- Home

- »

- Plastics, Polymers & Resins

- »

-

Neoprene Market Size And Share, Industry Report, 2030GVR Report cover

![Neoprene Market Size, Share & Trends Report]()

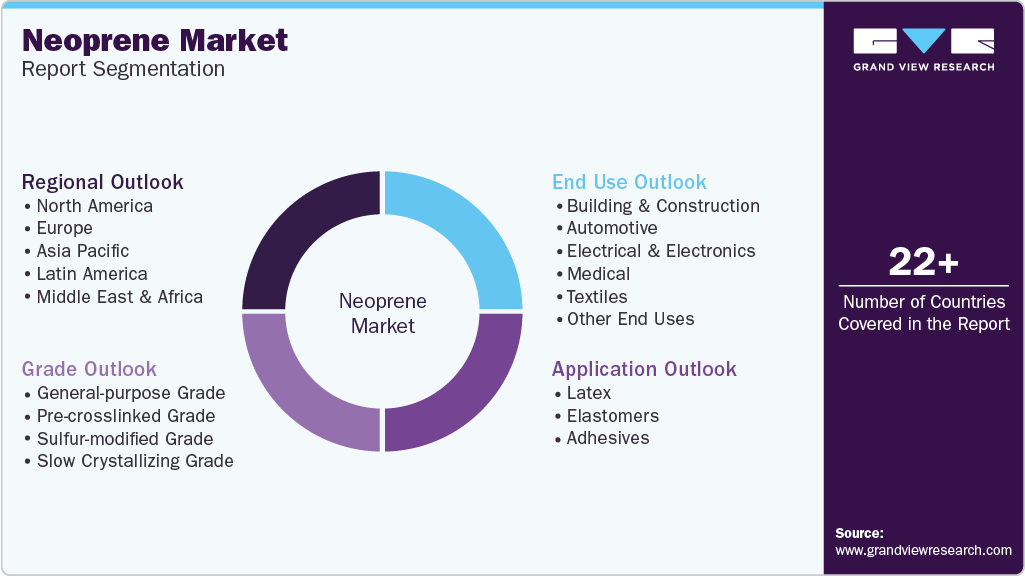

Neoprene Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (General-purpose Grade, Pre-crosslinked Grade, Sulfur-modified Grade, Slow Crystallizing Grade), By Application (Latex, Elastomers, Adhesives), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-594-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Neoprene Market Size & Trends

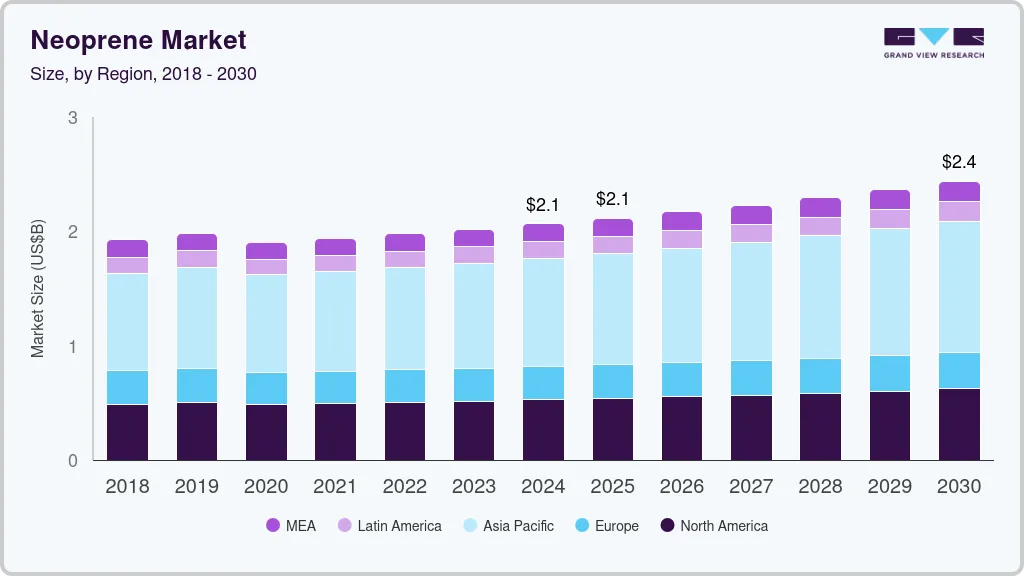

The global neoprene market size was estimated at USD 2,066.7 million in 2024 and is expected to grow at a CAGR of 2.9% from 2025 to 2030. Rising demand for protective gear and wetsuits in the sports and defense sectors is driving neoprene consumption.

Key Highlights:

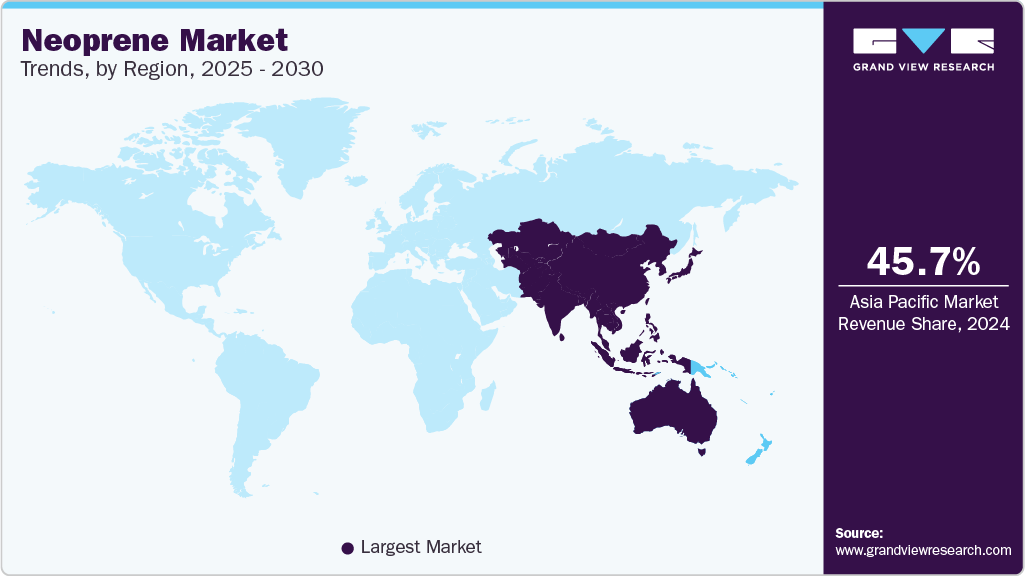

- Asia Pacific dominated the global neoprene market and accounted for the largest revenue share of 45.74% in 2024

- China neoprene market is expected to witness growth during the forecast period

- By grade, the pre-crosslinked grade segment is anticipated to grow at a significant CAGR of 3.53% through the forecast period

- By application, the elastomers dominated the neoprene industry with a revenue share of 44.89% in 2024

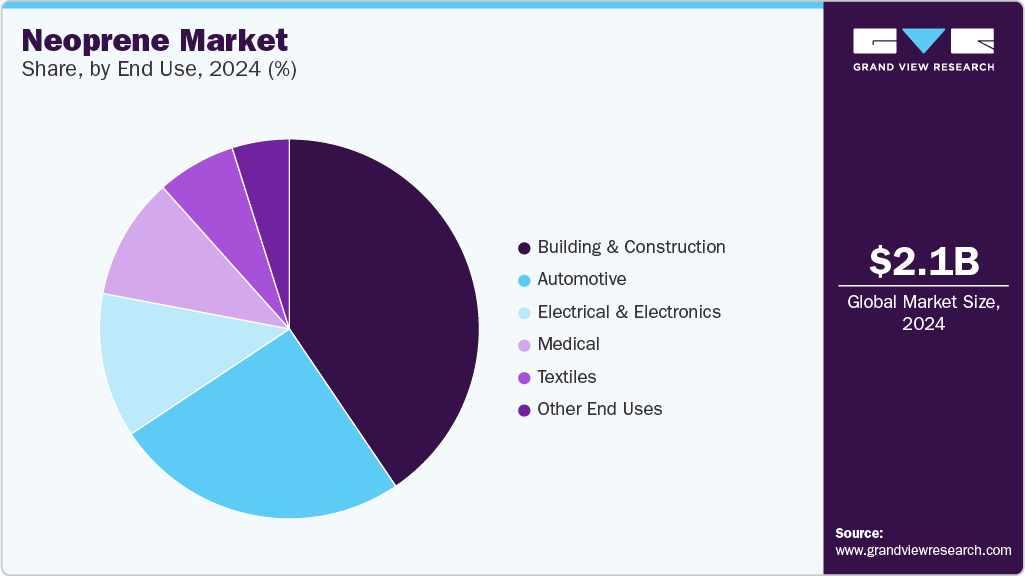

- By end use, the building and construction dominated the neoprene market and accounted for a revenue share of 40.54% in 2024

Its flexibility and water resistance make it ideal for use in diving suits, gloves, and military-grade equipment. A prominent trend in the neoprene industry is the pivot toward sustainable and bio-based alternatives to petroleum-derived raw materials. With rising ESG compliance mandates and end user preference for greener solutions, manufacturers are increasingly investing in renewable feedstocks like bio-butadiene. Concurrently, firms are optimizing energy efficiency across production cycles, enhancing both environmental performance and operational economics. This shift is redefining competitive dynamics in the industry, influencing procurement strategies and R&D direction.

Drivers, Opportunities & Restraints

The surge in demand for high-performance elastomers across automotive, electrical, and construction applications is a key growth catalyst for the neoprene market. Neoprene's superior resistance to oil, heat, weathering, and mechanical stress makes it indispensable for automotive belts, gaskets, and insulation components. As OEMs and infrastructure developers worldwide seek durable and versatile synthetic rubbers, neoprene’s functional versatility positions it as a core material supporting both industrial innovation and lifecycle performance.

Rapid industrialization in emerging economies presents a substantial opportunity for neoprene manufacturers to expand their market footprint. Countries in Southeast Asia, Latin America, and Africa are investing heavily in transportation, manufacturing hubs, and power infrastructure-verticals where neoprene’s technical properties deliver high value. Additionally, the growing penetration of e-mobility and renewable energy sectors offers new application areas, particularly in battery insulation, vibration dampening, and sealing systems.

Volatility in raw material prices, particularly butadiene and chloroprene, poses a critical restraint on the neoprene industry’s stability. Supply chain disruptions, geopolitical uncertainties, and the limited availability of feedstock due to environmental regulations have increased procurement risks. These cost fluctuations not only compress margins but also create long-term pricing unpredictability, forcing manufacturers to reassess supply strategies and hedge against input cost pressures.

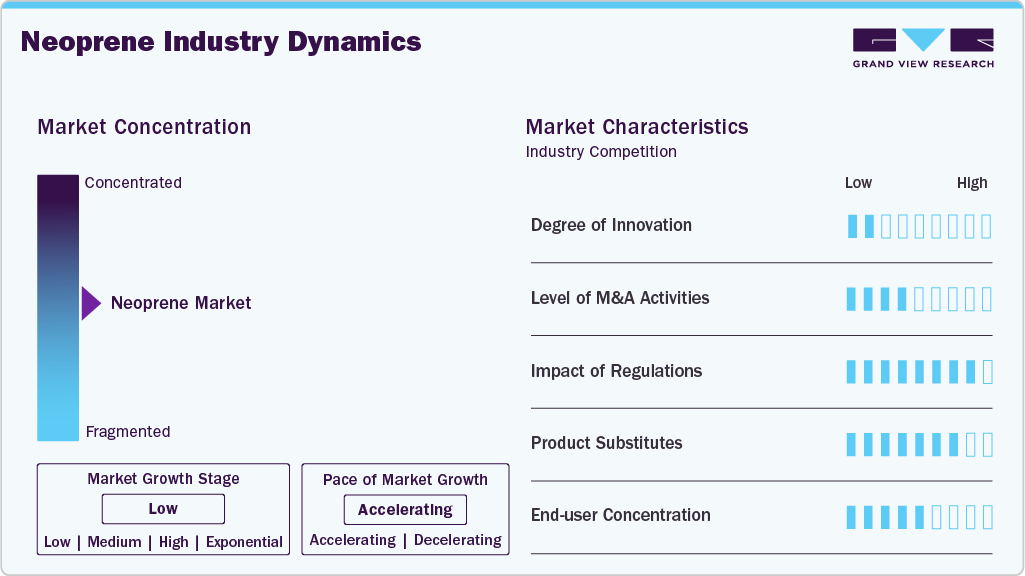

Market Concentration & Characteristics

The growth stage of the neoprene market is low, and the pace of growth is accelerating. The market exhibits a significant level of concentration, with key players dominating the landscape. Major companies like Denka Company Limited; Guangzhou Huaxing Sports Goods Co. Ltd.; Macro Products, Inc.; ARIAPRENE (Tiong Liong Industrial Co., Ltd); Neoprene Craft Hub; and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

Manufacturers are increasingly evaluating alternative elastomers such as nitrile rubber for superior oil and fuel resistance, EPDM for enhanced weather and ozone durability, and silicone where extreme temperature performance is paramount Thermoplastic elastomers (TPEs) are also gaining ground by offering recyclability and faster cycle times in injection molding, while polyurethane delivers higher tensile strength in load-bearing applications. This broadening competitive set is prompting neoprene producers to sharpen value propositions around cost, performance consistency, and supply reliability.

Stringent air-emissions standards under the U.S. Clean Air Act, most notably the April 9, 2024 EPA rule mandating about 80% reduction in chloroprene emissions within 90 days and two-year deadlines for other hazardous pollutants, are reshaping operational cost structures and compliance strategies across the neoprene value chain. Simultaneously, EU REACH classifications of chloroprene as a Category 1B carcinogen are driving capital investments into abatement technologies and fostering legal challenges, as exemplified by Denka’s appeal over accelerated timelines. Together, these regulatory actions are creating both headwinds in feedstock sourcing and opportunities for differentiated, low-emission production.

Grade Insights

General-purpose grade dominated the neoprene market across the grade segmentation in terms of revenue, accounting for a market share of 49.78% in 2024, due to its widespread utility across diverse low-to-moderate performance applications, particularly in automotive and consumer goods manufacturing. OEMs are increasingly turning to this grade for parts like seals, hoses, and shock absorbers, driven by cost-efficiency and ease of processing. Additionally, the rise in retrofitting activities and aftermarket demand for replacement parts is reinforcing volume growth across mature markets.

The pre-crosslinked grade segment is anticipated to grow at a significant CAGR of 3.53% through the forecast period, driven by their growing adoption in extrusion and injection molding processes, where consistency and dimensional stability are critical. With industries such as wire & cable insulation and precision gaskets requiring minimal post-curing and improved flow properties, manufacturers are favoring pre-crosslinked grades to enhance throughput and reduce production cycle times. The segment is gaining strategic relevance in high-automation environments.

Application Insights

The elastomers dominated the neoprene industry with a revenue share of 44.89% in 2024. The segment is benefiting from a marked increase in demand for high-resilience materials in electric vehicles (EVs), particularly for components exposed to heat, chemicals, and vibration. Neoprene’s proven thermal stability and resistance to degradation are key factors behind its selection in EV battery casings, mounts, and thermal management systems. As EV adoption accelerates globally, elastomer-grade neoprene is becoming a material of choice for next-generation mobility solutions.

The adhesives segment is anticipated to grow at a significant CAGR of 3.38% through the forecast period, driven by the resurgence of neoprene-based contact adhesives in the footwear and furniture sectors, particularly in Asia-Pacific. As manufacturers seek strong, fast-bonding adhesives that remain effective under stress and moisture, neoprene’s performance advantages are gaining renewed commercial interest. Post-pandemic supply chain localization is also increasing demand for regionally sourced adhesive solutions, further lifting market penetration.

End Use Insights

Building and construction dominated the neoprene market and accounted for a revenue share of 40.54% in 2024. The building and construction industry’s intensified focus on energy efficiency and weather resistance is creating robust demand for neoprene in expansion joints, window gaskets, and waterproof membranes. With regulations tightening around thermal insulation and water ingress in both residential and commercial projects, developers are actively incorporating neoprene-based components to meet compliance while ensuring durability. This is especially evident in urban infrastructure upgrades across North America and the Middle East.

The medical segment is projected to witness a substantial CAGR of 3.54% over the forecast period. In the medical sector, the expanding need for non-latex alternatives in wearable health devices and orthopedic supports is accelerating neoprene uptake. Allergic reactions linked to natural rubber have prompted a shift toward synthetic, hypoallergenic materials like neoprene, particularly in rehabilitation products and braces. Moreover, its ability to offer compression, support, and breathability positions it well for therapeutic applications in both hospital and homecare settings.

Regional Insights

Asia Pacific dominated the global neoprene market and accounted for the largest revenue share of 45.74% in 2024, fueled by rapid urbanization and a booming automotive sector. Infrastructure expansion in Southeast Asia and India is elevating need for neoprene-based seals and membranes, while China’s automotive clusters absorb significant volumes for belts, hoses and insulation. This confluence of construction and mobility investment is catalyzing sustained neoprene uptake.

China neoprene market is expected to witness growth during the forecast period. China’s strategic push for chemical self-reliance and surging electric vehicle production are key drivers of the country’s neoprene industry. Domestic manufacturers are leveraging state incentives to ramp up capacity for chloroprene and butadiene, securing feedstock supply for battery insulation gaskets, motor mounts, and renewable energy seals. This alignment of policy support and EV-led growth is positioning China as a pivotal growth engine for global neoprene demand.

North America Neoprene Market Trends

North America’s neoprene industry is underpinned by a robust R&D ecosystem and strong end use demand for high-performance, water-resistant fabrics across automotive, marine and electronics sectors. Canada’s advanced materials clusters and U.S. innovation hubs are continuously unveiling next-generation neoprene grades with enhanced durability and processing efficiency. This synergy between research capabilities and diverse industrial applications is solidifying North America’s leadership in neoprene innovation and adoption.

U.S. Neoprene Market Trends

Federal infrastructure investment is a primary catalyst for U.S. neoprene consumption, with the Bipartisan Infrastructure Law, enacted in 2021, allocating USD 1.2 trillion toward transportation and resilience projects. This spending surge on roads, bridges and water systems is driving demand for neoprene in expansion joints, sealing gaskets and waterproof membranes that must meet stringent “Buy America” content requirements. As state and local agencies deploy these funds, neoprene suppliers are scaling capacity to support accelerated construction timelines.

Europe Neoprene Market Trends

In Europe, automotive OEMs are pivoting to sustainable, lightweight materials to comply with the March 5, 2025, EU Action Plan on automotive innovation and emissions reduction. Neoprene’s thermal stability and long service life make it an ideal choice for engine mounts, vibration dampers, and sealing solutions, aligning with stricter CO₂ targets and circular economy mandates. Consequently, major manufacturers in Germany, France, and the UK are expanding neoprene usage to meet both performance and regulatory benchmarks.

Key Neoprene Company Insights

The neoprene market is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Neoprene Companies:

The following are the leading companies in the neoprene market. These companies collectively hold the largest market share and dictate industry trends.

- Denka Company Limited

- Guangzhou Huaxing Sports Goods Co. Ltd.

- Macro Products, Inc.

- ARIAPRENE (Tiong Liong Industrial Co., Ltd)

- Neoprene Craft Hub

- Mueller Sports Medicine

- Ansell

Recent Developments

-

In January 2025, Mueller Sports Medicine, a leading global sports medicine company, announced it had acquired the Pro Orthopedic brand, a well-known provider of Neoprene-based orthopedic products for athletes and active individuals. This acquisition was part of Mueller’s strategy to expand its product portfolio and strengthen its presence in the professional and institutional sports medicine market.

-

In August 2023, Ansell introduced SENSOPRENE Technology, which produced surgical gloves up to 30% thinner than their standard neoprene gloves. This innovation allowed users to experience greater sensitivity and comfort, while still maintaining durability and strong protection against allergies and sensitivities caused by latex or chemical accelerators.

Neoprene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2116.5 million

Revenue forecast in 2030

USD 2,438.2 million

Growth rate

CAGR of 2.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Denka Company Limited; Guangzhou Huaxing Sports Goods Co. Ltd.; Macro Products, Inc.; ARIAPRENE (Tiong Liong Industrial Co., Ltd); Neoprene Craft Hub; Mueller Sports Medicine; Ansell

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neoprene Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the neoprene market report based on grade, application, end use, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

General-purpose Grade

-

Pre-crosslinked Grade

-

Sulfur-modified Grade

-

Slow Crystallizing Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Latex

-

Elastomers

-

Adhesives

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Electrical & Electronics

-

Medical

-

Textiles

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global neoprene market size was estimated at USD 2.07 billion in 2024 and is expected to reach USD 2.12 billion in 2025.

b. The global neoprene market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2030 to reach USD 2.44 billion by 2030.

b. General-purpose grade dominated the neoprene market across the grade segmentation in terms of revenue, accounting for a market share of 49.78% in 2024, due to its widespread utility across diverse low-to-moderate performance applications, particularly in automotive and consumer goods manufacturing.

b. Some key players operating in the neoprene market include Denka Company Limited, Guangzhou Huaxing Sports Goods Co. Ltd., Macro Products, Inc., ARIAPRENE (Tiong Liong Industrial Co., Ltd), Mueller Sports Medicine, Ansell, and Neoprene Craft Hub

b. Rising demand for protective gear and wetsuits in the sports and defense sectors is driving neoprene consumption. Its flexibility and water resistance make it ideal for use in diving suits, gloves, and military-grade equipment

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.