- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Automotive Plastics For Exterior Trim Market Report, 2028GVR Report cover

![North America Automotive Plastics For Exterior Trim Market Size, Share & Trends Report]()

North America Automotive Plastics For Exterior Trim Market Size, Share & Trends Analysis Report By Product (PC/ABS Blends, PMMA/ASA Blends), By End Use, By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-657-3

- Number of Report Pages: 56

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

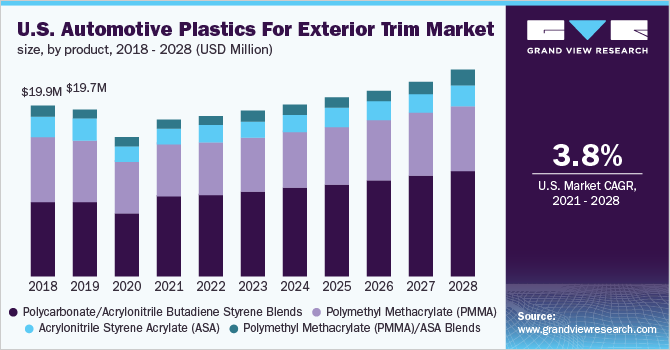

The North America automotive plastics for exterior trim market size was valued at USD 19.57 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2021 to 2028. The automotive industry in North America has witnessed a significant change over the years due to the growing trend towards lightweight vehicles to improve fuel efficiency. Plastics are a vital part of this rising trend as they are capable of providing substantial weight reduction, which results in reduced cost of the vehicle and improved fuel efficiency. Automotive exterior trim helps to increase the vehicle's aesthetic appeal and protect the vehicle from the damage that can occur from the external surrounding. Furthermore, exterior trims are used to enhance the vehicle's aesthetic appeal. The automotive exterior trim not only provides aesthetic appeal but also features such as prevention from dents, scratches, and others. The rising disposable income of the population in North America is driving consumers to purchase newly designed vehicles due to the increased branding by automotive manufacturers.

The U.S. accounted for a significant revenue share in the North American market in 2020. This is attributed to the growing utilization of plastics in the automotive industry. The diminishing oil and gas reserves and rising environmental pollution caused by vehicle emissions have propelled the demand for automotive plastics in exterior applications. The utilization of plastics has resulted in improving vehicle engine efficiency. Moreover, the rising trend among consumers to purchase appealing and economically feasible models of vehicles has driven the consumption of plastics in automotive exterior trims.

Automotive manufacturers are constantly developing quality products in response to customer preferences. The automotive market in North America is witnessing a concentration of efforts by component suppliers, automotive manufacturers, and distributors on designing vehicles, managing programs, handling the majority of the vehicular assembly, and carrying out the brands' marketing. The COVID-19 resulted in the closure of boundaries across countries in North America, which resulted in supply chain disruptions and production cuts at some North American automotive manufacturing facilities due to the shortage of semiconductors.

The United States-Mexico-Canada Agreement mandates that at least 75% of the content for a vehicle in North America is to be procured from North America-based suppliers and manufacturers. This is expected to result in trade encouraging policies for trucks, automobiles, trucks, and other products and create a leveled playing field for the North American automotive industry. The policies compliant with the automotive industry are anticipated to grow the North American market for automotive plastics for exterior trim.

Product Insights

Polycarbonate/acrylonitrile butadiene styrene (PC/ABS) blends dominated the market and accounted for a revenue share of more than 40.0% in 2020. PC/ABS blend is a thermoplastic alloy of PC and ABS components and exhibits excellent chemical and mechanical properties and superb processability. Polycarbonate is a plastic with high heat and impact resistance but is difficult to process. By mixing PC with ABS, it improves processability and flame retardancy, making them suitable in manufacturing exterior trims in automotive.

Polymethacrylate (PMMA) exhibits excellent weatherability, good mechanical properties, and resistance to acids, alkanes, and oils. Their high transparency, lightweight, and shatter-resistance make them suitable as a replacement for regular glass in tail lights for cars. Moreover, their excellent surface hardness, UV resistance, abrasion resistance, and easy processability make them suitable to create exterior trims, fenders, bumpers, and other molded parts.

Acrylonitrile styrene acrylate (ASA), a thermoplastic elastomer developed from modified styrene-acrylonitrile (SAN), exhibits excellent resistance to UV irradiation, moisture heat, and stress cracking. It is designed for manufacturing exterior trim applications, such as radiator grills. Increasing demand for automobiles and rising disposable income are anticipated to propel the demand for ASA resin in the automotive industry across North America.

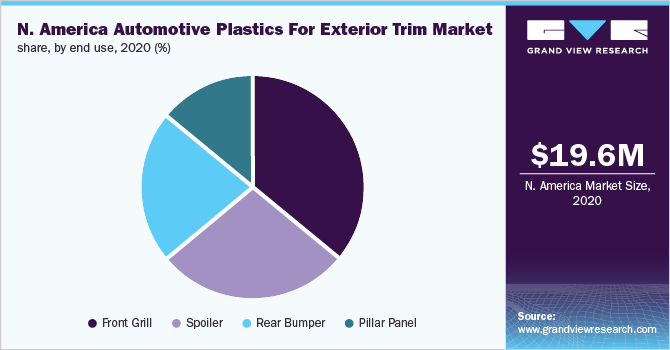

End-use Insights

The front grill segment dominated the market and accounted for more than 30.0% share of the overall revenue in 2020. The front grill is widely used for providing both brand awareness and customer appeal to a vehicle. The front grill allows airflow inside the hood, cooling off many parts, specifically for the radiator and vehicle’s engine. Plastics such as ASA have emerged as an alternative to metal-based grills in automotive vehicles due to their heat resistance and lightweight. Additionally, the electric vehicle development by automotive manufacturers is expected to result in increased demand for front grills to provide an aesthetic appeal to the vehicles.

Spoilers have gained popularity as a commonly used accessory not only in sports cars but also in roadsters and sedans. Even some hatchback and SUV roofs are now installed with compact spoilers. Spoilers are one of the most common aerodynamic accessories used to disrupt the flow of air. The disruption of wind resistance results in reduced drag and better fuel efficiency.

Since PC/ABS is used in manufacturing spoilers due to higher heat resistance, it helps to prevent heat generation from air drags. Apart from reducing air drags, spoilers are also used to increase the customer appeal of the vehicle. The growing trend of developing designs in vehicle models is expected to result in the growing consumption of plastics in the exterior trim market.

Country Insights

The U.S. dominated the North American market and accounted for a revenue share of more than 80.0% in 2020. The automotive industry in the U.S. has been witnessing a significant change over the years, and there is an increasing trend toward reducing the weight of automobiles to improve fuel efficiency. The growth of the logistics sector resulted in increased production of commercial vehicles despite the fact that the manufacturing sector was negatively impacted. The growth of the e-commerce and logistics sectors is expected to expand the market in the years to come.

The automotive sector in Mexico is one of the major sectors contributing to the GDP. According to the International Trade Administration, it emerged as the sixth-largest global passenger vehicle manufacturer globally and the leading global exporter of heavy commercial vehicles. It is a significant manufacturing hub for many global automotive players, including MAN SE, Cummins Inc., Scania AB AG, Mercedes-Benz AG, AB Volvo, and Isuzu Motors Ltd. The growing automotive sector in Mexico is expected to positively increase the demand for plastics in the exterior trim market.

Key Companies & Market Share Insights

The North American market for automotive plastics for exterior trim has been characterized by the presence of key players and a few country players. Established foreign players are establishing their manufacturing centers to cater to the rising demand for automotive plastics in exterior trim parts in the automotive sector. For instance, in May 2021, Chinese bases Jiangsu Xinquan Automotive Trim Co., Ltd. announced setting up a factory in Mexico to manufacture automotive components. The company produces automotive exterior parts, interior parts, car dashboards, and other products. This strategic initiative is expected to result in the positive growth of the market. Some prominent players in the North America automotive plastics for exterior trim market include:

-

SABIC

-

LG Chem

-

Trinseo S.A.

-

Covestro AG

-

Mitsubishi Chemical Corporation

-

RTP Company

-

LOTTE Chemical CORPORATION

-

Sumitomo Chemical Co., Ltd.

-

Gehr Kunstoffwerk GmbH & Co. KG

-

Asahi Kasei Corporation

North America Automotive Plastics For Exterior Trim Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 22.10 million

Revenue forecast in 2028

USD 28.65 million

Growth Rate

CAGR of 3.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD thousands, and CAGR (%) from 2021 to 2028

Report coverage

Volume forecast, revenue forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Product, end use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

SABIC; LG Chem; Trinseo S.A.; Covestro AG; Mitsubishi Chemical Corporation; RTP Company; LOTTE Chemical CORPORATION; Sumitomo Chemical Co., Ltd.; Gehr Kunstoffwerk GmbH & Co. KG; Asahi Kasei Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the North America automotive plastics for exterior trim market report based on product, end use, and country:

-

Product Outlook (Volume, Tons; Revenue, USD Thousands, 2017 - 2028)

-

Polycarbonate/Acrylonitrile Butadiene Styrene Blends

-

Acrylonitrile Styrene Acrylate (ASA)

-

Polymethyl Methacrylate (PMMA)

-

Polymethyl Methacrylate (PMMA)/ASA Blends

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousands, 2017 - 2028)

-

Front Grill

-

Spoiler

-

Pillar Panel

-

Rear Bumper

-

-

Country Outlook (Volume, Tons; Revenue, USD Thousands, 2017 - 2028)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America automotive plastics for exterior trim market size was estimated at USD 19.57 million in 2020 and is expected to reach USD 22.10 million in 2021

b. The North America automotive plastics for exterior trim market is expected to grow at a compound annual growth rate of 3.8% from 2021 to 2028 to reach USD 28.65 million by 2028.

b. The polycarbonate/acrylonitrile butadiene styrene blends in the product segment dominated the North America automotive plastics for exterior trim market with a share of 45.60% in 2020. This is attributable to properties of PC resin such as high clarity, toughness, and heat resistance along with the properties of ABS resin such as high impact & chemical resistance which makes them suitable for manufacturing exterior trim applications of vehicles including front grill frames, exterior pillars, exterior pillar covers, and others.

b. Some key players operating in the North America automotive plastics for exterior trim market include SABIC, LG Chem; Trinseo S.A.; Covestro AG; Mitsubishi Chemical Corporation; RTP Company; LOTTE Chemical CORPORATION; Sumitomo Chemical Co., Ltd.; Gehr Kunstoffwerk GmbH & Co. KG; and Asahi Kasei Corporation

b. Key factors that are driving the automotive plastics for exterior trim market growth include the increasing demand for lightweight vehicles and advancements in the recycling process of plastic waste generated from the automotive industry which utilizes recycled plastics in exterior trims manufacturing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."