- Home

- »

- Plastics, Polymers & Resins

- »

-

Non-phthalate Plasticizers Market Size & Share Report, 2030GVR Report cover

![Non-phthalate Plasticizers Market Size, Share & Trends Report]()

Non-phthalate Plasticizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Adipates, Trimellitates, Benzoates, Epoxies), By Application (Flooring & Wall Coverings, Wires & Cables), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-347-8

- Number of Report Pages: 172

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-phthalate Plasticizers Market Trends

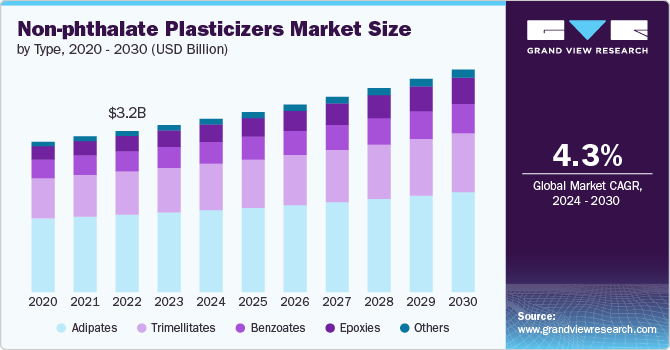

The global non-phthalate plasticizers market size was estimated at USD 3.31 billion in 2023 and expected to grow at a CAGR of 4.25% from 2024 to 2030. Health and environmental concerns associated with traditional phthalates have led industries to seek out non-phthalate options. This trend is particularly evident in sectors such as packaging, medical devices, and automotive, where the use of non-toxic materials is becoming increasingly critical. The market is also witnessing a rise in applications across various industries, reflecting a broader shift towards sustainability and safety.

Another notable trend in the non-phthalate plasticizers market is the increasing focus on bio-based plasticizers. As sustainability becomes a paramount concern across industries, manufacturers are exploring renewable sources for plasticizer production. Bio-based plasticizers, derived from natural materials such as vegetable oils and other biomass, offer an eco-friendly alternative to conventional options. This trend is gaining momentum as companies strive to reduce their carbon footprint and meet consumer demands for greener products. The development and commercialization of bio-based non-phthalate plasticizers not only aligns with global sustainability goals but also opens new avenues for innovation and market expansion.

Drivers, Opportunities & Restraints

Stringent regulations and policies imposed by governments worldwide play a significant role, as these measures aim to reduce the use of harmful chemicals in Typees. Regulatory bodies such as the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA) have been instrumental in enforcing standards that limit the use of phthalates, thereby encouraging the adoption of safer alternatives. Additionally, growing consumer awareness about the potential health risks associated with phthalates is prompting manufacturers to switch to non-phthalate plasticizers.

The non-phthalate plasticizers market presents numerous opportunities for innovation and growth. There is a growing need for cost-effective, sustainable alternatives that can match or exceed the performance of traditional phthalates. This demand is driving investments in research and development to enhance product performance and expand the application scope of non-phthalate plasticizers. As industries continue to prioritize environmentally friendly solutions, companies that can develop efficient and effective non-phthalate plasticizers are well-positioned to capitalize on this trend. Additionally, increasing collaborations and partnerships among key players in the market can facilitate the development of new and improved products, further boosting market growth.

Despite the positive growth outlook, the market for non-phthalate plasticizers faces several challenges. One of the primary restraints is the higher production costs associated with these alternatives. Non-phthalate plasticizers often require more complex Typees and raw materials, which can increase overall production expenses. Moreover, there is limited awareness among end-users about the benefits of non-phthalate plasticizers, which can hinder market adoption. Educating consumers and manufacturers about the advantages of non-phthalate options is essential to overcoming these barriers.

Type Insights

Adipates segment held the largest market share of 45.73% in 2023. Adipates are widely used due to their exceptional flexibility and performance in low-temperature conditions, making them suitable for products that require durability in variable climates. Trimellitates, on the other hand, are preferred for their high-temperature stability and resistance to oil and solvent extraction, which makes them ideal for use in automotive and industrial applications where materials are exposed to harsh environments. These characteristics of adipates and trimellitates ensure their continued relevance in markets requiring robust and reliable plasticizing solutions.

Benzoates are another significant category within the non-phthalate plasticizers market, known for their excellent compatibility with polyvinyl chloride (PVC). This makes them a popular choice in applications requiring enhanced plasticizing efficiency and performance, such as flexible PVC applications in the construction and automotive industries.

Epoxies offer unique advantages with their superior heat and UV stability, making them indispensable in outdoor applications where long-term durability and resistance to weathering are critical. These types of plasticizers provide tailored solutions that address specific performance requirements, thereby broadening the application scope of non-phthalate plasticizers.

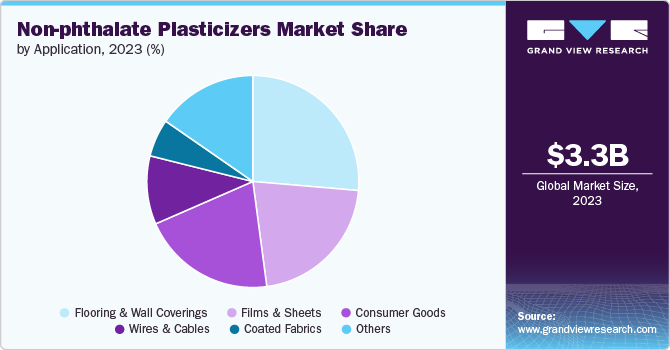

Application Insights

Flooring & wall coverings segment held the largest market share of 26.36% in 2023. In the construction sector, these plasticizers are essential in the production of flooring and wall coverings, providing the necessary flexibility, durability, and safety. This application is particularly important as it aligns with increasing regulatory standards for building materials that are both effective and environmentally friendly. The electrical industry also benefits significantly from non-phthalate plasticizers, particularly in the manufacturing of wires and cables. These plasticizers enhance the flexibility and resistance of electrical components to harsh environmental conditions, ensuring reliability and safety in both residential and commercial settings.

The packaging industry is another major user of non-phthalate plasticizers, particularly in the production of films and sheets. These materials benefit from the plasticizers' ability to improve flexibility, transparency, and overall performance, making them suitable for a wide range of packaging applications, from food packaging to industrial wraps. In the automotive sector, coated fabrics that use non-phthalate plasticizers are essential for interior components, providing enhanced durability, comfort, and safety. The versatility of these plasticizers ensures their widespread use in various consumer goods, including toys, household items, and medical devices, where safety and non-toxicity are paramount.

Regional Insights

In North America, the non-phthalate plasticizers market is driven by stringent regulatory standards set by agencies such as the U.S. Environmental Protection Agency (EPA) and the Consumer Product Safety Commission (CPSC). These regulations mandate the reduction of harmful chemicals in consumer products, leading to a surge in demand for safer, non-toxic alternatives. The market in the U.S. is particularly robust, with significant adoption in industries such as packaging, automotive, and medical devices.

U.S. Non-phthalate Plasticizers Market Trends

The U.S. market is characterized by high levels of innovation, with companies investing in research and development to create advanced non-phthalate plasticizers that meet stringent regulatory requirements while offering superior performance. The growing consumer awareness of the health risks associated with traditional phthalates further drives the adoption of non-phthalate plasticizers in the U.S.

Europe Non-phthalate Plasticizers Market Trends

Europe represents a mature market for non-phthalate plasticizers, driven by comprehensive regulatory frameworks such as the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) legislation. The region's strong emphasis on sustainability and environmental protection has accelerated the adoption of non-phthalate plasticizers across various industries, including construction, automotive, and consumer goods. Countries such as Germany, France, and the United Kingdom are leading the charge, with significant investments in research and development to enhance the performance and application range of non-phthalate plasticizers.

Asia Pacific Non-phthalate Plasticizers Market Trends

Asia Pacific dominated global non-phthalate plasticizers market and accounted for largest revenue share of over 56.00 in 2023. The Asia-Pacific (APAC) region, characterized by rapid industrialization and urbanization, is emerging as a major market for these plasticizers, driven by increasing manufacturing activities and growing environmental consciousness. Each region presents unique opportunities and challenges, shaping the global landscape of the non-phthalate plasticizers market.

Major economies such as China, India, and Japan are experiencing a surge in manufacturing activities, leading to heightened demand for safer, non-toxic plasticizers in sectors like construction, automotive, and packaging. Government initiatives aimed at reducing environmental pollution and improving product safety are also contributing to market expansion in the region.

Key Non-phthalate Plasticizers Company Insights

The non-phthalate plasticizers market is highly competitive, with several key players dominating the landscape. Major companies include BASF, Eastman Chemical Company, ExxonMobil, Evonik Industries, and DIC Corporation. The non-phthalate plasticizers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Non-phthalate Plasticizers Companies:

The following are the leading companies in the non-phthalate plasticizers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Eastman Chemical Company

- ExxonMobil

- Evonik Industries

- DIC Corporation

- Perstorp

- Lanxess AG

- KLJ Group

- Polynt

- Mitsubishi Chemical Corporation

Recent Developments

-

In January 2024, Perstorp launched Pevalen Pro 100, a non-phthalate plasticizer made from 100% renewable carbon based on mass balance principles. This innovation reduces the product's carbon footprint by approximately 80% compared to fossil-based equivalents, enhancing the environmental profile of flexible PVC applications without compromising performance.

-

In March 2023, BASF introduced Ecoflex EL 1165, its latest non-phthalate plasticizer. Designed as a low-odor and low-migration option, Ecoflex EL 1165 is versatile, catering to various applications such as food packaging, toys, and medical devices.

-

In December 2022, Hanwha Solutions unveiled Eco-DEHCH, a phthalate-free plasticizer known for its exceptional heat and cold resistance, making it well-suited for outdoor applications. This launch was part of Hanwha Solutions' strategy to diversify its product range and offer sustainable solutions to the market.

Non-phthalate Plasticizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.44 billion

Revenue forecast in 2030

USD 4.41 billion

Growth rate

CAGR of 4.25% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Eastman Chemical Company; ExxonMobil; Evonik Industries; DIC Corporation; Perstorp; Lanxess AG; KLJ Group; Polynt; Mitsubishi Chemical Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Non-phthalate Plasticizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented non-phthalate plasticizers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Adipates

-

Trimellitates

-

Benzoates

-

Epoxies

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flooring & wall coverings

-

Wires & cables

-

Films & sheets

-

Coated fabrics

-

Consumer goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-phthalate plasticizer market size was estimated at USD 3.31 billion in 2023 and is expected to reach USD 3.44 billion in 2024.

b. The global non-phthalate plasticizer market is expected to grow at a compound annual rate of 4.25% from 2024 to 2030, reaching USD 4.41 billion by 2030.

b. The adipates type segment led the global non-phthalate plasticizer market, accounting for more than 45.73% of the global revenue in 2023.

b. Some of the major companies in the global non-phthalate plasticizer market include BASF, Eastman Chemical Company, ExxonMobil, Evonik Industries, DIC Corporation, Perstorp, Lanxess AG, KLJ Group, Polynt, and Mitsubishi Chemical Corporation.

b. Health and environmental concerns associated with traditional phthalates have led industries to seek out non-phthalate options. This trend is particularly evident in sectors such as packaging, medical devices, and automotive, where the use of non-toxic materials is becoming increasingly critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.