- Home

- »

- Electronic Devices

- »

-

Molded Interconnect Device Market Size Report, 2033GVR Report cover

![Molded Interconnect Device Market Size, Share & Trends Report]()

Molded Interconnect Device Market (2025 - 2033) Size, Share & Trends Analysis Report By Device (Laser Direct Structuring (LDS), Two-Shot Molding), By Product (Sensor Housings, Connectors & Switches), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-381-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Molded Interconnect Device Market Summary

The global molded interconnect device market size was estimated at USD 5,463.2 million in 2024 and is projected to reach USD 10,200.2 million by 2033, growing at a CAGR of 11.4% from 2025 to 2033. The molded interconnect device (mid) market is expanding rapidly.

Key Market Trends & Insights

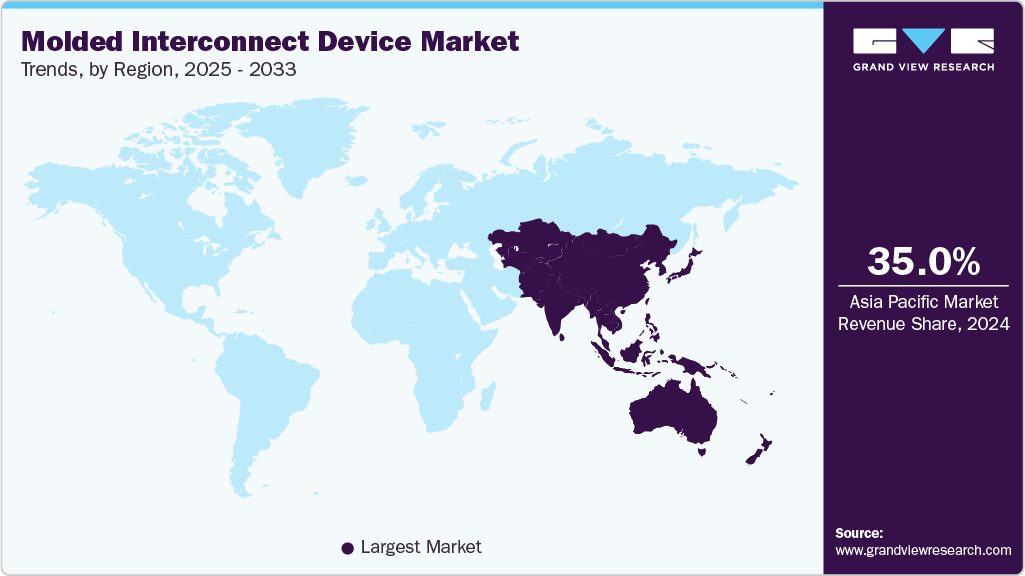

- Asia Pacific molded interconnect device industry dominated the global market with the largest revenue share of 35.0% in 2024.

- The molded interconnect device industry in the U.S. led the North America market and held the largest revenue share in the region in 2024.

- By device, Laser Direct Structuring (LDS) led the market and held the largest revenue share of 47.4% in 2024.

- By product, the sensor housings segment held the dominant position in the market and accounted for the largest revenue share of 28.0% in 2024.

- By end use, the consumer electronics segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5,463.2 Million

- 2033 Projected Market Size: USD 10,200.2 Million

- CAGR (2025-2033): 11.4%

- Asia Pacific: Largest market in 2024

Demand is rising for compact and multifunctional electronic components. Growth is especially strong in automotive, aerospace, and consumer electronics. Advanced manufacturing technologies are enabling more complex 3D circuitry on plastic substrates. The use of advanced materials is increasingly influencing the Molded Interconnect Device (MID) market. Companies are focusing on integrating high-performance resins to improve device functionality. These materials enable heat resistance and miniaturized designs for complex applications. Automotive and ICT sectors are driving demand for such next-generation MIDs. Strategic acquisitions help firms access patented technologies and expand their product portfolios. Material innovation is supporting the growth and scalability of MID solutions. Companies are actively pursuing these initiatives to strengthen their MID offerings. For instance, in February 2025, Sumitomo Chemical, a chemical company in Japan, acquired Syensqo’s LCP neat resin business to expand its product and technology portfolio for mobility and ICT applications. Using Syensqo's patents and technology, the company aims to supply next-generation automotive MIDs, supporting scalable production for connected and autonomous vehicles and reinforcing LCP’s role in future automotive electronics.

The trend towards smaller, more compact electronic devices necessitates advanced interconnect solutions that MID technology can provide. MIDs allow for more efficient use of space and integration of electronic components. Industries such as automotive, consumer electronics, and medical devices require high-performance yet lightweight components. MIDs, made from lightweight materials, meet these needs while maintaining performance standards.

The demand for customized electronic components is growing, and MIDs offer the flexibility to create bespoke designs that meet specific application requirements. MIDs are becoming more accessible for prototyping and low-volume production, allowing companies to experiment with innovative designs without significant upfront investment.

Government initiatives can have a significant positive impact on the molded interconnect device industry. For instance, in February 2024, the Indian government launched the "Digital India FutureLABS" at the Digital India FutureLABS Summit 2024, emphasizing India's progress from a technology consumer to a leader in developing next-generation electronics. The summit featured the announcement of 22 Memorandums of Understanding (MoUs) with companies like NXP Semiconductors and Qualcomm Technologies, Inc., aiming to strengthen India's Electronics System Design and Manufacturing (ESDM) sector through innovation and collaboration in key areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and quantum computing. Such initiatives can accelerate technological advancements and reduce the cost barriers associated with developing innovative MID solutions.

Device Insights

The Laser Direct Structuring (LDS) segment dominated the market in 2024, accounting for a 47.4% share. The Laser Direct Structuring (LDS) segment in the MID market is gaining significant attention due to its ability to create precise 3D circuit patterns on molded components. LDS enables integration of electronic circuits directly onto complex plastic surfaces, reducing the need for traditional wiring and connectors. This technology is particularly valuable in automotive, consumer electronics, and ICT applications where space-saving and miniaturization are critical. Manufacturers favor LDS for its high accuracy, design flexibility, and efficiency in producing small-batch or customized components.

The two-shot molding segment is growing due to increasing demand for multifunctional and compact MID components. This device allows combining different materials in a single mold, reducing assembly steps and production time. It is widely adopted in automotive, consumer electronics, and medical applications where integrated features are essential. Manufacturers are leveraging two-shot molding to enhance product durability, design flexibility, and cost efficiency. The segment is expected to continue expanding as companies focus on producing high-performance, space-saving MID solutions.

Product Insights

In terms of product, the sensor housings segment dominated the market in 2024, due to their widespread use in automotive, consumer electronics, and industrial applications. They enable the precise placement of sensors within compact and complex structures. The integration of circuits directly onto molded housings reduces wiring complexity and assembly costs. High-performance materials, such as LCPs, enhance heat resistance and durability in these housings. Manufacturers prefer sensor housings for their ability to support miniaturization and multifunctionality. Overall, sensor housings continue to dominate due to their critical role in enabling reliable and efficient device operation.

The antennas segment is experiencing rapid growth in the MID market, driven by increasing demand for wireless communication and connectivity solutions. MID-based antennas allow integration of complex circuits directly onto 3D molded structures, saving space and improving performance. Applications in automotive, IoT devices, and 5G infrastructure are fueling adoption. Advanced manufacturing techniques, such as LDS, enable precise patterning and high-frequency performance. Companies are investing in antenna development to support compact, multifunctional devices. The segment is expected to continue expanding as connectivity requirements grow across industries.

End Use Insights

In terms of end use, the automotive segment dominated the market in 2024. The automotive sector dominated the MID market due to the high demand for advanced electronic components in vehicles. MIDs are extensively used in sensors, antenna modules, and lighting systems within modern cars. Their ability to integrate circuits directly into 3D molded parts reduces wiring complexity and saves space. High-performance materials, like LCPs, ensure durability, heat resistance, and miniaturization for automotive applications. Manufacturers prefer MIDs in vehicles for enhanced reliability, compact design, and multifunctionality. The automotive sector remains the largest adopter of MID technology globally.

The consumer electronics segment is experiencing significant growth in the MID market, driven by demand for compact and multifunctional devices. MIDs allow integration of circuits into small, complex 3D structures used in smartphones, wearables, and smart home devices. Laser Direct Structuring (LDS) and Two-Shot Molding enhance precision, design flexibility, and miniaturization. Companies are adopting MID technology to reduce assembly steps and improve product performance. The rising focus on lightweight, space-saving designs is fueling adoption in this segment. Growth is expected to continue as consumer electronics become increasingly sophisticated and connected.

Regional Insights

Asia Pacific molded interconnect deviceindustry dominated globally in 2024 and accounted for a revenue share of over 35.0%. The growing demand for consumer electronics in the region is driving the market’s growth. Asia Pacific is a major hub for consumer electronics manufacturing and consumption, including smartphones, wearables, and smart home devices. MIDs are essential for integrating complex functionalities into these compact devices. Moreover, the roll-out of 5G networks across the Asia Pacific creates a high demand for advanced antennas and connectivity solutions. MIDs help in integrating these components into compact and efficient designs.

North America Molded Interconnect Device Market Trends

The molded interconnect deviceindustry in North America is expanding due to strong technological innovation and growing demand for advanced electronic devices, including smartphones, wearables, and automotive systems. Supportive government policies and incentives promoting technological development and manufacturing improvements are driving growth. In March 2024, the U.S. government collaborated with Mexico through the ITSI Fund to evaluate Mexico’s semiconductor industry and regulatory environment. This initiative aims to identify opportunities to strengthen the semiconductor supply chain and enhance North America’s competitiveness in advanced electronics and related technologies.

U.S. Molded Interconnect Device Market Trends

The U.S. molded interconnect deviceindustry is witnessing steady growth. Demand is driven by automotive, aerospace, and medical applications requiring compact, multifunctional components. Advanced technologies like Laser Direct Structuring (LDS) and two-shot molding are widely adopted. LCP-based materials enhance thermal stability and electrical performance. Collaborations, product launches, and innovations are further boosting market expansion.

Europe Molded Interconnect Device Market Trends

The molded interconnect deviceindustry in Europe is driven by the expansion of the European automotive industry. The European automotive industry is at the forefront of adopting Electric Vehicles (EVs) and Advanced Driver Assistance Systems (ADAS). MIDs are crucial for integrating the complex electronics required for these technologies. Moreover, Europe’s well-established manufacturing infrastructure supports the production and distribution of high-quality MIDs.

Key Molded Interconnect Device Company Insights

Some of the key companies operating in the market include TE Connectivity, KYOCERA AVX Components Corporation, Molex, and Amphenol Corporation, among others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

TE Connectivity has been focusing on advancing Molded Interconnect Device (MID) solutions for automotive, industrial, and consumer electronics applications. The company leverages Laser Direct Structuring (LDS) and high-performance materials to create compact and multifunctional components. TE’s MID offerings enable integration of circuits into 3D molded parts, reducing wiring complexity and assembly costs. Research and development efforts are aimed at improving the precision, durability, and miniaturization of components. Overall, TE Connectivity continues to expand its MID portfolio to support next-generation electronic systems.

-

MID Solutions GmbH specializes in developing innovative MID components for automotive, medical, and industrial applications. The company uses advanced resins and LDS technology to produce high-precision, heat-resistant, and miniaturized devices. Their MIDs integrate multiple functions into a single part, improving efficiency and reducing assembly steps. MID Solutions GmbH invests in R&D to enhance the design flexibility and reliability of its products. The company’s focus on technological innovation positions it as a key player in the growing MID market.

Key Molded Interconnect Device Companies:

The following are the leading companies in the molded interconnect device market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- KYOCERA AVX Components Corporation

- LPKF

- Molex

- Amphenol Corporation

- Taoglas

- HARTING Technology Group

- Sumitomo Electric Industries, Ltd.

- MID Solutions GmbH

- TEPROSA

Recent Developments

-

In September 2025, Cogenuity Partners, a U.S.-based private equity firm, acquired Interconnect Solutions Company (ISC), a provider of custom and complex interconnect solutions, including custom overmolded solutions and molded strain reliefs. This acquisition enhances Cogenuity's advanced industrial portfolio, specifically within the high-performance connectivity sector serving markets like aerospace and data centers.

-

In November 2023, Molex expanded its manufacturing footprint by opening a new campus in Katowice, Poland. It features an initial 23,000 square-meter space dedicated to producing advanced medical devices and electric vehicle solutions. With plans to expand it up to 85,000 square meters, this facility will support Molex's growth in Europe. The facility will feature advanced capabilities, such as advanced medical device assembly, drug handling, packaging, and injection molding.

-

In July 2022, TE Connectivity inaugurated a new, larger production facility in Hermosillo, Mexico, to enhance its Data and Devices business unit. This 230,000-square-foot site, replacing a smaller facility from 1996, will support the company's IoT product portfolio, including high-speed communications connectors and cables. It will employ over 1,750 people and benefit from its proximity to TE Connectivity's global logistics center and four other Hermosillo facilities.

Molded Interconnect Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,954.7 million

Revenue forecast in 2033

USD 10,200.2 million

Growth rate

CAGR of 11.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

TE Connectivity; KYOCERA AVX Components Corporation; LPKF; Molex; Amphenol Corporation; Taoglas; HARTING Technology Group; Sumitomo Electric Industries, Ltd.; MID Solutions GmbH; TEPROSA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molded Interconnect Device Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the global molded interconnect device market report based on device, product, end use, and region.

-

Device Outlook (Revenue, USD Million, 2021 - 2033)

-

Laser Direct Structuring (LDS)

-

Two-Shot Molding

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sensor Housings

-

Antennas

-

Connectors & Switches

-

Lighting

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

Automotive

-

Consumer Electronics

-

Telecommunication

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molded interconnect device market size was estimated at USD 5,463.2 million in 2024 and is expected to reach USD 5,954.7 million in 2025.

b. The global molded interconnect device market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2033 to reach USD 10,200.2 million by 2033.

b. Asia Pacific dominated the molded interconnect device market with a share of over 35.0% in 2024. This is attributable to rapid industrial growth, technological advancements, and increased demand from the automotive and electronics sectors.

b. Some key players operating in the molded interconnect device market include TE Connectivity, KYOCERA AVX Components Corporation, LPKF, Molex, Amphenol Corporation, Taoglas, HARTING Technology Group, Sumitomo Electric Industries, Ltd., MID Solutions GmbH, and TEPROSA.

b. Key factors driving market growth include the trend towards miniaturization of electronic devices and the growing use of electronics in the automotive sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.