- Home

- »

- Advanced Interior Materials

- »

-

North America Ceiling Tiles Market Size & Share Report, 2030GVR Report cover

![North America Ceiling Tiles Market Size, Share & Trends Report]()

North America Ceiling Tiles Market Size, Share & Trends Analysis Report By Product (Mineral Wool, Metal, Gypsum), By End-use (Non-Residential, Residential), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-995-3

- Number of Report Pages: 71

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

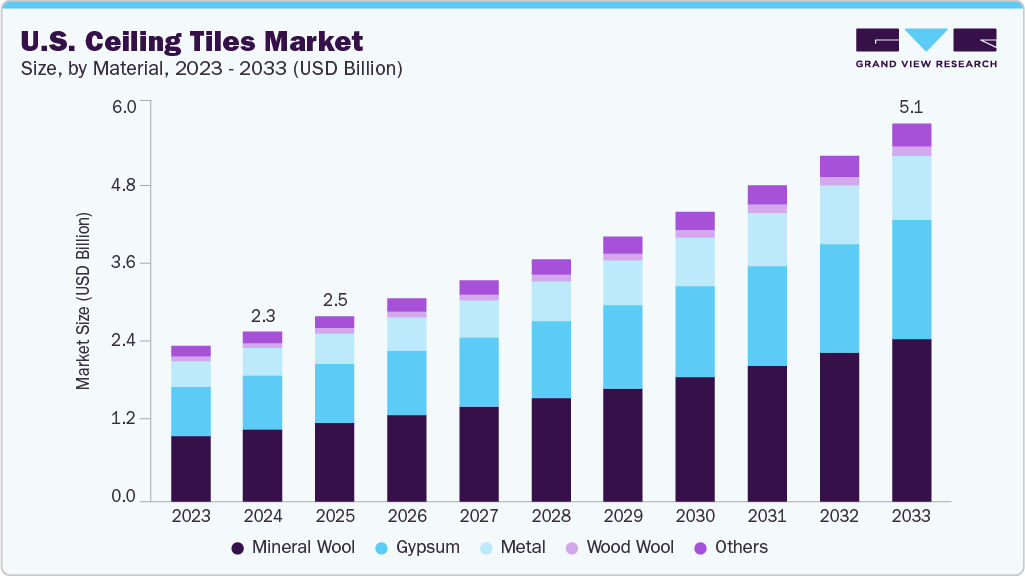

The North America ceiling tiles market size reached USD 1.97 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. The increase in the construction of residential and commercial buildings in the region remains the primary growth driver. The need for the upgradation of existing buildings and structures in the region is expected to open significant opportunities for growth in both residential and commercial construction applications. Increasing population and rapid urbanization & industrialization in emerging economies continue to push governments to increase infrastructure spending. This, in turn, is anticipated to fuel the demand in various construction applications over the forecast period.

The U.S. accounted for the largest revenue share of the ceiling tiles market in North America. This growth is attributed to the flourishing construction industry in the country. States such as New York, California, Ohio, and Texas are fast-growing markets for commercial real estate. Also, with rapid urbanization, the need for commercial spaces, including offices, showrooms, rental apartments, and retail outlets continues to increase rapidly. This remains the key trigger for the demand for ceiling tiles in the market.

Product Insights

Over the forecast period, it is anticipated that the rising use of natural materials will drive the mineral wool segment. Mineral wool is made from natural rock materials, including slag and ceramics. These are economical alternatives to various forms of other materials. The super-performing attributes of mineral wool, such as thermal insulation, sound absorption ability, asbestos-free, enhanced light reflectance, lightweight property, and higher recyclability have increased the use of mineral wool in commercial and residential construction.

Gypsum ceiling tiles remain in high demand from consumers, thanks to their key properties including sound isolation and fire resistance. The gypsum ceiling tiles product segment of the market also continues to grow. Its lightweight structure, easy-to-maintain and repairable nature and widespread availability of diverse designs remain important drivers of growth.

The wood ceiling tiles remain popular in diverse applications including corporate buildings, hospitals, education, airports, and residential buildings. The product incurs relatively higher costs coupled with a longer time for installations. In addition, design varieties remain limited, limiting the growth potential for the wood ceiling segment.

The ceiling tiles manufactured with plastic possess water-resistant properties which aids in maintaining the appearance as well as the structural quality of the tile. In addition, the product also delivers various essential benefits including resistance to corrosion; anti-fungal, termite-proof, and easily cleanable properties. These are expected to increase the application of plastic ceiling tiles in end-use industries. Hence, this segment is expected to grow at a considerable rate.

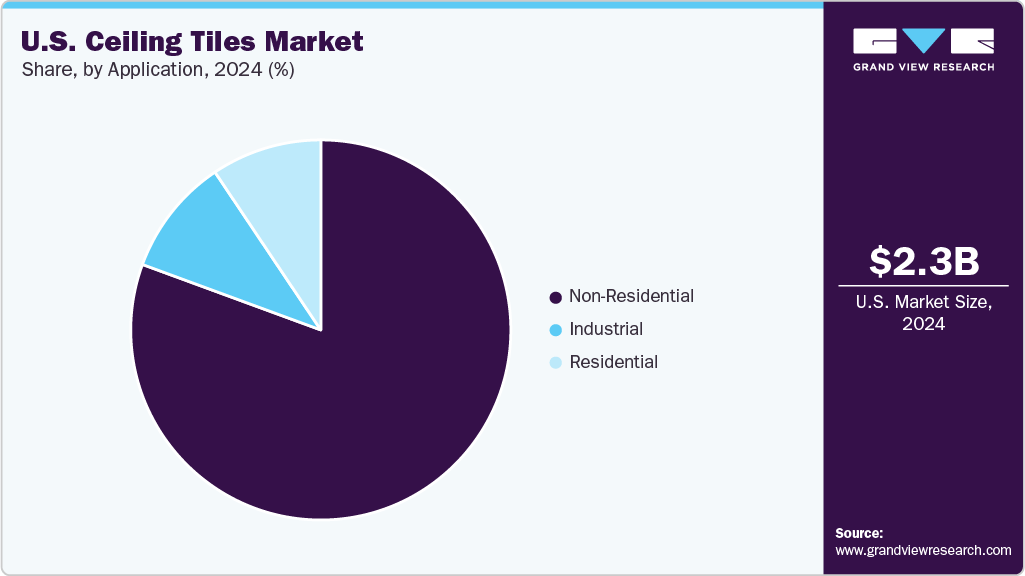

End-use Insights

The growth of the ceiling tiles market in North America is attributed to its extended use in the non-residential sector. The non-residential end-use segment led the market in 2021. It continues to grow due to growing investments in the construction of commercial spaces. These include office complexes, institutional buildings, hospitals, transportation, retail stores, bars, and clubs.

The growth in the population and migration of people from villages to cities has increased the need for commercial construction. The development of spaces like offices and hospitals is also responsible for the increased demand for modernization of infrastructure. These factors remain primary drivers for the growth of the North America ceiling tiles market.

The residential application segment accounted for a significant total industry share in 2021. Growing population, rising disposable income, and urbanization remain key factors anticipated to propel the growth of the residential application segment of North America ceilings tiles market. Materials such as mineral wool and metals are generally suited for residential applications. The residential buildings consist of apartments, single-family, and multi-family units.

The decline in mortgage rates in North America is expected to contribute to the growth of residential construction. This is expected to result in significant demand for ceiling tiles in the region. Furthermore, the rising disposable income, and changing preferences in housing interiors and exteriors are expected to contribute to the demand for ceiling tiles over the forecast period.

The increasing demand for green building materials for construction in North American countries is expected to result in demand for lightweight and environmentally friendly ceiling tiles. Moreover, stringent VOC policies and regulations over building materials are anticipated to increase the usage of low-VOC ceiling tiles. These remain key in order to reduce the VOC emissions from the building material, and new constructs such as adhesive-free bio-based suspended ceiling tiles promise new opportunities in the arena of sustainable growth.

Regional Insights

The ceiling tiles market in North America is expected to witness significant growth over the coming years on account of the increasing construction of residential and commercial buildings in the region. The need for the upgradation of existing buildings and structures in the region is expected to augment the dependency on ceiling tiles in both residential and commercial constructions.

The U.S. accounted for the largest revenue share in 2021, attributed to the flourishing construction industry in the country. States such as New York, California, Ohio, and Texas are fast-growing markets for commercial real estate. Also, with rapid urbanization, the need for commercial spaces, including offices, showrooms, rental apartments, and retail outlets continues to increase rapidly. This drives the demand for ceiling tiles in the region.

The rise in commercial construction activities in key provinces of Canada is expected to boost the consumption of ceiling tiles over the forecast period. The increased immigration in Toronto, Edmonton, Calgary Area, and Vancouver positively influenced residential construction activities in the country. This is the key driver of the new surge in the demand for ceiling tiles in residential construction.

Mexico is forecasted to grow at a considerable pace in the coming years. This is due to the emergence of Mexico as an upcoming manufacturing hub which has resulted in the establishment of numerous industries. The establishment of several new industrial facilities has also drawn large residential settlements in order to support production. Hence, Mexico is anticipated to drive major demand for ceiling tiles in North America.

Key Companies & Market Share Insights

There are a large number of players offering ceiling tiles in North America that provide a range of product varieties, leading to a highly competitive landscape in the industry. The key players offering ceiling tiles operating in North America include Hunter Douglas, USG Corporation, SAS International, CertainTeed, Knauf Digital GmbH, and Odenwald Faserplattenwerk GmbH (OWA).

Major industry players in the region have a strong presence in the economies of the U.S., Canada, and Mexico. The high degree of forward and backward integration of dominant players persists in the region which has intensified the rivalry and competition thus making the entry for new players difficult. Some prominent players in the North America ceiling tiles market include:

-

Hunter Douglas

-

USG Corporation

-

SAS International

-

CertainTeed

-

Knauf Digital GmbH

-

Odenwald Faserplattenwerk GmbH (OWA)

-

Capitol Materials, Inc.

-

Rockwool Manufacturing Company

-

Armstrong World Industries, Inc.

-

Aerolite Industries Private Limited

-

KET Ceilings

North America Ceiling Tiles Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.31 billion

Revenue forecast in 2030

USD 4.70 billion

Growth Rate

CAGR of 9.1% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Hunter Douglas; USG Corporation; SAS International; CertainTeed; Knauf Digital GmbH; Odenwald Faserplattenwerk GmbH (OWA); Capitol Materials, Inc.; Rockwool Manufacturing Company; Armstrong World Industries, Inc.; Aerolite Industries Private Limited; KET Ceilings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Ceiling Tiles Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America ceiling tiles market report based on product, end-use, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

Mineral Wool

-

Metal

-

Gypsum

-

Wood

-

Plastic

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

Non-Residential

-

Residential

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America ceiling tiles market size was estimated at USD 1.97 billion in 2021 and is expected to reach USD 2.31 billion in 2022.

b. The North America ceiling tiles market is expected to grow at a compound annual growth rate of 9.1% from 2022 to 2030 to reach USD 4.70 billion by 2030.

b. Mineral wool product segment dominated the North America ceiling tiles market with a share of 42.4% in 2021 which is attributed to the increasing investment in the North American construction industry by the government and private entities.

b. Some of the key players operating in the North America ceiling tiles market include Hunter Douglas, USG Corporation, SAS International, CertainTeed, Knauf Digital GmbH, Odenwald Faserplattenwerk GmbH (OWA), Capitol Materials, Inc., Rockwool Manufacturing Company, Armstrong World Industries, Inc., Aerolite Industries Private Limited, and KET Ceilings.

b. The key factors that are driving the North America ceiling tiles market include the rise in the middle-class population and urbanization has increased the need for commercial and institutional construction.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."