- Home

- »

- Medical Devices

- »

-

Non-invasive Coronary Imaging Market, Industry Report 2030GVR Report cover

![Non-invasive Coronary Imaging Market Size, Share & Trends Report]()

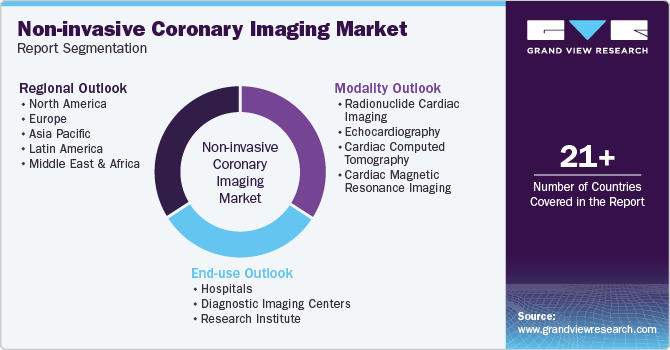

Non-invasive Coronary Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (Radionuclide Cardiac Imaging, Echocardiography, CAT, CMR), By End-use (Hospitals, Diagnostic Imaging Centers, Research Institute) By Region, And Segment Forecasts

- Report ID: GVR-4-68039-998-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

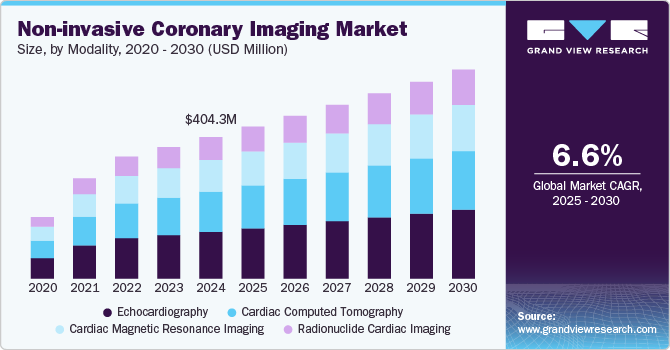

The global non-invasive coronary imaging market size was estimated at USD 404.3 million in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The growth of the non-invasive coronary imaging industry is primarily driven by the rising prevalence of cardiovascular diseases (CVDs), fueled by unhealthy lifestyles and chronic conditions such as obesity and diabetes. In addition, the expanding aging population, which is more vulnerable to heart conditions, has increased the need for accurate and early detection methods. Rapid technological advancements, such as AI-driven image analysis and high-resolution imaging systems, have further enhanced diagnostic precision and efficiency.

The growing prevalence of cardiac disorders, including coronary artery disease (CAD) and other cardiovascular conditions worldwide, is significantly driving the adoption of advanced non-invasive coronary imaging methods. For instance, the WHO, reports that cardiovascular diseases (CVDs) are the leading global cause of mortality, claiming approximately 17.9 million lives annually. These disorders are becoming increasingly common due to factors such as sedentary lifestyles, unhealthy dietary habits, rising obesity rates, and aging populations. Non-invasive imaging techniques, such as Cardiac CT, MRI and echocardiography, offer a safer, quicker, and more accurate means of diagnosing and monitoring these conditions without the risks associated with invasive procedures. These methods allow for detailed visualization of coronary arteries, enabling early detection of blockages or abnormalities, which is essential for timely intervention and improved patient outcomes.

Advancements in imaging technology, such as AI-enhanced analysis and high-resolution imaging, have further boosted their adoption by ensuring precise diagnoses while reducing the burden of radiation exposure or contrast-related complications. This combination of rising disease prevalence, patient safety concerns, and technological innovation has established non-invasive coronary imaging as a preferred choice in cardiac care.

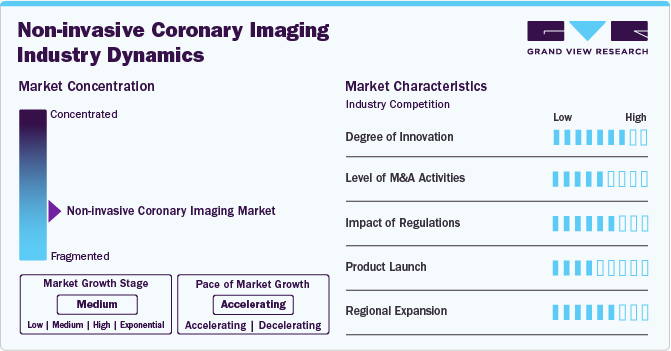

Market Concentration & Characteristics

The non-invasive coronary imaging industry is growing at a significant rate, owing to advancements in technology and an increasing global demand for safer, more efficient diagnostic solutions, growing awareness of the benefits of early detection and preventive care among patients and healthcare providers, leading to the widespread adoption of non-invasive imaging methods. The surge in demand is also fueled by the rising prevalence of cardiovascular diseases (CVDs) worldwide, which remain a leading cause of mortality.

Companies in the non-invasive coronary imaging industry are leveraging strategic partnerships and collaborations to strengthen their industry position and expand competitive advantages. For instance, in August 2023 between SSM Health and Siemens Healthineers the 10-year strategic partnership was announced. This collaboration focuses on enhancing access to high-quality healthcare services and fostering the development of the next generation of healthcare professionals. By combining Siemens Healthineers’ advanced imaging technologies with SSM Health’s extensive healthcare network, the partnership aims to deliver innovative solutions and improve patient outcomes. Furthermore, this agreement represents Siemens Healthineers' most extensive geographic partnership to date, reflecting the growing trend of large-scale collaborations to address evolving healthcare demands and drive industry growth.

The degree of innovation in the non-invasive coronary imaging industry is high, driven by continuous advancements in technology in response to the growing need for accurate and early diagnosis of cardiovascular diseases (CVDs). For instance, in November 2024, SCHILLER introduced the new medilogFD Holter ECG device, a 12-lead Holter ECG designed to provide comprehensive heart health analysis with spatial precision.

Industry players are actively engaging in mergers and acquisitions to strengthen their position, expand their product offerings, and enhance their technological capabilities. For instance, in January 2023, GE HealthCare entered into an agreement to acquire a France-based company, IMACTIS, an innovator in the quickly expanding area of Computed Tomography (CT) interventional guide across the variety of healthcare settings.

Regulations significantly impact non-invasive coronary imaging by ensuring safety, effectiveness, and quality. Health authorities like the FDA and EMA impose stringent approval processes for new devices, maintaining high patient care standards. These regulations, however, can create industry entry barriers due to extensive testing and compliance requirements. Despite these challenges, they ensure trust in innovative technologies and patient safety.

Manufacturers in the non-invasive coronary imaging industry are frequently launching new products to meet the growing demand for advanced diagnostic solutions. For instance, in November 2024, Philips announced that its next-generation 1.5T BlueSeal MR wide-bore scanner will be revealed at RSNA 2024. This advanced scanner boasts a 70 cm wide-bore design and incorporates AI-driven MR Smart Workflow solutions, aimed at improving accessibility and diagnostic accuracy to enhance patient outcomes.

Industry players are actively focused on regional expansion by establishing a presence in various countries to increase their availability and reach. In July 2023, Siemens Healthineers AG, inaugurated its new Innovation Center in Erlangen, Germany, situated at the epicenter of the regional medical technology research hub known as Medical Valley.

Modality Insights

The Echocardiography segment dominated the market by capturing a share of 33.1% in 2024. This dominance can be attributed to factors such as its cost-effectiveness, widespread availability, and non-invasive nature, making it a preferred choice for routine cardiovascular assessments. In addition, advancements in echocardiography technology, including 3D imaging and improved Doppler capabilities, have enhanced diagnostic accuracy. The ability to assess heart function and detect abnormalities in real-time, along with its portability and ease of use, further drives the widespread adoption of echocardiography in clinical settings.

The radionuclide cardiac imaging segment is expected to grow at a fastest CAGR of 7.3% over the forecast period. This growth can be attributed to the increasing demand for advanced imaging techniques that provide detailed insights into myocardial perfusion and function. Radionuclide imaging, such as SPECT and PET, offers high sensitivity for detecting coronary artery disease, ischemia, and other cardiac conditions. Furthermore, advancements in technology, such as improved imaging systems, along with growing awareness of the benefits of early, non-invasive cardiovascular disease detection, are expected to further support the segment's expansion. In October 2024, at the European Association of Nuclear Medicine (EANM) 2024 Congress, GE HealthCare introduced the Aurora dual-head SPECT/CT system, powered by AI technologies. This innovative system is designed to enhance clinicians' capabilities, expanding the range of procedures for cardiac patients and supporting the detection and localization of abnormalities in conditions such as cancer and neurological disorders, all of which depend on early, precise intervention.

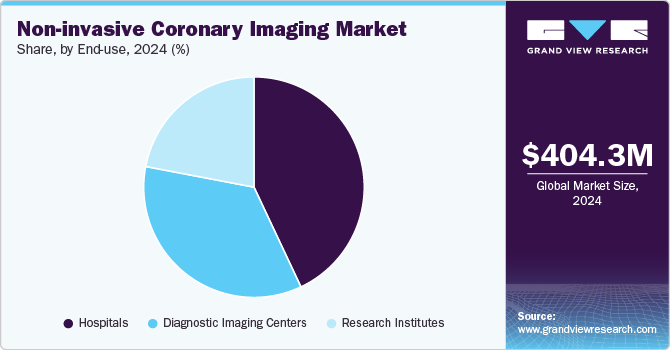

End-use Insights

The hospital segment dominated the market by capturing a share of 42.6% in 2024. This is owing to the growing number of patient visits to hospitals, driven by the increasing prevalence of cardiovascular diseases. In addition, hospitals are increasingly adopting advanced diagnostic technologies, which enhances their ability to provide accurate and timely diagnoses. The demand for non-invasive coronary imaging in emergency settings, particularly for rapid ECG assessments, further contributes to the segment's growth, as hospitals are the primary healthcare facilities equipped to handle urgent cardiac care needs.

The research institutes segment is expected to grow at the fastest rate of 7.1% over the forecast period. This growth can be attributed to increasing investments in cardiovascular research and development, driven by the rising prevalence of heart diseases and the need for innovative diagnostic solutions. Research institutes play a crucial role in advancing non-invasive coronary imaging technologies, including AI-driven analytics and high-resolution imaging techniques. Collaborations between academic institutions and industry players further drive the segment, enabling access to advanced technologies and funding. In addition, government and private grants supporting medical research initiatives are expected to fuel the expansion of this segment.

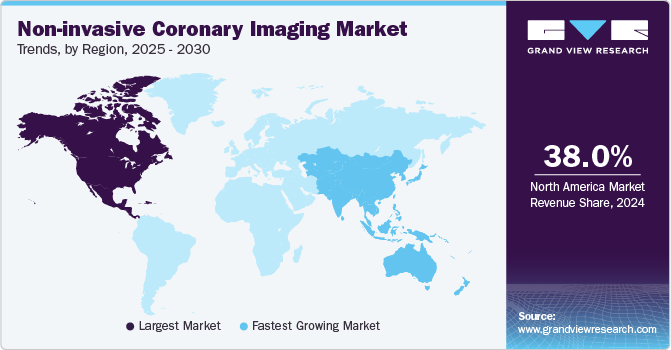

Regional Insights

North America non-invasive coronary imaging market held the largest share of 38% in 2024. This dominance is primarily attributed to the presence of major market players in the region and their strategic efforts to strengthen their presence. Companies have been actively expanding their operations and enhancing their market influence through initiatives like new subsidiaries and partnerships. For instance, in November 2022, Canon Medical Systems Corporation established a new subsidiary, Canon Healthcare USA, Inc., underscoring its commitment to expanding its presence in the U.S. medical market and advancing the development of its healthcare business. These efforts, combined with a well-established healthcare infrastructure and high demand for advanced diagnostic solutions, have positioned North America as a leading market for non-invasive coronary imaging.

U.S. Non-invasive Coronary Imaging Market Trends

The U.S. non-invasive coronary imaging market held the largest market share in the North America region. This is attributed to the rising prevalence of cardiovascular disorders in the country. For instance, data published by the CDC in 2022 reported that 702,880 people in the U.S. died from heart disease, accounting for 1 in every 5 deaths. In addition, the growing adoption of advanced technologies is anticipated to further fuel market growth.

Europe Non-invasive Coronary Imaging Market Trends

Europe Non-invasive Coronary Imaging Market held a significant market share in 2024, driven by the presence of key industry players and their strategic initiatives, such as product launches. For instance, in July 2024, AliveCor introduced its InstantQT in Europe, enabling physicians to remotely capture point-of-care ECG recordings. This device allows physicians to record ECGs and assess patients for potential cardiac abnormalities in under one minute.

UK non-invasive coronary imaging market is experiencing significant growth, owing to the rising incidence of cardiovascular diseases (CVD) in the country. CVDs, including coronary artery disease, remain a leading cause of morbidity and mortality in the UK, creating a growing demand for advanced diagnostic tools. Non-invasive coronary imaging plays a critical role in diagnosing and managing these conditions by providing detailed visualizations of coronary arteries without the need for surgical intervention.

The non-invasive coronary imaging market in France is expected to grow over the forecast period, with strategic initiatives undertaken by market players to strengthen their presence and remain competitive in the country. For instance, in October 2024, GE HealthCare launched its first CT scanner production line in France and announced the installation of the first France-manufactured scanner at the Montargis Hospital Center. Such investments not only enhance local production capabilities but also support the adoption of advanced imaging technologies, further boosting market growth.

Germany non-invasive coronary imaging market is experiencing significant growth, driven by the rising prevalence of cardiovascular diseases (CVD), robust healthcare infrastructure, and advancements in medical imaging technology, the market is seeing significant growth. With CVD being a major cause of morbidity and mortality in the country, the demand for precise and non-invasive diagnostic solutions continues to grow.

Asia Pacific Non-invasive Coronary Imaging Market Trends

Asia Pacific non-invasive coronary imaging market is expected to witness the fastest growth of CAGR 6.9% over the forecast period. This rapid growth is largely attributed to the expanding healthcare sectors in key countries such as China, India and Japan. These nations are witnessing a surge in healthcare investments, both public and private, aimed at improving medical infrastructure and access to advanced diagnostic technologies. The rising burden of cardiovascular diseases (CVD), driven by aging populations, unhealthy lifestyles, and increasing rates of obesity and diabetes, is further boosting the demand for non-invasive coronary imaging.

China non-invasive coronary imaging market is expected to grow at notable growth rate over the forecast period. This growth is owing to the rising prevalence of cardiac diseases across the country. According to the World Heart Federation, nearly one in five adults in China is affected by cardiovascular disease, placing the nation among those with the highest rates of cardiovascular disease-related mortality worldwide.

Non-Invasive coronary imaging market in Japan is significantly driven by the country’s aging population, advancements in medical technology, and a strong healthcare infrastructure. Japan has one of the world’s oldest populations, with a growing number of elderly individuals at higher risk for cardiovascular diseases (CVD). This demographic shift has led to a rising demand for early and accurate diagnostic methods to detect heart conditions, fueling the adoption of non-invasive coronary imaging techniques.

Latin America Non-invasive Coronary Imaging Market Trends

Latin America non-invasive coronary imaging market is expected to growowing to the rising prevalence of cardiovascular diseases (CVD), improvements in healthcare infrastructure, and increasing access to advanced medical technologies. As CVD continues to be a leading cause of death in many Latin American countries, there is a growing demand for early and accurate diagnostic tools to detect and manage heart conditions. Non-invasive coronary imaging techniques, such as coronary CT and cardiac MRI, are becoming increasingly essential in diagnosing coronary artery disease without the need for invasive procedures.

Middle East & Africa Non-invasive Coronary Imaging Market Trends

Middle East & Africa non-invasive coronary imaging market is experiencing notable growth, driven by various government initiatives focused on enhancing healthcare infrastructure across the region. Many countries in the Middle East and North Africa (MENA) are investing heavily in modernizing healthcare systems, upgrading medical facilities, and expanding access to advanced diagnostic technologies. This is particularly important as cardiovascular diseases (CVD) are becoming more prevalent due to lifestyle changes, an aging population, and increasing rates of diabetes and obesity in the region. Governments are also supporting the adoption of advanced medical technologies through healthcare reforms, subsidies, and public-private partnerships.

Key Non-invasive Coronary Imaging Company Insights

The market players in the non-invasive coronary imaging industry are actively focusing on strategies such as technological innovation, strategic partnerships, product launches, and geographical expansion to maintain a competitive edge. By investing in advanced technologies, such as AI-powered imaging systems and advanced imaging modalities, companies are enhancing the accuracy, efficiency, and accessibility of their products. Strategic partnerships with healthcare providers and research institutions further help to integrate these technologies into clinical practice, expanding their market presence. These efforts are driving the overall growth of the non-invasive coronary imaging market.

Key Non-invasive Coronary Imaging Companies:

The following are the leading companies in the non-invasive coronary Imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V

- Siemens Healthineers AG

- Canon Medical Systems Corporation

- Neusoft Medical Systems

- United Imaging Healthcare

- Esaote SpA

- Fujifilm Holdings Corporation

- Shimadzu Corporation

Recent Developments

-

In February 2024, Philips introduced the Philips CT 5300 system, featuring advanced AI capabilities designed for use in diagnosis, interventional procedures, and screening. This versatile X-ray CT system enhances diagnostic accuracy, improves workflow efficiency, and maximizes system uptime, ultimately contributing to better patient outcomes and increased productivity within medical departments.

-

In February 2024, GE Healthcareunveiled a strategic collaboration with Biofourmis, with the aim of improving continuity of care by facilitating safe, effective, and accessible care in the home, thus supporting patients beyond the hospital environment. This collaboration harnesses the collective expertise of two industry leaders to expand and deliver innovative care-at-home solutions on a scale.

- In July 2024, Shanghai United Imaging Healthcare Co., LTD, announced the installation of the first PET/CT scanner in Mexico, located at the Instituto Nacional de Pediatría.

Non-invasive Coronary Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 433.8 million

Revenue forecast in 2030

USD 596.8 million

Growth rate

CAGR of 6.6 % from 2025 to 2030

Base year

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Canon Medical Systems Corporation; Neusoft Medical Systems; United Imaging Healthcare; Esaote SpA; Fujifilm Holdings Corporation; Shimadzu Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-invasive Coronary Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global non-invasive coronary imaging market report on the basis of modality, end-use and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Radionuclide Cardiac Imaging

-

Echocardiography

-

Cardiac Computed Tomography

-

Cardiac Magnetic Resonance Imaging

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Research Institute

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The non-invasive coronary imaging market size was estimated at USD 404.3 million in 2024 and is expected to reach USD 433.8 million in 2025.

b. The non-invasive coronary imaging market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 596.8 million by 2030.

b. North America dominated the market with a share of 38% in 2024 owing to the presence of technologically sound medial staff, improved healthcare expenditure by the government, rise in number of cancer cases, increase in obesity ratio compared to other nations

b. Some key players operating in the market include GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Canon Medical Systems Corporation; Neusoft Medical Systems; United Imaging Healthcare; Esaote SpA; Fujifilm Holdings Corporation; Shimadzu Corporation.

b. The need to develop efficient diagnostic tools with reduced turnaround time, increased need to reduce radiologists burden, rising need to reduce diagnosis cost, and the need to avoid unnecessary complication arising from invasive detection techniques, are the factors influencing the noninvasive coronary imaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.