- Home

- »

- Advanced Interior Materials

- »

-

Modular Flooring Market Size & Share, Industry Report, 2033GVR Report cover

![Modular Flooring Market Size, Share & Trends Report]()

Modular Flooring Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Flexible LVT, Rigid LVT, Carpet Tile, Rubber Flooring), By End-use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-703-2

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modular Flooring Market Summary

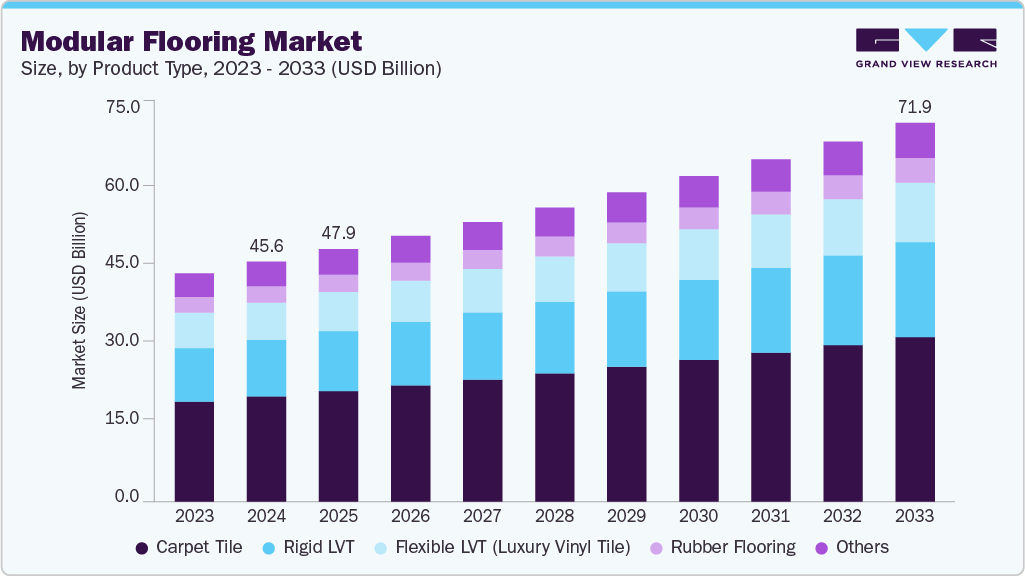

The global modular flooring market size was estimated at USD 45.57 billion in 2024 and is projected to reach USD 71.92 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The demand for modular flooring is rising due to the growing emphasis on aesthetics, functionality, and sustainability in residential, commercial, and industrial spaces.

Key Market Trends & Insights

- North America dominated the modular flooring market with the largest revenue share of 32.5% in 2024.

- The U.S. modular flooring industry is characterized by strong demand for LVT (luxury vinyl tiles), carpet tiles, and eco-friendly flooring.

- By product type, the rigid LVT segment is expected to grow at the fastest CAGR of 5.9% from 2025 to 2033.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 45.57 Billion

- 2033 Projected Market Size: USD 71.92 Billion

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Easy installation, reduced labor costs, and minimal downtime make modular flooring an ideal choice for both renovations and new constructions. With rising urbanization and increasing disposable incomes, end users are investing in modular options like luxury vinyl tiles, carpet tiles, and rubber tiles. Growing awareness about green building certifications also contributes to market adoption. Modular solutions allow for easy replacement, making them a long-term economical choice.Key growth drivers for the modular flooring industry include rapid urban infrastructure development and the booming construction industry, particularly in Asia-Pacific. The shift toward flexible workspaces and the growth of coworking environments are prompting the use of design-forward, easily interchangeable flooring solutions. Technological advancements such as antimicrobial, acoustic-insulating, and water-resistant tiles are enhancing product appeal. The increasing popularity of DIY home improvement projects is also contributing to market traction. Retail chains, hospitality chains, and airports are leaning towards modular flooring for branding through customizable patterns and colors.

The market is witnessing strong innovation in bio-based and recyclable flooring materials that address both environmental and aesthetic concerns. Smart modular flooring systems equipped with sensors for foot traffic and environmental conditions are gaining popularity in commercial setups. 3D printing is enabling mass customization with unique textures and geometric patterns. Leading players are introducing click-lock and interlocking systems that simplify installation further. Acoustic-dampening and moisture-wicking layers are being integrated into newer products to serve high-performance needs. Another trend is modular carpet tiles with replaceable zones, which extend product life and reduce cost. Subscription-based flooring models, where companies lease and recycle modular tiles, are also emerging. Digital tools such as AR/VR for virtual floor design visualization are transforming the customer experience.

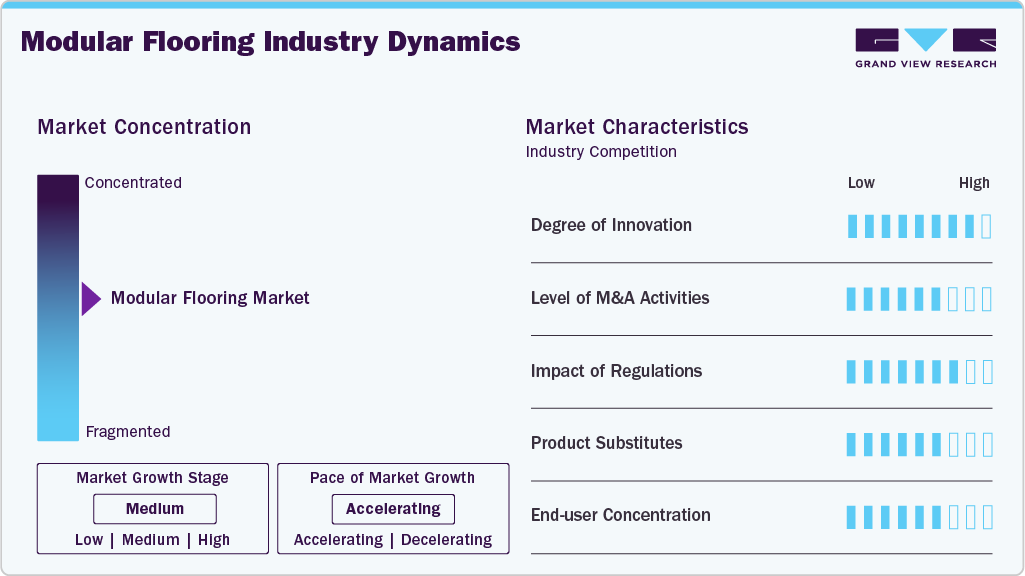

Market Concentration & Characteristics

The modular flooring market is moderately consolidated, with a mix of global leaders and regional players. Key players dominate through extensive product portfolios, distribution networks, and brand presence, particularly in North America and Europe. However, emerging companies and local manufacturers are increasingly entering the market with innovative and affordable solutions, especially in Asia and Latin America. Strategic alliances, OEM partnerships, and acquisitions are shaping the competitive landscape. Product differentiation through design, durability, and environmental certifications is crucial for market share. While big players control much of the urban and commercial demand, regional firms often cater to rural and residential areas with tailored products.

Traditional flooring types such as hardwood, marble, and ceramic tiles pose a moderate threat, especially in high-end residential and luxury commercial markets. However, these alternatives often lack the benefits of modular flooring, such as fast installation, customization, and ease of replacement. Epoxy and polished concrete are gaining popularity in industrial settings, acting as substitutes. The growing consumer preference for sustainable and low-maintenance materials mitigates the threat. Still, price-sensitive markets may opt for cheaper, non-modular variants in the short term. Hence, while substitutes exist, they are less flexible, less efficient, and often more costly over a product’s lifecycle.

Product Type Insights

The carpet tile segment led the modular flooring industry with the highest revenue share of 43.8% in 2024, due to its widespread use in commercial offices, educational institutions, and hospitality spaces. Its popularity stems from ease of installation, noise reduction properties, and design flexibility, which allows for easy replacement of individual tiles without disrupting the entire floor. Additionally, carpet tiles offer excellent durability, acoustic performance, and insulation, making them ideal for high-traffic areas. Leading manufacturers continue to innovate with recycled fibers, customizable patterns, and enhanced underlays, further solidifying carpet tiles' dominance in the market.

The rigid LVT segment is expected to grow at the fastest CAGR of 5.9% over the forecast period, driven by its superior durability, waterproof properties, and realistic wood and stone aesthetics. Its rigid core construction provides enhanced dimensional stability and resistance to dents, making it suitable for both residential and commercial applications. Rigid LVT is also easy to install through click-lock mechanisms, which appeal to DIY users and reduce labor costs. Manufacturers are increasingly focusing on sustainable variants like PVC-free or recycled-content rigid LVT, aligning with global green building trends and further fueling segment growth.

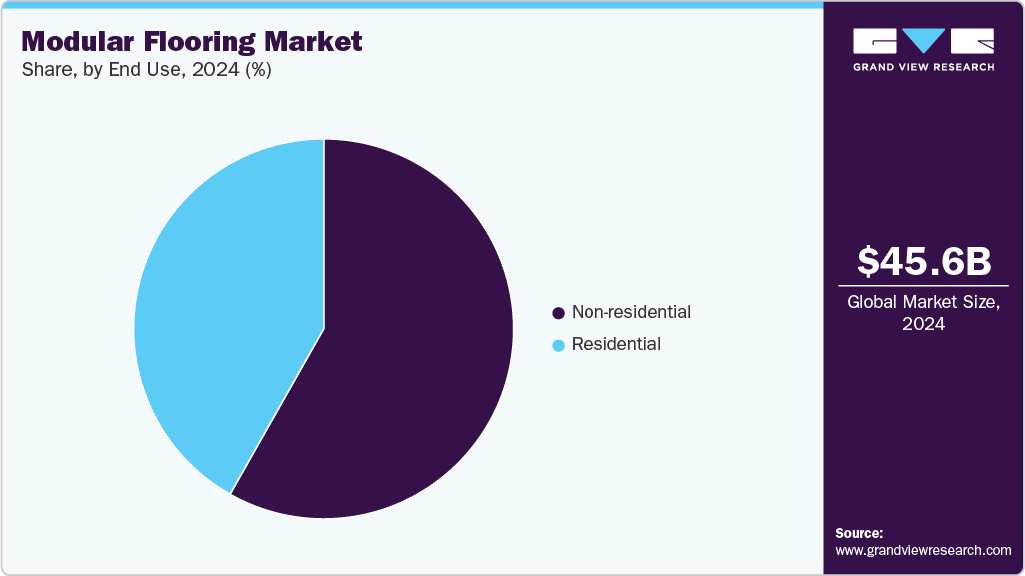

End Use Insights

The non-residential segment held the highest revenue share of 58.2% in 2024, due to its extensive use in commercial offices, educational institutions, healthcare facilities, and hospitality environments. These spaces require flooring solutions that are durable, easy to maintain, and quickly replaceable—all strengths of modular flooring. High foot traffic, frequent reconfigurations, and design customization needs make carpet tiles and vinyl modular products especially attractive. Additionally, corporate sustainability goals and regulatory compliance often drive the adoption of eco-friendly modular flooring in public and private infrastructure projects.

The residential segment is expected to grow at a significant CAGR of 5.0% over the forecast period, fueled by rising urbanization, increasing disposable incomes, and a strong post-pandemic focus on home improvement. Homeowners are opting for modular solutions like LVT and carpet tiles for their ease of installation, aesthetic flexibility, and cost-efficiency. The surge in DIY culture and the availability of modular flooring through online and retail channels is further driving adoption. Enhanced designs, comfort features, and the growing appeal of low-maintenance and pet-friendly flooring options are also accelerating residential market growth.

Regional Insights

North America dominated the global modular flooring market with the largest revenue share of 32.5% in 2024. It is expected to witness robust growth, led by the U.S. and Canada, owing to strong renovation activity, high disposable incomes, and environmental consciousness. Modular flooring is favored in healthcare, hospitality, and commercial office spaces for its durability and easy maintenance. Companies are investing heavily in recyclable and antimicrobial product variants. LEED certifications and other green construction norms significantly drive product choices. E-commerce channels are increasingly being used for modular flooring sales, especially in residential DIY segments.

U.S. Modular Flooring Market Trends

The U.S. modular flooring industry is characterized by strong demand for LVT (luxury vinyl tiles), carpet tiles, and eco-friendly flooring. Hospitals, schools, and airports are major consumers of modular flooring due to safety and hygiene concerns. Aging infrastructure and rising home remodeling trends also fuel demand. Technological integration, like sensor-embedded smart flooring for commercial spaces, is a notable innovation. Sustainability continues to be a key factor influencing buyer decisions, especially among institutional buyers and urban planners.

Asia Pacific Modular Flooring Market Trends

The growth of the Asia Pacific modular flooring industry is driven by large-scale construction, rapid urbanization, and expanding commercial spaces in China, India, and Southeast Asia. Affordable modular products, rising income levels, and increasing interior design awareness contribute to high regional demand. Demand from educational institutions, retail chains, and coworking hubs continues to soar. Additionally, government-backed infrastructure projects and export-oriented manufacturing hubs make the region a key player in both demand and supply.

China’s modular flooring market is flourishing due to the booming real estate sector and strong demand from the education, retail, and healthcare sectors. Domestic manufacturers are rapidly innovating in material science and automation, producing competitively priced, quality products. The government's emphasis on green buildings and low-emission materials is pushing adoption. Custom designs and branding elements in flooring for commercial chains are also a rising trend. Smart flooring applications are beginning to gain traction in high-end commercial projects.

Europe Modular Flooring Market Trends

The Europe modular flooring industry exhibits steady growth with strong sustainability mandates and an emphasis on design aesthetics. Markets in Germany, France, and the UK prioritize recyclable and low-emission flooring materials. The region’s mature commercial real estate market fuels demand for high-end, customizable modular flooring solutions. Retrofits and renovations in heritage buildings using modular systems that don’t damage existing structures are increasingly common. Consumer interest in acoustic and thermal insulation benefits also supports growth.

The Germany modular flooring market leads the European modular flooring landscape due to its focus on green building standards and strict regulations on VOC emissions. Modular flooring is widely used in public institutions, offices, and retail environments. The preference for precision-engineered and high-durability products aligns well with the modular concept. Manufacturers are investing in circular economy models and material innovation. Retrofit solutions for historic and energy-efficient buildings are on the rise.

Central & South America Modular Flooring Market Trends

The modular flooring industry is growing slowly but steadily in Central & South America, with Brazil and Mexico leading the charge. Demand is largely from commercial retail chains and urban residential developments. Price sensitivity remains a concern, but modular flooring’s long-term cost efficiency is being recognized. Local manufacturers are beginning to explore environmentally friendly product lines to meet both export requirements and rising domestic awareness. Logistics challenges and limited skilled labor are key barriers.

Middle East & Africa Modular Flooring Market Trends

MEA’s modular flooring industry is evolving, primarily driven by hospitality, commercial real estate, and luxury residential projects in the UAE, Saudi Arabia, and other countries. Construction boom and mega-events like Expo 2020 Dubai have sparked increased demand. Heat- and moisture-resistant modular tiles are preferred in this region due to the climatic conditions. The government's focus on non-oil revenue and infrastructure diversification supports market expansion. However, high import dependency and lower awareness levels in sub-Saharan regions pose challenges.

Key Modular Flooring Company Insights

Some of the key players operating in the market include Mohawk Industries, Inc. and Tarkett S.A.

-

Mohawk Industries is one of the world’s largest flooring manufacturers, offering a wide range of products including carpet tiles, luxury vinyl tiles (LVT), laminate, and hardwood. Known for its innovation, global reach, and sustainable manufacturing practices, Mohawk serves both residential and commercial markets through brands like Daltile, Pergo, and Karastan.

-

Tarkett is a global leader in modular and resilient flooring solutions, offering vinyl tiles, linoleum, carpet tiles, and wood flooring. The company focuses heavily on sustainability, circular economy practices, and healthy indoor environments. Tarkett serves sectors like healthcare, education, retail, and sports with operations in over 100 countries.

Interface, Inc. and Milliken & Company are some of the emerging participants in the modular flooring market.

-

Interface is a pioneer in modular carpet tile manufacturing and a leader in sustainable design. The company is well-known for its environmentally conscious approach, including carbon-neutral products and circular design. Interface primarily serves commercial spaces such as offices, educational institutions, and hospitality venues.

-

Milliken is a diversified manufacturer that offers high-performance modular carpet tiles and LVT for commercial interiors. Renowned for its advanced textile technology and design innovation, Milliken combines functionality, sustainability, and aesthetic appeal. The company has a strong presence in offices, healthcare, and educational spaces.

Key Modular Flooring Companies:

The following are the leading companies in the modular flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Interface, Inc.

- Tarkett S.A.

- Armstrong Flooring, Inc.

- Forbo Flooring Systems

- Milliken & Company

- Gerflor Group

- Beaulieu International Group

- LX Hausys

Recent Developments

-

In October 2024, Mohawk Industries, Inc. introduced a PVC‑free resilient flooring made from recycled single-use plastics and natural stone.

-

In July 2022, Mohawk Industries, Inc. acquired Georgia-based custom flooring specialist Foss Floors for $148 million; integrated under the Mohawk Home division.

-

In June 2025, Milliken & Company introduced "Pattern Play," a bold and customizable new carpet tile collection themed around color, joy, and creative expression. Designed in the UK and targeting designers who want flexible, expressive flooring design options.

Modular Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.94 billion

Revenue forecast in 2033

USD 71.92 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Mohawk Industries, Inc.; Shaw Industries Group, Inc.; Interface, Inc.; Tarkett S.A.; Armstrong Flooring, Inc.; Forbo Flooring Systems; Milliken & Company; Gerflor Group; Beaulieu International Group; LX Hausys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Flooring Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global modular flooring market report based on product type, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flexible LVT

-

Rigid LVT

-

Carpet Tile

-

Rubber Flooring

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global modular flooring market size was estimated at USD 45.57 billion in 2024 and is expected to reach USD 47.94 billion in 2025.

b. The global modular flooring market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 71.92 billion by 2033.

b. The carpet tile segment held the highest revenue market share, 43.8%, in 2024 due to its widespread use in commercial offices, educational institutions, and hospitality spaces.

b. Some of the key players operating in the modular flooring market include Mohawk Industries, Inc., Shaw Industries Group, Inc., Interface, Inc., Tarkett S.A., Armstrong Flooring, Inc., Forbo Flooring Systems, Milliken & Company, Gerflor Group, Beaulieu International Group, and LX Hausys.

b. Key factors driving the modular flooring market include ease of installation, design flexibility, durability, sustainability trends, and growing demand from commercial and residential sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.