- Home

- »

- Medical Devices

- »

-

Neuroprosthetics Market Size & Share, Industry Report 2033GVR Report cover

![Neuroprosthetics Market Size, Share & Trends Report]()

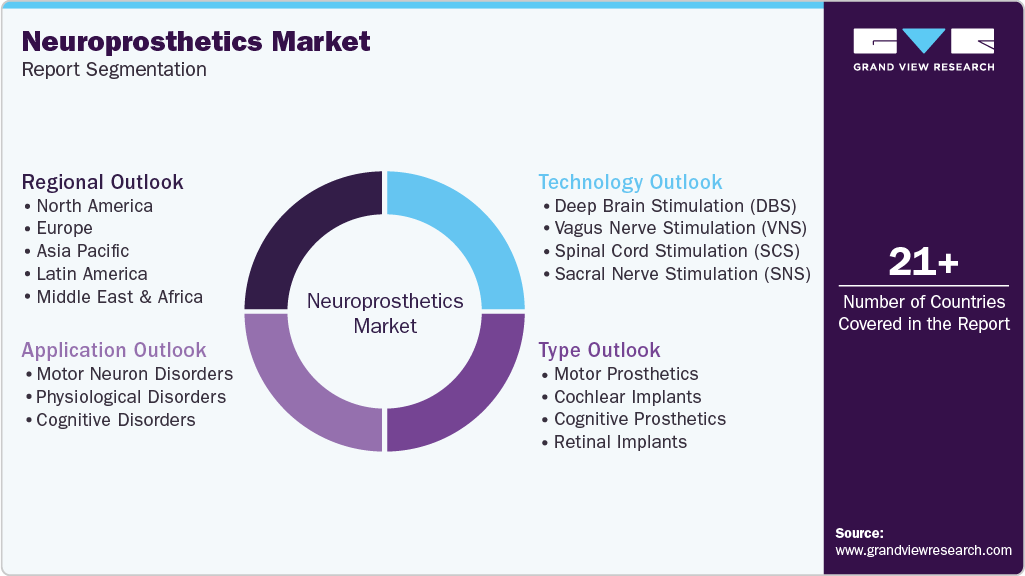

Neuroprosthetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Motor Prosthetics, Cochlear Implants, Cognitive Prosthetics), By Technology (Deep Brain Stimulation, Spinal Cord Stimulation), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-891-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Neuroprosthetics Market Summary

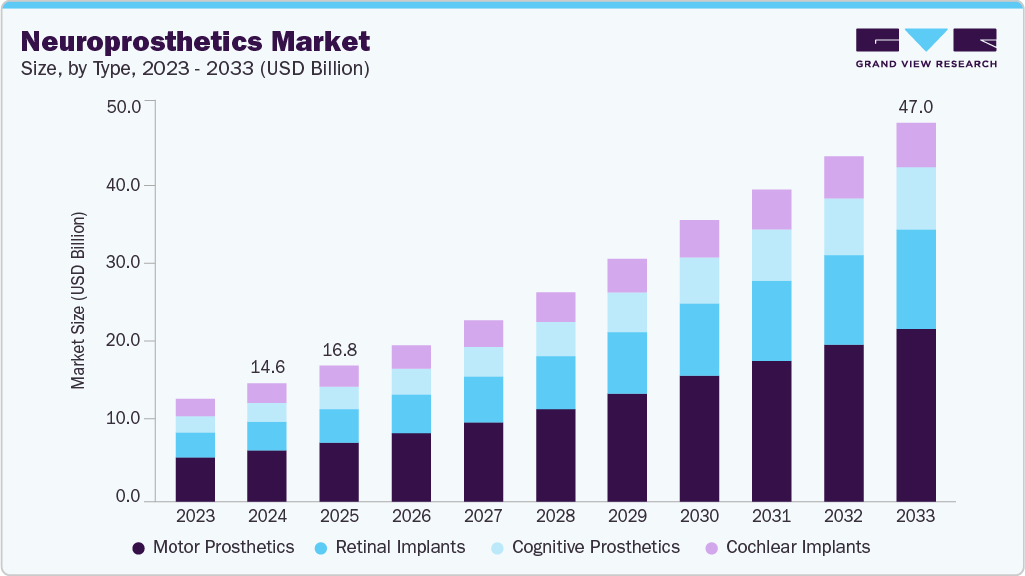

The global neuroprosthetics market size was estimated at USD 14.62 billion in 2024 and is projected to reach USD 47.0 billion by 2033, growing at a CAGR of 13.69% from 2025 to 2033. The market is driven by the increasing prevalence of neurological, cardiac, and kidney disorders, as well as ongoing advancements in medical technology.

Key Market Trends & Insights

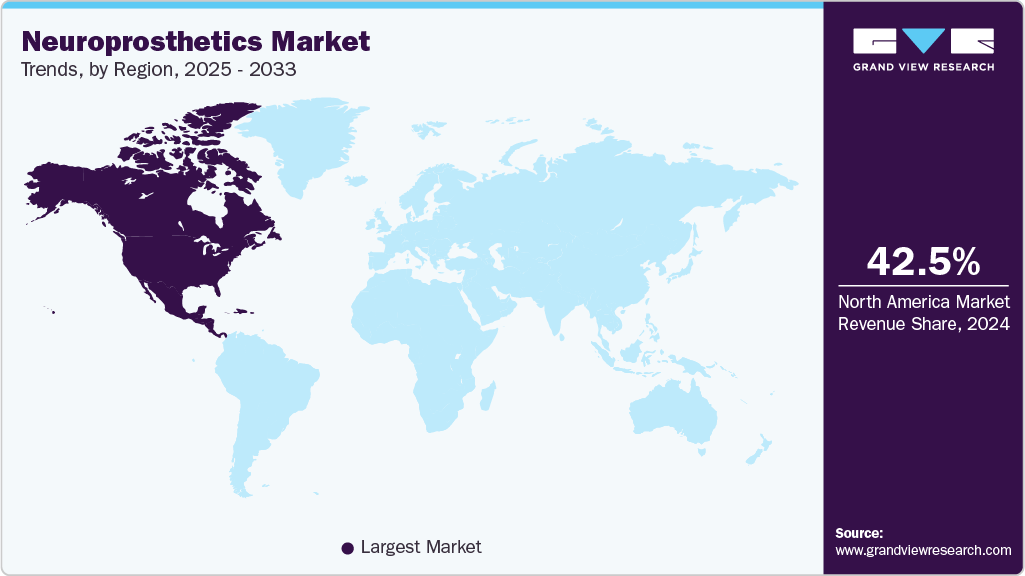

- North America dominated the global neuroprosthetics industry with the largest revenue share of 42.50% in 2024.

- The U.S. neuroprosthetics industry is expected to grow significantly in the coming years.

- By type, the motor prosthetics segment led the market with the largest revenue share of 43.09% in 2024.

- Based on application, the cognitive disorders segment is anticipated to grow fastest over the forecast period.

- Based on technology, the sacral nerve stimulation (SNS) segment is anticipated to grow fastest over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14.62 Billion

- 2033 Projected Market Size: USD 47.0 Billion

- CAGR (2025-2033): 13.69%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, expanded research efforts and a greater focus on industry growth are anticipated to support the market in the coming years. The burden of neurological disorders such as Parkinson’s disease, epilepsy, Alzheimer’s disease, and depression is increasing significantly, which is anticipated to propel the demand for neuroprosthetic devices. According to the WHO data published in February 2024, approximately 50 million people worldwide are living with epilepsy. Furthermore, the burden of neurological disorders remains significant across various demographic groups, contributing to the rising demand for neuroprosthetic devices. According to the CDC, approximately 2.9 million U.S. adults aged 18 and older reported having active epilepsy during 2021 and 2022.

Furthermore, the increasing prevalence of physiological disorders, particularly those affecting the auditory, ophthalmic, cardiac, and renal systems, is expected to drive market growth. According to WHO data published in February 2025, around 2.5 billion people may experience some extent of hearing loss by 2050, with over 700 million requiring hearing rehabilitation.

Currently, over 430 million individuals, representing more than 5% of the global population, including 34 million children, require rehabilitation for hearing loss. This number is projected to exceed 700 million, or about 1 in 10 people, by 2050. Around 80% of those with hearing loss live in low- and middle-income countries, and prevalence rises with age, affecting over 25% of adults above 60. This increasing global burden of auditory disorders is expected to drive demand for cochlear implants and support market expansion during the forecast period.

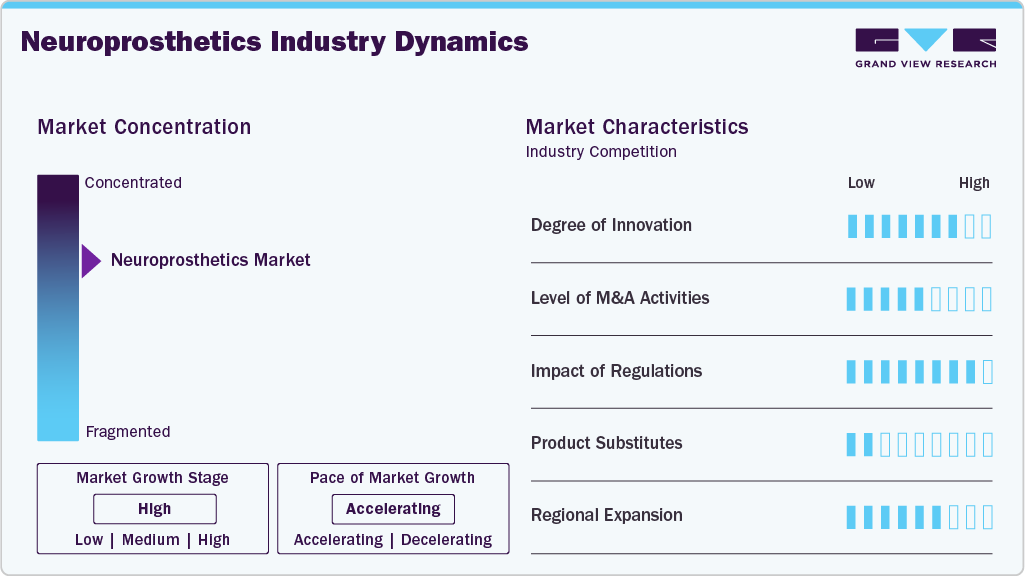

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is characterized by a high degree of growth due to the rising prevalence of neurological diseases, auditory disorders, retinal diseases, and continued research and technological advancements.

Industry players and researchers are developing advanced neuroprosthetics. They are focusing on differentiating products based on technology, designs, and features. Technological advancements in neuroprosthetics such as cochlear implants include AI-driven smart sound processing that adapts to changing environments, enhanced noise filtering for clearer speech, and wireless Bluetooth connectivity for seamless streaming from smart devices. In addition, bilateral implants and hybrid systems that combine acoustic amplification with electrical stimulation offer improved spatial hearing and effective solutions for patients with partial hearing loss.

Regulatory authorities such as the European Medicines Agency (EMA), the MHRA, the U.S. Food and Drug Administration (FDA), and Health Canada play a pivotal role in defining the regulatory landscape for the neuroprosthetics industry. Cochlear and retinal implants are classified as Class III, high-risk medical devices, requiring rigorous clinical evaluations and extensive post-market surveillance to ensure safety and effectiveness. While these stringent standards enhance patient protection, they also create significant challenges for manufacturers navigating the approval process.

The market is expected to witness strong mergers and acquisitions (M&A) activity as companies aim to broaden their product portfolios, capitalize on synergies, and expand into new regions. Major industry players are increasingly acquiring smaller innovators to strengthen their technological capabilities. For instance, in April 2025, Science Corporation acquired the intellectual property and related assets of the PRIMA retinal implant from Pixium Vision SA, a bioelectronics company specializing in BCI technology, based in France.

“The PRIMA retinal implant, developed by Pixium and based on research done at Stanford University, shows great promise. The early clinical trial results we’ve seen are impressive. Together with the work being done at Science on the Science Eye, we now have two great opportunities to develop BCI technology for the potential restoration of vision in certain patients with severe vision loss. We are committed to bringing meaningful restoration of vision to patients as quickly as possible.” Said CEO and co-founder Max Hodak.

Type Insights

The motor prosthetics segment held the largest share of the market, accounting for 43.09% of total revenue in 2024. Motor prosthetics are devices that replace or enhance lost motor functions, including prosthetic limbs, exoskeletons, and neurostimulators. Recent technological advancements, including improved sensors and materials, have improved the functionality and user-friendliness of these devices.

The retinal implants segment is projected to experience the fastest growth during the forecast period, driven by the rising prevalence of blindness. According to WHO data published in August 2023, at least 2.2 billion people worldwide have near or distance vision impairment. Advances in retinal implant materials and technology are expected to support this growth. For example, research from Johns Hopkins University in February 2024 found that a biocompatible nanocomposite material, utilized in a retinal implant, can acoustically stimulate cells in the diseased retina and send signals to the brain’s visual cortex. Ongoing studies and clinical trials are anticipated to further accelerate segment growth.

Application Insights

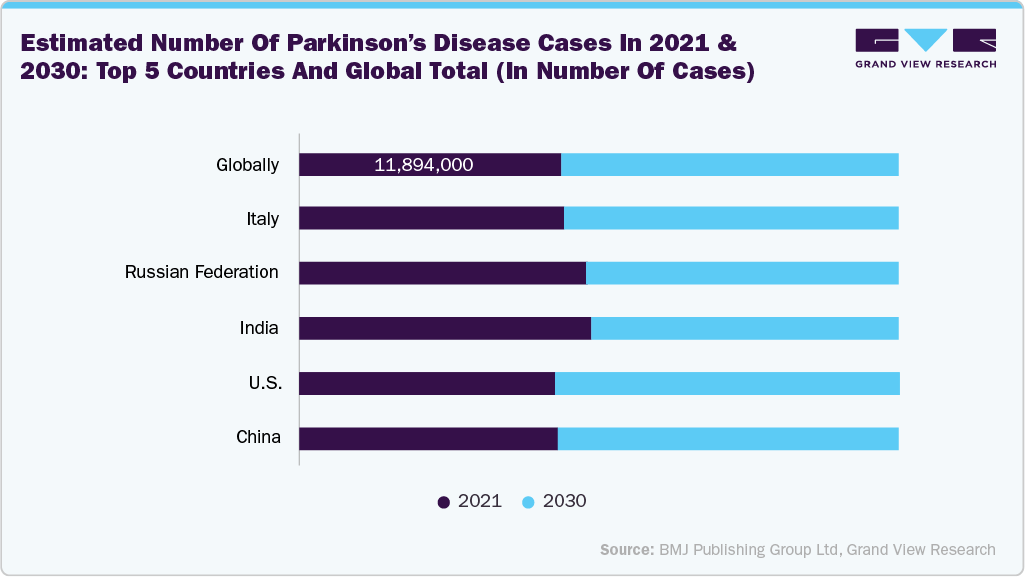

The motor neuron disorders segment accounted for the largest share of the market in 2024. This is mainly because more people are being diagnosed with conditions like Parkinson’s disease and epilepsy worldwide. The Parkinson's Foundation reports that almost one million people in the U.S. have Parkinson's disease, and this number could reach 1.2 million by 2030. Each year, about 90,000 new cases are diagnosed in the U.S., and over 10 million people globally are living with Parkinson’s. This large patient group is expected to drive growth in this segment.

The cognitive disorders segment is projected to experience the fastest CAGR during the forecast period, driven by the rising occurrence of cognitive ailments such as Alzheimer's disease and extreme depression. The trend is driven by the increasing elderly population, growing awareness, advancements in technology, and the limited treatment choices available. As research and development progress, neuroprosthetics are expected to gain increasing significance in the treatment and management of cognitive disorders.

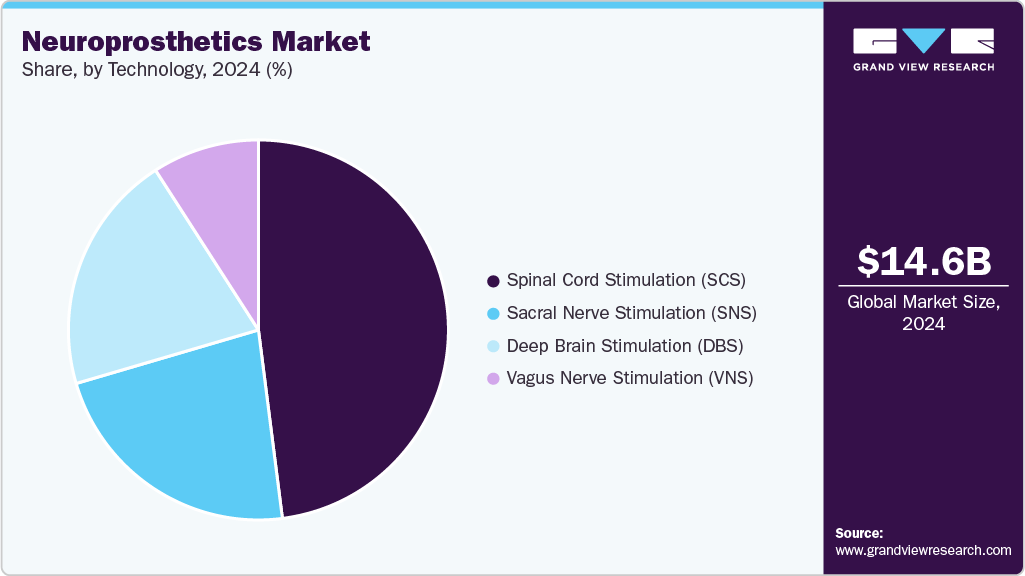

Technology Insights

The Spinal Cord Stimulation (SCS) segment dominated the market in 2024, accounting for the largest share. This dominance is primarily driven by the increasing prevalence of chronic pain globally. Technological advancements have led to the development of advanced SCS devices that provide enhanced pain relief capabilities, ultimately improving the quality of life for patients. For instance, more advanced SCS devices can be customized to administer various stimulation patterns and strengths, enabling doctors to personalize therapy for each patient.

The Sacral Nerve Stimulation (SNS) segment is expected to witness the fastest CAGR from 2025 to 2033. The market for SNS is expanding quickly because bladder and bowel problems are becoming more common worldwide, driven by factors such as the growing elderly population and the increasing rate of chronic diseases like diabetes. Technological advancements have led to the development of advanced SNS devices that provide improved outcomes for individuals with bladder and bowel disorders. More recent devices come with rechargeable batteries, wireless programming, and MRI compatibility, enhancing convenience and user-friendliness for patients.

Regional Insights

North America neuroproethetics industry accounted for the largest share of 42.50% of the global market in 2024.This is mainly a result of the rising occurrence of neurological disorders and the expanding elderly population in the region. There is an increase in neurological disorders such as stroke, epilepsy, and Parkinson’s disease in North America. The increasing elderly population in North America is contributing to the expansion of the market. Neurological disorders are more common in older adults, leading to an increased need for neuroprosthetics in this demographic. The Population Reference Bureau projects that the number of Americans aged 65 and older is expected to increase from 58 million in 2022 to 82 million by 2050.

U.S Neuroprosthetics Market Trends

The U.S. neuroprosthetics industry is expected to grow significantly in the coming years, driven by several factors, including advancements in technology and increasing awareness. Technological advancements have led to the development of advanced neuroprosthetics.

Europe Neuroprosthetics Market Trends

The Europe neuroprosthetics industry was identified as a lucrative region in 2024. The region has a strong healthcare system and a high number of neurological disorders. These factors, along with advancements in technology and growing investments in research and development, are driving the market.

The UK neuroprosthetics industry is projected to experience rapid growth in the coming years. The National Health Service (NHS) provides comprehensive healthcare coverage, ensuring that innovative treatments, such as neuroprosthetics, are accessible to a wider range of people. Furthermore, the UK government has made significant investments in neurotechnology research and development, creating an ideal environment for innovation.

Germany's neuroprosthetics industry is experiencing notable growth, primarily driven by thecountry’s advanced healthcare sector and growing studies focusing on neuroprosthetics. Moreover, the availability of a significant population suffering from kidney disorders, cardiac disorders, and neurological diseases is anticipated to drive the market growth.

Asia Pacific Neuroprosthetics Market Trends

The Asia Pacific neuroprosthetics industry is anticipated to witness the fastest CAGR of 14.50% during the forecast period. The market is expected to witness growth owing to the increasing number of technological advancements for developing neuroprosthetic devices, rising cognitive disorders such as Alzheimer’s disease, and severe depression.

The China’s neuroprosthetics industry is growing at a lucrative rate, driven by the country's robust economy and expanding healthcare infrastructure. The nation has a significant number of people with neurological disorders, and the government is making substantial investments in innovative medical technology research and development.

The neuroprosthetics industry in India is growing rapidly due to the rising incidence of Parkinson’s disease. Data from Amrita Hospital published in April 2024 indicate that India is emerging as a key market for Parkinson’s disease, with prevalence rates between 15 and 43 per 100,000 people. Approximately 40 to 45 percent of Indian PD patients develop early-onset motor symptoms between ages 22 and 49.

Latin America Neuroprosthetics Market Trends

The Latin America neuroprosthetics industry is driven by increased government investment in healthcare infrastructure, greater awareness of chronic disorders, and higher demand for advanced medical technologies. The rising incidence of hearing disorders and a growing elderly population also contribute to market growth in the region.

Middle East and Africa Neuroprosthetics Market Trends

The neuroprosthetics industry in the Middle East and Africa (MEA) is witnessing steady growth, driven by the increasing prevalence of auditory disorders, ophthalmic conditions, and neurological diseases. Hearing impairment varies significantly across age groups and regions; for example, a 2023 review of three tertiary hospitals in Riyadh reported permanent bilateral hearing loss ≥40 dB in 2.3 per 1,000 live births. In addition, a study published by BMC in October 2025 highlighted that visual impairment and blindness pose a substantial public health challenge in Saudi Arabia. This growing disease burden is expected to boost the demand for neuroprosthetic solutions, including cochlear and retinal implants.

Key Neuroproethetics Company Insights

Medtronic, LivaNovaPLC, Cochlear Ltd., Abbott, Boston Scientific Corporation, NevroCorp, Sonova, Science Corporation, among others are some of the major players in the neuroprosthetics industry. They are introducing new products, seeking regulatory approvals, and forming distribution partnerships to strengthen their competitive position.

Key Neuroproethetics Companies:

The following are the leading companies in the neuroproethetics market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- LivaNova PLC

- Cochlear Ltd.

- Abbott

- Boston Scientific Corporation

- Nevro Corp

- Sonova

- Science Corporation

- Advanced Bionics AG

- MED-EL Medical Electronics

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

Recent Developments

-

In September 2025, Case Western Reserve University launched a USD 9.9 million clinical trial of its iSens sensory-enabled neuroprosthesis, aiming to restore touch and improve prosthetic control for upper-limb amputees.

-

In April 2025, Science Corporation acquired the intellectual property and related assets of the PRIMA retinal implant from Pixium Vision SA, a bioelectronics company specializing in BCI technology, based in France.

Neuroprosthetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.8 billion

Revenue forecast in 2033

USD 47.0 billion

Growth Rate

CAGR of 13.69% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; LivaNova PLC; Cochlear Ltd.; Abbott; Boston Scientific Corporation; Nevro Corp; Sonova; Science Corporation; Advanced Bionics AG; MED-EL Medical Electronics; ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neuroprosthetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global neuroprosthetics market report based on type, technology, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Motor Prosthetics

-

Cochlear Implants

-

Cognitive Prosthetics

-

Retinal Implants

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Deep Brain Stimulation (DBS)

-

Vagus Nerve Stimulation (VNS)

-

Spinal Cord Stimulation (SCS)

-

Sacral Nerve Stimulation (SNS)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Motor Neuron Disorders

-

Parkinson’s Disease

-

Epilepsy

-

-

Physiological Disorders

-

Auditory Disorders

-

Opthalmic Disorders

-

Cardiac Disorders

-

Kidney Disorders

-

-

Cognitive Disorders

-

Alzheimer’s Disease

-

Severe Depression

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neuroprosthetics market size was estimated at USD 14.62 billion in 2024 and is expected to reach USD 16.8 billion in 2025.

b. The global neuroprosthetics market is expected to grow at a compound annual growth rate of 13.69% from 2025 to 2033 to reach USD 47.0 billion billion by 2033.

b. North America dominated the neuroprosthetics market with a share of 42.50% in 2024. This is attributable to the rising prevalence of Parkinson’s disease, epilepsy, auditory disorders, cardiac disorders, Alzheimer’s disease, and severe depression, along with the growing geriatric population in the region.

b. Some of the key players operating in the neuroprosthetics market include Medtronic, LivaNova PLC, Cochlear Ltd., Abbott, Boston Scientific Corporation, Nevro Corp, Sonova, Science Corporation, Advanced Bionics AG, MED-EL Medical Electronics, and ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD.

b. Key factors that are driving the market growth include rising incidence of neurological disorders, improvement in the quality of life of patients, and increasing R&D investment from the public and private sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.