- Home

- »

- Petrochemicals

- »

-

Naphtha Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Naphtha Market Size, Share & Trends Report]()

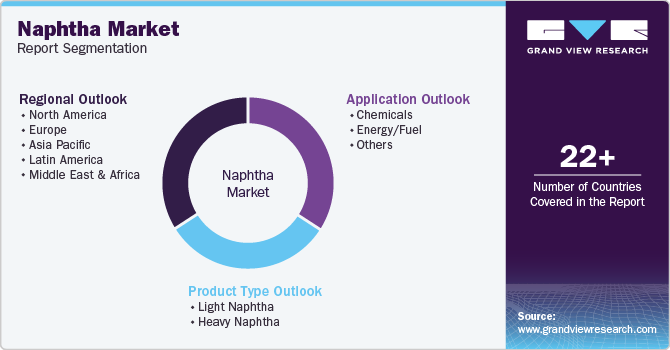

Naphtha Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Light Naphtha, Heavy Naphtha), By Application (Chemicals, Energy/Fuel), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: 978-1-68038-580-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Naphtha Market Summary

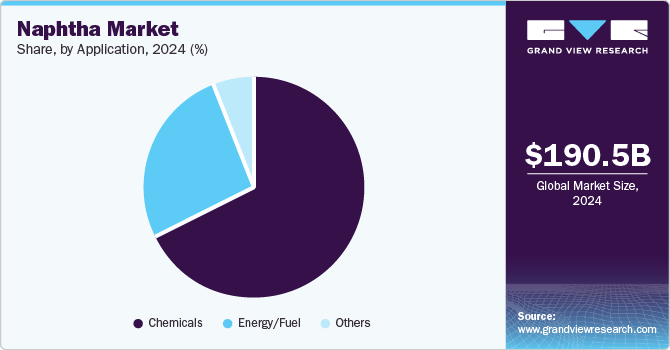

The global naphtha market size was valued at USD 190.55 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. Growing end use industries, development of new manufacturing processes, rise in the petrochemical industry, and expanding transportation sectors are the factors driving the naphtha market growth.

Key Market Trends & Insights

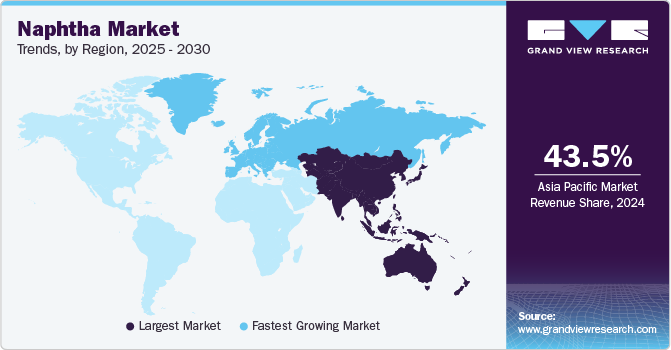

- Asia Pacific naphtha market dominated the global market with the largest revenue share of 43.5% in 2024.

- By product type, the light naphtha dominated the global naphtha market with the largest revenue share of 61.4% in 2024.

- By application, the chemicals segment led the market and accounted for the largest revenue share of 68.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 190.55 Billion

- 2030 Projected Market Size: USD 245.82 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

In addition, growing technological advancement in the refining process increases naphtha utilization. Moreover, the expanding transportation sector increases the need for gasoline, further driving the naphtha market demand.

The naphtha market is driven by innovations in refining technologies, which have improved the yield and quantity of naphtha, making it a more competitive feedstock for petrochemical production. The application of advanced technologies, such as steam cracking, has enabled the efficient conversion of naphtha into high-value olefins, such as ethylene, further boosting its competitiveness. The development of these technologies has driven performance, flexibility, and sustainability in naphtha usage, shaping the market’s evolution and growth.

In addition to its use as a petrochemical feedstock, naphtha serves as a solvent in various industries, including paint and coatings, commercial cleaning, and specialty chemical manufacturing. Its ability to dissolve large quantities of materials at a low cost makes it a preferred choice for many methods. The expanding production, automotive, and manufacturing sectors have led to regular calls for naphtha as a solvent, driving its demand. Ongoing research efforts to enhance its solvent properties are expected to further drive market growth.

The transportation sector is another significant driver of the naphtha market. As the transportation sector expands, there is increased demand for products that include plastics and artificial fibers, which are derived from naphtha. This extended demand for petrochemicals leads to higher consumption of naphtha as a feedstock, thereby boosting the naphtha market. Overall, the naphtha market is driven by the combination of technological advancements, expanding industrial applications, and growing demand from the transportation sector. These factors are expected to continue shaping the market growth and competitiveness in the future.

Product Type Insights

Light naphtha dominated the global naphtha market with the largest revenue share of 61.4% in 2024. Light naphtha is highly sought after in the petrochemical industry due to its high paraffin content, used to produce plastics and chemical compounds. The rising industrialization and urbanization in the economy drive demand for light naphtha as a feedstock and blending agent, fueling growth in the petrochemical and automotive industries.

The heavy naphtha segment is expected to grow at a CAGR of 4.3% over the forecast period. This growth is expected to be driven by technological advancements, increasing market demand, regulatory support, and cost reduction. Furthermore, continuous innovation has improved efficiency and effectiveness, while favorable policies from authorities promote the use of heavy naphtha, further driving market growth in the forecast period.

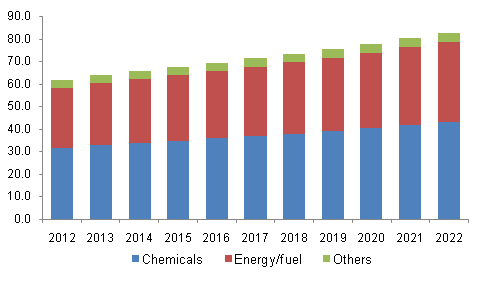

Application Insights

Chemicals led the market and accounted for the largest revenue share of 68.0% in 2024. Naphtha is primarily used to produce gas, ethylene, and propylene. The demand for chemicals, including paints and coatings, is driving growth in this segment. Moreover, the rising demand for chemicals and cleaning agents used in the automobile and production industries has also boosted the demand for naphtha-based products.

The energy/fuel segment is expected to register significant growth with a CAGR of 4.8% over the forecast period, driven by increasing demand from the automobile and construction industries, rising disposable income, and growing demand from chemical industries. Moreover, the expansion of power plants and fertilizer units contributes to market growth. As emerging economies develop industrially and economically, their energy consumption increases, with a corresponding rise in demand for naphtha-based fuels.

Regional Insights

Asia Pacific naphtha market dominated the global market with the largest revenue share of 43.5% in 2024. The market dominance can be attributed to factors such as rapid industrialization and urbanization, a rise in the automotive industry, and an increase in disposable income lead market growth. In addition, an increase in the plastic intake in the construction sector drives the naphtha market growth in Asia Pacific.

China Naphtha Market Trends

The naphtha market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024. This dominance can be attributed to the economic growth and development in industries leading to high demand for naphtha. In addition, the Chinese government has been implementing policies regarding investments in the petrochemical industries.

Europe Naphtha Market Trends

Europe naphtha market is expected to grow at the fastest CAGR of 4.3% over the forecast period. The growth of this region can be attributed to elements including strong demand for naphtha from the petrochemical industry, disposable income increase driving commercial activities, emphasis on cleaner fuels, deliver chain dynamics, and global market trends shaping the overall naphtha market growth.

The naphtha market in Germany led the European market and held a substantial market share in 2024, owing to the well-developed infrastructure and access to key market players that help in the export opportunities. Moreover, the regulation regarding environmental safety for cleaner fuels has driven the naphtha market in Germany.

North America Naphtha Market Trends

The North America naphtha market is expected to witness substantial growth over the forecast period. The region is experiencing a rise in gasoline intake, fueled by economic increase and enhanced business activity. In addition, North America drives the presence of distinguished marketplace players, fostering innovation, funding, and infrastructure improvement in the petrochemical sector.

The naphtha market in the U.S. dominated the North American market and held the largest revenue share in 2024, due to increasing petrochemical industries, increased demand for naphtha in the construction industry, and increased importance of naphtha in power plants, fertilizer units, and paint industries has driven the market growth.

Key Naphtha Company Insights

Some key companies in the naphtha market include Reliance Industries Limited; Exxon Mobil Corporation; Saudi Arabian Oil Co.; and others. The industry is characterized by intense competition among key players who focus on product innovation, strategic partnerships, and expansion to gain a larger market share.

-

Reliance Industries Limited is an Indian petrochemicals company, operating across various sectors including petrochemicals, with a significant presence in the industry.

-

Saudi Arabian oil Co. (Aramco) is a naphtha producer, supplying a significant portion of the global petrochemical feedstock. The company’s integrating upstream and downstream operations, including the Amiral complex, to capture more value across the hydrocarbon chain and strengthen its position in the petrochemical industry.

Key Naphtha Companies:

The following are the leading companies in the naphtha market. These companies collectively hold the largest market share and dictate industry trends.

- Reliance Industries Limited

- Exxon Mobil Corporation

- Saudi Arabian Oil Co.

- LG Chem

- Formosa Petrochemical Corporation

- Shell plc

- Indian Oil Corporation Ltd

- Asahi Kasei Corporation

- Petróleos Mexicanos

- JFE Chemical Corporation

Recent Developments

-

In February 2024, Saudi Aramco solidified its domestic supply chain ecosystem by securing 40 procurement agreements worth USD 6 billion with Saudi-based suppliers, supporting localization initiatives and aligning with the iktva program, which fosters economic growth and diversification in Saudi Arabia.

-

In December 2023, Coolbrook cracked naphtha in its large-scale pilot plant, validating its RotoDynamic Reactor Technology for electric steam cracking and reducing CO2 emissions by 300 million tons annually, solidifying its leadership in electric steam cracking and decarbonization.

-

In March 2023, ExxonMobil Corporation completed its USD 2 billion Beaumont refinery expansion, adding 250,000 barrels per day capacity to a Gulf Coast complex, equivalent to a medium-sized refinery, boosting energy product output and meeting growing demand.

Naphtha Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 198.43 billion

Revenue forecast in 2030

USD 245.82 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Million Metric Tons, Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa, and UAE.

Key companies profiled

Reliance Industries Limited; Exxon Mobil Corporation; Saudi Arabian Oil Co.; LG Chem; Formosa Petrochemical Corporation; Shell plc; Indian Oil Corporation Ltd; Asahi Kasei Corporation; Petróleos Mexicanos; JFE Chemical Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Naphtha Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global naphtha market report based on product type, application, and region:

-

Product Type Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Light Naphtha

-

Heavy Naphtha

-

-

Application Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

Chemicals

-

Energy/Fuel

-

Others

-

-

Regional Outlook (Volume, Million Metric Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.