- Home

- »

- Consumer F&B

- »

-

Nitro-infused Beverages Market Size & Share Report, 2030GVR Report cover

![Nitro-infused Beverages Market Size, Share & Trends Report]()

Nitro-infused Beverages Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Nitro Coffee, Nitro Tea, Nitro Soft Drinks), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-966-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nitro-Infused Beverages Market Summary

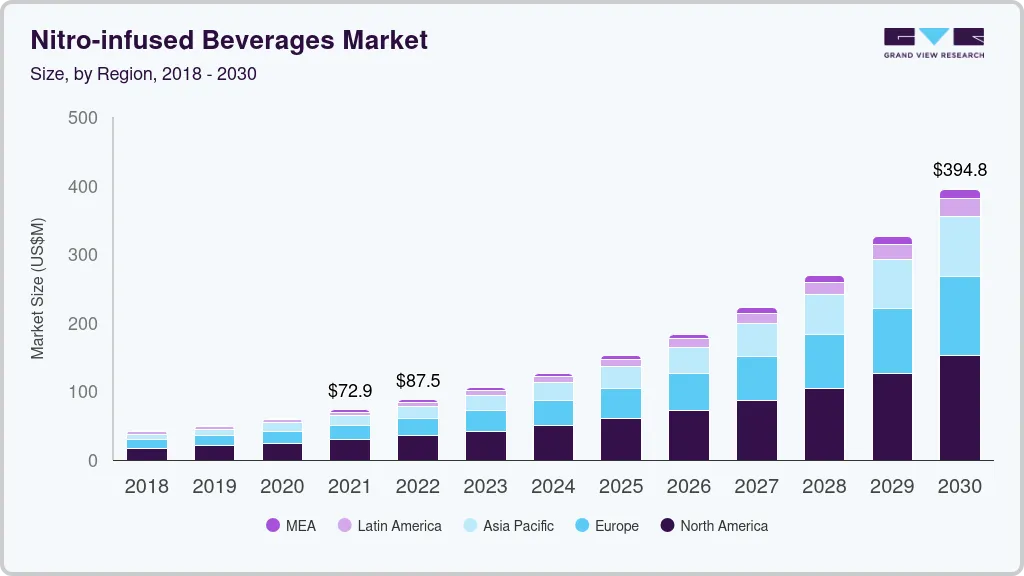

The global nitro-infused beverages market size was estimated at USD 72.9 million in 2021 and is projected to reach USD 394.8 million by 2030, growing at a CAGR of 20.6% from 2022 to 2030. The market growth is attributed to the rapidly growing demand for ready-to-drink beverages across developing and developed nations.

Key Market Trends & Insights

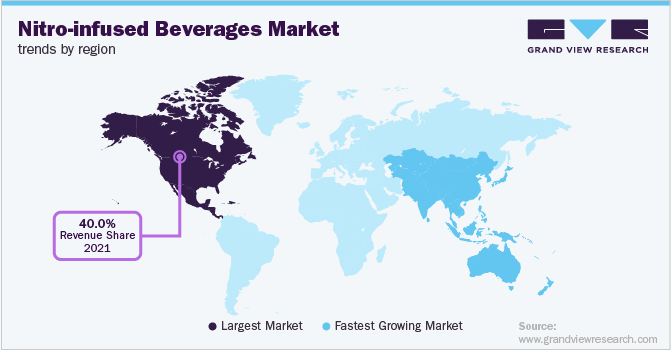

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, Germany is expected to register the highest CAGR from 2022 to 2030.

- In terms of segment, nitro coffee accounted for a revenue of USD 43.1 million in 2021.

- Nitro Soft Drinks is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 72.9 Million

- 2030 Projected Market Size: USD 394.8 Million

- CAGR (2022-2030): 20.6%

- North America: Largest market in 2021

Moreover, the rising demand for healthy and low-sugar drinks due to the growing health concerns among consumers is propelling the industry growth. Furthermore, the rising rapid urbanization, the increasing middle-class population, and the rising number of youngsters across the developing economies have encouraged the adoption of convenience-oriented lifestyles and have increased the demand for ready-to-drink nitro-infused drinks around the globe.

The outbreak of coronavirus across the globe adversely affected the global economy. To discontinue the chain and spread of COVID-19, lockdown guidelines were imposed by various nations around the world. During the pandemic, there was a high demand for healthy diet items, particularly ready-to-drink beverages and low-sugar food products, which boosted the industry growth. Moreover, the considerable increase in online sales of beverage products during the shutdown aided industry growth. During the COVID-19 pandemic, consumers spent more time at home, which raised consumer interest in personal health and weight management that further increased the sales of less sweetened products.

The growing trend of shifting consumers’ preferences toward convenience beverages i.e., ready-to-drink beverages, and the organized retail market, especially in developing economies, are projected to boost the industry growth during the forecast period. Furthermore, continuously shifting consumer behavior and drinking habits and rising demand for new products among consumers are propelling the industry growth. Moreover, the growth of the market is anticipated to be accelerated by the fact that the infusion of nitrogen significantly improves the taste and texture of the brew. However, the increasing prices of raw materials such as coffee and tea across the globe are hindering the industry growth.

The companies are investing in research and development activities and innovating new products with nitro-infusion like soft drinks, cocktails, and other beverages. Additionally, the continuous development of innovative and attractive packaging of nitro-infused drinks is a major trend in the market and accelerates the demand for ready-to-drink beverages in developing nations. Moreover, the increasing demand for various flavored nitro-infused beverage products is expected to drive the market over the forecast period. Furthermore, the rising demand for premium quality beverage products due to the freshness, taste, mouthfeel, and diversity of the products is expected to boost the industry growth over the forecast period.

Product Insights

The nitro coffee segment held the largest revenue share of over 55.0% in 2021. The increasing consumption of ready-to-drink coffee across the globe is accelerating the industry growth. Moreover, the rising adoption of modern values and lifestyles is expected to accelerate industry growth. With the rising popularity of cold brew coffee in developing economies, companies are expanding their product offerings to attract consumers around the world. For instance, Starbucks has introduced ready-to-drink nitro cold brew, which comes in three flavors: dark caramel, vanilla sweet cream, and black.

The nitro soft drinks segment is expected to register the fastest growth rate of 23.4% from 2022 to 2030. The increasing consumption of soft drinks in developed and developing economies is fueling the industry growth. The rising demand for cold brew, coupled with the growing spending power of consumers across the globe, is accelerating industry growth. Moreover, the growing trend of nitro-infused beverages among millennials across the globe is projected to propel industry growth over the forecast period. Furthermore, the companies are introducing new nitro soft drinks with unique tastes and textures to expand their product portfolio across the globe.

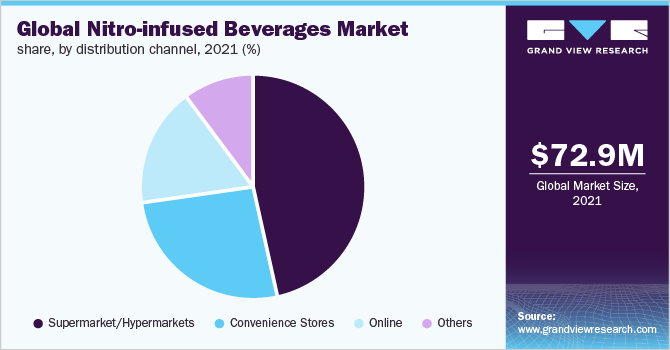

Distribution Channel Insights

The supermarkets/hypermarkets segment held the largest revenue share of over 45.0% in 2021. The growing consumers’ preference for hypermarkets and supermarkets for buying consumer goods, grocery, and beverage products, where they can physically verify product quality is accelerating the industry growth. Furthermore, the rising penetration of hypermarkets and supermarkets in emerging economies will boost the sales of nitro-infused drinks through this distribution channel. Walmart; Aldi; Kroger; 7-Eleven Inc.; Ahold Delhaize; and Carrefour are the leading supermarket chains in the world.

The online segment will register the fastest CAGR of 21.8% from 2022 to 2030. This can be attributed to the rising popularity and usage of e-commerce platforms across the globe. Moreover, the increasing penetration of the internet and smartphones across the globe is fueling segment growth. Most of the manufacturers are collaborating with online retailers planning to reach out to new customers. Also, an increase in the sales of ready-to-drink beverages mostly through company-owned websites and other e-commerce platforms is further expected to accelerate the growth of the online distribution channel segment over the forecast period.

Regional Insights

North America held the largest revenue share of over 40.0% in 2021 due to the rising spending power of millennials, along with the growing preference for ready-to-drink beverages in this region. Moreover, the increasing demand for nitro-infused drinks is accelerating market growth. Furthermore, several manufacturers are focusing on introducing new variants of the product through several distribution channels, which is also likely to have a positive impact on the market. Additionally, the growing investments in premium and healthy beverage product launches by the manufacturers are expected to accelerate regional market growth during the forecast period.

Asia Pacific is expected to expand at the highest CAGR of 22.2% from 2022 to 2030. The increasing middle-class population, disposable income, and rapid urbanization are the major factors driving the regional market. Furthermore, the extended retail market, along with growing buying power in the countries, including China and India, is anticipated to boost the demand for ready-to-drink beverages. Moreover, the increasing millennial population and rising consumer spending on beverages are expected to propel market growth. Additionally, the growing penetration of multiple supermarkets, retail shops, and online stores for purchasing nitro-infused beverages is propelling the market growth in this region.

Key Companies & Market Share Insights

Small and large players are introducing innovative products and expanding their portfolios in order to appeal to consumers across the globe. Moreover, several manufacturers of nitro-infused beverages are witnessing a high demand for the product, especially among the millennials.

-

In February 2022, PepsiCo announced the launch of Nitro Pepsi, the first-ever nitrogen-infused cola. The creamy, smooth texture has been made possible by an exclusive widget placed at the bottom of each can.

-

In February 2021, Cruise Beverages announced the launch of a new line of Nitro-infused CBD Craft drinks. These highly functional beverages offer an alternative to alcoholic drinks. They are intended to stimulate focus and help people manage anxiety and stress without the feelings of a sugar crash or a hangover.

Some prominent players in the global nitro-infused beverages market include:

-

Rise Brewing Co.

-

Starbucks Corporation

-

Lucky Jack

-

Califia Farms

-

Caveman Coffee Co.

-

Left Hand Brewing Co.

-

Monster Energy Company

-

PepsiCo

-

Quivr

-

Bona Fide Nitro Coffee and Tea

-

Nitro Beverage Co.

-

Funkin Cocktails

-

BEANLY

-

East Forged

-

Cruise Beverages

Nitro-infused Beverages Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 87.5 million

Revenue forecast in 2030

USD 394.8 million

Growth rate

CAGR of 20.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy Spain; China; India, Japan; South Korea; Indonesia; South Africa; Brazil

Key companies profiled

Rise Brewing Co.; Starbucks Corporation; Lucky Jack; Califia Farms; Caveman Coffee Co.; Left Hand Brewing Co.; Monster Energy Company; PepsiCo; Quivr; Bona Fide Nitro Coffee and Tea; Nitro Beverage Co.; Funkin Cocktails; BEANLY; East Forged; Cruise Beverages

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitro-infused Beverages Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global nitro-infused beverages market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Nitro Coffee

-

Nitro Tea

-

Nitro Soft Drinks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarket/Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global nitro-infused beverages market size was estimated at USD 72.9 million in 2021 and is expected to reach USD 87.5 million in 2022.

b. The global nitro-infused beverages market is expected to grow at a compound annual growth rate of 20.6% from 2022 to 2030 to reach USD 394.8 million by 2030.

b. Nitro coffee dominated the nitro-infused beverages market with a share of 59.1% in 2021. This is attributable to increasing consumption ready to drink coffee, rising adoption of modern values and lifestyles, and rising popularity of cold brew coffee in developing economies and companies.

b. Some key players operating in the nitro-infused beverages market include Rise Brewing Co.; Starbucks Corporation; Lucky Jack; Califia Farms; Caveman Coffee Co.; Left Hand Brewing Co.; Monster Energy Company; PepsiCo; Quivr; Bona Fide Nitro Coffee and Tea; Nitro Beverage Co.; Funkin Cocktails; BEANLY; East Forged; and Cruise Beverages.

b. Key factors that are driving the nitro-infused beverages market growth include the growing rapid demand for ready-to-drink beverages across developing and developed nations, rising demand for healthy and low-sugar drinks and rising rapid urbanization, and the increasing middle-class population, and the rising number of youngsters across the developing economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.