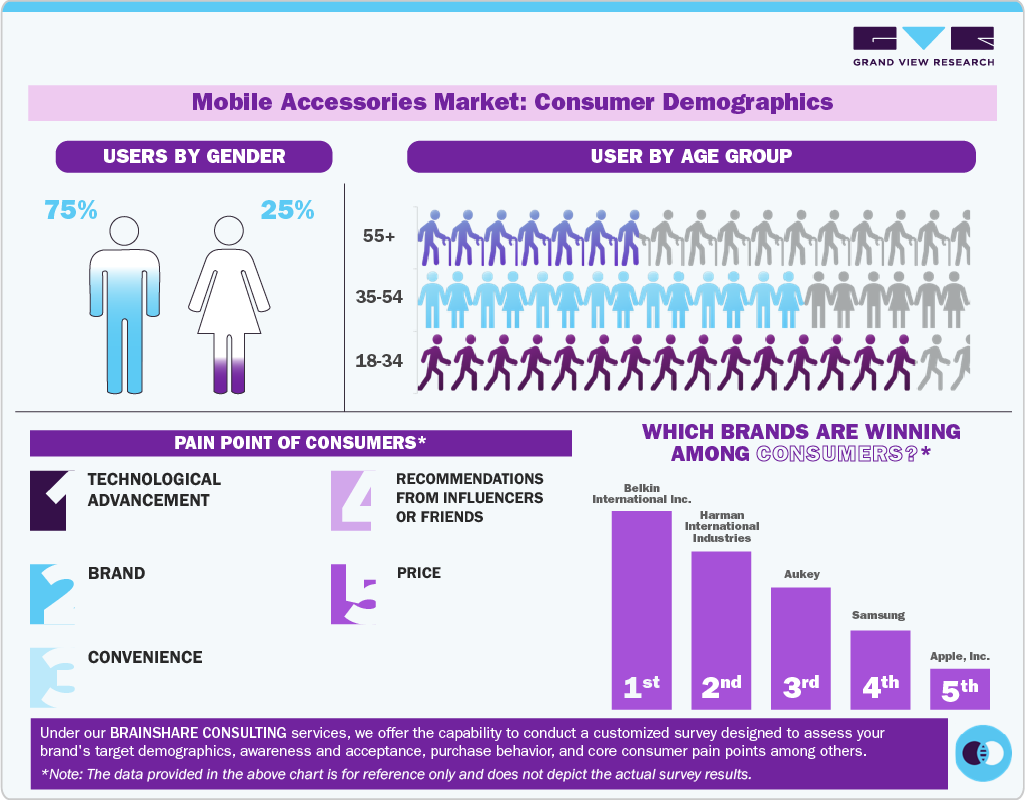

Consumer Insights

The increasing demand for mobile accessories is the desire for enhanced user experience and functionality. As smartphones become increasingly sophisticated, with features such as 5G connectivity, advanced cameras, and larger screens, accessories are evolving to complement these advancements. Consumers, particularly younger users, are seeking accessories that not only offer convenience but also enhance their overall mobile experience. This includes items such as wireless chargers, high-quality audio devices, and gaming controllers, which cater to their needs for entertainment, productivity, and convenience.

In addition, the desire for personalization and self-expression plays a crucial role in driving the growth of mobile accessories. Younger consumers often view mobile accessories as an extension of their personal style, seeking products that reflect their identity. Items such as colorful phone cases, pop sockets, and modular accessories allow users to customize their devices and stand out, contributing to a sense of individuality. As mobile devices have become a central part of daily life, consumers are eager to invest in accessories that not only enhance functionality but also serve as a form of self-expression.

Another key driver of this trend is the affordability and accessibility of mobile accessories. Unlike smartphones, which are a significant investment, accessories are available at a wide range of price points, making them more accessible to younger consumers. The rise of online shopping platforms and social media has further facilitated the discovery and purchase of new accessories, as consumers can easily explore the latest trends and innovations through influencer recommendations and unboxing videos.

Moreover, the increasing adoption of mobile gaming, streaming, and content creation has driven the demand for specialized accessories designed to enhance these activities. Products such as phone coolers, gaming grips, and tripods cater to the growing number of young consumers who use their smartphones for gaming, streaming, and content creation. These accessories provide a more immersive experience and help users optimize their devices for specific tasks, such as gaming performance or content production.

Product Insights

The protective cases segment accounted for a leading share of 32.0% in 2025. As smartphones become more sophisticated and higher-priced investments, consumers are increasingly motivated to safeguard them from damage such as drops, scratches, and spills-thereby increasing the perceived value of protective cases. The sheer proliferation of smartphones globally means there’s a larger installed base of devices that require accessories; reports indicate that shipments of protective cases and market size are strongly correlated with smartphone adoption. Protective cases are no longer purely functional; they now cater to personalization, style, and identity. Custom prints, designer branding, and premium materials are increasingly expected, especially among younger, fashion‑conscious segments.

The headphone segment is expected to register a CAGR of 8.3% during the forecast period. The increasing global adoption of smartphones and the growing consumption of mobile media, such as music, videos, gaming, and calls, have made headphones essential accessories for daily mobile use. Also, the transition from wired to wireless audio, particularly with the widespread adoption of Bluetooth technology and true wireless earbuds, has further fueled this demand. The removal of the 3.5mm headphone jack in many modern smartphones has also encouraged consumers to invest in wireless models, which offer enhanced audio quality, active noise cancellation, and smart features.

Distribution Channel Insights

The offline segment dominated the mobile accessories market, accounting for a 68.3% share in 2025. Increasing demand for the costly devices such as smartwatch and mobile camera lens and perception of issues with the delivery of fragile items are propelling the segment growth. Traditional method of shopping and difference in price in local retail outlets and other wholesale markets are the reasons for the segment growth.

The online segment is anticipated to expand at a CAGR of 8.5% from 2026 to 2033. Increasing internet penetration in rural areas, faster and trusted delivery by various online portals, and replacement options are driving the segment. Moreover, the young working consumer groups with hectic schedules prefer to buy online rather than offline due to easy access and doorstep service. These are the key factors driving market growth within the specified timeframe.

Regional Insights

North America Mobile Accessories Market Trends

The North America mobile accessories market accounted for a share of 14.5% in 2025. The regionhas very high smartphone penetration, and consumers increasingly use their devices not just for communication but for entertainment, fitness, streaming, and productivity leading to a strong need for protective and functional accessories. Moreover, the rise of wireless technologies-especially Bluetooth earbuds/headphones, wireless charging pads, power banks and protective cases designed for premium devices has further amplified accessory demand.

Europe Mobile Accessories Market Trends

The mobile accessories market in Europe accounted for a 21.1% share in 2025. Consumers are increasingly investing in upgraded and premium accessories designed to complement newer smartphone technologies such as foldable phones, 5G connectivity, and wireless charging, which drives accessory replacement and enhancement cycles. One report highlights that innovations such as wireless earbuds, power banks, and smart cases are gaining traction as lifestyle‑driven accessories rather than mere add‑ons. In addition, the shift towards online purchasing channels and e-commerce in Europe has lowered barriers to accessory buying, enabling a greater variety, quicker delivery, easier comparison shopping, and more frequent purchases of multiple accessories per user.

Asia Pacific Mobile Accessories Market Trends

The Asia Pacific mobile accessories market Asia Pacific dominated the market with a share of 47.3% in 2025 and is expected to grow at a CAGR of 8.4% from 2026 to 2033. Rapid smartphone penetration-especially in large markets including China, India, and Southeast Asia is expanding the addressable base for accessories. Rising disposable incomes and an expanding middle class are enabling consumers to spend more on complementary devices such as power banks, wireless earbuds, phone cases, and chargers. Additionally, technological advancements (e.g., 5G rollout, wireless charging, improved audio/video quality) are creating demand for new types of accessories that enhance the smartphone experience wireless earbuds, high-speed cables, gaming controllers, and camera lenses.

Central & South America Mobile Accessories Market Trends

The Central & South America mobile accessories market is expected to grow at a CAGR of 6.1% from 2026 to 2033. As smartphone penetration continues to rise across the region, particularly in countries such as Brazil, Mexico, and Argentina, the demand for complementary accessories, including chargers, protective cases, wireless earbuds, and power banks, has increased significantly. Additionally, the expansion of e-commerce platforms has made these products more accessible, driving impulse purchases and increasing market reach.

Middle East & Africa Mobile Accessories Market Trends

In the Middle East and Africa, the mobile accessories market is expected to grow at a CAGR of 6.8% from 2026 to 2033. Rising smartphone penetration, driven by more affordable handsets, improved network infrastructure, and a younger demographic, has expanded the addressable base for accessories such as chargers, cases, and earphones. Consumers are increasingly viewing mobile phones as multifunctional hubs, thereby elevating the need for value-added accessories that enhance the experience, protect devices, or complement mobile lifestyle habits.

Key Mobile Accessories Company Insights

The market presents moderate to low entry barriers due to presence of a large number of unstructured dealers in the market. The market is further driven by innovation in technology, mergers and acquisitions, and joint ventures.

-

In November 2025, Anker partnered with Honor of Kings to be the official charging sponsor for the 2025 Honor of Kings International Championship (KIC2025), held in Manila, Philippines, from November 14 to 30. The collaboration features the Anker 25K Powerbank and 140W Charger as official tournament gear, highlighting their fast-charging capabilities, stability, and cooling features essential for esports.

-

In Octpber 2025, JBL recently launched its new Tour One M3 premium headphones in India, featuring advanced noise cancellation, premium audio quality, and long battery life. The headphones are priced competitively for the Indian market and are now available for purchase through major retailers.

-

In September 2025, URBAN launched two new power banks in India: the URBAN CAMP (30,000mAh, 65W output) for heavy-duty laptop and multi-device charging, and the URBAN CAMP 2 (compact 22.5W, built-in Type-C cable) for fast everyday mobile charging. Both offer rugged builds, smart power management, and digital status displays, with prices of ₹3,999 for CAMP and ₹2,199 for CAMP 2.

-

In September 2025, Apple announced the AirPods Pro 3, featuring a redesigned build, greatly improved active noise cancellation, heart rate sensing, enhanced in-ear fit with foam-infused ear tips, workout tracking, Live Translation for multiple languages, and a longer battery life. The earbuds are also water and sweat-resistant, include expanded hearing health features, and are made with a high percentage of recycled materials.

Key Mobile Accessories Companies:

The following are the leading companies in the mobile accessories market. These companies collectively hold the largest market share and dictate industry trends.

- Belkin International Inc.

- Harman International Industries

- Aukey

- Groovemade Walnut

- Anket Powercore

- UE Boom

- Samsung

- Apple Inc.

- Sandisk

Mobile Accessories Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 112.37 billion

Revenue forecast in 2033

USD 189.92 billion

Growth rate (Revenue)

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Belkin International Inc.; Harman International Industries; Aukey; Groovemade Walnut; Anket Powercore; UE Boom; Samsung; Apple Inc.; Google; Sandisk

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Accessories Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mobile accessories market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Earphones/Headphones

-

Charger

-

Power Bank

-

Protective Cases

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mobile accessories market size was estimated at USD 88.07 billion in 2022 and is expected to reach USD 93.38 billion in 2022.

b. The global mobile accessories market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 148.81 billion by 2030.

b. Asia Pacific dominated the mobile accessories market with a share of 46.5% in 2022. This is attributable to the high usage of different types of mobile accessories and the innovation of different products at lower rates, predominantly by Chinese players.

b. Some key players operating in the mobile accessories market include Google; Samsung; Apple; Harman International Inc.; Belkin International Co.; Aukey; Groovemade Walnut; Anket Powercore; and UE Boom, among others.

b. Key factors that are driving the market growth include increasing demand for smartphones and wireless devices, coupled with technological advancements in the industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.