- Home

- »

- Renewable Chemicals

- »

-

Natural Oil Polyols Market Size, Share Analysis Report, 2030GVR Report cover

![Natural Oil Polyols Market Size , Share & Trends Report]()

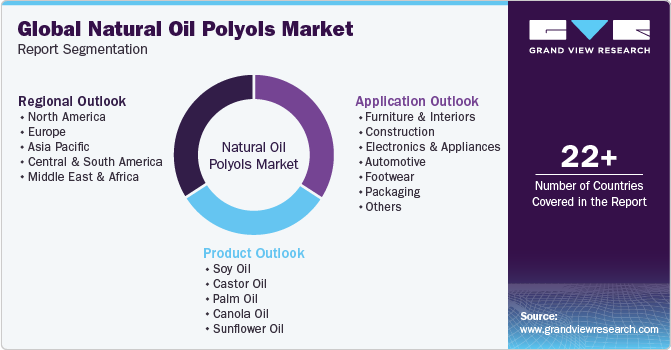

Natural Oil Polyols Market (2023 - 2030) Size , Share & Trends Analysis Report By Product (Soy oil, Castor oil, Palm oil, Canola oil, Sunflower oil, Others), By Application (Furniture and Interiors, Construction, Electronics & Appliances, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-296-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Oil Polyols Market Size & Trends

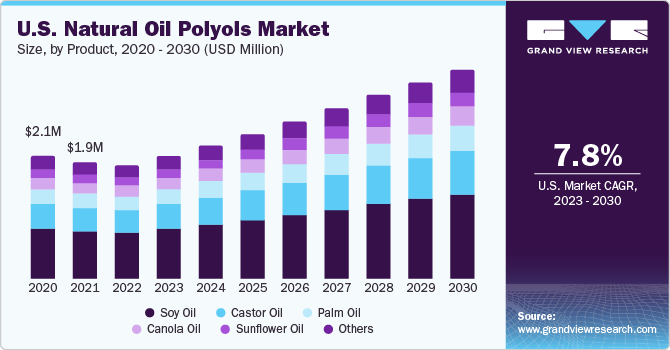

The global natural oil polyols market size was valued at USD 6.23 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. The market growth is attributed to the increasing demand for lightweight and highly durable products in industries including automotive, construction, and electronics, especially in emerging economies such as China, India, and Indonesia. The growth of the market is likely to be propelled by the increasing consumption of bio-based polyurethane foams in automotive, construction, electrical and electronics, and other sectors. Regulations to reduce vehicle weight to enhance fuel efficiency and reduce carbon emissions have propelled automotive OEMs to embrace the use of polyurethane foams obtained from natural oils polyol in different automotive components, such as seat covers and interiors.

The growing demand for environmentally friendly plastic products, coupled with volatile prices of key raw materials used for manufacturing conventional (petrochemicals-based) polyols, is expected to remain a key driving factor for the market. Major petrochemical-based polyol manufacturers such as Cargill Incorporated and BASF SE have shifted their focus towards manufacturing eco-friendly products in order to reduce reliance on conventional polyols, thus reducing the risks associated with its price volatility.

Increasing environmental concerns, coupled with the volatile prices associated with conventional polyurethane, have spurred the adoption of bio-based polyurethane globally. Favorable regulations for manufacturing bio-based products, coupled with stringent environmental sanctions on petrochemicals and synthetic polymers, are expected to have a positive impact on the bio-based polyurethane market growth.

The growing number of specialty retail shops, salons, spas, online sales platforms, and direct response television platforms, such as the home shopping channels and infomercials, has pushed the personal care product sales in the last few years and this is expected to continue over the forecast period. The growing preference for beauty and skin care products in Germany, India, the U.K., and France is expected to drive the demand for bio-based polyols over the forecast period.

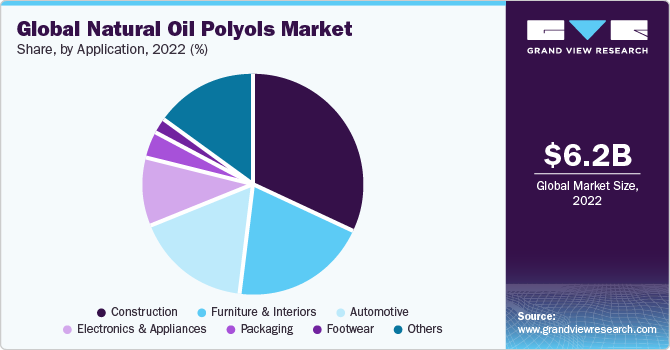

Application Insights

The construction segment dominated the market and held the market share of 31.8% in 2022. This is attributed to the growing use of polyurethanes in the construction of roofs and walls of buildings. The global construction industry is projected to witness rapid growth in the coming years with the U.S. construction market growing at a faster rate than the market in China. Increased construction activities worldwide are expected to create a surged demand for rigid polyurethane foams made from natural oil polyols in the coming years.

The furniture and interiors segment held the second-largest revenue share in 2022. Natural oil polyols are primarily used for manufacturing polyurethane products. Polyurethane, inflexible form is a popular material used for developing carpet underlays, bedding, and furniture. Flexible polyurethane foams produced from natural oil polyols are used in furniture to make them comfortable, durable, and reliable. They are also used as cushioning materials in upholstered furniture.

Product Insights

The soy oil segment accounted for the largest revenue share of 36.0% in 2022. The surging demand for soy oil polyols for use in food and animal feed is estimated to fuel the growth of this segment.

Castor oil is one of the commercially available products produced directly from oilseeds. It is used to manufacture a variety of polyurethane products such as foams and coatings. This oil is increasingly used for manufacturing polyurethane foams. Surging demand for high-purity natural oil polyols at low prices, coupled with the advancements in extraction technologies, has led to the development of castor oil polyols.

Palm oil is one of the most economical oil crops in the world. It is a readily available renewable and crucial bio-based polyol raw material suitable for the production of semi-rigid or rigid polyurethane foams, polyurethane adhesives and coatings, composites, and elastomers used in various industrial applications. Growing R&D expenditure for developing alternate vegetable polyol sources, along with increasing palm oil extraction for industrial purposes, is estimated to have a positive impact on the growth of the palm oil polyol segment over the forecast period.

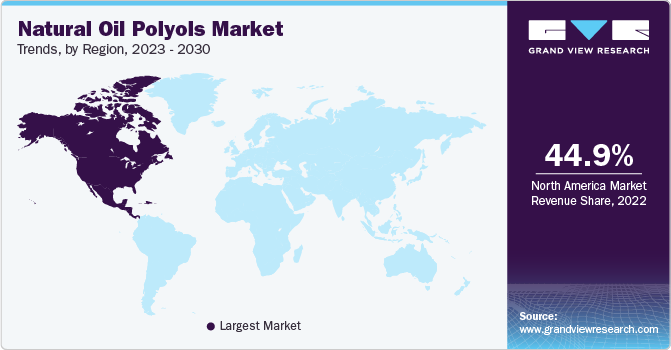

Regional Insights

North America dominated the market and held a market share of 44.9% in 2022. This is attributed to the increasing biofuel demand due to the rising energy costs associated with volatile petrochemical prices. The growing demand from the end-use industries such as construction, electrical and electronic appliances, and furniture and interiors across the region is also likely to favor the market growth.

Germany is one of the most prominent automotive markets in Europe. The country is a prominent producer of passenger cars among all the member countries of the European Union and accounts for the largest market share in the European automotive market. These factors are expected to contribute to the growth of the market over the forecast period.

The growing manufacturing sector in the region on account of cheap raw material costs, the availability of skilled labor, and low manufacturing costs are expected to drive natural oils polyol production in the region. Major overseas companies are expanding their production capabilities in the region on account of the above-stated factors. This trend is expected to further strengthen the production landscape of the regional market.

The growing utilization of soy-based, palm-based, and other oilseed-based polyurethane in appliances, along with the developments in the electronics industry, is creating a strong growth potential for the market in Central and South America. Saudi Arabia is one of the fastest-growing real estate and construction markets in the Gulf, which has increased the demand for oilseed-based polyurethane for applications such as tapes and adhesives, roofing, and flooring. Thus, the growing construction industry is expected to propel the demand for natural oil polyols over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive due to the presence of a large number of multinationals that are engaged in constant research & development activities. Global companies are also focusing on capacity expansions, signing partnership agreements with advanced biotechnology companies, and various other operational strategies to gain an edge in the competitive market space. For instance, companies such as Cargill Incorporated purchased Agrol, a product line of natural oil polyols, from BioBased Technologies LLC. These competitive strategies are likely to reflect higher rivalry in the coming years.

Key Natural Oil Polyols Companies:

- Cargill, Incorporated

- Basf SE

- Jayant Agro Organics Ltd.

- Stepan Company

- Elevance Renewable Sciences Inc.

- Biobased Technologies

- Emery Oleochemicals

- Mitsui Chemicals, Inc.

- Vertellus

Recent Developments

-

In November 2022, C16 Biosciences, Inc. announced its intentions to unveil a fermentation-based alternative to palm oil for both the personal care and food industries by 2024. The company is actively preparing to submit the formulation to the FDA for approval.

-

In March 2023, Perstorp Holding AB unveiled two novel polyol grades: Evyron T100 (trimethylolpropane) and Neeture N100 (neopentyl glycol). These polyols are exclusively derived from 100% renewable sources. Operating on a traceable mass-balance principle, these products are intricately crafted to curtail the carbon footprint across the entirety of the value chain, while actively contributing to the sourcing of renewable and recycled raw materials from sustainable sources. This expansion of the portfolio serves to further solidify the company's position as a foremost provider of chemicals with a minimal carbon footprint.

-

In September 2022, Ingevity completed the expansion of its manufacturing facility in DeRidder, Louisiana. This new facility significantly enhances the production of polyols by 40% while also reducing lead times. These improvements enable the company to serve its clients more efficiently and meet the escalating demand for the Capa range more effectively.

Natural Oil Polyols Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.75 billion

Revenue forecast in 2030

USD 11.40 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, Volume in Kilo Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Belgium; China; Japan; India; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cargill; Incorporated; Basf SE; Jayant Agro Organics Ltd.; Stepan Company; Elevance Renewable Sciences Inc.; Biobased Technologies; Emery Oleochemicals; Mitsui Chemicals, Inc.; Vertellus

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Oil Polyols Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural oil polyols market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

Soy Oil

-

Castor Oil

-

Palm Oil

-

Canola Oil

-

Sunflower Oil

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

Furniture and Interiors

-

Construction

-

Electronics & Appliances

-

Automotive

-

Footwear

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Belgium

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global natural oil polyols market size was estimated at USD 6.23 billion in 2022 and is expected to reach USD 6.76 billion in 2023.

b. The global natural oil polyols market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 11.40 billion by 2030.

b. North America dominated the natural oil polyols market with a share of 44.9% in 2022. This is attributable to several government initiatives promoting the production and consumption of bio-based materials including polyurethanes are expected to be the prime boosters of market growth in the U.S. and Canada.

b. Some key players operating in the natural oil polyols market include BASF SE, Cargill Incorporation, The Dow Chemical Company, IFS Chemicals Group, Emery Oleochemicals.

b. Key factors that are driving the natural oil polyols market growth include growing manufacturer focus towards the adoption of sustainable feedstock and towards the production of green polyurethane products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.