- Home

- »

- Advanced Interior Materials

- »

-

North America Concrete Flooring Market Size Report, 2030GVR Report cover

![North America Concrete Flooring Market Size, Share & Trend Report]()

North America Concrete Flooring Market Size, Share & Trend Analysis Report By Product (Coated, Polished), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-059-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

The North America concrete flooring market size was valued at USD 2,839.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This growth is attributed to a rise in spending on residential and commercial construction owing to the increasing population in the region. Furthermore, an increase in the use of strong, durable and cheaper flooring in commercial spaces such as warehouses and garages is further expected to increase the demand for concrete flooring in North America. The market for concrete flooring is hampered owing to the presence of other flooring substitutes such as vinyl, ceramic tiles, carpet, wood flooring, laminate flooring, and porcelain tiles.

There has been a growing demand for these materials as these flooring is easier to install and provides better aesthetics than concrete flooring. Furthermore, rising disposable incomes have increased investments in modern flooring options. These factors are expected to negatively affect the concrete flooring market's demand.

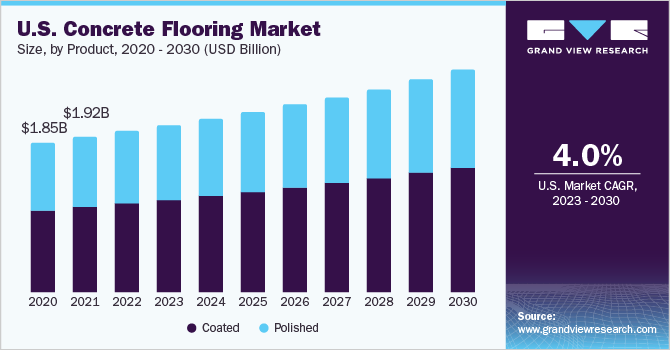

The U.S. concrete flooring market is expected to grow in the coming years owing to rising investments in the construction of affordable homes in the U.S. as a result of the rising population and globalization in the country. Moreover, increasing government spending for the construction of commercial spaces in the U.S. is further expected to boost the demand for concrete flooring in the country.

Product Insights

The coated product segment is growing at the fastest CAGR of 4.4% in terms of revenue over the forecast year. Coated concrete floors are used for providing high-temperature resistance to indoor and outdoor areas and protect the floors in commercial and residential buildings. It also provides protection to non-building structures in the power, metal, and environmental protection industries. The growth of the U.S. construction and manufacturing sectors is expected to increase the demand for coated concrete flooring in the region.

Coated concrete flooring is applied to concrete surfaces to provide a protective layer. This coating is used in areas where the floor is more vulnerable to damage, such as garages, as it helps reduce damage by adding an extra layer to the surface. Concrete floors tend to get slippery when the surface is wet. Coatings help to add an additional layer to resist the surface's slipperiness and prevent injuries. In addition, these coatings provide long-lasting protection to the concrete floors, improve their appearance, and are most affordable.

The North America polished concrete flooring market accounted for the largest volume share and was valued at USD 1,278.8 million in 2022, and is growing at a CAGR of 3.7% over the forecast year. This growth is attributed to its growing demand in various commercial buildings such as hotels, hospitals, and restaurants owing to its characteristics such as better aesthetics, durability, ease of maintenance, and lower cost as compared to other flooring options.

The market for polished concrete flooring is hampered because it doesn’t retain heat. Concrete floor surfaces can become much colder in the winter, especially in countries like Canada and the U.S. where temperatures can drop to -15 degrees. However, factors such as reduced maintenance, stain resistance, LEED compatibility, thermal shock resistance, and high durability provided by polished concrete flooring are anticipated to fuel the overall market demand in the region.

Application Insights

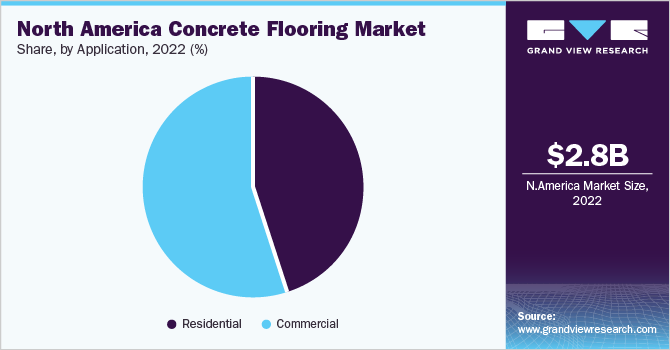

The residential application segment accounted for a market share of 44.5% in 2022 and is anticipated to grow at a significant rate over the forecast year. Government initiatives towards the development of affordable residential homes in the U.S. due to the rising population and globalization are anticipated to increase the need for less expensive and more durable flooring options. Thus, augmenting the demand for concrete flooring in the region.

Commercial application segments of North America's concrete flooring industry accounted for the highest share of 55.4% in 2022. Commercial sectors are high traffic areas, so they require durable flooring options. Polished concrete flooring is most often used in commercial applications because it provides an aesthetic appearance and can withstand heavy traffic.

Concrete flooring products are used in numerous commercial building applications, including offices, convenience stores, hotels, shopping malls, and the construction of other retail stores. The rise in construction spending towards commercial buildings, especially in countries such as the U.S. and Canada, is expected to propel the growth of the concrete flooring market over the forecast period.

Regional Insights

The U.S. market for concrete flooring has dominated the North America market and accounted for USD 1,993.9 million in 2022 and is growing at a CAGR of 4.1% over the forecast year 2023 - 2030. The growth of the U.S. concrete flooring market is attributed to the increasing construction of residential and commercial buildings in the region. The rising demand for multifamily housing projects in the country is likely to further fuel the growth of the concrete flooring market. Moreover, government initiatives for promoting economic recovery in the U.S. are leading to infrastructural developments in the region.

The concrete flooring market in Canada is growing at a significant rate over the coming years. Increasing government investment in infrastructure projects, coupled with an expanding population, rising globalization, and an increased immigration rate across the country, is driving the demand for the construction of residential and non-residential building structures. Rising commercial construction activities in the country owing to the growth of the service industry are expected to fuel the demand for hospitality spaces, thereby driving the overall concrete flooring market over the forecast period.

Mexico concrete flooring market is growing at the fastest CAGR of 4.4% over the forecast year. The local governments of Mexico are focusing on providing affordable homes to their residents. In February 2022, the local government of Puebla and the national housing development chamber announced a project to construct 7,000 homes in the city. This type of government support is expected to have a positive impact on the concrete flooring market in the country.

Moreover, Mexico has established several manufacturing industries, such as automotive, construction, energy, and pharmaceutical. Factors such as low manufacturing costs, availability of raw materials, low labor costs, and proximity to the U.S. have made Mexico a manufacturing hub for automobiles, electronics, and the oil and gas sector and boosted the demand for concrete flooring in industrial applications.

Key Companies & Market Share Insights

The North America concrete flooring market is fragmented in nature, with the presence of several players who are trying to increase their market share by opting for strategies such as the expansion of their product portfolio and increasing their geographical presence. These companies also use a strong distribution and sales network to connect with their customers across regions easily. Some prominent players in the North America concrete flooring market include:

-

Trucrete Surfacing Systems

-

The Sherwin-Williams Company

-

North American Coating Solutions

-

Henkel Corporation

-

Vanguard Concrete Coating

-

Elite Crete Systems

-

CPC Floor Coatings

-

Surface Solutions

-

APPLIED FLOORING

-

Liquid Floors

North America Concrete Flooring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,948.3 million

Revenue forecast in 2030

USD 3,912.8 million

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square feet, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Trucrete Surfacing Systems; The Sherwin-Williams Company; North American Coating Solutions; Henkel Corporation; Vanguard Concrete Coating; Elite Crete Systems; CPC Floor Coatings; Surface Solutions; APPLIED FLOORING; Liquid Floors

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Concrete Flooring Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America concrete flooring market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Coated

-

Polished

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America concrete flooring market size was estimated at USD 2,839.7 million in 2022 and is expected to reach USD 2,948.3 million in 2023.

b. The North America concrete flooring market is expected to grow at a compound annual growth rate, a CAGR of 4.1% from 2023 to 2030, to reach USD 3,912.8 million by 2030.

b. The polished product segment accounted for the largest revenue share of 54.9% in 2022. The growth is attributed to the rising demand for polished concrete flooring in various commercial buildings such as hotels, hospitals, and restaurants owing to its characteristics such as better aesthetics, durability, ease of maintenance, and lower cost as compared to other flooring options.

b. Some key players operating in the North America concrete flooring market include Trucrete Surfacing Systems, The Sherwin-Williams Company, North American Coating Solutions, Henkel Corporation, Vanguard Concrete Coating, Elite Crete Systems, CPC Floor Coatings, Surface Solutions, APPLIED FLOORING, Liquid Floors.

b. Key factors that are driving the market growth include the rising government spending on construction of residential and commercial construction in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."