- Home

- »

- Advanced Interior Materials

- »

-

Natural Zeolites Market Size & Share, Industry Report, 2030GVR Report cover

![Natural Zeolites Market Size, Share & Trends Report]()

Natural Zeolites Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Animal Feed, Pet Litter, Water Treatment, Agriculture & Soil Amendments, Building & Construction), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-2-68038-648-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Zeolites Market Summary

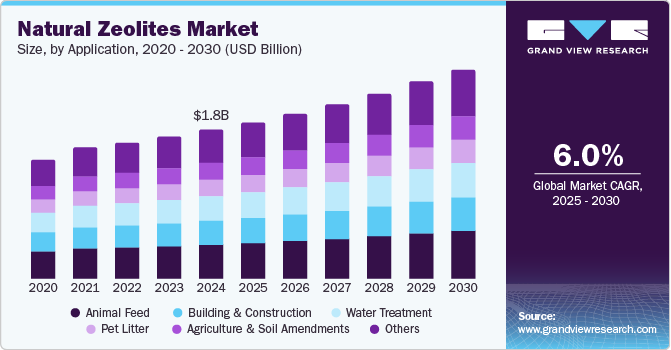

The global natural zeolites market size was valued at USD 1.77 billion in 2024 and is projected to reach USD 2.49 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The increasing demand for clean and safe water is driving the use of natural zeolites in water treatment processes.

Key Market Trends & Insights

- The U.S. natural zeolites market dominated North America with a significant revenue share in 2024

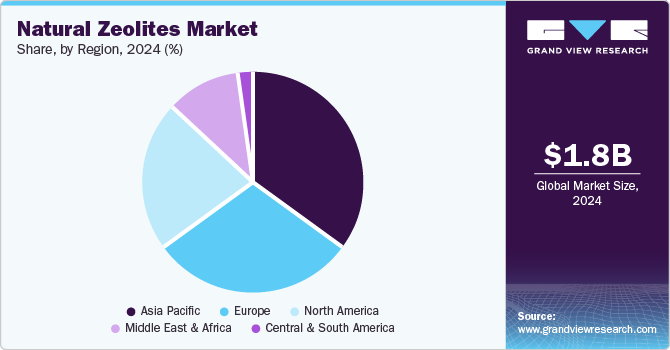

- Asia Pacific natural zeolites market held the highest revenue share of 34.6% in 2024.

- By application, the animal feed segment dominated the market and accounted for the largest revenue share of 23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.77 Billion

- 2030 Projected Market Size: USD 2.49 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

These zeolites are effective in wastewater purification, helping to remove contaminants such as heavy metals. They are also used as filters in industrial and residential applications, ensuring water quality. As water treatment needs grow, natural zeolites are being recognized for improving filtration efficiency and reducing environmental impact. This rising demand for safe water solutions is one of the key factors contributing to the growth of the natural zeolites industry.

The increasing focus on sustainable agricultural practices drives using natural zeolites in farming. These zeolites are utilized as soil conditioners to improve soil quality and enhance plant growth. They also help retain nutrients in the soil, reducing reliance on chemical fertilizers. In addition, natural zeolites are added to animal feed to promote better digestion and nutrient absorption. As the demand for eco-friendly and efficient farming methods grows, using natural zeolites is becoming more widespread. This trend is a significant driver of growth in the natural zeolites industry.

Due to their unique adsorption, ion exchange, and catalytic properties, natural zeolites are increasingly used in various industries, including petrochemical, automotive, and food processing. In the petrochemical industry, they are essential for refining and as catalysts in chemical reactions. Natural zeolites play a key role in emission control and air purification systems in the automotive sector. Food processing also benefits from these zeolites for improving product quality and safety. With such a wide range of applications across multiple industries, the demand for natural zeolites continues to rise. This growing usage is driving significant growth in the natural zeolites industry.

Application insights

The animal feed segment dominated the market and accounted for the largest revenue share of 23% in 2024, driven by the rising demand for high-quality animal nutrition. Natural zeolites are valued for their ability to improve feed efficiency and promote better digestion by providing essential minerals. The growing livestock industry, particularly in agricultural regions, has increased the use of zeolite-based feed additives. In addition, farmers awareness of the benefits of natural zeolites in animal feed is driving the segment's strong growth. This trend is contributing significantly to the expansion of the natural zeolites industry.

The water treatment segment is expected to grow at a CAGR of 6.4% over the forecast period, owing to the rising demand for effective water purification solutions. Natural zeolites are highly effective in removing contaminants such as heavy metals and ammonium from water due to their excellent ion-exchange properties. As concerns about water quality and environmental impact grow, more industries and municipalities turn to natural zeolites for sustainable water treatment options. In addition, increasing regulatory pressures to meet clean water standards are contributing to the demand for these solutions. This growing need for water treatment is fueling the expansion of the natural zeolites industry.

Regional Insights

North America natural zeolites market is expected to register a significant CAGR over the forecast period, which can be attributed to the region's growing awareness of sustainable agricultural practices and environmental management. The agricultural sector in North America is increasingly adopting natural zeolites as soil amendments and fertilizers due to their ability to enhance soil health and crop yields. Moreover, the presence of established industries that utilize natural zeolites in various applications, including construction and water treatment, provides a solid foundation for market growth in this region.

U.S. Natural Zeolites Market Trends

The U.S. natural zeolites market dominated North America with a significant revenue share in 2024 due to its extensive use across multiple sectors, such as agriculture, construction, and environmental remediation. The country’s advanced agricultural practices have led to a high demand for soil enhancers such as natural zeolites that improve nutrient retention and promote healthier crops. In addition, the U.S. market benefits from a robust construction industry that increasingly utilizes lightweight concrete materials incorporating natural zeolites, further bolstering revenue growth.

Europe Natural Zeolites Market Trends

Europe natural zeolites market held a substantial market share in 2024, driven by increasing applications in the agriculture and environmental sectors. The European Union's commitment to sustainable agriculture has prompted farmers to adopt natural zeolite products for their soil conditioning and crop yield enhancement benefits. Furthermore, stringent regulations regarding waste management and water treatment have led to higher adoption rates of natural zeolites in these applications across various European countries.

Asia Pacific Natural Zeolites Market Trends

Asia Pacific natural zeolites market held the highest revenue share of 34.6% in 2024, driven by rapid industrialization and urbanization in key countries such as China and India. The region's growing agricultural sector increasingly utilizes natural zeolites as soil amendments to improve crop productivity amid rising food demand. Moreover, significant investments in infrastructure development have led to increased usage of natural zeolites in construction applications, further contributing to the market's dominance.

The China natural zeolites market dominated the Asia Pacific, with a significant revenue share in 2024 due to its large-scale agricultural production and industrial activities. China's emphasis on improving agrarian output has spurred demand for natural zeolite products that enhance soil quality and nutrient retention. Moreover, rapid urbanization has increased investments in water treatment facilities utilizing natural zeolites for effective contaminant removal, supporting strong growth within this market segment.

Key Natural Zeolites Company Insights

Key companies in the global natural zeolites market are da-Ore; Imerys; KMI Zeolite Inc.; Maruti Mineral Industries, and NALCO India. These players adopt numerous strategies to improve their competitive edge. Strategic partnerships are formed to leverage complementary strengths, improve product offerings, and expand distribution networks. In addition, mergers and acquisitions enable companies to consolidate resources, enter new markets, and diversify their product lines. Furthermore, new product launches focus on innovation and meeting evolving consumer preferences, allowing companies to capture market share and respond effectively to pet nutrition and health trends.

-

Ida-Ore provides various natural zeolite products for multiple industrial applications, including pelletized zeolite for odor control and filtration, granular zeolite for soil stabilization and chemical processes, and powdered zeolite for agriculture and animal feed. It also offers zeolites for water treatment, using ion-exchange properties to remove contaminants. These products support agriculture, water treatment, construction, and environmental management, highlighting the versatility of natural zeolites.

-

Imerys offers a range of natural zeolite products, focusing on wastewater treatment, agriculture, and pet care. Its ImerPure Z range is designed for ammonia removal in wastewater treatment, while ImerFert Z enhances soil quality and nutrient availability in agriculture. In addition, the company provides non-clumping cat litter made from natural zeolite, which effectively controls odors by adsorbing ammonia ions.

Key Natural Zeolites Companies:

The following are the leading companies in the natural zeolites market. These companies collectively hold the largest market share and dictate industry trends.

- Ida-Ore

- Imerys

- KMI Zeolite Inc.

- Maruti Mineral Industries

- NALCO India

- ROTA MINING CORPORATION

- St. Cloud Mining

- United States Antimony Corporation

- ZEOCEM s.r.o.

- Zeotech Corporation

Recent Developments

-

In August 2024,United States Antimony Corporation announced the acquisition of new mining claims in Montana to enhance its resource base and increase production capabilities in antimony. This acquisition supports the company's growth strategy by providing opportunities for exploration and development, ensuring a stable supply of antimony for its customers. The company expects these new claims to impact its performance positively in the coming years.

-

In September 2023,Imerys partnered with VINCI Construction to come into being with sustainable construction solutions, focusing on low-carbon concrete using metakaolin produced by the company. This collaboration supports the construction of the Nantes University Hospital, France's first large-scale low-carbon building, by replacing traditional Portland cement with mineral-based alternatives.

Natural Zeolites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.86 billion

Revenue forecast in 2030

USD 2.49 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, form, region

Regional scope

North America, Asia Pacific, Europe, Central & South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, Spain, UK, Italy, China, India, Japan, Brazil, GCC.

Key companies profiled

Ida-Ore; Imerys; KMI Zeolite Inc.; Maruti Mineral Industries; NALCO India; ROTA MINING CORPORATION; St. Cloud Mining; United States Antimony Corporation; ZEOCEM s.r.o.; Zeotech Corporation.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Zeolites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the natural zeolites market report based on application, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Animal Feed

-

Pet Litter

-

Water Treatment

-

Agriculture and Soil Amendments

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Spain

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

GCC

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.