- Home

- »

- Automotive & Transportation

- »

-

North America E-commerce Fulfillment Services Market Report, 2030GVR Report cover

![North America E-commerce Fulfillment Services Market Size, Share, & Trends Report]()

North America E-commerce Fulfillment Services Market (2023 - 2030) Size, Share, & Trends Analysis Report By Service Type (Warehousing & Storage, Bundling, Shipping), By Application, By Sales Channel, By Organization Size, And Segment Forecasts

- Report ID: GVR-4-68040-039-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

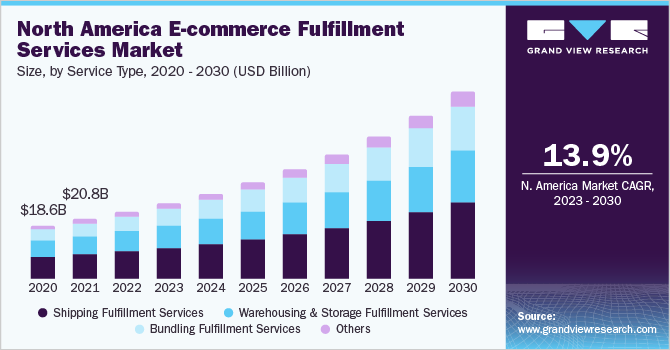

The North America e-commerce fulfillment services market size was valued at USD 23,334.14 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. Fulfillment service centers allow e-commerce merchants to outsource services such as product bundling, warehousing, shipping, and other value-added services, including quick parcel and return management services. The growth in online shopping owing to the rising internet penetration is a significant factor driving the market’s growth. The region's higher internet penetration rate enables an ever-increasing number of consumers to use online retailing services and gain several advantages such as doorstep deliveries and reduced time spent on shopping, thereby driving the market’s growth during the forecast period.

Cross-border shipment agreements and trade liberalization policies have resulted in increased trade and shipping activities in the past few years globally. The Progressive Trans-Pacific Partnership (CPTPP) is one recent example of rising multilateral free-trade agreements. Free Trade Agreements (FTAs) are boosting the demand for international e-commerce transportation.

Furthermore, bilateral free-trade agreements between the U.S. and Canada, known as Canada-U.S. Free Trade Agreement are influencing the demand for cross-border e-commerce services. Such developments are expected to bring more trade opportunities in the coming years, thereby driving the e-commerce fulfillment services market in the region.

A significant rise in the internet penetration rate worldwide as well as in the region has boosted e-commerce sales considerably in recent years. As of December 2021, there were around 417 million active internet users in North America, of which approximately 307.2 million users were from the U.S.

Moreover, the proliferation of smartphones has made it convenient for consumers to shop from anywhere. This has also resulted in a considerable increase in total sales and demand for various product categories, including apparel and footwear, consumer electronics, and medicines, via global e-commerce networks.

The increasing use of advanced technologies such as robotics, automation, and Augmented Reality (AR) has enabled e-commerce companies to excel on the fronts of efficiency and reachability. An increasing number of consumers prefer online purchasing over in-store purchasing owing to benefits such as convenience, lead time, cost, and variety of choices. E-commerce businesses strongly rely on their shipping and warehousing capabilities to transfer products from retailer/manufacturing units to end-users in a shorter lead time.

The COVID-19 pandemic had severely impacted the world economy, leading to unprecedented wealth destruction of businesses and individuals. Governments worldwide took/are taking varied measures to contain the spread of the infection, such as mandatory lockdowns and restrictions on movement and transportation activities, and border restrictions.

These limitations have had a significant impact on enterprises in every industry, reducing profitability and depleting cash flows and financial reserves. On the contrary, the pandemic created a fresh long-term development opportunity for North American E-commerce and service satisfaction firms. To fulfill the growing number of online sale orders, regional e-commerce enterprises are increasingly opting for outsourcing fulfillment services and are focusing on enhancing their internal operational efficiency and building a robust distribution network.

Service Type Insights

The shipping fulfillment service segment led the market and accounted for more than 40% of the regional revenue share in 2022. The increasing preference for shipping fulfillment services by e-commerce firms is increasing as shipping through a third-party source can be especially beneficial for them as these services enable e-commerce merchants to outsource warehousing and shipping. Furthermore, the increasing cross-border trade activities, coupled with the trade liberalization policies, have majorly contributed to the high share of this segment.

The warehouse and storage fulfillment service segment also held a considerable revenue share in 2022. Warehousing and storage fulfillment services offer customers and businesses with unique solutions that can help optimize the logistics flow. These services include receiving and storage or warehousing of the products. The rising preference to use these services by the firms is because they assist the firms in overcoming storage issues and making items available when needed by the customers, allowing them to keep the pricing low.

Sales Channel Insights

The business-to-business segment dominated the overall market and accounted for a revenue share of more than 60% in 2022. B2B order fulfillment services are involved with the delivery of goods from one business to another business. In other words, they deliver large, bulk shipments to a destination company. These services enable businesses to pre-store materials needed to carry out day-to-day operations. Furthermore, B2B fulfillment services are critical to a company's ability to meet orders on time.

The business-to-customer segment is expected to account for the fastest CAGR over the projected period. The B2C fulfillment services comprise picking and packing of the items for smaller, one-time purchases or subscriptions delivered on a recurrent basis. Moreover, B2C fulfillment services provide improved order accuracy to clients due to fewer goods per purchase that are transported and delivered directly to customers.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of more than 53% in 2022. Large enterprises comprise at least 5,000 employees. E-commerce fulfillment services are widely utilized by large enterprises due to larger business volumes and higher-paying capabilities. Furthermore, these services offer large enterprises several benefits such as increased revenue generation, lower investment in warehouse infrastructure, and reduction in shipping costs among others.

The small and medium enterprises (SME) segment is also projected to exhibit a strong CAGR of around 14.2% from 2023 to 2030. The small enterprises comprise at least 250 employees. E-commerce fulfillment services offered by numerous logistics & warehousing service providers are valuable to SMEs since they relieve small & medium enterprises from the responsibility of additional costs associated with labor and legal obligations.

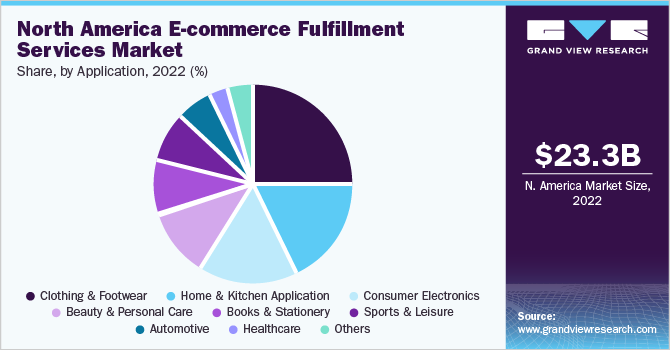

Application Insights

The clothing & footwear segment held the largest market share of more than 25% in 2022. This segment's high revenue share can be attributed to the increased inclination of customers toward buying clothing products through online channels. For instance, in the U.S., shein.com was the biggest online retailer, with a turnover of USD 5.8 billion in 2021.

The consumer electronics segment is expected to emerge as the fastest-growing segment, accounting for a CAGR of 16.4% from 2023 to 2030. The rise is attributed to increased consumer electronics demand as well as the need for careful handling of fragile electrical equipment. Consumer electronics such as mobile phones, tablets, and televisions, among others often need special care while packaging. Since most consumer devices are highly delicate, they must be properly packaged to avoid the chance of damage. Additionally, the shipping boxes/ cartons should also be appropriately sealed to prevent moisture from getting in and defecting the product.

Country Insights

The U.S. dominated the North America e-commerce fulfillment services market and accounted for over 81% of the revenue share in 2022. The country’s growth can be attributed to the increasing consumer preferences for online shopping. For instance, according to various industry experts, the U.S. is the second largest e-commerce market, following China. The U.S. country recorded online sales of USD 870 billion in 2021, which was a 14% increase from 2020. With the rising demand for e-commerce in the country, the demand for e-commerce logistics is likely to witness a subsequent increase.

The Canada e-commerce fulfillment services market is projected to exhibit the fastest CAGR of around 14.4% from 2023 to 2030. According to experts from the e-commerce industry, Canada is among the top 10 countries in the global e-commerce market. Amazon, Walmart, and Costco are the leading online retailers in the country, accounting for about 25% of the e-commerce market. Other key e-commerce sites include eBay, Kijiji, Best Buy, Canadian Tire, Home Depot, Hudson’s Bay, and Newegg.

Key Companies & Market Share Insights

The key players include Amazon.com, Inc.; Ship Network; Ingram Micro, Inc.; FedEx; and United Parcel Service of America, Inc. These companies are aggressively adopting different strategies, such as expansion and mergers & acquisitions, to cater to more customers and increase their market share. For instance, Amazon.com, Inc. announced that it is building a fulfillment center in Fort Wayne to expand its investment in Indiana, U.S. In addition, players are launching new shipping routes to improve efficiency and provide last-mile delivery.Some prominent players in the North America e-commerce fulfillment services market include:

-

Amazon.com, Inc.

-

eFulfillment Service, Inc.

-

Ingram Micro, Inc.

-

ShipRocket

-

Red Stag Fulfillment

-

ShipBob, Inc.

-

Shipfusion Inc.

-

Xpert Fulfillment

-

Sprocket Express

-

FedEx

-

United Parcel Service of America, Inc.

-

Deutsche Post AG (DHL GROUP)

North America E-commerce Fulfillment Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26,270.62 million

Revenue forecast in 2030

USD 65,356.53 million

Growth Rate

CAGR of 13.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service type, application, sales channel, organization size, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Amazon.com, Inc.; eFulfillment Service; Ingram Micro, Inc.; ShipRocket; Red Stag Fulfillment; ShipBob, Inc.; Shipfusion Inc.; Xpert Fulfillment; FedEx; Sprocket Express Plainville; MA; United Parcel Service of America, Inc.; Deutsche Post AG (DHL GROUP)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America E-commerce Fulfillment Services Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America e-commerce fulfillment services market report based on service type, application, sales channel, organization size, and country:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Warehousing And Storage Fulfillment Services

-

Bundling Fulfillment Services

-

Shipping Fulfillment Services

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Beauty & Personal Care

-

Books & Stationery

-

Consumer Electronics

-

Healthcare

-

Clothing & Footwear

-

Home & Kitchen Application

-

Sports & Leisure

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct To Customer

-

Business To Customer

-

Business To Business

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small And Medium Enterprises

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America e-commerce fulfillment services market size was estimated at USD 23,334.14 million in 2022 and is expected to reach USD 26,270.62 million in 2023.

b. The North America e-commerce fulfillment services market is expected to grow at a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 65,356.53 million by 2030.

b. The shipping fulfillment service segment led the North America e-commerce fulfillment services market and accounted for more than 40% of the regional revenue in 2022.

b. The key players in the market include Amazon.com, Inc.; Ship Network; Ingram Micro, Inc.; FedEx; and United Parcel Service of America, Inc.

b. The growth in online shopping owing to the increasing penetration of the internet is a major factor driving the market’s growth. In addition, fulfillment service centers allow e-commerce merchants to outsource services such as bundling, warehousing, shipping, and other value-added services such as urgent parcel and return management services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.