- Home

- »

- Plastics, Polymers & Resins

- »

-

Nitrile Butadiene Rubber Market Size & Share Report, 2030GVR Report cover

![Nitrile Butadiene Rubber Market Size, Share & Trends Report]()

Nitrile Butadiene Rubber Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hoses, Belts, Cables, Molded & Extruded Products), By Application (Automotive, Mechanical Engineering, Oil & Gas), By Region, And Segment Forecasts

- Report ID: 978-1-68038-207-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nitrile Butadiene Rubber Market Trends

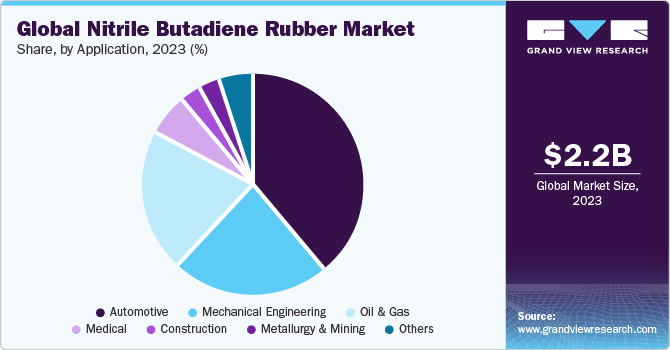

The global nitrile butadiene rubber market size was valued at USD 2.24 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Extensive utilization of nitrile butadiene rubber (NBR) across the automotive and transportation industry along with usage across hoses & gaskets across the oil & gas industry are anticipated to propel the demand for NBR. However, since acrylonitrile and butadiene are both the major raw materials for NBR, fluctuations across the prices of these raw materials poses as a challenge for the market. Furthermore, the NBR market space is highly competitive, since many manufacturers are indulged in implementing strategic initiatives such as production expansion, new product launch, merger & acquisitions, and other. For instance, in May 2023, ARLANXEO announced the beginning of construction for its synthetic rubber production plant in Jubail, Saudi Arabia, with a production capacity of 140 kilotons per annum.

The Chinese market is anticipated to witness significant growth over the forecast period owing to the rising demand for the product in end-use industries including automotive, construction, oil & gas, metallurgy & mining, medical, and others. China is one of the prominent producers as well as consumers of automobiles across the globe, which, further contributes to the demand for nitrile butadiene rubber in the automobile industry.

China is one of the major producers of oil & gas in Asia Pacific region. According to the U.S. Energy Information Administration, the country accounted for approximately 5% of the global oil production in 2022. Thus, oil & gas industry is anticipated to create significant demand for nitrile butadiene rubber during the forecast period.

Growing middle-class population, improving standards of living, and rising disposable income are the major factors contributing to the growth of the construction industry, which, in turn, is expected to generate a demand for nitrile butadiene rubber over the forecast period. Furthermore, government initiatives, such as Make in India, Smart Cities Mission, and Housing for All, are likely to boost the growth of the construction industry in the coming years.

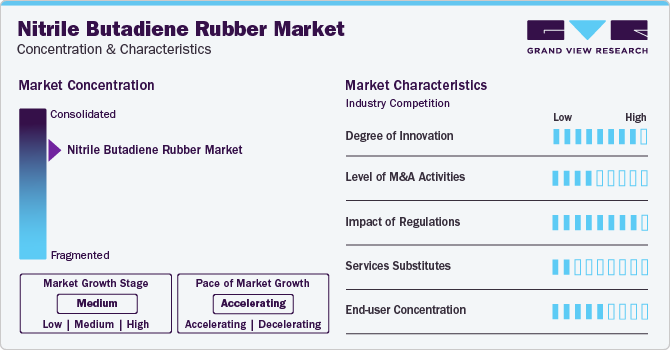

Market Concentration & Characteristics

Market growth stage is high, and pace of market growth is accelerating owing to overly consolidated market. Nitrile butadiene rubber (NBR) manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, production expansion, among others.

For instance, in January 2023, Kumho Petrochemicals Co. Ltd. announced its plans for expansion of its nitrile butadiene rubber (NBR) production capacity in South Korea. The plant is estimated to produce 20 kilotons per annum nitrile butadiene rubber whilst the commencement of its operations.

Product Insights

Seals & O-rings dominated product segmentation for 2023 in terms of revenue share above 19.0%. Seals & O-rings are used in various pressure-sensitive applications to prevent the loss of a fluid or gas. They are employed on a large-scale in automobile components such as engines, doors, braking systems, power steering systems, batteries, and others. Rising trend of electric vehicles is anticipated to propel the growth of the automobile industry in the coming years, which is projected to fuel the demand for nitrile butadiene rubber over the forecast period. Seals & O-rings are also used in the oil & gas, industrial machinery, mining, construction, and other end-use industries.

Followed by molded & extruded products with a market share of above 15.0% in 2023. Nitrile rubber is widely utilized in the production of molded nitrile gaskets, washers, and others, owing to its properties such as corrosion resistance, abrasion resistance, wear resistance, and low permeability of fuel & gas. Molded rubber gaskets are employed on a large-scale in high-pressure systems due to their high chemical & temperature resistance.

Application Insights

Automotive dominated the application segmentation in 2023 with a market revenue share above 38.0%. Automotive was the largest end-use segment in the nitrile butadiene rubber market in 2020 and this trend is projected to continue over the forecast period. The automotive segment includes automobiles, earth moving equipment, and industrial machinery & equipment. Growing demand for nitrile butadiene rubber products such as seals & O-rings, hoses, belts, molded products, cables, and others are expected to fuel market growth over the forecast period.

Followed by mechanical engineering with a market revenue share of above 23.0% in 2023. NBR is utilized for the manufacturing of O-rings which are highly used across mechanical engineering, including machinery used for the manufacturing of vehicles in the production units, pumps used across vehicles in the construction industry, and others. Furthermore, gaskets manufactured using NBR have witnessed high utilization across compression machines, and hydraulic equipment prevents leakage of gas or liquid. Advancements in technology has increased the demand for machinery to reduce labor work and increase efficiency across every industry, hence propelling the demand for NBR across mechanical engineering during the forecast period.

Regional Insights

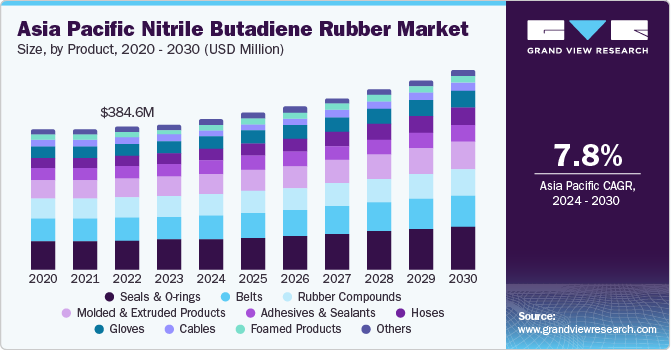

In 2023, Asia Pacific dominated global automotive plastics market with a market share of above 33.0%. Increasing demand from several end-use industries such as automotive, oil & gas, footwear, metallurgy & mining, construction, medical, and others are anticipated to fuel the market growth during the forecast period. Zeon Chemicals L.P., JSR Corporation, PetroChina Company Limited, LG Chem Ltd., Kumho Petrochemical Co., Ltd., and Apcotex Industries Limited, are some of the nitrile butadiene polymer rubber producers operating in the region.

Availability of cheap labor as well as close proximity to raw material suppliers, coupled with favorable FDI norms by governments, is further projected to facilitate investment in the industrial sector in Asia Pacific, which is likely to propel the demand for nitrile butadiene rubber in the automotive, industrial machinery, construction, footwear, and other end-use industries.

Followed by Europe with a market revenue share of above 29.0%in 2023. Europe witnessed significant demand in the past few years owing to high consumption of nitrile rubber in industrial & medical gloves and automobile markets. Industrial & medical gloves segment is expected to witness the highest growth rate on account of well-established medical industry in the region coupled with a large number of chemical processing units.

Key Companies & Market Share Insights

Most of key players operating in market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements.

Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives for maintaining competitive environmental.

Key Nitrile Butadiene Rubber Companies:

- ARLANXEO

- Zeon Chemicals L.P.

- NITRIFLEX

- SIBUR

- PetroChina Company Limited

- Dynasol Group

- Synthos S.A.

- KUMHO PETROCHEMICAL

- LG Chem

- Versalis S.p.A.

- JSR Corporation

- AirBoss of America

- Atlantic Gasket Corporation

- Precision Associates, Inc.

- Anqing Hualan Technology Co., Ltd.

- NANTEX Industry Co., Ltd

- Apcotex Industries Limited

- Chang Rubber

- Hanna Rubber Company

Recent Developments

Some key players operating in market include China Petroleum & Chemical Corporation (Sinopec), ARLANXEO; Zeon Chemicals L.P.; NITRIFLEX; SIBUR; Dynasol Group; among others.

-

In May 2023, Sinopec initiated operations for its new synthetic rubber plant in Hainan, China. The project is a joint venture in between Baling New Material and Sinopec’s subsidiary Hainan Refining & Chemical, Co.

Nitrile Butadiene Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.33 billion

Revenue forecast in 2030

USD 3.26 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; India; Japan; South Korea; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

ARLANXEO; Zeon Chemicals L.P.; NITRIFLEX; SIBUR; PetroChina Company Limited; Dynasol Group; Synthos S.A.; KUMHO PETROCHEMICAL; LG Chem; Versalis S.p.A.; JSR Corporation; AirBoss of America; Atlantic Gasket Corporation; Precision Associates, Inc.; Anqing Hualan Technology Co., Ltd.; NANTEX Industry Co., Ltd.; Apcotex Industries Limited; Chang Rubber; and Hanna Rubber Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitrile Butadiene Rubber Market Report Segmentation

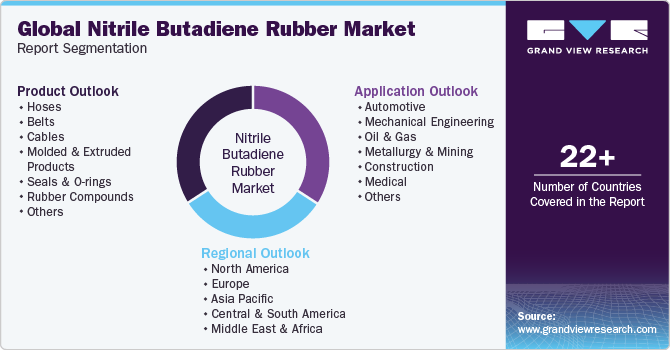

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For purpose of this study, Grand View Research has segmented global nitrile butadiene rubber market report on basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hoses

-

Belts

-

Cables

-

Molded & Extruded Products

-

Seals & O-rings

-

Rubber Compounds

-

Adhesives & Sealants

-

Gloves

-

Foamed Products

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Mechanical Engineering

-

Oil & Gas

-

Metallurgy & Mining

-

Construction

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nitrile butadiene rubber market size was estimated at USD 2.24 billion in 2023 and is expected to reach USD 2.33 billion in 2024.

b. The global nitrile butadiene rubber market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 3.26 billion by 2030.

b. The seals & O-rings segment dominated the nitrile butadiene rubber market with a share of 19.09% in 2023. Seals & O-rings are used in various pressure-sensitive applications and are widely used in automobile engines as reciprocating and rotary seals for relative motion between inner and outer elements.

b. Some key players operating in the nitrile butadiene rubber market include ARLANXEO, KUMHO PETROCHEMICAL, PetroChina Company Limited, Synthos S.A., Zeon Chemicals L.P., SIBUR, and JSR Corporation.

b. Key factors driving the nitrile butadiene rubber market growth include ascending demand from oil & gas industry, and increasing demand from the automotive industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.