- Home

- »

- Advanced Interior Materials

- »

-

North America & Asia Aluminum Die Casting Market Report, 2027GVR Report cover

![North America & Asia Aluminum Die Casting Market Size, Share & Trends Report]()

North America & Asia Aluminum Die Casting Market Size, Share & Trends Analysis Report By Production Process (Pressure Die Casting, Others), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-108-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The North America and Asia aluminum die casting market size was valued at USD 19.30 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2020 to 2027. The market growth is mainly attributed to the increasing demand for aluminum in the transportation industry in passenger vehicles, commercial vehicles, aircraft, and railways. Mounting market growth took a hit in 2020 owing to the outbreak of coronavirus across the world.

The pandemic severely affected the sales and production of the transportation industry, which is expected to impact the demand for aluminum die casting. In the first half of 2020, the consequences of the pandemic and measures taken to contain it compelled the sales to drop significantly in the international passenger car market. The U.S. is a prominent producer and consumer of aluminum die castings. Over 95% of aluminum die castings produced in the country are made from post-consumer recycled aluminum.

The U.S. is one of the hardest-hit countries in the world due to the covid-19 pandemic, which has resulted in major consequences in the manufacturing activities of the country, thereby negatively impacting the product demand. The aviation industry, a significant end-user of the market, too has been impacted by the spread of coronavirus. For example, in April 2020, Boeing announced to sharply reduce the production of its wide-body planes and it aims to cut its workforce by 10%. The company is expected to halve the production of the 787 Dreamliner to 7 from 14 a month by 2022. This is a negative sign for product demand during 2020-2022.

Growth in the transportation industry is the key driver for the market as aluminum die castings are increasingly used owing to their lightweight, good corrosion resistance, mechanical properties, and dimensional stability. High-quality, thin-walled pressure die-cast aluminum components are beneficial for load-carrying and stiffening functions and can be also applied simultaneously as joining elements.

However, the market growth received a setback in 2020 owing to the covid-19 pandemic that significantly affected vehicle sales. For instance, key sales regions of China, the U.S., and Europe witnessed a year-to-date fall equating to nearly a 28% reduction in sales. The market in China, however, recovered for the second month in succession. The sales of new cars fell by 23% in the first half of 2020 in the country, the sales, however, rose by 1% in June 2020. As automotive production slowly regains its stability, the product demand is anticipated to rise again.

Production Process Insights

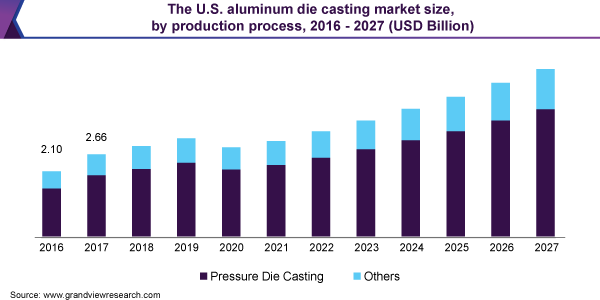

Pressure die casting was the largest segment with a volume share of more than 75.0% in 2019. The segment has been split in to high and low-pressure die casting. Manufacturers take into account the different capabilities and restrictions of both processes before choosing a method for production depending upon the component requirements. Growth of the segment is attributed to its associated benefits, such as thinner cross-sections and smooth surfaces by high pressure die casting and low cost and capability to produce heavier components by low pressure die casting.

High-pressure die casting proves to be beneficial for both manufacturers and consumers, hence various key players use this process. Bocar, Madison-Kipp Corporation, Accurcast Inc., Spartan Light Metal Products, and George Fischer Ltd are amongst the key market players that provide high-pressure aluminum die castings.

Apart from pressure die casting, there are various other processes used to die-cast aluminum parts and components, such as squeeze or cold-chamber. The cold-chamber process focuses on minimizing machine corrosion rather than production efficiency. It is an excellent alternative to the hot-chamber process for applications that are too corrosive for immersion design, such as metal casting with high melting temperatures.

End-use Insights

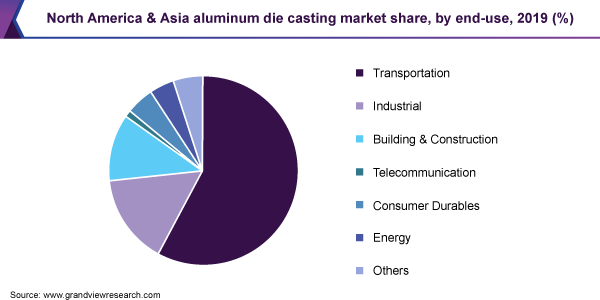

The transportation segment was the largest end-use segment that accounting for a revenue share of 57.8% in 2019 and this trend is anticipated to continue over the forecast period. The segment has been further split into general road transportation, sports road transportation, heavy vehicles, and aerospace and aviation.

The transportation industry has been hit hard due to the ongoing covid-19 pandemic, which is anticipated to have a negative impact on product demand. Aluminum die-cast parts are prominently preferred in premium bikes owing to their characteristics. Owing to covid-19, the world motorcycles market lost 64% in April 2020 and is projected to lose 21% in the entire of 2020. Key market players have reported a significant decline in their sales owing to covid-19, for example, Harley-Davidson’s revenue is estimated to decline by 44% to USD 808.5 million for the quarter through June 2020.

The industrial sector is the second key end-use segment of the market that has been further bifurcated into agricultural equipment, construction equipment, and others. In the agricultural sector, the product finds application in seeders, rotors, pulleys, turbines, baseplates, wheels, and cranks as aluminum is only one-third of steel or iron in weight, is non-corrosive, and offers high strength.

The agricultural sector has also been affected by the covid-19 pandemic as the sales and production of equipment required have fallen down. For example, Mahindra & Mahindra Ltd.’s Farm Equipment Sector’s sales dropped to 4,716 units in April 2020 in India, facing a decline of 83.5% owing to a nationwide lockdown. This is a negative sign for the aluminum die castings market in the agricultural sector.

In the construction industry, the halt in major activities in the second quarter of 2020 due to the covid-19 pandemic has impacted the construction equipment demand. For example, the U.S. construction machinery new orders through April 2020 dropped by 12.2% compared to April 2019. However, with the constant efforts by government bodies in various nations, the lockdown restrictions are witnessing slight ease and manufacturing operations are resuming back again. This shall help uplift product demand in the coming months.

Regional Insights

Asia emerged as the largest regional market with a volume share of 74.0% in 2019. The region is anticipated to maintain its lead across the forecast period on account of significant investments in the energy and transportation sectors in developing economies of the region. The energy sector plays a significant role in the market and Asia dominates the global renewable energy capacity expansion.

The renewable energy sector was witnessing double-digit growth for a few years with rising environmental concerns and increasing government initiatives. However, the sector did not remain unharmed due to the pandemic and will have short-term impacts, such as a decline in global energy consumption. Although, the solar sector of China remained unharmed despite the virus outbreak as the country’s solar panel output in the first half of 2020 increased by 15.7% compared to the same period in 2019. This is a positive sign for the aluminum die castings market to flourish in the country.

North America is anticipated to witness sluggish growth across the forecast period as the economies of the region have faced severe impact owing to the pandemic. Companies are compelled to either shut down their operations or operate at extremely minimal capacity, thereby affecting the demand for raw materials.

Automotive, aviation, industrial, construction, and consumer durable industries have been majorly hit due to the pandemic in the region, thus having a negative impact on market growth. For instance, the aviation industry has been compelled to cut down its production due to the pandemic. General Dynamic Corp got delayed in delivering 11 complete Gulfstream jets owing to the pandemic, which caused a 24.5% revenue decline in the company’s aerospace business segment for the first quarter of 2020. Such delays, coupled with supply-chain disruptions, due to the coronavirus outbreak forced the company to cut its production of jets and reduce its 2020 sales projection to 125 planes from 150.

Key Companies & Market Share Insights

The ongoing coronavirus pandemic harshly impacted the players of the market as they were compelled to suspend their production activities during the lockdown period, which had a negative impact on their sales. For example, in April 2020, the Pace Industries LLC sought Chapter 11 protection after its attempt of selling and re-organizing was disrupted by the pandemic. The company is a key supplier to the auto parts industry with nearly 2,600 salaried employees. Due to the pandemic, it was forced to shut down five plants and the employment fell to 252 salaried and 478 hourly employees. The companies are striving to resume their operations and are operating at minimal capacity in order to trade off their losses. Some of the prominent players in the North America and Asia aluminum die casting market include:

-

Bocar

-

Shiloh Industries

-

Madison-Kipp Corporatio

-

George Fischer Ltd.

-

MartinRea Honsel

-

Ryobi Limited

North America & Asia Aluminum Die Casting Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 15.90 billion

Revenue forecast in 2027

USD 33.49 billion

Growth Rate

CAGR of 7.1% from 2020 to 2027

Market demand in 2020

5,664.3 kilotons

Volume forecast in 2027

8,832.2 kilotons

Growth Rate

CAGR of 3.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Volume and revenue forecast, company market positioning, competitive landscape, growth factors, and trends

Segments covered

Production process, end-use, region

Regional scope

North America; Asia

Country scope

The U.S.; Canada; Mexico; China; South Korea

Key companies profiled

Bocar; Shiloh Industries; Madison-Kipp Corporation; George Fischer Ltd.; Martinrea Honsel; Ryobi Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the North America and Asia aluminum die casting market report on the basis of the production process, end-use, and region:

- Production Process Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Pressure Die Casting

-

High Pressure Die Casting

-

Low Pressure Die Casting

-

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Transportation

-

General Road Transportation

-

Sports Road Transportation

-

Heavy Vehicles

-

Aerospace & Aviation

-

-

Industrial

-

Agricultural Equipment

-

Construction Equipment

-

Others

-

-

Building & Construction

-

Telecommunication

-

Consumer Durables

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Asia

-

China

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The North America & Asia aluminum die casting market size was estimated at USD 19.30 billion in 2019 and is expected to drop down to USD 15.90 billion in 2020.

b. The North America & Asia aluminum die casting market is expected to grow at a compound annual growth rate of 7.1% from 2020 to 2027 to reach USD 33.49 billion by 2027.

b. Pressure die casting dominated the North America & Asia aluminum die casting market and accounted for a volume share of more than 75.0% in 2019 on account of its benefits such as thinner cross-sections and smooth surfaces.

b. Some of the key players operating in the North America & Asia aluminum die casting market include Bocar, Shiloh Industries Inc., Madison-Kipp Corporation, George Fischer Ltd, and Martinrea Honsel.

b. The key factors driving the North America & Asia aluminum die casting market include increasing demand for aluminum in the automotive industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."