- Home

- »

- Agrochemicals & Fertilizers

- »

-

North America Biochar Market Size, Industry Report, 2033GVR Report cover

![North America Biochar Market Size, Share & Trends Report]()

North America Biochar Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Gasification, Pyrolysis), By Application (Agriculture, Animal Feed, Health & Beauty Products), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-677-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Biochar Market Summary

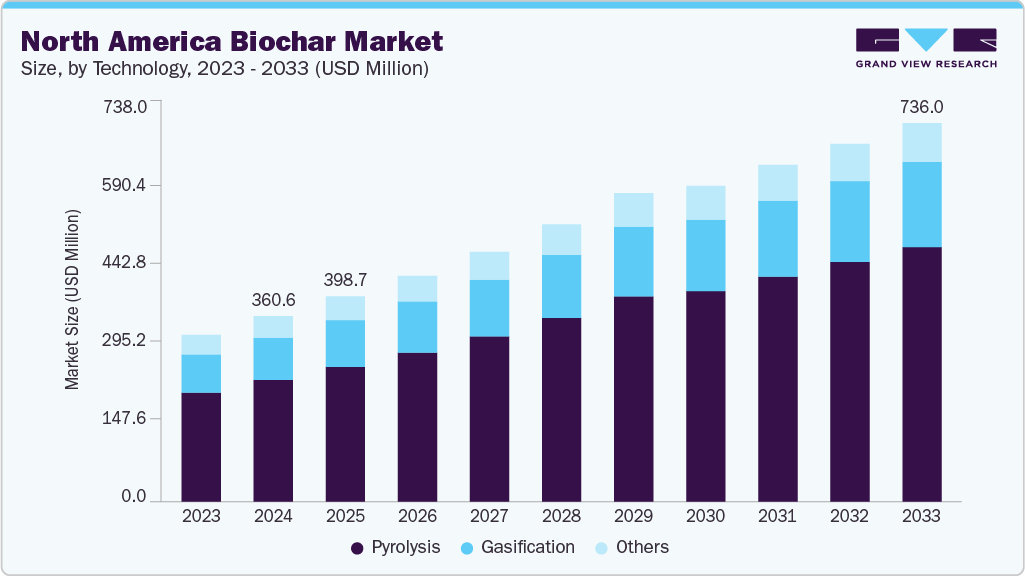

The North America biochar market size was estimated at USD 360.6 million in 2024 and is projected to reach USD 736.0 million by 2033, growing at a CAGR of 8.0% from 2025 to 2033. The growth is driven by the increasing demand for sustainable solutions in various industries, including agriculture, energy, and environmental conservation.

Key Market Trends & Insights

- The North America biochar market is projected to grow at a CAGR of 8.0% from 2025 to 2033.

- By technology, the pyrolysis segment is expected to witness the fastest growth of 8.3% from 2025 to 2033.

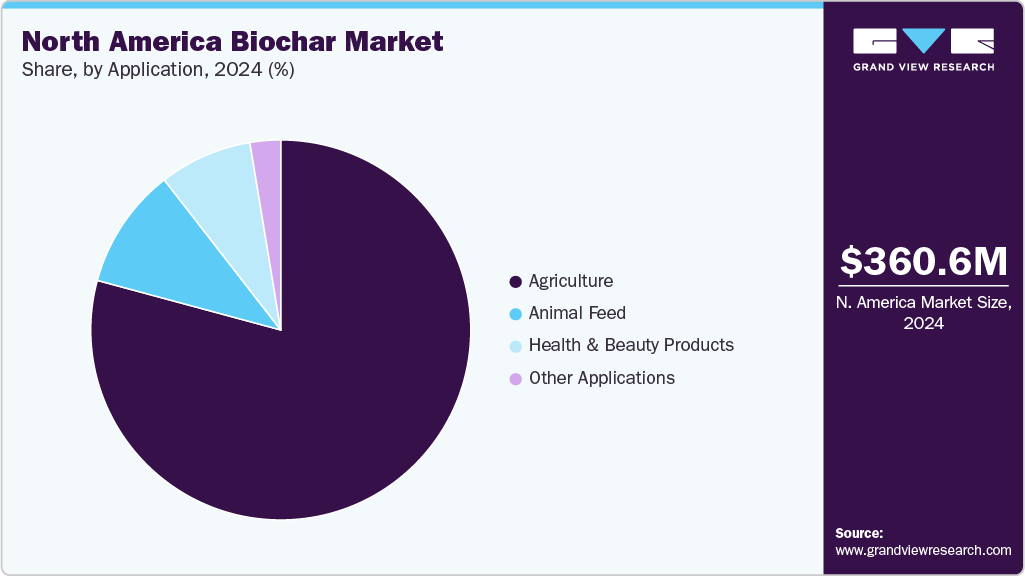

- By application, agriculture segment dominated the market with a revenue share of 79.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 360.6 Million

- 2033 Projected Market Size: USD 736.0 Million

- CAGR (2025-2033): 8.0%

Biochar, a form of charcoal produced through the pyrolysis of organic materials, is valued for its ability to sequester carbon and improve soil health. As governments and organizations worldwide intensify their efforts to combat climate change, biochar has emerged as a key player in carbon capture and storage strategies. The North America market for biochar is expected to grow significantly over the next decade, spurred by its multifunctional benefits and the rising adoption of sustainable farming practices.In North America, agriculture represents a significant driver of demand for biochar. Farmers across the region are increasingly adopting biochar as a soil amendment due to its proven benefits in enhancing soil fertility, improving water retention, and optimizing nutrient management. This is particularly relevant in areas facing soil degradation, drought stress, and declining organic matter. Biochar improves soil structure by increasing porosity, facilitating better root development, and retaining moisture. Moreover, its ability to reduce dependency on chemical fertilizers aligns with the region’s growing emphasis on sustainable and cost-effective farming practices, making biochar a valuable component in modern agricultural strategies.

The North America market for biochar is gaining significant momentum within the renewable energy sector, driven by its dual-role potential in environmental management and sustainable energy generation. In this region, biochar is increasingly produced through pyrolysis. This process yields biochar and generates valuable by-products such as bio-oil and syngas, which can be utilized for renewable energy production. This integrated approach resonates strongly with North America's ongoing efforts to transition away from fossil fuels and toward cleaner, low-carbon energy solutions. Biochar addresses regional environmental priorities such as agricultural waste management, soil restoration, and carbon sequestration, further strengthening its appeal as a sustainable technology in the energy and environmental sectors.

In addition, biochar is gaining increasing attention for its agricultural and energy-related applications and significant environmental benefits. As a highly stable form of carbon, biochar can persist in the soil for hundreds to thousands of years, serving as a long-term carbon sequestration solution. This capability aligns well with North America's broader climate goals and decarbonization strategies, making biochar an important tool in efforts to combat climate change. In addition, biochar in North America is produced from a wide array of feedstocks, including agricultural residues, forestry by-products, and urban organic waste. This versatility in raw materials supports sustainable waste management practices, reduces landfill dependence, and drives growth in the regional biochar market.

Despite its promising potential, the North America market faces challenges that could impact its growth trajectory. High production costs, limited awareness in certain regions, and inconsistent regulatory frameworks remain obstacles to widespread adoption. However, as technology advances and economies of scale are realized, production costs are expected to decrease, making biochar more accessible to a broader range of industries. In addition, increasing collaboration between governments, research institutions, and private sector players is likely to create a more supportive environment for the biochar industry, accelerating its expansion in the coming years.

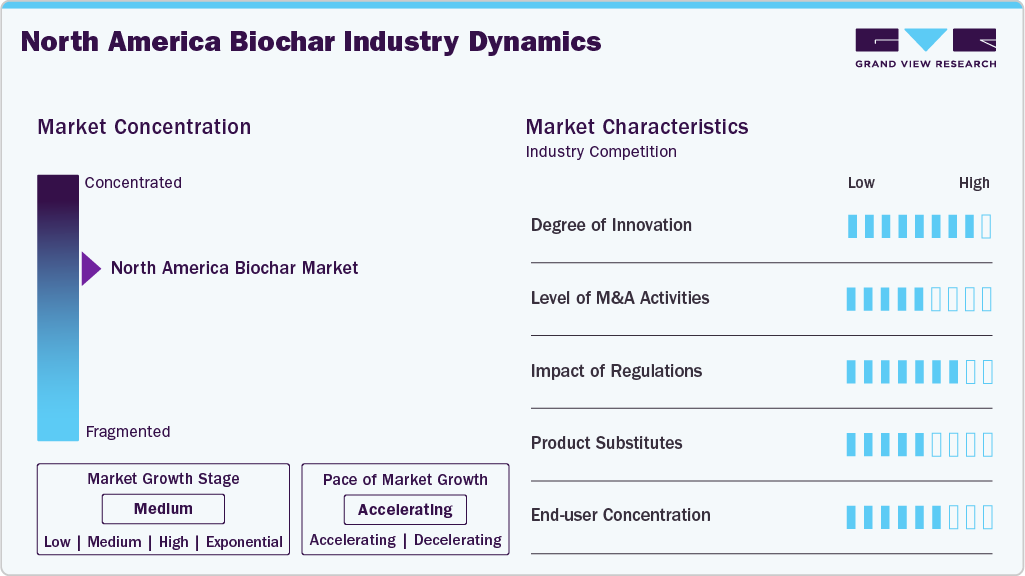

Market Concentration & Characteristics

The North America biochar industry is moderately consolidated, dominated by a few large, vertically integrated players who maintain a strong competitive edge through control over the entire value chain. These leading companies benefit from economies of scale, advanced production technologies, and integrated operations that encompass feedstock sourcing, often from agricultural and forestry residues to pyrolysis and downstream processing. Their robust domestic distribution networks and established relationships across agriculture, environmental remediation, water treatment, and energy sectors further reinforce their market position.

These incumbents have strategically invested in sustainable production practices and carbon-negative technologies, allowing them to meet increasingly stringent environmental regulations while appealing to environmentally conscious consumers and institutional buyers. Their vertical integration ensures cost efficiency, consistent biochar quality, and dependable supply for applications ranging from soil amendment and carbon sequestration to filtration and construction materials.

At the same time, regional and mid-sized players are reshaping the competitive landscape by leveraging local biomass availability, innovation in reactor technologies, and targeted partnerships with farmers and municipal bodies. These players often focus on price-competitive markets and regional agricultural use, offering specialized formulations to improve soil fertility, water retention, and crop yield.

However, the North America market also faces key challenges, including regulatory uncertainty and the lack of standardized quality benchmarks across states and industries. Moreover, while biochar is increasingly recognized for its environmental benefits, the market still contends with limited farmer awareness, high upfront application costs, and complexities in carbon credit monetization. These factors, coupled with the need for clearer federal policy support, continue to moderate the pace of adoption across broader end use sectors.

Technology Insights

Pyrolysis technology in biochar dominated the market and accounted for the largest revenue share of 65.6% in 2024. An integral process in biochar production is crucial in transforming organic materials into biochar. This thermal decomposition process occurs without oxygen, enabling the organic matter to undergo a complex series of chemical reactions. Manufacturers use both fast and slow pyrolysis processes depending on their requirements. In fast pyrolysis, the finely ground biomass is pyrolyzed within a few seconds, while slow pyrolysis can bake large particles for a longer period, which results in better carbon sequestration.

Gasification technology in the biochar segment is expected to grow fastest at a CAGR of 7.8% from 2025 to 2033 during the forecast period, which is similar to pyrolysis, wherein the biomass is heated with limited oxygen, which helps break down the woody biomass, yielding synthetic gas. This technology has witnessed a rise in demand due to the growing need for electricity in distributed energy systems. Phoenix Energy is engaged in producing biochar using gasification systems and generating electricity using customized diesel engines. The 500 KW gasifier system, located in California, U.S., produces electricity using waste wood and one ton of biochar per day. Gasification systems are expected to witness strong demand over the forecast period owing to the growing demand for clean energy.

Application Insights

Agriculture biochar by application dominated the market with a revenue share of 79.1% in 2024 due to its use in the agriculture sector to enhance soil fertility, improve plant growth, and provide crop nutrition. It is responsible for improving crop yield and, therefore, overall productivity. Farmers are the most important customers in the North America market. Major application areas of agriculture include gardening, horticulture, field crops, landscaping, and turf. End users mostly prefer dry biochar owing to its easy application to the soil. Other forms of biochar include blended and inoculated, which can modify soil texture, improve water management, and increase the soil's carbon content.

Animal feed biochar by application is expected to grow fastest with a CAGR of 7.8% from 2025 to 2033 during the forecast period, for its use as an additive to improve the digestive health of livestock. Biochar's porous structure allows it to absorb toxins, heavy metals, and other harmful substances in the gut of animals, reducing the risk of gastrointestinal issues. This detoxification effect has been shown to support overall animal health, promoting better feed conversion rates, which is critical for the profitability of livestock production. Furthermore, biochar's ability to neutralize harmful gases such as ammonia and methane within animal digestive systems can help reduce odor and improve air quality in animal housing facilities.

Country Insights

U.S. Biochar Market Trends

The biochar industry in the U.S. held a 72.0% revenue share of the North America market in 2024, owing to its demand, which was primarily fueled by its diverse applications in agriculture, environmental sustainability, and various industrial sectors. In agriculture, biochar is gaining traction as a sustainable soil amendment. Farmers are leveraging its ability to improve soil structure, enhance microbial activity, and increase crop productivity while reducing dependence on synthetic fertilizers. Its effectiveness in boosting water retention and nutrient availability makes it particularly valuable in drought-prone areas or regions with degraded soils. In addition, biochar finds growing use in sectors such as construction, energy, and water treatment, where it serves roles in filtration, emissions reduction, and renewable energy generation. The broad scope of these applications is driving continued growth in biochar demand across the U.S. market.

Canada Biochar Market Trends

The biochar industry in Canada held 17.3% of the North America revenue share in 2024. This growth is fueled by rising demand for biochar due to its dual role in promoting sustainable agriculture and supporting Canada’s net-zero emissions ambitions. In a major development, Canada launched its first industrial-scale biochar facility in Port-Cartier, Quebec, in 2024. At the same time, BluSky Carbon Inc. initiated biochar production in the U.S., reflecting a broader expansion in North American capacity. These advancements are timely, aligning with the Canadian government’s July 5, 2023, statement that identified large-scale biochar production as a strategic asset for achieving national climate goals.

Mexico Biochar Market Trends

The Mexico biochar industry secured 10.7% of the market share in 2024, due to several challenges, including soil erosion, nutrient depletion, and the adverse effects of climate change. These persistent issues have driven interest in biochar as a sustainable solution. Studies in Mexico demonstrate that biochar enhances soil fertility, boosts water retention, and strengthens plant resistance to pests and diseases. Moreover, biochar contributes to carbon sequestration, effectively lowering greenhouse gas emissions. As a result, it has gained traction among farmers aiming to implement eco-friendly practices and support Mexico’s broader climate action initiatives.

Key North America Biochar Company Insights

Some of the key players operating in the North America biochar industry include Airex Energy and Black Owl Biochar

-

Airex Energy offers advanced, industrial-scale biochar solutions through its proprietary CarbonFX and DryFX technologies. The company focuses on transforming forestry residues into high-quality biochar that supports carbon sequestration and soil regeneration. Airex Energy’s biochar is used across multiple sectors, including agriculture, sustainable construction, water treatment, and environmental remediation. Its biochar also serves as a key tool for industrial decarbonization and is integrated into certified carbon credit systems. With a strong emphasis on innovation and climate impact, Airex Energy aims to scale global biochar production to meet the growing demand for carbon-negative technologies.

Strategic Environmental & Energy Resources, Inc. and Advance Renewable Technology International (ARTI) are the emerging market participants in the North America biochar industry.

-

Strategic Environmental & Energy Resources, Inc. (SEER) is a U.S.-based environmental solutions company actively expanding into the biochar sector through its subsidiary, SEER Carbon Corp. Leveraging patented technology licensed from Biochar Now, SEER focuses on producing high-quality, carbon-rich biochar for carbon sequestration and soil enhancement. The company’s biochar is designed to generate fully insured, high-integrity carbon credits, which are blockchain-verified and tokenized for global trading. SEER is currently developing a 60-kiln biochar production facility in Texas, with plans to expand internationally. It also offers smart carbon solutions integrated with renewable energy and circular economy initiatives.

Key North America Biochar Companies:

- Black Owl Biochar

- Karr Group

- Aries Clean Technologies

- Pacific Biochar Benefit Corporation

- Advance Renewable Technology International (ARTI)

- Soil Reef LLC

- Biochar Now

- Oregon Biochar Solutions

- New England Biochar

- CharGrow

- Strategic Environmental & Energy Resources, Inc.

- Airex Energy

Recent Developments

-

In March 2025, Strategic Environmental & Energy Resources (SEER) launched a new division, SEER Carbon Corp., to produce high-quality biochar using Biochar Now's patented technology and generate fully insured carbon credits. The company plans to tokenize these credits through blockchain-enabled smart contracts, enhancing transparency and trust. A 60-kiln facility will be established in Texas, backed by regulatory approvals. SEER's initiative aims to address quality concerns in the rapidly expanding biochar market and create new revenue streams through carbon trading and utility tokens.

-

In May 2025, Airex Energy, Groupe Rémabec, and SUEZ inaugurated Carbonity, Canada's largest industrial-scale biochar plant in Port-Cartier, Quebec, with an initial capacity of 10,000 tonnes annually, expected to triple by 2026. Utilizing Airex's CarbonFX and DryFX technologies, the facility will convert 58,000 tonnes of forestry residues into biochar, supporting carbon sequestration and soil regeneration. Carbonity aims to sequester 75,000 tonnes of CO₂ annually and generate certified carbon credits, with Microsoft committing to purchase 36,000 credits over three years. This flagship project strengthens Quebec's position in sustainable forestry, carbon removal, and circular economy innovation.

North America Biochar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 398.7 million

Revenue forecast in 2033

USD 736.0 million

Growth rate

CAGR of 8.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Black Owl Biochar; Karr Group; Aries Clean Technologies; Pacific Biochar Benefit Corporation; Advance Renewable Technology International (ARTI); Soil Reef LLC; Biochar Now; Oregon Biochar Solutions; New England Biochar; CharGrow; Strategic Environmental & Energy Resources, Inc.; Airex Energy

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Biochar Market Report Segmentation

This report forecasts revenue growth at North America regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the North America biochar market report based on technology, application, and country.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Pyrolysis

-

Gasification

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agriculture

-

Animal Feed

-

Health & Beauty Products

-

Other Applications

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America Biochar market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2033 to reach USD 736.0 million by 2033.

b. The agriculture segment led the largest North America Biochar market and accounted for the largest revenue share of 79.1 % in 2024, due to their use used in the agriculture sector to enhance soil fertility, improve plant growth, and provide crop nutrition.

b. Some of the key players operating in the North America biochar market include Black Owl Biochar, Karr Group, Aries Clean Technologies, Pacific Biochar Benefit Corporation, Advance Renewable Technology International (ARTI), Soil Reef LLC, Biochar Now, Oregon Biochar Solutions, New England Biochar, CharGrow, Strategic Environmental & Energy Resources, Inc., Airex Energy

b. The growth is attributed to North America biochar market is increasingly driven by the increasing demand for sustainable solutions in various industries, including agriculture, energy, and environmental conservation.

b. The North America Biochar market size was estimated at USD 360.6 million in 2024 and is expected to reach USD 398.7 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.