- Home

- »

- Clinical Diagnostics

- »

-

North America, Europe, And Asia Pacific ELISA Analyzers MarketGVR Report cover

![North America, Europe, And Asia Pacific ELISA Analyzers Market Size, Share & Trends Report]()

North America, Europe, And Asia Pacific ELISA Analyzers Market Size, Share & Trends Analysis Report By Type (Optical Filter, Optical Grating), By Mode, By Application, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-064-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The North America, Europe, and Asia Pacific ELISA analyzers market size was valued at USD 515.53 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. The market growth can be attributed to the rising incidence of chronic diseases and increasing usage of ELISA in the detection of these diseases, as it has relatively higher specificity and sensitivity. For instance, according to the American Cancer Society, around 1.96 million new cancer cases are estimated to be diagnosed, and 609,820 cancer-related deaths are estimated in 2023 in the U.S. The incidence of breast, prostate, lung, and colorectal cancer is expected to be high in the coming years. The increasing incidence of chronic diseases, such as infectious & non-infectious diseases, is a major factor driving the demand for ELISA analyzers worldwide, as it is one of the major immunoassay techniques used to diagnose targeted diseases. For instance, according to the Global Cancer Observatory, in 2020, there were more than 50 million cancer cases across the globe. Around 19.2 million cases and 9.9 million cancer-related deaths were recorded in the same year. Moreover, according to a WHO report published in June 2022, around 58 million people worldwide are suffering from chronic hepatitis C infection, with about 1.5 million new infections occurring per year.

Technological advancements in instruments and the introduction of benchtop analyzers for point-of-care facilities are expected to drive market growth over the forecast period. For instance, in May 2022, Molecular Devices, LLC launched automated work cells for ELISA workflows, which streamline and automate the process of testing, allowing for faster and more efficient analysis of large volumes of samples. Moreover, in April 2022, Molecular Devices and Danaher launched SpectraMax Mini Multimode Microplate Reader for academic and biotechnology laboratories. Moreover, favorable initiatives undertaken by companies are expected to increase the market penetration of ELISA instruments.

Market players are collaborating to introduce technologically advanced products in the market. For instance, in August 2021, Novatec Immundiagnostica GmbH and Virotech Diagnostics GmbH merged and formed a new entity, Gold Standard Diagnostics Europe. The company is committed to continuing the research & development activities to develop novel high-quality assays and instruments to detect infectious and chronic diseases. Moreover, in December 2019, Eurofins Abraxis announced the introduction of an automatic ELISA analyzer comprising a single plate analysis system.

Increasing R&D activities related to the development of novel therapeutic products and vaccines by pharmaceutical & biotechnology companies are driving the demand for instruments used in pre-clinical and clinical processes. As vaccine development activities increase, market players are developing novel ELISA products to evaluate the immunogenicity of vaccines and other investigational therapeutic drugs. For instance, BioAgilytix has developed a range of ELISA and cell-based assays for biologics and cell & gene therapies to ensure that vaccine products are well-positioned in development and approval pathways. Similarly, BioCat GmbH has developed the SARS-CoV-2 Spike Protein ELISA Kit for vaccine development.

Type Insights

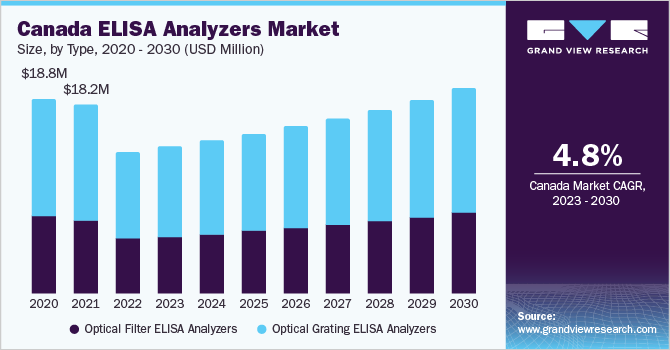

The optical grating segment accounted for the highest revenue share of 61.65% in 2022. A significant number of applications of grating-type analyzers and increased market penetration of these analyzers are key growth drivers. Moreover, eliminating the need for additional filters and a wide range of desired wavelength selection in optical grating ELISA analyzers make it suitable for diagnostic tests at central laboratories and point-of-care facilities to target biomarkers associated with cancer, neurological, cardiovascular, and other diseases.

However, the optical filter segment is expected to grow at the fastest CAGR over the forecast period. High sensitivity & improved results obtained by optical filter ELISA analyzers and an increase in the adoption of these analyzers for various end-use applications are the key factors that are expected to drive the growth of this segment over the forecast period. Moreover, the cost-effectiveness of these analyzers is expected to increase the market adoption of the product, thereby supporting segment growth.

Mode Insights

The automatic analyzers segment accounted for the largest revenue share of 62.0% in 2022 and is expected to maintain its dominance growing at the fastest CAGR over the forecast period. An increase in scientific awareness about automated analyzers and associated advantages is expected to drive the demand for automated ELISA analyzers over the forecast period. Moreover, government bodies are investing to boost the adoption of the latest technologies, and increasing approvals of novel tests performed at automated ELISA systems are expected to boost the demand.

For instance, in May 2021, ZEUS Scientific received U.S. FDA Emergency Use Authorization (EUA) approval for its novel SARS-CoV-2 total antibody test using Dynex DSX, Dynex DS2, and Dynex Agility automated ELISA systems. The growth of semi-automated analyzers is driven by the cost-effectiveness of these products. The adoption of these instruments is higher among low-throughput ELISA users, which are easy to use and provide reliable and fast results.

Application Insights

Based on applications, the vaccine development segment is expected to exhibit the fastest CAGR of 4.7% during the forecast period due to the increasing R&D to develop novel vaccine candidates and growing collaboration between industry players & research institutes to develop vaccines.Moreover, vaccine development is among the fastest-growing areas in the biotechnology and pharmaceutical sectors. The serious impact of infectious and chronic diseases on world health has increased the focus on developing novel and effective vaccines, which is expected to drive the demand for ELISA analyzers.

The immunology segment dominated the industry in 2022. The increasing R&D investment in immunology-based research and precise quantitative & semi-quantitative determination of samples for immunology applications are likely to support the growth of the segment over the projected period. ELISA is commonly used in the detection & quantification of a large number of molecules, such as peptides, proteins, antibiotics, and others. ELISA test can detect molecules of interest and the results are useful for basic research and disease research application needs.

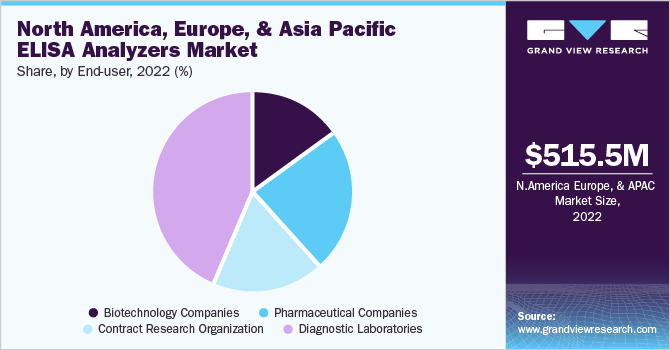

End-User Insights

The diagnostics laboratories segment held the largest share of 42.62% of the overall revenue in 2022 due to several advantages, such as faster results coupled with highly sensitive, specific, scalable, and cost-effective tests for various types of samples. ELISA technology is one of the most widely used immunoassays for the detection of antigens and antibodies in clinical diagnostics applications. Moreover, increasing incidence of infectious diseases, technological advancements, fast & accurate results, and cost-effectiveness of ELISA tests are expected to drive the demand for ELISA analyzers in clinical diagnostics facilities.

The contract research organization segment is expected to register the fastest growth rate during the forecast years due to the increasing outsourcing of research & development and manufacturing services in the pharmaceutical industries. Key companies outsource their research & drug development activities to various CROs to obtain a higher profit margin, which is likely to expand their scope of growth over the forecast period.

Regional Insights

North America dominated the market with a share of 44.61% in 2022 owing to the high adoption rate of technologically advanced testing products and the presence of key market players in the region. Well-established healthcare infrastructure, high awareness about analytical tools, and favorable reimbursement policies & government initiatives are further expected to drive market growth. Moreover, end-users have a wide range of options when choosing an ELISA analyzer due to the presence of several global market leaders and small companies offering ELISA analyzers.

Asia Pacific is expected to register a lucrative growth rate during the forecast period. The increasing incidence of diseases, such as chronic and infectious diseases, is encouraging companies to enter the regional ELISA analyzers market, which is expected to drive industry expansion in Asia Pacific. Moreover, countries, such as Japan and China, have introduced several awareness programs about infectious diseases, which may promote regional market growth over the forecast period.

Key Companies & Market Share Insights

Key players are undertaking various strategies, such as new product launches, mergers & acquisitions, and geographic expansion to increase their market footprint. For instance, in August 2021, Gold Standard Diagnostics, Novatec Immundiagnostica GmbH, and Virotech Diagnostics GmbH merged to continue R&D activities to develop novel high-quality assays and instruments to detect infectious and chronic diseases. Similarly, in April 2022, Molecular Devices, LLC announced the launch of SpectraMax mini multi-mode microplate reader for biotech laboratories and academia. Some of the prominent players in the North America, Europe, and Asia Pacific ELISA analyzers market include:

-

Thermo Fisher Scientific Inc.

-

PerkinElmer Inc.

-

Tecan Trading AG

-

Agilent Technologies, Inc.

-

VIRCELL S.L.

-

VedaLab

-

Dia.Pro Diagnostic Bioprobes S.r.l.

-

ProGnosis Biotech SA

-

RD-Ratio Diagnostics GmbH

-

Gold Standard Diagnostics

-

MEDICON HELLAS S.A.

-

Human Gesellschaft für Biochemica & Diagnostica

-

Institut Virion\Serion GmbH

-

Institute of Isotopes Co. Ltd.

-

Trina Bioreactives AG

-

Mabtech AB

-

Abcam Plc.

-

Miltenyi Biotec

-

Novel Biomarkers Catalyst Labs

-

Antibodies-online

-

WILEX AG.

-

Biorbyt

-

Hycult Biotech

North America, Europe, And Asia Pacific ELISA Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 529.40 million

Revenue forecast in 2030

USD 681.98 million

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode, application, end-user, region

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand

Key companies profiled

Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Tecan Trading AG; Agilent Technologies, Inc.; VIRCELL S.L.; VedaLab; Dia.Pro Diagnostic Bioprobes S.r.l.; ProGnosis Biotech SA; RD-Ratio Diagnostics GmbH; Gold Standard Diagnostics; MEDICON HELLAS S.A.; Human Gesellschaft für Biochemica & Diagnostica; Institut Virion\Serion GmbH; Institute of Isotopes Co. Ltd.; Trina Bioreactives AG; Mabtech AB; Abcam Plc.; Miltenyi Biotec; Novel Biomarkers Catalyst Labs; Antibodies-online; WILEX AG; Biorbyt; Hycult Biotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America, Europe, And Asia Pacific ELISA Analyzers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America, Europe, and Asia Pacific ELISA analyzers market based on type, mode, application, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Filter ELISA Analyzers

-

Optical Grating ELISA Analyzers

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated ELISA Analyzers

-

Semi-Automated ELISA Analyzers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunology

-

Vaccine Development

-

Drug Monitoring

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology Companies

-

Pharmaceutical Companies

-

Contract Research Organization

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The North America, Europe, and Asia Pacific ELISA analyzers market size was estimated at USD 515.53 million in 2022 and is expected to reach USD 529.40 million in 2023.

b. The North America, Europe, and Asia Pacific ELISA analyzers market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 and is expected to reach USD 681.98 million by 2030.

b. The optical grating ELISA analyzers segment is expected to dominate the North America, Europe, and Asia Pacific ELISA analyzers market with a share of 62.0% in 2022 due to the significant number of applications of grating-type analyzers and increased market penetration of these analyzers.

b. Some key players operating in the North America, Europe, and Asia Pacific ELISA analyzers market include Thermo Fisher Scientific Inc., PerkinElmer Inc., Tecan Trading AG, and Agilent Technologies, Inc. among others.

b. Rising incidence of infectious diseases & chronic diseases, increasing usage of ELISA in the detection of these diseases, and technological advancements in instruments are the major factors driving the North America, Europe, and Asia Pacific ELISA analyzers market growth over the forecast period.

b. North America held the largest share of 44.61% in 2022 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the well-established healthcare infrastructure, high awareness of analytical tools, presence of strong market players, and favorable reimbursement policies & government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."