- Home

- »

- Medical Devices

- »

-

Mobile IV Hydration Services Market, Industry Report, 2030GVR Report cover

![Mobile IV Hydration Services Market Size, Share & Trends Report]()

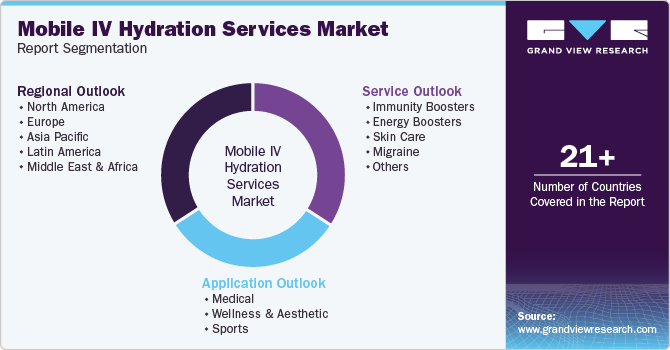

Mobile IV Hydration Services Market (2025 - 2030) Size, Share & Trends Analysis Report, By Services (Immunity Boosters, Energy Boosters, Skin Care, Migraine), By Application (Medical, Wellness & Aesthetic, Sports), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-565-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile IV Hydration Services Market Trends

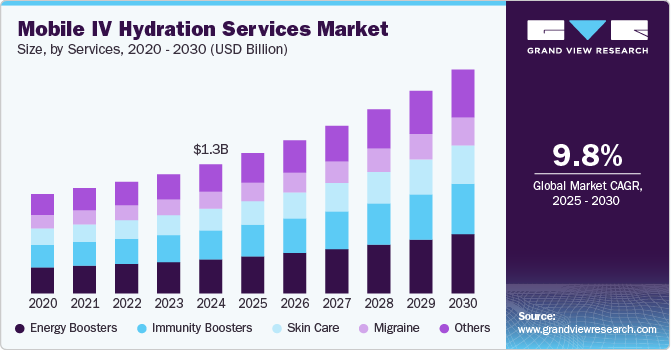

The global mobile IV hydration services market size was estimated at USD 1.3 billion in 2024 and is projected to grow at a CAGR of 9.8% from 2025 to 2030. This market is progressing on the strength of evolving consumer expectations, cross-functional health benefits, and widespread digital visibility. Providers capable of integrating medical reliability with lifestyle appeal are well-positioned to capture growth, especially as wellness becomes embedded in everyday routines. In April 2025, RevIVe Mobile intravenous (IV) launched services in Pittsburgh and Philadelphia, offering on-demand IV hydration for wellness and recovery. The service includes immune boosters, migraine relief, and vitamin drips delivered to homes and offices.

An increasing number of consumers are seeking health and wellness interventions that offer both personalization and immediacy. Mobile intravenous (IV) hydration services-particularly those addressing immunity, energy, and migraine relief-are becoming embedded in everyday wellness routines, especially in urban markets. As home-based care gains traction, these services are emerging as viable alternatives to conventional wellness clinics, aligning with the broader shift toward flexible healthcare delivery models. In March 2025, purelyIV launched its Take-Home B12 Kit, designed to complement in-home IV hydration therapy and help clients maintain their B12 levels between sessions. The kit includes a 3-month supply of Vitamin B12 injections, syringes, alcohol pads, and a sharps container, with a free online consultation included to ensure proper usage.

Consumers are no longer viewing wellness solely through the lens of illness prevention; instead, they are seeking solutions that offer both long-term health benefits and immediate enhancements in appearance or performance. IV hydration offers span recovery and proactive treatments for skin enhancement and stress-related symptoms. In June 2023, Liquid Mobile (formerly Liquid Mobile IV) expanded its services to include medical weight loss, hormone replacement therapy, aesthetics, and telehealth, in addition to its existing IV hydration therapy. The company, which operates in Kansas City and Phoenix, aims to provide on-demand health and wellness services directly to consumers’ doorsteps.

Momentum in the mobile IV market is being amplified by digital culture and influencer-driven health narratives. Endorsements on social platforms have accelerated consumer interest, positioning IV therapies as accessible and socially validated wellness tools. As younger demographics become increasingly health-conscious, demand is expanding beyond traditional segments into areas such as post-exertion recovery, performance support, and workplace well-being. In November 2024, purelyIV launched its new mobile app to streamline the process of booking mobile IV hydration therapy, managing appointments, and purchasing packages. The app, available for iOS and Android, allows users to browse services, track purchases, and manage wellness journeys conveniently from their mobile devices.

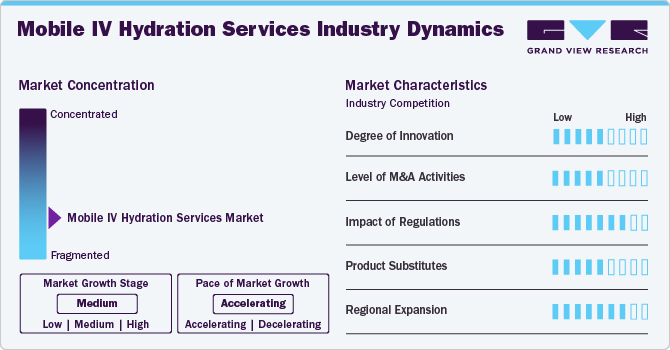

Market Concentration & Characteristics

Innovation in the mobile IV hydration services industry is moderate, with most advancements centered on service delivery models rather than core medical formulations. Providers are differentiating through digital booking platforms, tailored treatment menus, and value-added services such as lab testing or concierge wellness consultations. In July 2024, purelyIV introduced its J-Tip add-on for mobile IV hydration therapy, offering a virtually pain-free insertion experience using lidocaine delivery via CO₂.

The level of mergers and acquisitions in the mobile IV hydration services industry is moderate, reflecting a growing interest in regional consolidation and vertical integration. Larger players and health-focused service chains are acquiring smaller operators to expand geographic reach and streamline operations.In February 2022, Ehave, Inc. entered the U.S. mobile IV hydration market by acquiring Rejuv IV, now operating as KetaDASH. The service delivers hydration, vitamin infusions, and wellness drips at home across California.

Regulatory influence on the mobile IV hydration services industry is high, as providers must comply with medical practice laws, infusion protocols, and healthcare professional licensing standards. Oversight varies significantly by jurisdiction, with some regions requiring physician involvement or telehealth oversight for every treatment. These factors introduce operational complexity and liability risks, making regulatory navigation a critical determinant of scalability and market entry strategy.

The presence of product or service substitutes in the mobile IV hydration services industry is moderate, with alternatives such as oral supplements, wellness clinics, and traditional healthcare settings offering comparable benefits in less invasive formats. While these substitutes appeal to more cost-sensitive or risk-averse consumers, they often lack the immediacy and perceived efficacy of IV delivery, particularly for energy restoration, migraine relief, and post-dehydration recovery. As a result, substitution pressure exists but does not significantly erode demand among target users.

Regional expansion in the mobile IV hydration services industry is high, supported by the growing adoption of home-based wellness services and rising health consciousness across developed and emerging economies. Urban centers in North America, the Middle East, and Southeast Asia are seeing accelerated growth, driven by affluent consumer segments, tourism recovery, and favorable demographics. Market players are actively pursuing franchising models, telehealth integration, and local partnerships to overcome regional regulatory hurdles and capture new demand pockets.

Services Insights

Energy boosters segment held the largest revenue share of 26.4% in 2024 due to growing consumer demand for immediate relief from fatigue, jet lag, and burnout. These drips, rich in B vitamins, amino acids, and electrolytes, offer quick rehydration and enhanced vitality by delivering nutrients directly into the bloodstream. Their appeal is further driven by the rise of wellness-conscious lifestyles and the need for rapid recovery solutions among busy professionals, travelers, and fitness enthusiasts. HydraMed’s Energy Boost Max IV therapy is driving U.S. market growth by delivering high-potency energy formulations-like L-Carnitine, B12, and Taurine-directly to consumers seeking rapid fatigue relief and enhanced vitality at home.

The skincare segment is expected to grow at the highest CAGR in the mobile IV hydration services industry due to rising consumer interest in anti-aging, skin brightening, and hydration treatments that deliver visible results quickly. IV skincare therapies offer a premium, non-invasive alternative by infusing antioxidants, glutathione, and vitamin C directly into the bloodstream, enhancing skin tone and texture more effectively than oral supplements. In April 2022, IVDRIPS partnered with JTAV Clinical Skincare in New York City to offer mobile IV hydration treatments focused on skincare. The service delivers vitamin, hydration, and anti-aging NAD+ drips at the spa location to enhance skin glow, collagen production, and overall wellness.

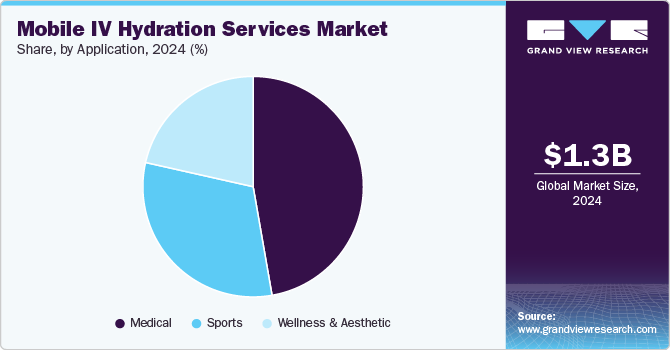

Application Insights

The medical segment held the largest revenue share of over 47.3% in 2024 in the mobile IV hydration services market due to its critical role in addressing dehydration, nutrient deficiencies, and recovery support in patients with chronic illnesses, migraines, flu, and gastrointestinal disorders. These services are often prescribed post-surgery or for patients undergoing intensive treatments such as chemotherapy, where rapid hydration and vitamin replenishment are medically necessary. In April 2024, Revive Drip expanded from mobile IV hydration services to a clinic in Gig Harbor, Washington. Run by former ER nurses, it offers medical-grade infusions at homes, events, and now a licensed facility to meet U.S. compounding regulations.

Wellness & aesthetic segment is expected to experience the fastest growth at a CAGR of 10.5% in the mobile IV hydration services market, owing to the rising popularity of preventive healthcare, lifestyle enhancement, and beauty optimization through IV therapy. Consumers are increasingly turning to customized infusions for energy, immunity, skin glow, and hangover recovery, especially in urban areas and among younger demographics. In April 2024, the DRIPBaR Statesboro launched a mobile IV hydration service, offering on-site wellness treatments such as hydration, immune support, and recovery. The service, available on select weekends, brings IV therapy directly to homes, offices, and events within a 30-mile radius, focusing on hydration and overall well-being.

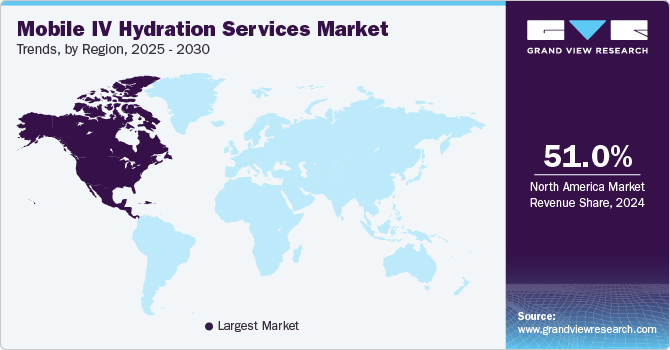

Regional Insights

North America mobile IV hydration services market dominated with a revenue share of 51.0% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, driven by rising demand for personalized wellness solutions, increased adoption of at-home medical services, and strong presence of key service providers. In February 2022, Liquid Mobile IV expanded into Arizona by leasing a clinic space in Phoenix’s Camelback Corridor. Known for its on-demand mobile IV hydration services, the company now operates a physical hub to support its 24/7 doorstep delivery model, run by over 20 nurses and clinicians.

U.S. Mobile IV Hydration Services Market Trends

The U.S. mobile IV hydration services market continues to drive growth in North America's mobile IV hydration services market through high consumer awareness, expanding wellness culture, and widespread availability of concierge medical services. In July 2023, Victory Square Technologies announced the upcoming U.S. launch of MobileMedIV.com, a hydration-focused nurse dispatch platform by VS Digital Health in partnership with Hydreight Technologies. Targeting the mobile IV therapy market, the service aimed to offer vitamin-infused drips for energy, immunity, detox, and anti-aging, with bookings supported by Registered Nurse consultations.

Europe Mobile IV Hydration Services Market Trends

The mobile IV hydration services market in Europe held the second-largest revenue share in 2024, supported by rising consumer demand for personalized wellness care and increasing adoption of in-home medical services. In December 2022, REVIV opened a premium hydration therapy clinic at Harrods, introducing the exclusive Harrods Signature Wellness Therapy IV infusion. The treatment combines selenium, glutathione, and key vitamins for detox and hydration, reinforcing REVIV’s focus on personalised, doctor led IV therapy in a luxury setting.

Germany mobile IV hydration services market is anticipated to grow at a significant rate in 2024 driven by increasing consumer interest in preventive wellness, especially among urban professionals and aging populations. Demand is also fueled by rising acceptance of home-based medical services and a growing focus on immune support and recovery therapies. Expansion is further supported by partnerships with spas, gyms, and wellness centers, enhancing service accessibility and consumer trust.

The UK mobile IV hydration services market held a significant revenue share in 2024 driven by growing wellness tourism, demand for at-home medical convenience, and expansion of premium IV therapy providers. In March 2024, Get A Drip launched Get A Drip Pharma to expand its UK hydration focused IV drip services into digital pharma. The new division offers competitively priced vitamin drips, injections, and medical aesthetics via a GPhC-registered online pharmacy, supported by the GADRx digital prescribing system.

Asia Pacific Mobile IV Hydration Services Market Trends

The Asia Pacific region is expected to grow at a significant rate during the forecast period. In this region, increasing work-related stress and a growing demand for quick wellness solutions drive the popularity of nutrient IV therapy. In October 2024, nutrient IV therapy, particularly hydration-focused drips, became a popular remedy for fatigue among young people in China and South Korea. These IV drips, combining saline and vitamins, are seen as quick solutions to combat dehydration and restore energy.

China mobile IV hydration services market accounted for the largest share in the Asia Pacific region in 2024. The conutry’s growth is driven by rising consumer demand for personalized wellness, increasing adoption of concierge healthcare models, and the growing presence of providers offering on-demand IV therapy in urban hubs like Hong Kong. Services such as immune boosters, energy drips, and beauty infusions gained traction among both residents and tourists, with companies offering flexible, in-home treatments across high-density areas including Central, Tsim Sha Tsui, and Causeway Bay.

Japan mobile IV hydration services market held the second largest revenue share in the Asia Pacific region driven by growing consumer interest in convenience and health optimization. Tokyo Midtown Clinic provides vitamin drips and injections to help with fatigue, skin health, and immunity. Treatments include vitamin cocktails, high-dose vitamin C, and placenta-infused options for fatigue recovery and beauty enhancement. Quick, efficient options are available for busy individuals.

India mobile IV hydration services market is experiencing significant growth driven by an expanding urban population seeking convenient wellness and recovery solutions. In May 2025, six Indian hospitals joined BD's PRIME programme, focused on improving IV therapy safety by reducing infections and medication errors. The six-month programme includes goal setting, expert consultations, and webinars, with certification awarded to hospitals upon completion.

Latin America Mobile IV Hydration Services Market Trends

The Latin America mobile IV hydration services market is growing due to improvements in urban healthcare infrastructure, increasing awareness of preventive wellness, and the gradual rise of concierge medical services in metropolitan areas. As urbanization accelerates, more individuals in large cities are seeking personalized, on-demand healthcare services. The market is further supported by a growing focus on overall well-being, boosting the demand for hydration, immune support, and recovery therapies.

Brazil mobile IV hydration services market is expanding, driven by an increasing interest in holistic health solutions and rising disposable incomes. The demand for services such as energy boosts, immunity drips, and fatigue recovery options is growing, particularly in urban centers like São Paulo and Rio de Janeiro. As consumers become more health-conscious, there is greater acceptance of innovative wellness treatments, fueling the market's expansion.

Middle East and Africa Mobile IV Hydration Services Market Trends

In the Middle East and Africa, the rising demand for mobile IV hydration services is driven by increasing health consciousness, the growing popularity of wellness trends, and a shift toward convenience in healthcare services. In April 2025, Dubai saw a surge in demand for home-based IV drip services, with AEON Clinic spotlighting the trend as a wellness revolution. Clients now receive personalized hydration, immunity, and energy-boosting drips at home, turning therapy into a lifestyle convenience.

Saudi Arabia mobile IV hydration services market is expected to grow at a significant CAGR over the forecast period owing to the increasing demand for personalized healthcare services, a rise in health and wellness awareness, and the growing trend of convenience-driven healthcare solutions. In June 2022, ivWatch received market authorization from the Saudi Food and Drug Authority (SFDA) for its SmartTouch sensor. This approval contributes to enhancing safety in IV therapies, which supports the growing demand for advanced mobile healthcare services in the region.

Key Mobile IV Hydration Services Company Insights

Key players in the mobile IV hydration services market include Drip Hydration, DriPros IV Hydration Wellness, wHydrate, and Hydration Room. These companies focus on tech-enabled service models, personalized wellness solutions, and expanding mobile reach. DRIPBaR, Restore, and Renew Ketamine & Wellness Center emphasize service innovation, while R2 Medical Clinic, AliveDrip, and Hydrate IV target niche demand and localized delivery to stay competitive.

Key Mobile IV Hydration Services Companies:

The following are the leading companies in the mobile IV hydration services market. These companies collectively hold the largest market share and dictate industry trends.

- Drip Hydration

- DriPros IV Hydration Wellness

- wHydrate

- Renew Ketamine & Wellness Center

- R2 Medical Clinic

- AliveDrip

- Hydrate IV

- Hydration Room

- DRIPBaR, Restore

Recent Developments

-

In April 2025, Prime IV Hydration & Wellness received multiple industry accolades, underscoring its continued growth and leadership in the IV therapy space. The franchise advanced 55 places in Entrepreneur’s Franchise 500 to rank #334 overall and retained the #1 spot in the IV Therapy category.

-

In May 2024, On The Glow by Glow Lab Studio launched its mobile IV hydration therapy service in New York, targeting consumer demand for at-home and discreet wellness solutions. By operating through both home visits and a mobile van setup, the company offers services like hydration, weight loss support, migraine relief, and hangover cures, emphasizing convenience and client privacy.

-

In May 2024, XWELL, Inc. launched IV hydration drip therapy at its XpresSpa site in Miami International Airport (MIA), initiating a pilot program in collaboration with Revitalize IV Lounge. This new service provides four tailored hydration treatments aimed at enhancing energy, boosting immune health, and promoting recovery.

Mobile IV Hydration Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.4 billion

Revenue forecast in 2030

USD 2.2 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room; DRIPBaR; Restore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile IV Hydration Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile IV hydration services market report based on service, application, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Immune Boosters

-

Energy Boosters

-

Skin Care

-

Migraine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Wellness & Aesthetic

-

Sports

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mobile IV hydration services market size was valued at USD 1.6 billion in 2024 and is expected to reach USD 1.7 billion in 2025.

b. The global mobile IV hydration services market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 2.6 billion by 2030.

b. The energy boosters segment held the largest share of 25.3% in 2024 due to the growing consumer demand for immediate relief from fatigue, jet lag, and burnout.

b. Some of the major participants in the mobile IV hydration services market include Drip Hydration; DriPros IV Hydration Wellness; wHydrate; Renew Ketamine & Wellness Center; R2 Medical Clinic; AliveDrip; Hydrate IV; Hydration Room

b. The mobile IV hydration services market is progressing with evolving consumer expectations, cross-functional health benefits, and widespread digital visibility. Providers integrating medical reliability with lifestyle appeal are well-positioned to capture growth, especially as wellness becomes embedded in everyday routines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.