- Home

- »

- Biotechnology

- »

-

Multiomics Market Size And Share, Industry Report, 2033GVR Report cover

![Multiomics Market Size, Share & Trends Report]()

Multiomics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Type (Single-cell, Bulk), By Platform, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-136-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multiomics Market Summary

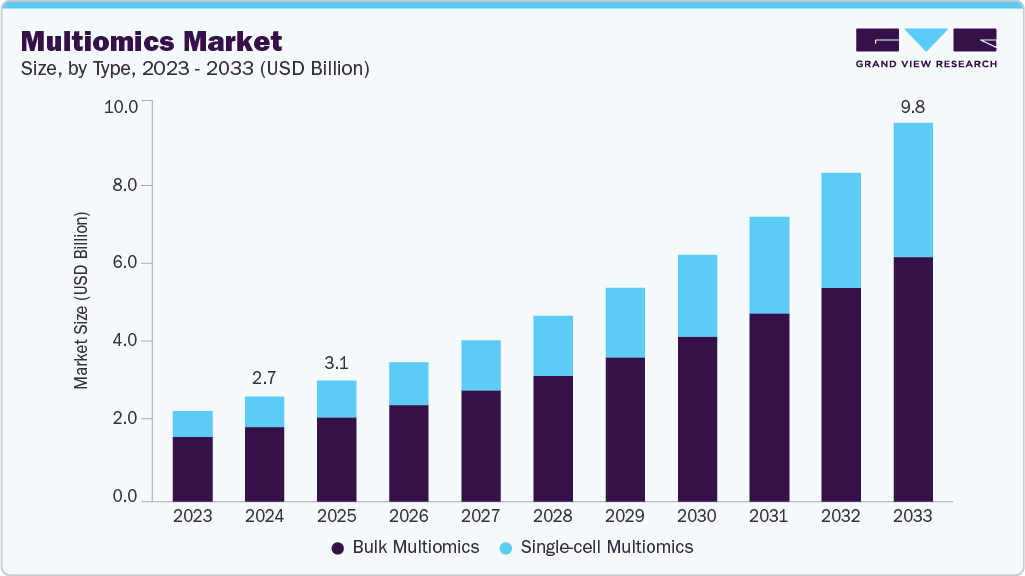

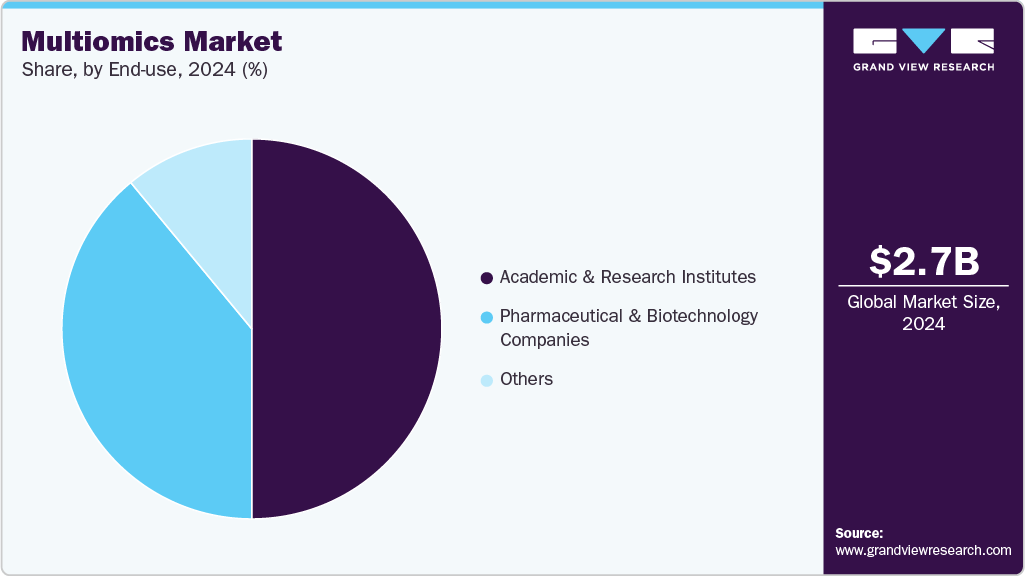

The global multiomics market size was estimated at USD 2.72 billion in 2024 and is projected to reach USD 9.81 billion by 2033, growing at a CAGR of 15.33% from 2025 to 2033. The growing demand for single-cell multiomics and ongoing advancements in omics technologies primarily drive the market’s expansion.

Key Market Trends & Insights

- North America multiomics market held the largest share of 48.76% of the global market in 2024.

- The multiomics industry in the U.S. is expected to grow significantly over the forecast period.

- By product & service, the product segment held the highest market share of 59.07% in 2024.

- Based on type, the bulk multiomics segment held the highest market share in 2024.

- By platform, the genomics segment held the highest market share in 2024.

- By application, the oncology segment held the highest market share in 2024.

- By end use, the academic and research institutes segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.72 Billion

- 2033 Projected Market Size: USD 9.81 Billion

- CAGR (2025-2033): 15.33%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, key components such as genomics, proteomics, metabolomics, and transcriptomics are experiencing increased adoption in healthcare applications. The large datasets generated through multiomics approaches also provide valuable insights that facilitate therapeutic development.

Rising Demand and Technological Advances in Single-Cell Genomics and Multiomics Platforms

Advancements in single cell multiomics platforms are further accelerating industry growth as companies develop innovative technologies to support scientific discovery across diverse fields. For example, in February 2023, BD launched the BD Rhapsody HT Xpress System in the United States, enabling advanced single cell multiomics analysis to accelerate biomedical research and expand scientific discovery capabilities.

Growing interest among researchers in single-cell genomics is expected to drive significant market demand. For instance, in May 2025, Illumina unveiled advanced multiomics technologies at the European Society of Human Genetics conference in Milan, Italy. These include spatial transcriptomics for detailed tissue analysis, a 5-base methylation solution for combined genetic and epigenetic profiling, and the upcoming Illumina Connected Multiomics software to integrate diverse biological data, enhancing genomic research and clinical insights.

Expanding Role of Multiomics in Cardiovascular Disease Research

Multiomics approaches are playing an increasingly vital role in cardiovascular disease (CVD) research, enabling the identification of novel biomarkers and therapeutic targets. By integrating genomics, transcriptomics, proteomics, and metabolomics data, researchers gain a holistic view of disease mechanisms, facilitating more precise diagnostics and personalized treatments. For instance, in June 2025, a study published in Scientific Reports utilized multiomics analysis to elucidate the mechanisms by which Vagus Nerve Stimulation (VNS) treats Chronic Congestive Heart Failure (CHF) in canine models. As the prevalence of CVDs continues to rise, these comprehensive approaches are expected to drive significant growth in the healthcare and life sciences markets during the forecast period.

Methods

Compounds

Targets

Type of disease or model study

Potential applications

Transcriptomics and proteomics (DARTS)

Arctigenin

PP2A

Diabetic kidney disease

Hypertension; inflammation

Genomics and proteomics (DARTS)

Ecumicin

ClpC1

Tuberculosis

Lead compounds for antituberculosis drugs

Chemical proteomics and bioinformatics (gene ontology)

Baicalin

CPT1

Obesity and hepatic steatosis

Inflammation; antibacterial; obesity

Proteomics (DARTS) and bioinformatics (gene docking)

Bithionol

NAD‐dependent dehydrogenases

Cryptococcus neoformans

Antifungal

CRISPR

Ispinesib

Kinesin‐5

Human cancer cells

Cancer

AI (machine learning)

β‐Lapachone

5‐lipoxygenase

Human cancer cells

Cancer

Methods

Compounds

Targets

Type of disease or model study

Potential applications

Source: Pubmed Central, Secondary Source, Grand View Research, Inc.

According to the World Heart Federation’s World Heart Report 2023, cardiovascular diseases affected over 500 million people globally and caused 20.5 million deaths in 2021, accounting for nearly one-third of all global deaths. This marks a notable increase from earlier estimates of 12.1 million CVD-related deaths, underscoring the urgent need for advanced research tools and innovative treatment strategies to combat the growing burden of cardiovascular conditions.

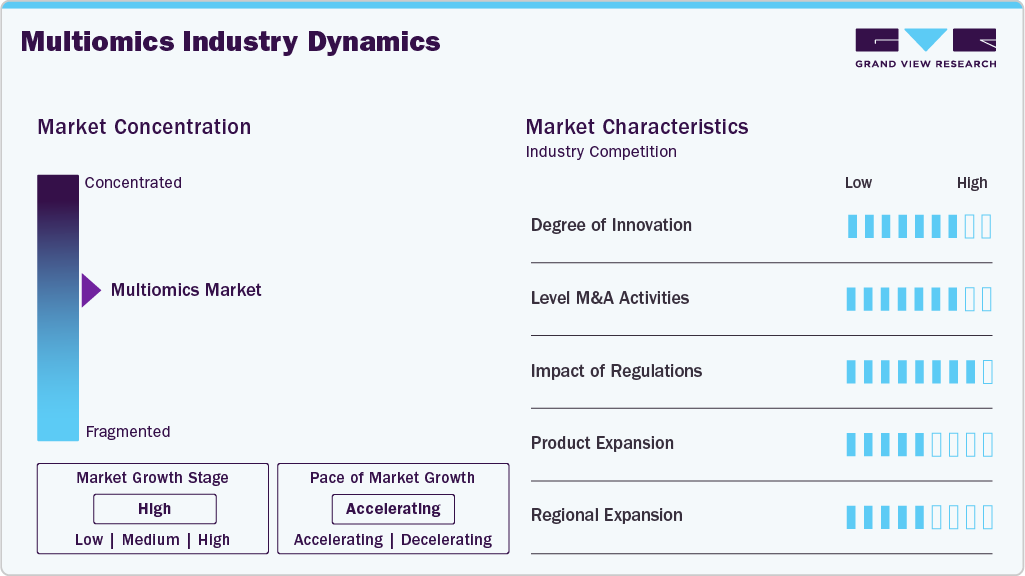

Market Concentration & Characteristics

The multiomics industry has seen significant innovation in recent years by integrating diverse omics technologies such as genomics, proteomics, metabolomics, and transcriptomics to deliver comprehensive biological insights that surpass traditional single-omics approaches. These developments are revolutionizing personalized medicine, biomarker discovery, and drug development by offering a holistic understanding of biological systems. Moreover, creating collaborative multiomics platforms and expanding applications across healthcare, agriculture, and environmental sciences further highlight the market’s innovative potential despite ongoing data standardization and cost challenges.

The level of M&A (mergers and acquisitions) activities in the multiomics industry has been significant in recent years. With the increasing demand for personalized medicine and the need to integrate multiple omics data types, many companies want to expand their capabilities through strategic partnerships and acquisitions. For instance, in September 2024, Lucius Partners' portfolio company, PD Theranostics (PDTx), merged with Ovation to form a leading multiomics data company. The merger integrates Ovation's DNA and RNA sequencing capabilities with PDTx's advanced imaging and multiomic analysis platform, facilitating comprehensive disease profiling and accelerating drug discovery and clinical decision-making across diverse therapeutic areas.

The impact of regulation on the multiomics industry is significant. With the generation of large-scale multiomics datasets, data privacy and security concerns become important. Regulations such as the General Data Protection Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. impose stringent requirements for collecting, storing, and sharing personal health information.

Product expansion in the multi-omics industry involves developing and commercializing innovative technologies, tools, and services to advance research, diagnostics, and therapeutics across various omics domains. Companies are developing integrated omics platforms that enable simultaneous analysis of multiple molecular layers. For instance, in March 2024, a review published in Experimental & Molecular Medicine highlighted significant advancements in single-cell and multimodal omics technologies, emphasizing their transformative impact on high-resolution molecular profiling. These innovations have enhanced our understanding of cellular heterogeneity and complexity, facilitating deeper insights into various biological processes and disease mechanisms. Integrating multiple omics layers within individual cells has provided a comprehensive view of cellular functions, enabling more precise and personalized approaches in biomedical research.

The multiomics industry is witnessing significant regional expansion driven by increasing investments in biotechnology infrastructure, rising healthcare awareness, and government initiatives supporting precision medicine across North America, Europe, and Asia-Pacific. This geographic diversification enables wider adoption of global multiomics technologies and fosters innovation tailored to regional healthcare needs.

Product & Service Insights

The product segment accounted for the largest market revenue share in 2024. The segment's growth is anticipated to be driven by the development surge and the number of product launches. Companies engage in partnerships to innovate and create novel platforms and instruments for multiomic research and analysis. For instance, in April 2025, Oxford Nanopore Technologies expanded its Compatible Products Programme (CPP) to enhance its multi-omics ecosystem. These advancements are expected to fuel the segment's expansion throughout the forecast period.

The service segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing demand for data analysis, integration, and interpretation services across genomics, proteomics, metabolomics, and transcriptomics. This demand is driven by the complexity of multi-omics datasets and the growing need for specialized bioinformatics and consulting expertise.

For instance, in April 2023, Bio-Techne and Lunaphore announced a strategic partnership to develop the first fully automated same-slide spatial multiomics solution. This collaboration integrates Bio-Techne’s RNAscope HiPlex technology with Lunaphore’s COMET system, enabling simultaneous detection of protein and RNA biomarkers at single-cell resolution. The solution aims to enhance translational and clinical research by providing a scalable, end-to-end workflow that combines protein and RNA analysis on a single tissue section, facilitating a comprehensive understanding of disease mechanisms.

Type Insights

The bulk multiomics segment accounted for the largest market revenue share in 2024. Typically, bulk multiomics is essential for systematically explaining disorder pathogenesis and different phenotypes at the individual level. The various advantages of bulk multiomics can be attributed to the segment's dominance. For instance, in November 2024, researchers published a study in npj Precision Oncology that employed single-cell spatial transcriptomics and bulk multi-omics to analyze the heterogeneity and ecosystems of hepatocellular carcinoma (HCC). These advantages include the simple experimental process and affordable large-scale sample dissection, further driving the market demand for multiomics.

The single-cell multiomics segment is expected to exhibit at the fastest CAGR of 17.84% during the forecast period. Single-cell multiomics technologies have transformed molecular cell biology by integrating various single-modality omics methods, including transcriptome, genome, epigenome, epigenome, epi transcriptome, proteome, and metabolome profiling. For instance, in April 2025, BioSkryb Genomics and Tecan introduced an advanced single-cell multiomics workflow that delivers sequencing-ready libraries in under ten hours. This integrated solution combines BioSkryb's ResolveOME Whole Genome and Transcriptome Single-Cell Core Kit in a 384-well format with Tecan's Uno Single Cell Dispenser, enabling scalable, high-resolution analysis of hundreds to thousands of individual cells. These approaches allow an extensive characterization of cell states and activities at the single-cell level, further boosting market growth.

Platform Insights

The genomics segment led the market with the largest revenue share of 40.63% in 2024. Several advanced products in the genomics industry have been developed. Moreover, companies are increasing their offerings in this segment, further propelling segment growth. For instance, in April 2025, a review published in Pediatric Research examined the role of genomics and multiomics in advancing precision medicine. The authors discussed how integrating genomics with other omics disciplines, such as transcriptomics, proteomics, epigenomics, metabolomics, and microbiomics, enhances understanding of complex gene-environment interactions. They highlighted the feasibility of this integrative approach, facilitated by advancements in bioinformatics, data sciences, and artificial intelligence, and its potential to improve health outcomes.

The metabolomics segment is expected to show at the fastest CAGR during the forecast period. Metabolomics contributes to understanding the underlying metabolic disruptions in diseases, identifying new therapeutic targets, and discovering biomarkers for disease diagnosis & therapeutic monitoring. For instance, in February 2025, a study published in BMC Medicine employed multi-omics integration of metabolomics and proteomics to identify early biomarkers for sepsis-associated acute kidney injury. Despite challenges in standardization and the evolving nature of metabolomic methods, it holds great promise for advancing the understanding of physiology, disease mechanisms, and responses to external factors, offering new opportunities for discovery & innovation in healthcare.

Application Insights

The oncology segment accounted for the largest market revenue share in 2024. The rising incidence of cancer and the growing use of multi-omics for cancer are anticipated to drive segment growth. Researchers and companies are undertaking numerous efforts to help cancer patients using multiomic approaches. For instance, in March 2025, a comprehensive multiomics study published in npj Precision Oncology investigated the molecular underpinnings of tumor budding (TB) in head and neck squamous cell carcinoma (HNSCC), providing valuable insights that could enhance targeted therapies and improve patient outcomes.

The neurology segment is expected to grow at the fastest CAGR of 15.70% over the forecast period, driven by the rising prevalence of neurological disorders, increased investments in neuroscience research, and the growing application of multiomics approaches to unravel complex neurobiological mechanisms and identify novel therapeutic targets.

End Use Insights

The academic & research institutes segment accounted for the largest market revenue share in 2024. Increasing studies and research are focusing on multiomics approaches, including genomics, proteomics, metabolomics, and transcriptomics. For instance, in November 2024, researchers at the Keck School of Medicine of USC introduced a novel framework integrating multi-omics data to advance precision environmental health. This approach aims to identify biomarkers of environment-related diseases, clarify underlying mechanisms, and pinpoint individuals at high risk. This innovative approach is driving segment growth by enabling the identification of biomarkers for environment-related diseases and helping to identify individuals at high risk for more personalized interventions.

The pharmaceutical & biotechnology companies’ segment is expected to show at the fastest CAGR during the forecast period. Pharmaceutical and biotechnology companies are engaged in large-scale omics sequencing projects by collaborating with community health systems and academic medical centers. For instance, in January 2023, Eurofins Scientific expanded its regional presence by entering the Indian pharmaceutical market by launching a new state-of-the-art facility in Hyderabad. The growing interest of pharmaceutical and biotechnology companies in multiomics is expected to drive the market.

Regional Insights

North America dominated the multiomics market with the largest revenue share of 48.76% in 2024. The presence of key players in the region supports its highest revenue share. Moreover, companies are undertaking numerous efforts to strengthen their presence, which is also fueling regional market growth. For instance, in May 2025, Pluto Bio secured USD 3.6 million in funding to enhance its AI-powered multi-omics platform for pharmaceutical applications. Pluto Bio's platform is already utilized by mid-market and enterprise clients across North America and Europe, integrating seamlessly into existing scientific workflows and further expanding the multiomics industry.

U.S Multiomics Market Trends

The multiomics market in the U.S. is highly competitive due to the growing demand for comprehensive biological insights fueled by advancements in omics technologies. This competition is intensified by active R&D efforts in academia and industry, with institutions and companies vying for funding and breakthrough discoveries. For instance, in February 2023, Tempus, the U.S.-based company, collaborated with Actuate Therapeutics to help discover and further validate biomarker profiles in cancer patients. Tempus uses the multiomics approach in this project to improve research and increase novel scientific insights. Such collaborations underscore the dynamic and innovative nature of the U.S. multiomics industry, positioning it for continued expansion and impact.

Europe Multiomics Market Trends

The multiomics market in Europe is expected to witness at a significant CAGR during the forecast period. Europe has a robust research infrastructure and a strong tradition of investing in scientific research. For instance, in May 2025, MGI Tech showcased its comprehensive multi-omics solutions at the European Society of Human Genetics (ESHG) conference in Milan. The company introduced the DNBelab C-YellowR 16, an automated high-throughput single-cell library preparation platform. These innovations aim to advance precision medicine by enabling detailed analysis of complex biological data. Government funding agencies, private institutions, and pharmaceutical companies allocate significant resources to support metagenomics research initiatives, accelerating the development of multiomics technologies and applications.

The UK multiomics market held a significant share in 2024. The UK government has committed to advancing genomics and multiomics research through funding initiatives, including Genome UK and the NHS Genomic Medicine Service. These initiatives aim to make genomic and multi-omics data more accessible for research and healthcare. For instance, in September 2024, the National Institutes of Health (NIH) awarded USD 27 million to establish the Genomics-enabled Learning Health System (gLHS) Network. The initiative will help develop partnerships with universities and allow undergraduate students to conduct genomic research. These factors are anticipated to support the growth of the UK market.

The multiomics market in Germany is anticipated to witness at a substantial CAGR during the forecast period, characterized by active participation from renowned academic institutions, biotech & pharmaceutical companies, and government funding for research projects. For instance, in July 2023, Centogene partnered with Lifera, owned by Saudi Arabia’s Public Investment Fund, to form a joint venture. This collaboration aims to expand access to advanced multiomic testing and build tailored bioinformatics and laboratory infrastructure across Saudi Arabia and the Gulf Cooperation Council (GCC), supporting regional precision medicine initiatives and Vision 2030 goals. Such international partnerships further fuel innovation and market expansion in the multiomics industry.

Asia Pacific Multiomics Market Trends

The multiomics market in Asia Pacific region is expected to grow at the fastest CAGR of 17.75% during the forecast period. This is driven by substantial advancements in metagenomics adoption across diverse applications in India and China. For instance, in October 2024, Singleton Biotechnologies partnered with Chennai-based Bioscreen Instruments Pvt. Ltd. to enhance researchers' access to single-cell multi-omics solutions in India. The region's emphasis on genomics and proteomics research and proactive initiatives from academic institutions to advance sequencing technologies create exceptional growth prospects throughout the forecast period.

The China multiomics market is expected to experience at a substantial CAGR over the forecast period, driven by prominent next-generation sequencing (NGS) centers such as BGI. Due to these advanced facilities, China holds a significant share of the global multiomics industry. Moreover, institutions like BGI have successfully integrated NGS platforms into various applications, including prenatal screening, oncology, idiopathic disorders, and infectious disease research. This further strengthens China’s position as a key player in the multiomics industry.

The multiomics market in Japan is expected to witness at a rapid CAGR over the forecast period. Healthcare and clinical research service providers in Japan have been progressively incorporating sequencing technologies over the past few years. They are projected to play a significant role in the Asia Pacific genomics revenue share. For instance, in April 2022, the Okinawa Institute of Science and Technology Graduate University (OIST), in collaboration with Tokyo-based Corundum Systems Biology Inc., introduced a research project to develop a complete automated system for disease prediction, highlighting Japan’s commitment to advancing multiomics-driven healthcare solutions.

MEA Multiomics Market Trends

The multiomics market in MEA is growing with the increasing adoption of advanced sequencing technologies and the growing demand for personalized medicine and disease diagnosis. One of the major trends in the MEA multiomics industry is the increasing focus on research and development activities by academic and research institutions. For instance, in April 2025, Abu Dhabi's Department of Health (DoH), the Abu Dhabi Investment Office (ADIO), and GSK announced a strategic partnership to establish a Multi-Omics Research Institute in Abu Dhabi. This collaboration aims to advance precision oncology research by integrating genomics, proteomics, and other omics disciplines, positioning the region as a key player in the global market.

The multiomics market in Kuwait is anticipated to grow at a significant CAGR during the forecast period, owing to various factors, such as increasing exports and a growing economy. With substantial developments in its healthcare infrastructure, the country is addressing the rising incidence of infectious diseases, chronic ailments, and lifestyle-related health issues. Moreover, government initiatives to boost scientific research and innovation in genetic diseases drive market growth.

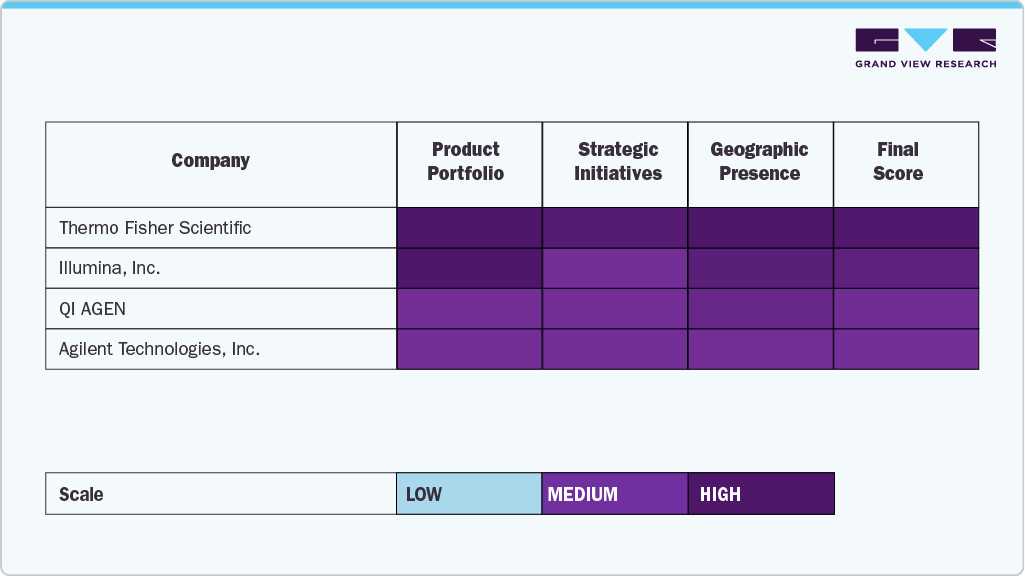

Key Multiomics Company Insight

The multiomics industry is defined by a competitive landscape dominated by key industry leaders who leverage robust product portfolios, strategic collaborations, and ongoing research and development investments. Prominent companies such as Thermo Fisher Scientific, Illumina, Danaher (Beckman Coulter), and QIAGEN maintain a strong market presence through comprehensive multiomics solutions, cutting-edge technologies, and extensive global distribution networks.

Leading organizations, including BD, PerkinElmer, Shimadzu Corporation, and Agilent Technologies, continue reinforcing their positions by offering integrated multiomics platforms that enable seamless genomics, proteomics, metabolomics, and other omics data analysis. These firms focus on advancing the precision, scalability, and automation of multiomics workflows to meet the increasing demand for holistic biological insights across research, clinical, and pharmaceutical applications.

Players like Bruker and BGI Genomics are expanding their influence in the multiomics industry through strategic investments, innovative product development, and collaborations with academic and industry partners. These companies emphasize enhanced sensitivity, data integration capabilities, and user-friendly software solutions to support systems biology and personalized medicine initiatives.

Companies like QIAGEN, Thermo Fisher Scientific, and Illumina drive growth by delivering end-to-end multiomics services, from sample preparation and sequencing to bioinformatics analysis. Their commitment to high-throughput capabilities and accurate data generation makes them indispensable partners in biomarker discovery, drug development, and clinical diagnostics.

The multiomics industry is experiencing rapid evolution fueled by the convergence of technological innovation and increasing demand for comprehensive biological data. Strategic mergers and acquisitions, collaborative research endeavors, and breakthrough platform advancements are intensifying competition. Companies that successfully combine technological excellence with accessible and cost-effective solutions will shape the future of multi-omics, enabling transformative insights into complex biological systems and advancing precision health worldwide.

Key Multiomics Companies:

The following are the leading companies in the multomics market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Thermo Fisher Scientific, Inc.

- Illumina, Inc

- Danaher (Beckman Coulter)

- PerkinElmer, Inc

- Shimadzu Corporation

- Bruker

- QIAGEN

- Agilent Technologies, Inc.

- BGI Genomics

Recent Developments

-

In June 2025, Bruker acquired Austria-based Biocrates, a leader in mass spectrometry-based quantitative metabolomics, to expand its capabilities in clinical and translational research across Europe and global markets. The acquisition strengthens Bruker's position in precision medicine, enhances its metabolomics portfolio, and supports biomarker discovery, diagnostics development, and systems biology research worldwide.

-

In May 2025, Illumina launched DRAGEN v4.4, enhancing clinical oncology and multiomics research capabilities. This update introduces advanced algorithms for improved variant detection and data analysis efficiency. It also supports expanded somatic and germline workflows, accelerates whole-genome processing, and enables greater accuracy in identifying low-frequency variants across diverse datasets.

Multiomics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.14 billion

Revenue forecast in 2033

USD 9.81 billion

Growth rate

CAGR of 15.33% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, type, platform, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Multiomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global multiomics market based on the product & service, type, platform, application, end use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Instruments

-

Consumables

-

Software

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-cell Multiomics

-

Bulk Multiomics

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Genomics

-

Transcriptomics

-

Proteomics

-

Metabolomics

-

Integrated Omics Platforms

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Biology

-

Oncology

-

Neurology

-

Immunology

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic and Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global multiomics market size was estimated at USD 2.72 billion in 2024 and is expected to reach USD 3.14 billion in 2025.

b. The global multiomics market is expected to grow at a compound annual growth rate of 15.33% from 2025 to 2033 to reach USD 9.81 billion by 2033.

b. North America dominated the multiomics market with a share of 48.76% in 2024. This is attributable to large number of service providers and end users within the region

b. Some key players operating in the multiomics market include BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI

b. Key factors that are driving the market growth include increasing advancements in omics technology and decreasing costs of omics technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.