- Home

- »

- Food Additives & Nutricosmetics

- »

-

Nisin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Nisin Market Size, Share & Trends Report]()

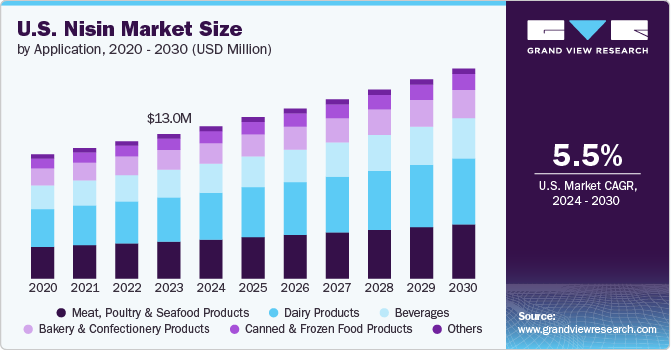

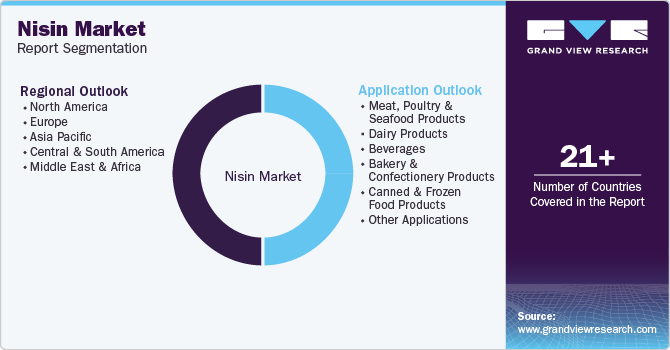

Nisin Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Meat, Poultry & Seafood Products, Dairy Products, Beverages, Bakery & Confectionery Products), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-436-2

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nisin Market Summary

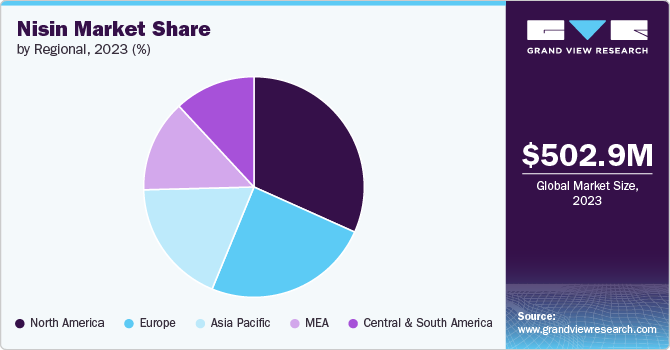

The global nisin market size was estimated at USD 502.93 million in 2023 and is projected to reach USD 691.12 million by 2030, growing at a CAGR of 4.7% from 2024 to 2030. This growth is due to the increasing number of health-conscious consumers, who have become more aware of the importance of organic ingredients in food and beverages, leading to a higher demand for nisin.

Key Market Trends & Insights

- The North America dominated the market and accounted for a 31.7% share in 2023.

- The Asia Pacific market is expected to grow due to the food industry in the region.

- Based on application, the dairy products dominated the market with a market and accounted for a revenue share of 30.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 502.93 Million

- 2030 Projected Market Size: USD 691.12 Million

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

Nisin is a polycyclic peptide derived from the bacterium Lactococcus lactis. It serves as a bactericidal food preservative. It effectively targets a wide range of gram-positive bacteria responsible for food spoilage, including Bacillus subtilis, Staphylococcus aureus, Listeria, Clostridium botulinum, and their spores. Nisin's effectiveness in controlling microbial growth at average and frozen temperatures eliminates the need for heat sterilization of packaged food products.

Drivers, Opportunities & Restraints

Nisin is a potent antimicrobial peptide produced by Lactococcus lactis and is widely recognized for its role as a natural food preservative. It effectively inhibits the growth of a broad spectrum of bacteria, including many pathogenic and spoilage ones, making it highly valued in the food industry, particularly in dairy products, canned foods, and meats. Beyond its food preservation capabilities, nisin exhibits therapeutic benefits, such as anti-inflammatory and anticancer properties. It has been explored for use in medical applications like treating infections and as a potential natural alternative to antibiotics. This dual functionality, both as a preservative and a compound with health-promoting properties, underscores nisin's unique and valuable role in various applications.

Alternative preservation techniques can be crucial in reducing the reliance on nisin as a food preservative. High-pressure processing pulsed electric fields and ultraviolet light treatment effectively inhibit microbial growth without needing antimicrobial peptides. Moreover, fermentation, using cultures other than Lactococcus lactis, can naturally extend the shelf life of foods while enhancing their flavors and nutritional value. Adopting these innovative and diverse preservation strategies could sustain food safety and quality and alleviate the demand for nisin, promoting a broader approach to food preservation that could be more sustainable and less dependent on specific antimicrobial agents.

In the brewery industry, implementing alternative preservation techniques could significantly enhance product quality and sustainability. High-pressure processing could extend the shelf life of beers while maintaining their taste and aroma, unlike traditional chemical preservatives. Pulsed electric fields and ultraviolet light treatment can be applied for the non-thermal pasteurization of beer, ensuring microbial safety without altering its sensory properties. Additionally, exploring fermentation methods with different cultures could introduce unique flavors and potentially health-beneficial properties to beers. Adopting these novel strategies could reduce reliance on conventional preservatives like nisin and meet consumer demand for naturally preserved, flavorful, and healthier beer options.

Application Insights

“Dairy Products emerged as the fastest growing application with a CAGR of 5.0%”

Dairy products dominated the market with a market and accounted for a revenue share of 30.7% in 2023. Nisin is widely utilized as a natural preservative due to its potent antimicrobial properties against spoilage organisms and pathogens, particularly Gram-positive ones. This peptide, produced by Lactococcus lactis, effectively extends the shelf life of dairy products such as cheese, yogurt, and milk. Its application helps prevent unwanted bacteria growth without affecting the product's taste, aroma, or nutritional value. Furthermore, nisin's use aligns with consumer preference for clean-label ingredients and natural preservation methods. By incorporating nisin, dairy producers can ensure the safety and quality of their products while catering to health-conscious consumers.

Nisin is also beneficial in the meat, poultry, and seafood industries, where it serves as a natural preservative, safeguarding products against spoilage and pathogenic bacteria, particularly Gram-positive ones. Its efficacy in extending the shelf life of these products ensures that they remain fresh and safe for consumption over a more extended period. By incorporating nisin, producers in these industries can maintain the quality and safety of their products, aligning with the growing consumer demand for natural and clean-label ingredients. This enhances the product's marketability and supports public health by reducing the risk of foodborne illnesses.

Regional Insights

“U.S. emerged as the fastest growing region in Asia Pacific with a CAGR of 5.5% in 2030”

North America dominated the market and accounted for a 31.7% share in 2023. The increasing demand for product markets from the food industry is expected to drive the demand for nisin in this region.

Mexico nisin market dominated the market and accounted for a market share of 44.0% in 2023. This growth is attributed to the increasing demand for food in the country. Mexico is one of the regions with highest food consumption country, leading to a rise in demand for product market in the region.

Asia Pacific Nisin Market Trends

The Asia Pacific market is expected to grow due to the food industry in the region. This growth will lead to a rise in demand for nisin, which is used in the food industry to prevent food-borne diseases in the region. Due to the rising population and to meet the demand of the growing population, nisin plays an important role in the food industry.

Europe Nisin Market Trends

Europe plays a significant role in the nisin market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for the food industry in the region leading to increased demand for product market.

Key Nisin Company Insights

Some of the key players operating in the global nisin market include

-

DSM is a science-based company specializing in beauty, health, and nutrition. The company's primary activities include manufacturing, innovation, and combining essential flavors, fragrances, and nutrients. DSM produces various products, including carotenoids, vitamins, specialty plastics, nutritional lipids, resin solutions, and fiber. Its products and services are used in multiple industries, such as chemicals, cosmetics, pharmaceuticals, food and beverages, biomedical materials, and medical nutrition. The company operates in Switzerland, the Netherlands, EMEA, North America, Latin America, China, and Asia.

-

DuPont Inc. provides technology-based materials and solutions. The company supplies materials and printing systems to the advanced materials and printing industry and solutions for fabricating semiconductors and integrated circuits throughout manufacturing. Its product portfolio includes advanced printing, adhesives, construction materials, animal nutrition, electronic solutions, biomaterials, fibers, fabrics, food & beverage ingredients, nonwovens, medical devices, and industrial films. DuPont has a global presence.

Cayman Chemicals and Huntsman advanced materials are some of the emerging market participants in the global nisin market.

-

Cayman Chemicals produces and supplies biochemical products and kits for life science research. The company offers purification and characterization of biochemicals, including small drug-like heterocycles, complex lipids, and fatty acids. Additionally, it is involved in the pre-clinical discovery of drugs in bone structure and muscular dystrophy, repair, inflammation, and oncology. Its product range includes assay kits, antibodies, biochemicals, and recombinant proteins.

-

Siveele B.V. develops natural protective ingredients and solutions for the pharmaceutical, food, feed, and personal and health care industries. Its products include bakery wares, beverages, culinary items, sauces and seasonings, dairy products, eggs and eggs, fruits and vegetables, meat and meat products, fish and seafood, and personal care products. The company aims to share its knowledge of natural ingredients and solutions with customers and distributors to create safer and healthier products.

Key Nisin Companies:

The following are the leading companies in the nisin market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Galactic

- DuPont

- Cayman Chemicals

- Siveele B.V.

- Zhejiang Silver-Elephant Bioengineering

- Shandong Freda Biotechnology

- Chihon Biotechnology

- Mayasan Biotech

- Handary S.A.

Recent Developments

-

In January 2022, DSM launched a new food & beverage ingredient business group to provide various end users with a full range of texture, taste, and health solutions. DSM is a global science-based nutrition, health, and materials company.

-

In January 2021, In the Middle East and Africa, DuPont introduced NovaGARD NR 100-G, antimicrobial preservatives containing nisin and rosemary. This preservative is designed explicitly for processed meat manufacturers.

Nisin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 525.06 million

Revenue forecast in 2030

USD 691.12 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

DSM; Galactic; DuPont; Cayman Chemicals; Siveee B.V.; Zhejiang Silver-Elephant Bioengineering; Shandong Freda Biotechnology; Chihon Biotechnology; Mayasan Biotech; Handary S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nisin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nisin market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Meat, Poultry & Seafood Products

-

Dairy Products

-

Beverages

-

Bakery & Confectionery Products

-

Canned & Frozen Food Products

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nisin market size was estimated at USD 502.93 million in 2023 and is expected to reach USD 525.06 million in 2024.

b. The global nisin market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 691.12 million by 2030.

b. North America dominated the nisin market with a share of 31.2% in 2023. The increasing demand for product markets from the food industry is expected to drive the demand for nisin in this region.

b. Some key players operating in nisin market include DSM, Galactic, DuPont, Cayman Chemicals, Siveee B.V., Zhejiang Silver-Elephant Bioengineering, Shandong Freda Biotechnology, Chihon Biotechnology, Mayasan Biotech, and Handary S.A.

b. This growth is due to the increasing number of health-conscious consumers, who have become more aware of the importance of organic ingredients in food and beverages, leading to a higher demand for nisin.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.