- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio-based Polyurethane Market Size & Share Report, 2030GVR Report cover

![Bio-based Polyurethane Market Size, Share & Trends Report]()

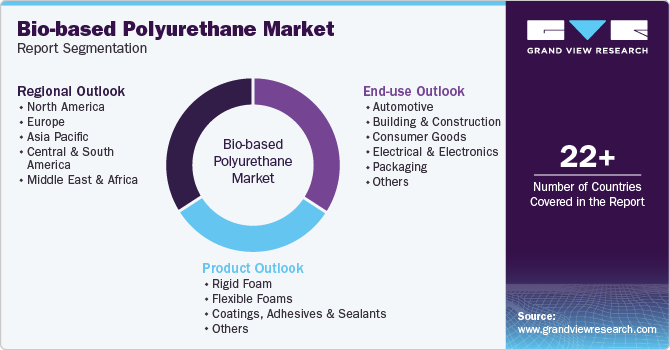

Bio-based Polyurethane Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rigid Foam, Flexible Foams), By End-use (Building & Construction, Packaging), By Region, And Segment Forecasts

- Report ID: 978-1-68038-306-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-based Polyurethane Market Summary

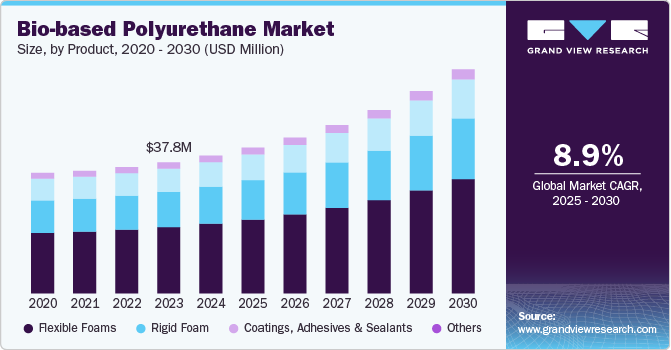

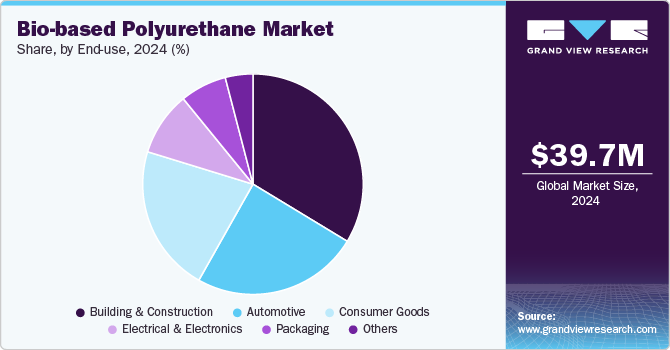

The global bio-based polyurethane market size was estimated at USD 39,694.98 thousand in 2024 and is projected to reach USD 64,596.15 thousand by 2030, growing at a CAGR of 8.99% from 2025 to 2030. The development of green buildings and the implementation of several sustainable construction initiatives are expected to augment the demand for polylactic acid over the forecast period.

Key Market Trends & Insights

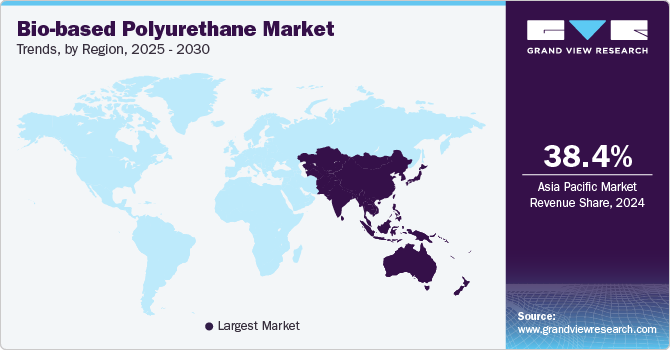

- The Asia Pacific bio-based polyurethane polymers market dominated with the largest global revenue share of 38.37% in 2024.

- By product, the flexible foam segment held the largest revenue share of 50.61% in 2024.

- By end use, the building & construction sector held the largest revenue share of 33.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39,694.98 Thousand

- 2030 Projected Market Size: USD 64,596.15 Thousand

- CAGR (2025-2030): 8.99%

- Asia Pacific: Largest market in 2024

Bio-based polyurethane coatings find application in the automotive industry. Properties such as abrasion resistance, scratch resistance, and durability are paving the demand for bio-based polyurethane coatings in the automotive industry. The increasing need to reduce dependency on foreign oil, and rising concern over CO2 emissions is propelling the demand for bio-based polyurethane among automobile manufacturers. The growth of the automotive industry on account of growing industrialization and increasing income levels is also expected to have a positive impact on the global market.

In recent years, there's been a significant increase in demand for sustainable and eco-friendly materials across various industries. Bio-based polyurethanes, derived from renewable sources like vegetable oils and agricultural waste, are attracting considerable interest as companies seek to lower their carbon footprint and reduce reliance on fossil fuels. This trend is reinforced by growing consumer awareness about environmental issues, alongside strict regulatory measures in regions such as Europe and North America aimed at limiting the use of petrochemical-based materials. Major end-use sectors, including automotive, construction, and packaging, are increasingly incorporating bio-based materials, including polyurethanes, to meet evolving green standards and enhance brand reputation in sustainable practices.

Drivers, Opportunities & Restraints

The regulatory landscape is a strong driver in the market, as governments worldwide implement policies to curb greenhouse gas emissions and promote renewable resources. The European Union, for example, has adopted strict guidelines under the Green Deal and the Circular Economy Action Plan, which prioritize bio-based and sustainable materials over traditional plastics. In North America, the U.S. Environmental Protection Agency (EPA) and state-level policies are similarly encouraging eco-friendly innovations, often incentivizing companies to adopt renewable solutions like bio-based polyurethane. These regulations push industries to shift towards bio-based materials, making bio-based polyurethane a preferred choice in applications where sustainable and compliant products are crucial.

As environmental awareness grows globally, emerging economies in Asia, South America, and Africa represent a substantial opportunity for bio-based polyurethane producers. Countries like China, India, and Brazil are adopting greener policies and focusing on reducing their environmental impact, creating a favorable environment for bio-based materials. The construction and automotive industries in these regions are expected to be high-growth areas, as manufacturers and developers seek to meet sustainable building certifications and energy-efficient product standards. Additionally, local governments are increasingly supporting bio-based industries through tax incentives and subsidies, making these markets ripe for bio-based polyurethane producers looking to establish or expand their international footprint.

A primary challenge in the market is the high cost of production compared to conventional polyurethane. Bio-based polyurethanes rely on specific agricultural inputs or plant-based oils, which are generally more expensive and may experience price volatility due to seasonal factors or supply chain disruptions. Additionally, the limited availability of sustainable feedstocks can hinder large-scale production, as the agricultural sector often competes for resources between food, fuel, and material production. This cost disparity makes it challenging for bio-based polyurethanes to achieve price parity with petroleum-based alternatives, limiting their adoption, particularly among cost-sensitive manufacturers.

Product Insights

The flexible foam sector dominated the end-use segment and accounted for the largest revenue share of over 50.61% in 2024, due to its broad usage as cushioning for consumer and commercial products, including carpet underlay, beds, furniture, automotive interiors, and packaging.

Bio-based polyurethane adhesives & sealants are primarily used to improve the flexibility and binding of products across various applications such as construction, footwear, windshield bonding, automotive interiors, and others. Growing demand for bio-based adhesives & coatings in construction, automotive, and footwear industries is expected to fuel their growth over the forecast period.

Bio-based polyurethane coatings are widely used in wood, construction, automotive, textile, and other applications to improve the durability and appearance of a product. Increasing demand from the above-mentioned end-use industries in China, India, Japan, and Brazil, is expected to create demand for PU coatings over the forecast period.

End-use Insights

The building & construction sector dominated the market and accounted for the largest revenue share of over 33.67% in 2024. Growing urbanization and industrialization, especially in emerging economies, such as China and India, coupled with rising infrastructure development activities in the Middle East is expected to fuel the growth of the construction industry, in turn, creating demand for bio-based polyurethane.

Packaging is one of the major end-users of bio-based polyurethane owing to the growing need for rigid bio-based plastic packaging for the food sector. Along with its shock-absorbing properties, bio-based polyurethane is ideal for storing and transporting things such as electronics, consumer goods, wines, and medical and healthcare products. Polyurethane's moisture resistance and thermal insulation properties aid in the preservation of perishable foodstuffs like seafood, fruits, and vegetables.

Bio-based polyurethane is also used in medical implants in various forms such as plates, rods, pins, screws, and anchors. This is expected to be a major advantage of bio-based polyurethane over other biocompatible polymers used in the medical industry. North America and Europe are expected to witness significant growth owing to the increasing penetration of bio-based polyurethane and rising demand for bio-based polymers in the medical industry.

Automotive is another major industry with a large market penetration increasing demand for bio-polyurethane in automobile parts such as automotive coatings, seat backs, armrests, seat cushions, head restraints, and others. Technological improvements and the growing popularity of electric vehicles have boosted the demand for recyclable and long-lasting items. A gradual increase in the number of electric vehicles on the road is predicted to drive the growth of the bio-based polyurethane market throughout the forecast period.

Regional Insights

The North Americabio-based polyurethane market is growing significantly. Corporate sustainability has become a key business focus, with companies in sectors like automotive, furniture, and packaging actively seeking renewable materials to meet their environmental targets. Leading brands are investing in bio-based solutions to align with sustainability goals, reduce greenhouse gas emissions, and appeal to a growing base of eco-conscious consumers. With major North American corporations like Ford and General Motors committing to carbon-neutral operations and sustainable supply chains, bio-based polyurethanes are gaining traction as they provide a viable alternative to fossil fuel-based products. The drive toward circular economies, where materials are reused and recycled, is also fostering a strong market for renewable, bio-based polyurethane in North America.

U.S. Bio-based Polyurethane Market Trends

In the U.S. bio-based polyurethane market demand is significantly driven by supportive federal and state-level policies aimed at reducing environmental impact. The U.S. Environmental Protection Agency (EPA) and individual states, like California and New York, are implementing strict regulations on carbon emissions and chemical usage, pushing companies to seek eco-friendly materials. Bio-based polyurethanes benefit from incentives such as tax breaks and grants under programs like the USDA’s BioPreferred Program, which promotes products derived from renewable sources. This government support, combined with a shift in public opinion towards green products, has positioned bio-based polyurethane as a highly favored material across industries ranging from consumer goods to automotive manufacturing.

Europe Bio-based Polyurethane Market Trends

Europe is a leader in promoting sustainable materials, with the European Union’s Green Deal and Circular Economy Action Plan driving robust demand for bio-based polyurethanes. The EU has set ambitious targets to reduce emissions and promote bio-based alternatives to traditional, petroleum-based materials, especially in sectors such as construction and automotive. With strict regulatory frameworks, including REACH and various waste reduction directives, manufacturers are highly motivated to adopt renewable and recyclable materials. Bio-based polyurethanes fit well within these objectives, providing a sustainable solution for applications like insulation, coatings, and adhesives. This regulatory support, along with rising public demand for green products, strongly drives bio-based polyurethane adoption in Europe.

Asia Pacific Bio-based Polyurethane Market Trends

The bio-based polyurethane polymers market in Asia Pacific dominated the global market and accounted for the largest revenue share of 38.37% in 2024, which is attributable to the rapid expansion in manufacturing and urbanization. Countries like India, Indonesia, and Vietnam are investing heavily in industrial growth, infrastructure, and construction, with sustainable materials gaining preference due to growing environmental regulations and increased awareness among consumers. As these economies urbanize, there is a strong push for eco-friendly materials in construction and automotive applications to meet sustainable urban development goals. Bio-based polyurethanes, known for their reduced environmental impact, are increasingly popular for insulation, interior furnishings, and automotive parts, as businesses prioritize sustainable solutions to appeal to both regulators and eco-conscious consumers.

China bio-based polyurethane market is aggressively pursuing green development initiatives as part of its national strategies to curb pollution and promote sustainable industrial practices. Government-led plans like "Made in China 2025" and the carbon neutrality goal by 2060 encourage industries to integrate renewable materials, making bio-based polyurethanes a strategic choice. With China’s automotive, electronics, and construction sectors under pressure to adopt sustainable materials, there is a growing emphasis on eco-friendly polymers that reduce environmental impact.

Key Bio-based Polyurethane Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies BASF SE, MCNS, RAMPF Holding GmbH & Co. KG, Covestro AG, Cargill, Incorporated, Huntsman International LLC, MCPU Polymer Engineering LLC, and WeylChem International GmbH. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Bio-based Polyurethane Companies:

The following are the leading companies in the bio-based polyurethane market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- MCNS

- RAMPF Holding GmbH & Co. KG

- Covestro AG

- Cargill, Incorporated

- Huntsman International LLC

- MCPU Polymer Engineering LLC

- WeylChem International GmbH

Recent Developments

-

In October 2024, Mitsubishi Chemical Group announced the adoption of a new plant-derived polyurethane raw material called BioPTMG for bio-synthetic applications. This innovative material aims to reduce reliance on fossil fuels and enhance environmental sustainability in various industries. The adoption of BioPTMG is expected to lead to more eco-friendly products, aligning with growing consumer demand for sustainable materials.

-

In September 2023, Covestro and Selena introduced a new line of bio-attributed polyurethane (PU) foams designed for thermal insulation. These foams are made using renewable raw materials, which helps reduce the carbon footprint associated with traditional PU foams. The collaboration aims to enhance sustainability in construction and building applications, aligning with the growing market demand for eco-friendly materials.

Bio-based Polyurethane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41,997.29 thousand

Revenue forecast in 2030

USD 64,596.15 thousand

Growth rate

CAGR of 8.99% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD thousand, volume in tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Malaysia; South Korea; Brazil; Argentina, Saudi Arabia; South Africa

Key companies profiled

BASF SE; MCNS; RAMPF Holding GmbH & Co. KG; Covestro AG; Cargill, Incorporated; Huntsman International LLC; MCPU Polymer Engineering LLC; WeylChem International GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-based Polyurethane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global bio-based polyurethane polymers market report based on the product, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Rigid Foam

-

Flexible Foams

-

Coatings, Adhesives & Sealants

-

Others

-

-

End-Use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Consumer Goods

-

Electrical & Electronics

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based polyurethane market size was estimated at USD 39.69 million in 2024 and is expected to reach USD 42.00 million in 2025.

b. The global bio-based PU market is expected to grow at a compound annual growth rate of 8.99% from 2025 to 2030 and it is expected to reach USD 64.60 million by 2030.

b. The flexible foam segment dominated the bio-based polyurethane market with a share of 50.61% in 2024. This is attributable to the rising demand for flexible foam in applications such as automotive seating, shoe soles, thermal insulations, and sports equipment.

b. Some key players operating in the bio-based polyurethane market include BASF SE , MCNS , RAMPF Holding GmbH & Co. KG, Covestro AG , Cargill, Incorporated, Huntsman International LLC, MCPU Polymer Engineering LLC, and WeylChem International GmbH.

b. Key factors that are driving the bio-based PU market growth include high demand for green buildings and increasing demand from the automotive industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.