- Home

- »

- IT Services & Applications

- »

-

Multichannel Order Management Market Size Report, 2030GVR Report cover

![Multichannel Order Management Market Size, Share & Trends Report]()

Multichannel Order Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (On-premises, Cloud), By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multichannel Order Management Market Summary

The global multichannel order management market size was estimated at USD 2.95 billion in 2022 and is projected to reach USD 6.86 billion by 2030, growing at a CAGR of 11.6% from 2023 to 2030. The growth is expected to be driven by the growth in retail sales and the online shopping industry.

Key Market Trends & Insights

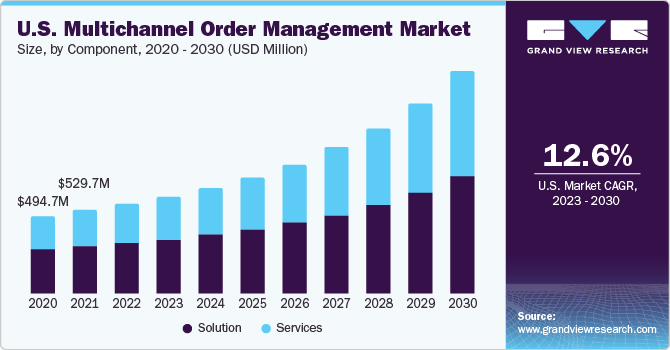

- The North America accounted for the highest revenue share of 29.9% in 2022. The regional market is anticipated to grow at a CAGR of over 11.9% from 2023 to 2030.

- The Asia Pacific region is anticipated to grow at the fastest CAGR of 12.7% from 2023 to 2030.

- Based on component, the solution segment dominated with a revenue share of 55.1% in 2022.

- Based on deployment, the on-premises segment dominated the market with a revenue share of 56.8% in 2022.

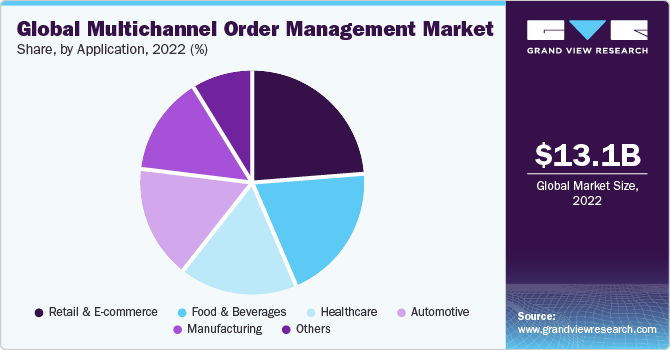

- Based on application, the retail & e-commerce segment dominated with a revenue share of 24.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.95 Billion

- 2030 Projected Market USD 6.86 Billion

- CAGR (2023-2030): 11.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing popularity of online shopping and the growth of the retail industry have contributed to the expansion of the market. For instance, according to Forbes, an estimated 20.8% of retail transactions will occur online in 2023, showing an expected increase in e-commerce revenues. As more businesses adopt multichannel selling strategies to reach customers through various channels, the demand for order management solutions that efficiently handle orders from multiple channels has increased.

Growth in multichannel selling is a significant driving factor for the multichannel order management industry. As businesses expand their presence across multiple sales channels, they face the challenge of efficiently managing orders from these channels. Multichannel order management solutions help businesses streamline processes, ensuring smooth operations and timely order fulfillment across all channels. With multichannel selling, businesses need to manage inventory across different channels effectively. Multichannel order management solutions provide real-time visibility into inventory levels across all channels, enabling businesses to optimize inventory allocation, prevent stockouts, and avoid overstocking. This leads to efficient inventory management and cost savings.

The growth of multichannel selling has raised concerns about data security and privacy in order management. Customer data collection, storage, and processing are subject to privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations impose strict requirements on businesses regarding data protection, consent, transparency, and individual rights. Businesses must ensure that their multichannel order management practices comply with these regulations to avoid legal and financial consequences. However, the development of augmented reality (AR), machine learning (ML), and artificial intelligence (AI). Such technologies offer MOM market players opportunities to improve customer engagement, streamline operations, and gain a competitive edge.

COVID-19 Impact

The COVID-19 pandemic has significantly impacted the multichannel order management (MOM) industry. The pandemic led to disruptions in global supply chains, affecting the availability and delivery of products. This impacted the order fulfillment process and highlighted the importance of efficient multichannel order management systems to manage inventory and ensure timely delivery. During lockdowns and social distancing measures, there was a surge in online shopping and a shift towards digital channels. This increased demand for online channels necessitated robust multichannel order management systems to handle the influx of orders from various channels and ensure smooth order processing and fulfillment.

With safety concerns and restrictions on physical interactions, businesses had to adapt by providing contactless and omnichannel experiences. Multichannel order management systems enabled businesses to offer options such as curbside pickup, buy online, pick up in-store (BOPIS), and seamless integration of online and offline channels. Moreover, the pandemic accelerated the need for advanced multichannel order management solutions as businesses adapted to the changing market dynamics. Due to the impact of COVID-19, the focus on digital channels, contactless experiences, real-time inventory management, and customer-centricity became crucial factors in the MOM market.

Component Insights

Based on component, the market is classified into solutions and services. The solution segment dominated with a revenue share of 55.1% in 2022. The segment growth is anticipated to be driven by the growth and expansion of the business operations. As businesses grow and expand their operations, they need software solutions to handle increased order volumes, accommodate new sales channels, and support evolving customer demands. The scalability and flexibility offered by software solutions make them attractive for businesses looking to future-proof their multichannel operations. In addition, such software gives businesses real-time visibility and control over their inventory, orders, and fulfillment processes across all channels. Players such as Zoho Corp, an Indian American technology firm offer its properity software Zoho Inventory which streamlines the process of monitoring and satisfying orders across various channels from a centralized hub, resulting in enhanced efficiency and the timely fulfillment of orders.

The services segment is anticipated to grow at the fastest CAGR of 13.2% from 2023 to 2030. Businesses often require assistance implementing and integrating multichannel order management systems into their infrastructure. Services providers offer expertise in system configuration, data migration, and integration with other business systems, such as ERP or CRM. This support ensures smooth implementation and minimizes disruptions to business operations. In addition, the services segment is driven by the increased demand for consulting & advisory services across the businesses. Services providers often provide consulting and advisory services to help businesses optimize their order management processes. They provide insights, best practices, and industry expertise to improve efficiency, reduce costs, and enhance customer experience.

Deployment Insights

Based on deployment, the market is classified into on-premises and cloud. The on-premises deployment segment dominated the market with a revenue share of 56.8% in 2022. On-premises solutions offer greater flexibility and customization options compared to cloud-based solutions. Businesses can tailor the system to their needs, workflows, and integrations with other in-house systems. This level of customization allows businesses to optimize their order management processes and align them with their unique requirements. In addition, providing enhanced data security, customization options, integration capabilities, compliance adherence, network stability, and long-term cost considerations, on-premises solutions meet businesses' specific needs and preferences, seeking greater control and flexibility over their order management processes.

The cloud segment is anticipated to grow at the fastest CAGR of 13.2% from 2023 to 2030. Cloud-based deployment often offers seamless integration capabilities with other cloud-based systems and third-party applications. This allows businesses to connect their order management system with other essential business tools, such as customer relationship management (CRM) systems, inventory management systems, or e-commerce platforms. Integrating and sharing data across different systems enhances overall operational efficiency. Furthermore, cloud-based deployment provides advanced analytics and reporting capabilities, allowing businesses to gain valuable insights into their order management processes. These insights can help businesses identify trends, optimize inventory management, improve customer experiences, and make data-driven decisions. Players such as NetSuite, an American cloud-based software firm offer NetSuite Multichannel Order Management, a cloud-based software to offer business benefits such as inventory visibility and order orchestration.

Enterprise Size Insights

The large enterprises segment dominated the market with a revenue share of 58.7% in 2022. Large enterprises have complex and diverse operations, including multiple sales channels, warehouses, and distribution centers. They require robust order management solutions to handle the high volume of orders and effectively manage inventory across different channels. MOM solutions provide the necessary capabilities to streamline and automate these complex operations, ensuring efficient order fulfillment. In addition, large enterprises deal with a high volume of orders, requiring scalable and high-performance solutions to handle the load. MOM solutions are designed to handle large transaction volumes, ensuring smooth order processing and minimizing the risk of system slowdowns or crashes. The scalability and performance of MOM solutions make them suitable for the demanding requirements of large enterprises.

The small and medium enterprises (SMEs) segment is anticipated to grow at the fastest CAGR of 13.1% from 2023 to 2030. Small and medium enterprises often need more data analysis and decision-making resources. MOM solutions that provide order visibility and analytics capabilities can be highly valuable for SMEs. By accessing real-time data and analytics insights, SMEs can make informed decisions regarding inventory management, pricing strategies, and sales channel optimization, leading to improved business performance. Additionally, players like Amazon are launching specific programs to address small business inventory and logistics issues. For instance, in September 2023, Amazon introduced a fresh initiative named "Multi-Channel Fulfillment" to tackle a significant challenge including the management of inventory, logistics, and delivery processes faced by small businesses and direct-to-consumer (D2C) brands.

Application Insights

Based on application, the market is classified into healthcare, automotive, manufacturing, food & beverage, automotive, retail & e-commerce, and others. Among these, the retail & e-commerce segment dominated with a revenue share of 24.0% in 2022. This dominance can be attributed to the increasing demand for online shopping among consumers across the globe. For instance, according to Insider Intelligence, In 2022, there were a total of 41.8 million online shoppers aged between 25 and 34, with millennials comprising the largest segment among digital purchasers. Furthermore, MOM solutions provide a centralized platform to streamline order management processes, including order processing, inventory management, and fulfillment. This centralized approach helps retailers and e-commerce businesses efficiently manage orders across multiple channels.

Healthcare is anticipated to emerge as the fastest-growing segment, with a CAGR of 13.1% from 2023 to 2030. The segment growth is anticipated to be driven by the increasing global demand for healthcare services. The healthcare industry has been adopting digital transformation, including providing online healthcare services such as telemedicine and online pharmacy. With the growth of online healthcare services, there is a need for efficient order management solutions to handle the processing and fulfillment of healthcare products and services. Furthermore, integration with electronic health records (EHR) systems is essential for the healthcare industry. MOM solutions can seamlessly integrate with EHR systems can enable efficient management of patient data, medication orders, and prescription fulfillment, improving the overall patient experience and healthcare provider efficiency.

Regional Insights

North America accounted for the highest revenue share of 29.9% in 2022. The regional market is anticipated to grow at a CAGR of over 11.9% from 2023 to 2030. The region is at the forefront of technological advancements and digital transformation. MOM solutions leverage emerging technologies such as artificial intelligence, machine learning, and data analytics to optimize order management processes. These technologies enable businesses to gain valuable insights, automate repetitive tasks, and make data-driven decisions, improving operational efficiency and competitive advantage. Additionally, the region is home to major players such as IBM Corporation, Oracle Corporation, and NetSuite, among others, contributing to the regional growth expansion.

The Asia Pacific region is anticipated to grow at the fastest CAGR of 12.7% from 2023 to 2030. Throughout the Asia-Pacific region, grocery stores, shopping malls, supermarkets, hypermarkets, and convenience stores are undergoing digital enhancements primarily aimed at maintaining competitiveness in the upcoming era of shopping experiences. These innovations have melded brick-and-mortar stores' tangible presence and reliability with the swiftness and convenience of online shopping, revolutionizing the entire in-person retail experience. These factors are anticipated to fuel the region's need for order management solutions over the projected period.

Key Companies & Market Share Insights

The multichannel order management industry is characterized by intense competition, with numerous large and small players offering software and services to domestic and international markets. The market is currently moderately fragmented and is moving toward a more fragmented state. Some key players in this market include IBM Corporation, HCL Technologies Limited, Oracle Corporation, and Salesforce.com, Inc. Major players operating in the market are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness.

For instance, in April 2023, Oracle unveiled new capabilities within the Oracle Fusion Cloud Applications Suite, designed to assist customers in accelerating supply chain planning, enhancing operational efficiency, and improving financial accuracy. These updates encompassed new planning features, usage-based pricing, rebate management capabilities in Oracle Fusion Cloud Supply Chain & Manufacturing (SCM), and enhancements to the quote-to-cash processes in Oracle Fusion Applications. In addition, in April 2023, Freestyle Software announced the release of version 12 of its Multichannel Order Manager (M.O.M.), marking the second major release since 2020. This latest version includes significant security enhancements and is among the first applications to receive certification under the more stringent PCI-S3 requirements. Some prominent players in the global multichannel order management market include:

-

NetSuite

-

Magento (Adobe Commerce)

-

IBM Corporation

-

SAP SE

-

Salesforce.com, Inc.

-

Zoho Corporation

-

HCL Tech

-

Oracle Corporation

-

Newfold Digital Inc.

-

Shopify Plus

-

Delhivery Pvt. Ltd.

-

VTEX

Multichannel Order Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.17 billion

Revenue forecast in 2030

USD 6.86 billion

Growth rate

CAGR of 11.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico;United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

NetSuite; Magento (Adobe Commerce); IBM Corporation; SAP SE; Salesforce.com, Inc.; Zoho Corporation; HCL Tech; Oracle Corporation; Newfold Digital Inc.; Shopify Plus; Delhivery Pvt. Ltd., VTEX.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multichannel Order Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global multichannel order management market report based on component, deployment, enterprise size, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Manufacturing

-

Food & Beverages

-

Automotive

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multichannel order management market size was estimated at USD 2.95 billion in 2022 and is expected to reach USD 3.17 billion in 2023.

b. The global multichannel order management market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 6.86 billion by 2030.

b. North America led the overall market in 2022 gaining a market share of 29.9%. The North American is home to major players such as IBM Corporation, Oracle Corporation, and NetSuite, among others, contributing to the regional growth expansion.

b. Some of the key player include NetSuite, Magento (Adobe Commerce), IBM Corporation, SAP SE, Salesforce.com, Inc., Zoho Corporation, HCL Tech, Oracle Corporation, Newfold Digital Inc., Shopify Plus, Delhivery Pvt. Ltd., and VTEX.

b. The market is expected to be driven by the growth in retail sales and the online shopping industry. The increasing popularity of online shopping and the growth of the retail industry have contributed to expanding the multichannel order management market. Furthermore, growth in multichannel selling is a significant driving factor for the multichannel order management market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.