- Home

- »

- Communications Infrastructure

- »

-

Network Emulator Market Size, Share & Growth Report, 2030GVR Report cover

![Network Emulator Market Size, Share & Trends Report]()

Network Emulator Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Technology (IoT, Cloud), By Test, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-335-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Network Emulator Market Summary

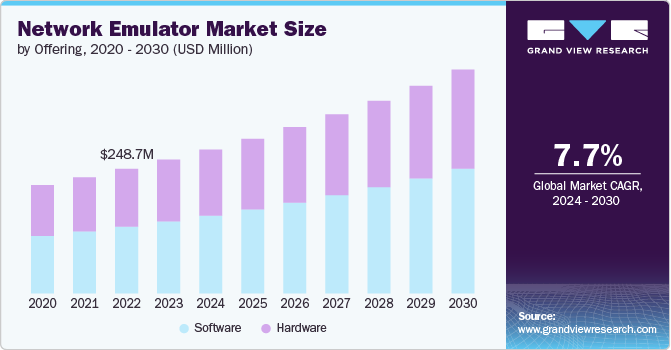

The global network emulator market size was estimated at USD 267.0 million in 2023 and is expected to reach USD 446.9 million by 2030, growing at a CAGR of 7.7% from 2024 to 2030. The market growth can be attributed to several driving factors, including the rapid adoption of cloud computing and the migration of critical applications and services to cloud environments.

Key Market Trends & Insights

- The North American dominated the global market in 2023.

- By offering, the software segment led the market and accounted for 53.9% of the global revenue in 2023.

- By technology, the IoT segment accounted for the largest market revenue share in 2023.

- By test, the application testing segment accounted for a significant market revenue share in 2023.

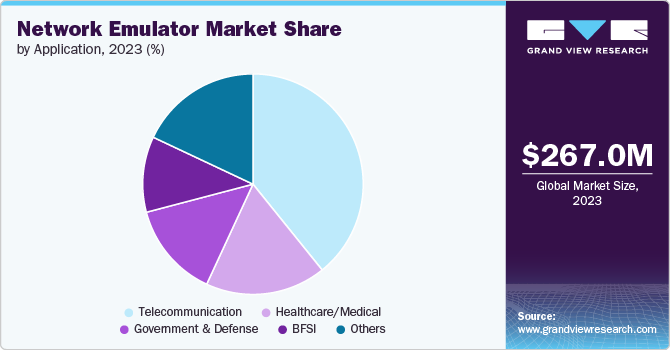

- By application, the telecommunication segment accounted for a significant market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 267.0 Million

- 2030 Projected Market Size: USD 446.9 Million

- CAGR (2024-2030): 7.7%

- North American: Largest market in 2023

Furthermore, as organizations move their workloads to the cloud, they face the challenge of ensuring their applications can perform optimally under varying network conditions. Network emulators enable them to simulate real-world network scenarios, including bandwidth constraints and latency, helping organizations identify and address potential performance issues before deploying their applications in cloud environments. This proactive testing approach ensures a seamless transition to the cloud, driving the demand for network emulation solutions.

The proliferation of Internet of Things (IoT) devices and the deployment of 5G networks are further fueling the growth of the network emulator market. For instance, as IoT devices become increasingly integrated into various industries, such as healthcare, manufacturing, and smart cities, the need to test and validate their performance under diverse network conditions becomes crucial. Additionally, network emulators allow organizations to assess how these devices will behave on real networks, helping them optimize their IoT solutions and ensure reliable connectivity. Moreover, the rollout of 5G networks introduces new complexities, including ultra-low latency and high bandwidth requirements. Thereby, network emulators play a vital role in testing and fine-tuning applications and services to meet the demands of 5G networks.

The rising importance of cybersecurity testing and training is another major driver fueling the growth of the network emulator market. With the increasing frequency and sophistication of cyberattacks, organizations are required to evaluate the resilience of their networks and security infrastructure. Network emulators enable organizations to replicate various cyber threat scenarios and test their network defenses, helping them identify vulnerabilities and improve their cybersecurity posture. Furthermore, these emulators are used for training security professionals, allowing them to simulate realistic attack scenarios and practice incident response procedures in a controlled environment. As cybersecurity remains a top priority for organizations across industries, the demand for network emulation solutions continues to grow.

Another key factor driving the growth of the network emulator market is the increasing reliance on remote work and virtual collaboration tools. With the global shift towards hybrid work models, organizations are investing heavily in solutions that ensure robust and reliable network performance. Network emulators are instrumental in testing and optimizing virtual private networks (VPNs) and other remote access technologies, enabling businesses to maintain high productivity and seamless communication among distributed teams. As remote work becomes a permanent fixture in the corporate landscape, the demand for advanced network emulation solutions is expected to rise significantly.

However, despite the promising growth prospects, the network emulator market faces challenges such as the high cost of deployment and the complexity of integrating these solutions into existing IT infrastructure. Smaller enterprises, in particular, may find it difficult to allocate the necessary resources for comprehensive network testing. However, this restraint can be mitigated by adopting scalable, cloud-based network emulation solutions that offer flexible pricing models and easier integration. By lowering the barriers to entry, vendors can expand their customer base and support the long-term growth of the network emulator market.

Offering Insights

The software segment led the market and accounted for 53.9% of the global revenue in 2023 and is expected to retain its dominance over the forecast period. Software-based network emulators are computer programs or applications meticulously designed to replicate real-world network conditions and behaviors within a controlled virtual environment. Their primary function is to allow users to imitate a range of network parameters, including bandwidth limitations, latency, and packet loss. Software-based network emulators serve as indispensable tools for validation, quality assurance, and development processes, enabling the early identification of issues and the optimization of performance.

The hardware segment is expected to register significant growth from 2024 to 2030. The segment’s growth is driven by the increasing demand for high-performance, real-time network testing solutions. Hardware-based network emulators offer superior precision and reliability, essential for applications requiring rigorous testing under specific network conditions. The growing complexity of modern networks and the need for comprehensive performance evaluation in sectors such as telecommunications and defense further fuel the expansion of this segment.

Technology Insights

The IoT segment accounted for the largest market revenue share in 2023. The segment’s growth is driven by the escalating integration of IoT devices across various industries, such as healthcare, manufacturing, and smart cities. The increasing need to test and validate the performance of IoT solutions under diverse network conditions propels the demand for network emulators. These emulators enable organizations to optimize IoT connectivity, ensuring reliability and robust performance, thereby contributing significantly to the segment’s growth.

The SD-WAN segment is expected to grow significantly from 2024 to 2030. This growth can be attributed to the widespread adoption of SD-WANs by organizations globally. The surge in SD-WAN adoption is driven by the remarkable capabilities of SD-WAN technology, which include enhancing network flexibility, optimizing performance, and reducing operational costs. As businesses increasingly pivot toward cloud-based applications and services, SD-WANs have emerged as a highly efficient solution for managing intricate and multifaceted networks, driving the segment’s growth.

Test Insights

The application testing segment accounted for a significant market revenue share in 2023. The segment's growth is driven by the increasing complexity of modern applications and the need to ensure their seamless performance under varied network conditions. Market consumers are adopting application testing to identify and address potential issues early in the development cycle, enhancing user experience and reducing post-deployment failures. This proactive approach to quality assurance is crucial for maintaining a competitive advantage in the fast-paced technology landscape.

The performance testing segment is expected to register significant growth from 2024 to 2030. This segment is expanding due to the rising demand for high-quality network performance in critical applications such as online gaming, streaming, and enterprise communications. Consumers are adopting performance testing to ensure their networks can handle peak loads and provide consistent, reliable service. This focus on optimizing network performance helps organizations meet user expectations and maintain operational efficiency, driving the segment's growth.

Application Insights

The telecommunication segment accounted for a significant market revenue share in 2023. The constant technological advancements and innovations in the IT & telecommunications industry drive the demand for network emulators. These tools are essential for testing and validating complex network environments characterized by intricate devices, protocols, and services. The industry's introduction of new technologies such as 5G, IoT, and cloud-based solutions further amplifies the demand for emulators to assess performance and security. Moreover, the critical focus on network security, regulatory compliance, and cost savings in this sector solidifies the central role of network emulators in maintaining network integrity and driving their prominence in the market.

The government & defense segment is expected to register significant growth from 2024 to 2030. This growth is driven by the increasing need for robust and secure network infrastructure to support critical operations. The adoption of network emulators in this segment is fueled by the necessity to simulate and test network conditions for mission-critical applications, ensuring resilience against cyber threats and optimizing communication systems. This focus on security and reliability underpins the segment's expansion.

Regional Insights

The North American network emulator market dominated the global market in 2023. The North American region, encompassing technologically advanced countries with strong infrastructures, serves as a major driver for the demand for network emulator solutions. The region's market dominance is a direct result of its well-established industries, which are capable of making substantial investments in advanced IT infrastructures, creating fertile ground for the adoption of network emulators. Moreover, the region's technological advancements, including the deployment of 5G networks, encourage telecom providers to incorporate network emulators across various network layers.

Network emulator market in the U.S. is thriving due to the rapid implementation of 5G networks and the growing focus on cybersecurity. The need to ensure seamless connectivity and robust network security across critical sectors like healthcare, finance, and defense drives the demand for network emulation. Moreover, the presence of a large number of tech startups and established firms emphasizes advanced network testing capabilities, fostering market growth.

Europe Network Emulator Market Trends

Network emulator market in Europe is experiencing growth driven by the region's commitment to digital transformation and the enhancement of telecommunication infrastructure. The EU's stringent regulatory frameworks for network reliability and data protection necessitate advanced testing solutions. Additionally, initiatives such as Industry 4.0 and the development of cross-border digital services create a substantial need for network emulation to ensure seamless and secure operations.

Asia Pacific Network Emulator Market Trends

Network emulator market in Asia Pacific is witnessing rapid growth due to significant investments in digital infrastructure and the extensive rollout of 5G technology. Countries such as China, Japan, and South Korea lead in adopting smart technologies and IoT applications, driving the need for comprehensive network testing. Furthermore, the region's diverse and rapidly growing internet user base requires robust network performance, enhancing the demand for network emulators.

Key Network Emulator Company Insights

Key players operating in the network emulator market include VIAVI Solutions Inc., Apposite Technologies, Calnex Solutions, Polaris Networks, InterWorking Labs, Inc., and others. The key market players are focusing on various strategic initiatives, including new product development, mergers & acquisitions, partnerships & collaborations, and agreements to gain a competitive advantage over their competitors.

Key players in the network emulator market are investing in research and development and launching innovative solutions. For instance, in June 2024, Canley Solutions unveiled its new network emulator, the SNE-X, featuring 400GbE interfaces. This network emulator facilitates the testing of AI infrastructure and other high-performance computing networks. The Calnex SNE-X 400G offers advanced testing and emulation capabilities, providing the first high-performance, controllable, and repeatable emulation solution specifically designed for AI infrastructure. Such initiatives are harnessing innovation in the network emulator market.

Key Network Emulator Companies:

The following are the leading companies in the network emulator market. These companies collectively hold the largest market share and dictate industry trends.

- Keysight Technologies

- Spirent Communications

- VIAVI Solutions Inc.

- Apposite Technologies

- Calnex Solutions

- Polaris Networks

- PacketStorm Communications, Inc.

- Aukua Systems Inc.

- InterWorking Labs, Inc.

- GigaNet Systems

Network Emulator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 287.0 million

Revenue forecast in 2030

USD 446.9 million

Growth rate

CAGR of 7.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, technology, test, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Keysight Technologies; Spirent Communications; VIAVI Solutions Inc.; Apposite Technologies; Calnex Solutions; Polaris Networks; PacketStorm Communications, Inc.; Aukua Systems Inc.; InterWorking Labs, Inc.; GigaNet Systems

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Emulator Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the network emulator market based on offering, technology, test, application, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

SD-WAN

-

IoT

-

Cloud

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Performance Testing

-

Application Testing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunication

-

BFSI

-

Government & Defense

-

Healthcare/Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The North America segment dominated the market in 2023. The North American region, encompassing technologically advanced countries with strong infrastructures, serves as a major driver for the demand for network emulator solutions.

b. Some key players operating in the network emulator market include Keysight Technologies, Spirent Communications, VIAVI Solutions Inc., Apposite Technologies, Calnex Solutions, Polaris Networks, PacketStorm Communications, Inc., Aukua Systems Inc., InterWorking Labs, Inc., GigaNet Systems

b. The market growth can be attributed to several driving factors, including the rapid adoption of cloud computing and the migration of critical applications and services to cloud environments.

b. The global network emulator market size was estimated at USD 267.0 million in 2023 and is expected to reach USD 287.0 million in 2024.

b. The network emulator market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 446.9 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.