- Home

- »

- Consumer F&B

- »

-

Molluscs Market Size & Share Report, 2022 - 2028GVR Report cover

![Molluscs Market Size, Share & Trends Report]()

Molluscs Market (2022 - 2028) Size, Share & Trends Analysis Report By Species (Crassostrea, Ruditapes Philippinarum, Scallops), By Form (Frozen, Canned), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-941-2

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

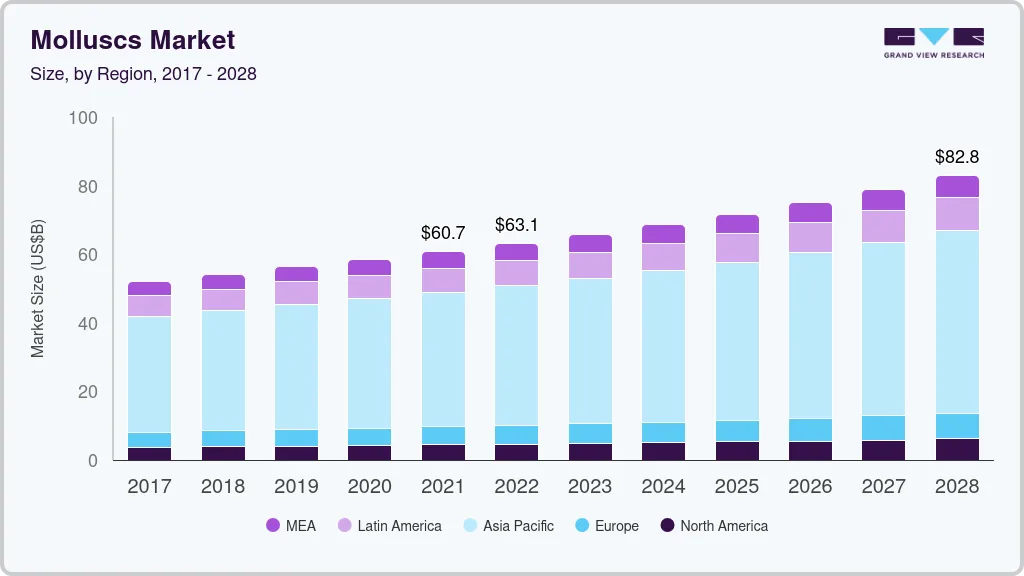

The global molluscs market size was estimated at USD 60.72 billion in 2021 and is projected to reach USD 82.85 billion by 2028, growing at a CAGR of 4.5% from 2022 to 2028. The growing food industry across the globe is anticipating market growth. Moreover, the growing health consciousness among consumers has increased the demand for nutritious food products and the consumption of molluscs. This reduces the risk of chronic diseases, which, in turn, is expected to promote market growth during the forecast period.

Moreover, the increasing demand and consumption for protein-rich diets instead of high-calorie food product intake are propelling the growth of the global molluscs market. Seafood is a low-fat and rich source of protein, which is used for muscle building, and it also contains ingredients such as vitamins, iron, and omega-3 fatty acid, which are anticipating the market growth. In addition to this, increasing demand for processed seafood is also driving the market growth during the forecast period.

The growing aquaculture fish production in developing economies like China, India, and Japan is the major driving force of the market. Furthermore, increasing disposable income of the consumers and rising inclination toward a healthy lifestyle, which has led to a rise in the consumption of protein-rich food, is the major growth factors for the market over the last few years. The growing demand for premium quality food products due to freshness, diversity of the products, and convenience for food safety are expected to boost the market growth during the forecast period.

The lockdown announced during the COVID-19 pandemic had disturbed transportation and suspended the supply of fish food products for a short duration. Aquaculture and fishery supply chains are susceptible to being disrupted or stopped by measures arising from COVID-19 restrictions. In the aquaculture sector, the unsold production of molluscs has resulted in increasing levels of live fish stocks. Further, it has created higher costs for feeding and risks of fish mortalities around the world.

Species Insights

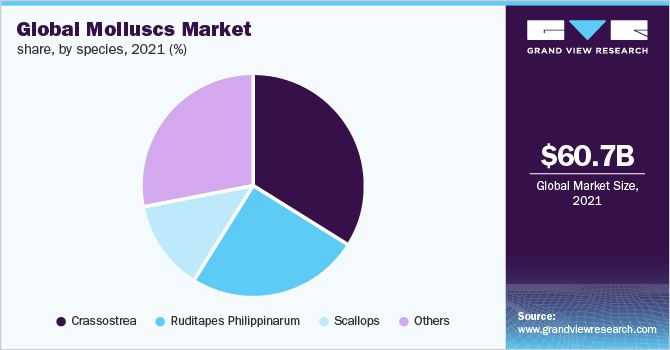

The Crassostrea segment contributed to the largest market share of more than 30% of the global molluscs market revenue in 2021 and is expected to grow with a CAGR of 4.7% from 2022 to 2028. The increasing production of Crassostrea products in developing economies like India, China, and Japan is propelling the growth of this segment. The rising popularity of fish food due to growing awareness about health consciousness among the consumers has projected the market growth in the forecast period.

The scallops segment is expected to expand with the fastest CAGR of 5.1% from 2022 to 2028. The increasing demand for scallops is due to valuable protein sources for human consumption, which has projected the growth of this segment in the forecast period. The increasing population, coupled with rising seafood consumption per capita across the globe, are major driving factors for the market.

Form Insights

The frozen segment contributed to the largest market share of more than 55% of the global molluscs market revenue in 2021 and is expected to expand with a CAGR of 4.2% from 2022 to 2028. The consumer's inclination toward consuming a healthy, nutritious, and protein-rich diet has significantly accelerated the demand for frozen seafood products. In addition to this, the rising demand for processed and packaged fish products worldwide has projected market growth during the forecast period.

The canned segment is anticipated to expand with a CAGR of 5.0% from 2022 to 2028. Continuously changing lifestyles and busy life schedules of consumers are demanding processed seafood like canned molluscs, which, in turn, are gaining popularity among the consumers. Moreover, the increasing consumption of molluscs products due to several health benefits such as reducing the risk of chronic diseases is propelling the growth of this segment in the forecast period.

Distribution Channel Insights

The hypermarkets and supermarket channels contributed a share of more than 40% in the global molluscs market in 2021. Suppliers of molluscs products use the traditional retail channel to sell by word of mouth, advertising, and marketing. Consumers prefer hypermarkets & supermarkets for purchasing goods, grocery, and fish food products, where they can physically verify product quality. Hypermarkets & supermarket channels are expected to remain dominant in the forecast period due to improved distribution channel networks across the globe.

The online segment of the molluscs market is expected to register the fastest expansion during the forecast years, with a CAGR of 5.7% from 2022 to 2028. The rising adoption of the e-commerce sector for the shopping of food products and essential products by consumers due to the internet penetration rate has witnessed lucrative growth in recent years. Several suppliers of molluscs are offering products on their websites which is further expected to drive industry demand during the forecast period.

Regional Insights

Asia Pacific made the largest contribution to the global molluscs market of over 60% in 2021. This can be credited to increased inclination among consumers towards a healthy lifestyle and increasing disposable income, which, in turn, will drive demand for healthy and nutritious food products. The increasing consumption of fish food products in countries like China, India, and Japan, owing to the rising demand for protein-rich fish food products, is propelling the industry growth in this region. Especially in China and India, which have a huge consumer base for food products, this has further shown growth in the production of molluscs products.

Europe is the fastest-growing molluscs market and is expected to witness a CAGR of 5.1% from 2022 to 2028. The growing demand for premium quality food products due to freshness, diversity of the products, and convenience for food safety are expected to boost the market growth during the forecast period. The rising consumption of molluscs products in countries like Germany, Spain, and Italy, is due to the increasing awareness about the health benefits that are propelling the market growth.

Key Companies & Market Share Insights

The market is fragmented with the presence of various established market players and suppliers of the molluscs across the globe. Some of them are Maruha Nichiro Corporation, Nireus Aquaculture S.A., Cermaq ASA, and Eastern Fish Company, coupled with numerous domestic players, along with an existing strong distribution channel. Various companies are increasing their investment in geographical expansion with distribution channels and production capacity expansion to maintain their brand image and market position. Some of the key players operating in the molluscs market include:

-

Maruha Nichiro Corporation

-

Nireus Aquaculture S.A.

-

Cermaq ASA

-

Eastern Fish Company

-

Cooke Aquaculture Inc.

-

Tassal Group Ltd.

-

Blue Ridge Aquaculture

-

Selonda Aquaculture S.A.

-

Ulka Seafoods Pvt. Ltd.

-

Avla Nettos Exports

Molluscs Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 63.10 billion

Revenue forecast in 2028

USD 82.85 billion

Growth rate

CAGR of 4.5% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD billion/million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, form, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, Italy, Spain, China, India, Japan, Brazil, and South Africa

Key companies profiled

Maruha Nichiro Corporation, Nireus Aquaculture S.A., Cermaq ASA, Eastern Fish Company, Cooke Aquaculture Inc., Tassal Group Ltd., Blue Ridge Aquaculture, Selonda Aquaculture S.A., Ulka Seafoods Pvt. Ltd., Avla Nettos Exports

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global molluscs market report based on species, form, distribution channel, and region:

-

Species Outlook (Revenue, USD Million, 2017 - 2028)

-

Crassostrea

-

Ruditapes Philippinarum

-

Scallops

-

Others

-

-

Form Outlook (Revenue, USD Million, 2017 - 2028)

-

Frozen

-

Canned

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Hypermarkets and Supermarkets

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molluscs market size was estimated at USD 60.72 billion in 2021 and is expected to reach USD 63.10 billion in 2022.

b. The global molluscs market is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2028 to reach USD 82.85 billion by 2027.

b. Asia Pacific dominated the molluscs market with a share of 64.6% in 2021. This is attributable to increased inclination among consumers towards healthy lifestyle and increasing demand for healthy and nutritious food products.

b. Some key players operating in the molluscs market include Maruha Nichiro Corporation; Nireus Aquaculture S.A.; Cermaq ASA; Eastern Fish Company; Cooke Aquaculture Inc.; Tassal Group Ltd.; Blue Ridge Aquaculture; Selonda Aquaculture S.A.; Ulka Seafoods Pvt. Ltd.; and Avla Nettos Exports.

b. Key factors that are driving the molluscs market growth include increasing growing health consciousness among consumers resulting in high demand for nutritious food products and growing aquaculture fish production in developing economies like China, India, and Japan.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.