- Home

- »

- Medical Devices

- »

-

Nerve Repair And Regeneration Market Size Report, 2030GVR Report cover

![Nerve Repair And Regeneration Market Size, Share & Trends Report]()

Nerve Repair And Regeneration Market (2024 - 2030) Size, Share & Trends Analysis Report By Surgery (Nerve Grafting, Neurorrhaphy), By Product (Biomaterials Neurostimulation & Neuromodulation Device), By Region, And Segment Forecasts

- Report ID: 978-1-68038-961-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nerve Repair And Regeneration Market Summary

The global nerve repair and regeneration market size was estimated at USD 9.1 billion in 2023 and is projected to reach USD 20.5 billion by 2030, growing at a CAGR of 12.2% from 2024 to 2030. Rising cases of neurological disorders and a strong product pipeline by the major companies are the key factors driving the market.

Key Market Trends & Insights

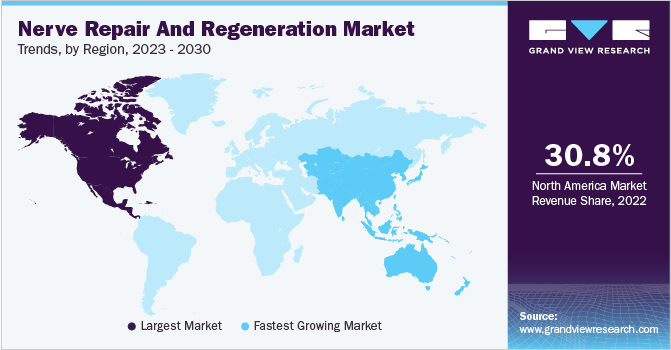

- North America dominated the global nerve repair and regeneration market with the largest revenue share of over 30.8% in 2022.

- The nerve repair and regeneration market in the U.S. led the North America market and held the largest revenue share in 2022.

- By product, the neurostimulation and neuromodulation devices segment led the market, holding the largest revenue share of 66.9% in 2022.

- By surgery, the stem cell therapy segment is expected to grow at the fastest CAGR from 2023 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 9.1 Billion

- 2030 Projected Market Size: USD 20.5 Billion

- CAGR (2024-2030): 12.2%

- North America: Largest market in 2022

Improved treatment efficiency for neurological disorders due to several technological advancements is also likely to contribute to the market growth. During the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) pandemic, various government containment measures led outpatient clinics' neurological activities to be disrupted. Vulnerable patients such as those with Parkinson's disease (PD) or dystonic patients with deep brain stimulation (DBS) were at a higher risk of chronic stress because of social restriction measures, and their motor and psychiatric symptoms were reported to deteriorate.

Furthermore, the availability of multiple therapies for treating various Central Nervous System (CNS) disorders, such as Parkinson’s disease and Alzheimer’s, and the increasing scope of applications are further expected to boost the market growth over the forecast period. According to the Alzheimer’s Association, in 2022, 6.5 million people aged 65 or more in America were suffering from Alzheimer's disease.

Increasing awareness, environmental influence, lifestyle, genetics, nutrition, and physical injuries are some of the factors that can cause such disorders. In 2015, a report presented at the annual meeting of the American Society for Surgery of the Hand (ASSH) stated that the processed nerve allograft used in the treatment of patients with upper extremity nerve impairments may lead to the restoration of motor and sensory nerve functions. Patients treated with a PNA allograft (Avance Nerve Graft, AxoGen) exhibited recovery of motor function and sensory nerve function in 75% and 85% of the patients, respectively.

Product Insights

The neurostimulation and neuromodulation devices segment emerged as the largest segment with a revenue share of over 66.9% in 2022. The segment is further sub-segmented into Deep Brain Stimulation (DBS), Spinal Cord Stimulation (SCS), Vagus Nerve Stimulation (VNS), Sacral Nerve Stimulation (SNS), and Gastric Electric Stimulation (GES) Devices. The spinal cord stimulation devices segment was the largest sub-segment in 2022 with a revenue share of over 40.0%. Many commercially available spinal cord products and a wide range of applications were the factors responsible for the growth of the segment. Based on product, the market has been classified into biomaterials and neurostimulation & neuromodulation devices.

Investments by key companies to develop more effective devices are likely to propel market growth in the coming years. For instance, in January 2023, Axogen Corporation launched an independent publication of a retrospective & comprehensive clinical review of recovery rates between autograft, conduits, and allograft using meta-analysis. The biomaterials segment is anticipated to expand at the fastest CAGR from 2023 to 2030 due to technological advancements, a wide range of applications, government funding for innovations, and biocompatibility. Advanced products such as biodegradable polymers are expected to enhance spinal stabilization and healing of fractures and reduce hospitalization.

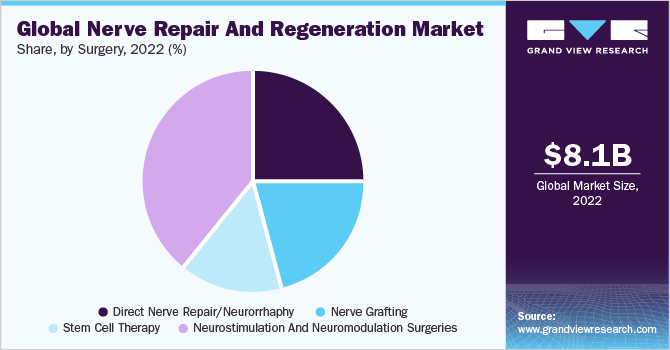

Surgery Insights

Neurostimulation and neuromodulation surgeries held the largest revenue share of over 39.1% in 2022. Stem cell therapy is expected to register the fastest CAGR over the forecast years. Various government initiatives and approvals to conduct clinical trials of biomaterials are anticipated to boost the market growth. There are approximately 570 clinics in the U.S. providing stem cell therapies and the number is expected to rise, thereby augmenting segment growth. Based on surgery, the market is divided into direct nerve repair or neurorrhaphy, nerve grafting, stem cell therapy, and neurostimulation and neuromodulation surgery.

Expected commercialization of the products in the coming years due to investments by companies and research institutes is also anticipated to boost the market growth. Neurostimulation and neuromodulation surgeries are expected to maintain their lead over the forecast period due to the availability of several products and technological advancements to reduce chronic pain. For instance, in April 2016, St. Jude launched Axium Neurostimulator System in the U.S. and approved the implants for Dorsal Root Ganglion (DRG). The system reduces the chronic pain for complex regional pain syndrome I and II patients, which could not be achieved through the traditional SCS system.

Regional Insights

In 2022, North America dominated the market with over 30.8% share owing to the increased incidence of neural disorders and supportive health insurance coverage scenario in the region. The availability of technologically advanced devices owing to the presence of major market players is also a major factor fueling the growth of this region. For instance, in February 2016, Medtronic plc launched Reclaim DBS therapy for the treatment of obsessive-compulsive disorder (OCD). Furthermore, Boston Scientific’s Precision Montage MRI-safe SCS, which is used for chronic pain, received FDA approval in May 2016.

The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period due to the increasing target population base, rising awareness among patients, supportive government initiatives, the presence of unmet medical needs, and the advent of innovative technologies. China, India, Japan, Australia, and Singapore are the major countries contributing to the regional growth.

Key Companies & Market Share Insights

Key companies are AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; and Medtronic plc. The industry contributors have a broad product pipeline for neurological disorders. Market players are in a process of introducing advanced products to improve treatment efficiency, in turn, capturing a higher market share. For Instance, in January 2018, Boston Scientific Corporation announced positive results from the randomized controlled trial - WHISPER.

The WHISPER data demonstrates that patients who are given both paresthesia-based SCS and sub-perception, achieve superior outcomes. In June 2016, St. Jude Medical launched direction DBS lead and Infinity DBS system to support treatments pertaining to movement disorders. It is designed with the aim of enabling Apple mobile devices to be used as wireless controllers with the help of a Bluetooth connection and is the only upgradable DBS system for disorders, such as tremor, dystonia, and Parkinson’s disease. In March 2023, Regenity Biosciences, formerly known as Collagen Matrix, Inc., unveiled its new website and visual identity. Some prominent players in the global nerve repair and regeneration market include:

-

AxoGen, Inc.

-

Stryker Corporation

-

St. Jude Medical, Inc.

-

Baxter International, Inc.

-

Polyganics B.V.

-

Boston Scientific, Inc.

-

Integra Lifesciences Corporation

-

Cyberonics, Inc.

-

Medtronic plc.

Nerve Repair And Regeneration Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.2 billion

Revenue forecast in 2030

USD 20.5 billion

Growth rate

CAGR of 12.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Product, surgery, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nerve Repair And Regeneration Market Report Segmentation

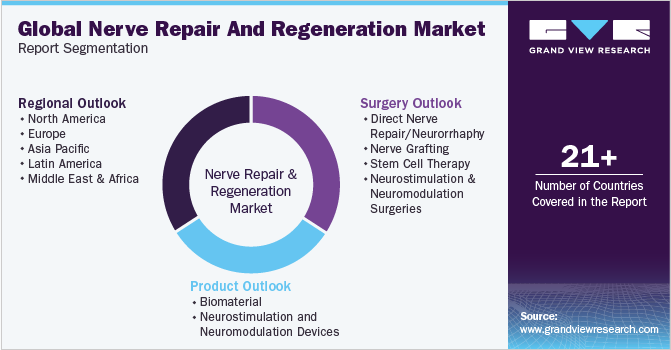

This report forecasts revenue growth at global, regional, and country level and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nerve repair and regeneration market on the basis of product, surgery, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomaterials

-

Neurostimulation and Neuromodulation Devices

-

Spinal Cord Stimulation Devices

-

Deep Brain Stimulation Devices

-

Sacral Nerve Stimulation Devices

-

Vagus Nerve Stimulation Devices

-

Gastric Electric Stimulation Devices

-

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Nerve Repair/Neurorrhaphy

-

Nerve Grafting

-

Stem Cell Therapy

-

Neurostimulation and Neuromodulation Surgeries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nerve repair and regeneration market size was estimated at USD 8.1 billion in 2022 and is expected to reach USD 9.1 billion in 2023.

b. The global nerve repair and regeneration market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 20.5 billion by 2030.

b. North America dominated the nerve repair and regeneration market with a share of 30.8% in 2022. This is attributable to the increased incidence of neural disorders and supportive health insurance coverage scenarios in the region.

b. Some of the key players operating in the nerve repair and regeneration market include AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; and Medtronic plc.

b. Key factors that are driving the nerve repair and regeneration market growth include increasing government funding and reimbursements, increasing incidences of neurological disorders, and rising medical tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.