- Home

- »

- Consumer F&B

- »

-

Nectars Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Nectars Market Size, Share & Trends Report]()

Nectars Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Not From Concentrate, From Concentrate), By Category (Private Label, Branded), By Packaging (Carton, Glass), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-454-3

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nectars Market Size & Trends

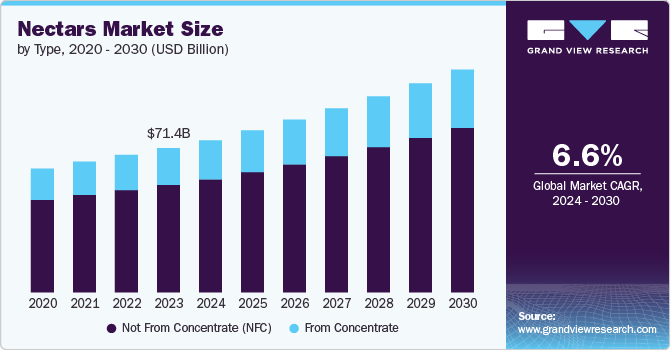

The global nectars market size was estimated at USD 71.39 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The rise in health consciousness among consumers is a significant trend. Increasing awareness of the health benefits associated with consuming natural, nutrient-rich juices is boosting demand. The rise of functional beverages, which offer additional health benefits, has led to a surge in demand for nectars products enriched with vitamins, minerals, and probiotics. Consumers are increasingly looking for juices that boost immunity, enhance digestion, and provide energy.

With a growing emphasis on sustainability, consumers are increasingly favoring products that incorporate eco-friendly practices. Brands that highlight sustainably sourced ingredients and environmentally conscious packaging are seeing higher customer loyalty. Manufacturers are also exploring new flavor profiles and combinations, moving beyond traditional nectars and juices to include exotic fruit blends and superfoods. This innovation appeals to diverse tastes and encourages consumers to try new products.

Consumers are shifting away from carbonated and sugary drinks in favor of healthier, natural alternatives. The perception of nectars as a premium, healthful component of a balanced diet enhances their appeal. Younger generations, who are particularly health-conscious, are driving this trend with their preference for clean-label products that are free from artificial ingredients.

Leading juice manufacturers are diversifying their product lines to include functional juices, organic options, and blends with superfoods like turmeric and ginger. This expansion aligns with evolving consumer preferences for organic, non-GMO, and additive-free products.

Wellness centers globally are promoting healthier diets for physical and mental well-being, with detoxification becoming a notable trend. Fruit juices are integral to detox programs, aiding in both cleansing and weight loss. In response, juice manufacturers are introducing products tailored for detoxification.

Veganism is also on the rise, with many consumers adopting vegan diets worldwide. Juice products that fit within a vegan lifestyle, offering essential vitamins and minerals, are in increasing demand. Companies are responding by launching a variety of flavors and innovative packaging to attract health-conscious consumers.

The market is set for sustained growth, driven by innovations in product formulations, campaigns, and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Many manufacturers are transitioning to recyclable, biodegradable, or compostable packaging to reduce environmental impact. Companies are focusing on sourcing fruits and ingredients from sustainable and certified farms to appeal to environmentally conscious consumers. To capture diverse consumer tastes, manufacturers are experimenting with exotic fruit combinations and superfoods like turmeric, ginger, and acai.

Type Insights

Based on type, not from concentrate (NFC) segment led the market with the largest revenue share of 74.25% in 2023. NFC nectars are made from fresh fruit juice without undergoing the concentration process. This preserves the natural flavor, aroma, and nutritional profile of the fruit, which consumers often perceive as higher quality compared to concentrated options. These align with the growing demand for natural and minimally processed foods. They are free from additives and preservatives commonly found in concentrated products, making them more attractive to health-conscious consumers.

From concentrate segment is expected to grow at the fastest CAGR of 6.9% from 2024 to 2030. Producing nectars from concentrate is generally more cost-effective compared to NFC options. Concentrating fruit juice reduces transportation costs and extends shelf life, which translates to lower production costs and pricing benefits for consumers. Concentrated juices have a longer shelf life due to reduced water content, making them easier to store and transport. This characteristic helps in reaching more markets and retail channels, including those in remote or less accessible areas. Manufacturers can tailor FC nectars to meet the specific tastes and preferences of different regions or demographics, enhancing their appeal and market reach.

Category Insights

Based on category, the branded segment led the market with the largest revenue share of 59.25% in 2023. Consumers frequently prefer well-known brands, especially for products like nectars that are linked to health and wellness. Established brands have earned a reputation for quality, consistency, and safety, fostering strong consumer loyalty. This trust in reputable brands leads to increased sales and a larger market share. Leading juice brands invest significantly in marketing and advertising campaigns that highlight the purity, health benefits, and exceptional taste of their products. These initiatives enhance brand recognition and reinforce the perceived value of branded nectars, drawing in a substantial consumer following.

The private label segment is expected to grow at the fastest CAGR of 7.2% from 2024 to 2030. The perception of private-label products has significantly improved over the years. Many retailers have invested in enhancing the quality of their private label offerings, ensuring they meet or even exceed the standards of branded products. This shift has led to increased consumer trust and acceptance of private-label nectars. Retailers are increasingly promoting their private label products, giving them prominent shelf space and visibility. With the rise of supermarket chains and e-commerce platforms, private-label nectars are becoming more widely available, making it easier for consumers to choose them over branded options.

Packaging Insights

Based on packaging, the carton segment led the market with the largest revenue share of 55.37% in 2023. Carton packaging is widely preferred by consumers for its convenience, ease of use, and portability. It is easy to store, pour, and reseal, making it an ideal choice for both home use and on-the-go consumption. This broad consumer appeal contributes to its dominant market share. They are less expensive to produce and transport compared to other packaging materials like glass. This cost efficiency allows juice producers to offer their products at competitive prices, which attracts more consumers and drives higher sales volumes.

The glass segment is expected to grow at the fastest CAGR of 7.1% from 2024 to 2030. Glass packaging is often associated with premium quality and freshness. Consumers perceive products in glass bottles as more natural and less processed compared to those in plastic or other materials. Moreover, it is non-reactive and does not leach chemicals into the product, unlike some plastics. This makes it a preferred choice for health-conscious consumers who are concerned about the potential effects of packaging materials on their food and beverages. As sustainability becomes increasingly important to consumers, the eco-friendly nature of glass packaging aligns with the growing demand for environmentally responsible choices.

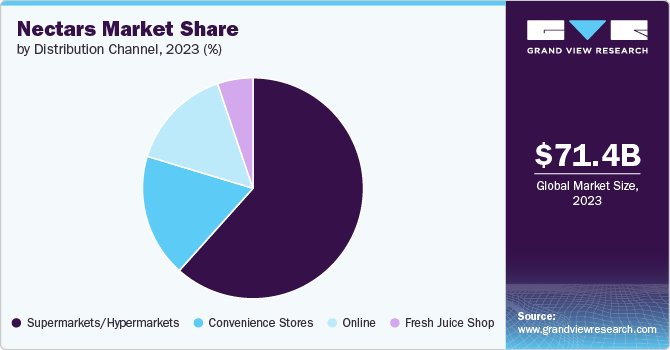

Distribution Channel Insights

Based on distribution channel, the supermarkets/hypermarkets segment led the market with the largest revenue share of 61.62% in 2023. These retail formats offer a one-stop shopping experience, where consumers can purchase all their grocery needs, including nectars, in a single trip. The convenience of picking up different juice products along with other household essentials boosts sales through these channels. Supermarkets and hypermarkets typically offer an extensive range of nectars products, including various brands, flavors, and packaging sizes. This vast selection attracts a broad customer base, allowing consumers to find exactly what they are looking for, which drives higher sales volumes.

The online segment is expected to grow at the fastest CAGR of 7.5% from 2024 to 2030. Juice manufacturers are increasingly investing in direct-to-consumer (D2C) online channels, bypassing traditional retail intermediaries. This approach allows brands to build stronger relationships with consumers, offer customized products, and collect valuable data on consumer preferences, all of which drive sales growth. Moreover, online platforms often utilize algorithms to provide personalized recommendations based on a consumer’s past purchases and preferences. This personalization encourages repeat purchases and increases the likelihood of trying new products, driving higher sales in the online segment.

Regional Insights

North America dominated the nectars market with the largest revenue share of 39.07% in 2023. The market is experiencing steady growth, driven by increasing consumer demand for healthier beverage options and a growing preference for natural and minimally processed products. North American consumers are increasingly prioritizing health and wellness, leading to higher consumption of nectars that are perceived as healthier alternatives to sugary drinks and carbonated beverages. Manufacturers are innovating with diverse flavor profiles and exotic fruit combinations to cater to varying consumer tastes. This includes blends featuring superfoods and functional ingredients.

U.S. Nectars Market Trends

The nectars market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030. The U.S. market is experiencing robust growth, fueled by increasing consumer awareness of its health benefits, the rise of wellness trends, and a growing preference for natural and healthy beverages. The preference for clean label products is rising, and nectars, made from roasted barley grains without additives, fits this trend perfectly. Established juice and beverage brands dominate the market, leveraging their strong brand recognition and extensive distribution networks.

Europe Nectars Market Trends

The nectars market in Europe is expected to grow at the fastest CAGR of 6.6% from 2024 to 2030. European consumers are increasingly prioritizing health and wellness, leading to a strong preference for natural, clean-label products. Nectars, with no added sugars, preservatives, or artificial ingredients, aligns well with this trend. There is a strong preference for nectars with clean labels, meaning they are free from artificial additives and preservatives. This aligns with the broader European trend towards transparency in food and beverage labeling. European manufacturers are innovating with exotic fruit blends and functional ingredients. This includes adding superfoods like acai, chia, or turmeric to cater to health-conscious consumers.

Asia Pacific Nectars Market Trends

The nectars market in Asia Pacific is expected to witness at a significant CAGR of 7.4% from 2024 to 2030. There is an increasing preference for healthier beverage options as consumers move away from sugary and carbonated drinks. Nectars are seen as a healthier alternative due to their natural fruit content and perceived health benefits. The Asia Pacific market is seeing innovation in flavor profiles, with manufacturers introducing exotic and tropical fruit blends that cater to regional tastes and preferences. Ingredients such as dragon fruit, mangosteen, and lychee are popular. Nectars that promote detoxification or have specific health benefits are gaining traction. Products that support digestion, weight management, and overall wellness are in demand.

Key Nectars Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the global market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace nectars.

Key Nectars Companies:

The following are the leading companies in the nectars market. These companies collectively hold the largest market share and dictate industry trends.

- Del Monte Foods, Inc.

- Suntory Beverage & Food

- The Hain Celestial Group, Inc.

- Ocean Spray Cranberries, Inc.

- Welch Foods Inc.

- Juice Master Ltd.

- SUJA LIFE, LLC

- 7-ELEVEN, Inc.

- Greenhouse Juice Co.

- Pulp & Press Juice Co.

Recent Developments

-

In June 2024, RFG expanded its product offerings by entering the fruit nectar juice market, building on the success of the Rhodes brand in the 100% fruit juice market.

-

The newly introduced Rhodes fruit nectar juice line is available in three pack sizes: 200ml, 1 liter, and 2 liters. Consumers can enjoy five enticing flavors: guava, tropical, apple, Mediterranean, and red grape

-

In June 2023, PepsiCo teamed up with Transmed Ghana Limited to launch the new Ceres Nectar line of juices. This innovative range complements the selection of juices already available in the market. Ceres Nectar comes in five delicious flavors, offered in convenient one-litre and 200ml packaging. Among the standout varieties are Tropical Blast, Mango Orange, and Multifruit Fusion, which combines the delightful tastes of bananas, pineapples, apples, oranges, peaches, and strawberries

Nectars Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 76.08 billion

Revenue forecast in 2030

USD 111.43 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, category, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India;Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Del Monte Foods, Inc.; Suntory Beverage & Food; The Hain Celestial Group, Inc.; Ocean Spray Cranberries, Inc.; Welch Foods Inc.; Juice Master Ltd.; SUJA LIFE, LLC; 7-ELEVEN, Inc.; Greenhouse Juice Co.; Pulp & Press Juice Co.

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Nectars Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nectars market report based on type, category, packaging, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Not From Concentrate

-

From Concentrate

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Label

-

Branded

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Carton

-

Plastic

-

Glass

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Fresh Juice Shop

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nectars market is expected to grow at a compounded growth rate of 6.6% from 2024 to 2030 to reach USD 111.43 billion by 2030.

b. The Not from Concentrate (NFC) segment dominated the nectar market with a share of 74.25% in 2023. NFC nectars are made from fresh fruit juice without undergoing the concentration process. This preserves the natural flavor, aroma, and nutritional profile of the fruit, which consumers often perceive as higher quality compared to concentrated options.

b. Some key players operating in the nectars market include Del Monte Foods, Inc.; Suntory Beverage & Food; The Hain Celestial Group, Inc.; Ocean Spray Cranberries, Inc.; Welch Foods Inc.; and Juice Master Ltd.

b. Key factors that are driving the market growth include the Increasing awareness of the health benefits associated with consuming natural, nutrient-rich juices. Manufacturers are also exploring new flavor profiles and combinations, moving beyond traditional nectars and juices to include exotic fruit blends and superfoods.

b. The global nectars market size was estimated at USD 71.39 billion in 2023 and is expected to reach USD 76.08 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.