- Home

- »

- Medical Devices

- »

-

North America And Europe Intravenous Infusion Pumps Market, 2030GVR Report cover

![North America And Europe Intravenous Infusion Pumps Market Size, Share & Trends Report]()

North America And Europe Intravenous Infusion Pumps Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Volumetric Infusion Pumps, Syringe Infusion Pumps), By Disease Indication (Chemotherapy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-528-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

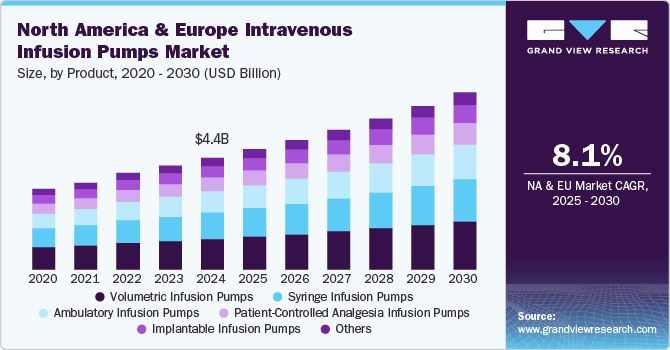

The North America and Europe intravenous infusion pumps market size was valued at USD 4.45 billion in 2024 and is projected to grow at a CAGR of 8.10% from 2025 to 2030. This growth is attributed to the increase in the prevalence of chronic diseases such as respiratory diseases, stroke, diabetes, cancer, and cardiovascular diseases, wherein cardiovascular disease is the major cause of death in Europe and North America. For instance, according to the U.S. Department of Health and Human Services, an estimated 129 million people in the US have at least one major chronic disease. Intravenous infusion pumps ensure controlled, regulated, & error-free delivery of nutrients and medications while treating patients via radiation therapy or chemotherapy, as these are very complex processes and require precise dosages of medication. The use of these pumps helps in reducing errors during administration, as medication errors are the most common types of errors and cannot be taken carelessly while handling patients with chronic diseases.

There is a need for advanced delivery systems that are safer, more efficient, and standardized. The introduction of smart infusion pumps or next-generation intravenous pumps is imparting greater growth opportunities for the overall pump market. Smart pumps are infusion devices that are embedded with a computer software system aimed at decreasing drug dosing errors through the presence of drug libraries, ensuring safe medication administration. For instance, in April 2024, Mackenzie Health in Canada became the first healthcare system to implement BD Alaris EMR Interoperability, enabling two-way communication between IV infusion pumps and electronic medical records (EMRs). This advancement eliminates the need for manual programming, significantly reducing medication administration errors while improving workflow efficiency. Studies show an 86% reduction in keystrokes needed for infusion programming. Such smart infusion technologies are driving market growth by increasing hospital demand for interoperable and automated IV pumps.

Regulatory approvals of advanced infusion pump technologies are a key market driver for the intravenous infusion pump market, improving patient safety, efficiency, and connectivity in healthcare settings. For instance, in April 2024, Baxter International Inc. recently received FDA 510(k) clearance for its Novum IQ large volume infusion pump with Dose IQ Safety Software, expanding its Novum IQ Infusion Platform. This integrated system, which includes both large volume and syringe pumps, allows clinicians to use a single, connected platform across multiple care settings, enhancing workflow efficiency and reducing medication errors. As hospitals increasingly adopt smart, interoperable infusion technologies, demand for next-generation IV pumps is expected to grow significantly.

Market Concentration & Characteristics

The market is witnessing a high degree of innovation through advanced technologies in software and programming. Smart infusion pumps are being increasingly adopted in both North America and Europe. Companies are focusing on research, development and seeking regulatory approvals for new infusion devices.

Several market players, such as ICU Medical, Inc., are involved in collaborations and partnerships with other leading players. Through strategic activities, these companies foster innovation, distribution, and geographical expansion to enhance their presence and address the growing demand for infusion pumps.

Regulations in the market have a significant impact, ensuring product safety and efficacy through stringent approvals. Regulatory compliance boosts consumer confidence and market acceptance. However, the lengthy approval processes can delay market entry and increase development costs for manufacturers.

Alternative product choices such as subcutaneous intrathecal and enteral pumps are gaining traction. These pumps are integrated with advanced technology, with connectivity to smartphones.

Market players are expanding their presence regionally by entering untapped geographical markets, forging strategic partnerships with local distributors, and modifying product applications to accommodate specific healthcare demands within each region.

Product Insights

The volumetric infusion pumps segment held the largest share, over 27.44%, in 2024. Many critical conditions require an intravenous infusion of medication, which is regulated and error-free. Volumetric infusion pumps are medical devices that employ electronic peristaltic pressure, capable of continuous and specific delivery of fluids coupled with a high level of accuracy, thereby increasing the efficiency of drug administration. Volumetric infusion pumps are used in hospitals, home care settings, ambulatory care settings, and outpatient infusion centers, as well as help deliver nutrients or medications, such as hormones, antibiotics, chemotherapy drugs, & pain relievers in large volumes.

The ambulatory infusion pumps segment is expected to show lucrative growth during the forecast period, driven by the ease of use, delivery of medication while allowing patients to be mobile, and reduction in hospital stays. Advancements in technology and the development of new devices further fuel the market growth. For instance, in May 2024, Moog Inc. received FDA 510(k) clearance for its CURLIN 8000 Ambulatory Infusion System, designed specifically for home infusion therapy. This multi-therapy system features an intuitive user interface for both clinical and non-clinical users, ensuring precise and continuous infusion delivery. As home healthcare adoption rises due to aging populations and cost-saving initiatives, the demand for portable, user-friendly ambulatory infusion pumps is expected to increase, driving market growth.

Disease Indication Insights

The pediatrics/neonatology segment held the largest share, 26.47%, in 2024 due to increasing congenital disabilities and convenience in administering medications with the help of infusion pumps. According to the Centers for Disease Control and Prevention, each year, 1 in every 33 babies born in the U.S. is diagnosed with congenital disabilities. Similarly, out of 5 million births every year in the European Union, 2.5% of all babies are diagnosed with congenital anomalies. The number of babies born preterm can be reduced by nearly three quarters with feasible, cost-effective care and proper nutrition in the initial stages after birth. In addition, numerous diseases can affect older children, including neuroblastoma, Krabbe disease, and Gaucher disease. These conditions require proper medications with advanced infusion pumps for error-free delivery and to minimize the odds of accidental overdose.

The chemotherapy segment is projected to grow with the fastest CAGR of 9.28% during the forecast period. According to an article published in the American Cancer Society Journal, more than 2 million new cancer cases, with 611,720 cancer deaths, were projected to occur in the U.S. in 2024. Similarly, according to the WHO, cancer is the leading cause of death in the European region, with annual 3.7 million new cases and 1.9 million deaths. Currently, 30% to 50% of cancers can be prevented by avoiding risk factors, timely diagnosis, and efficient treatment. Benign cancer cells can be removed through surgeries; however, malignant ones can invade other healthy tissues and have to be treated with chemotherapy drugs, which is a combination of alkylating agents, nitrosoureas, antimetabolites, antitumor antibiotics, corticosteroids, etc. Chemotherapy is majorly given intravenously to the patient or through capsules. The dosage depends on the severity of the cancer and thus requires calculated drug delivery in a controlled manner via intravenous infusion pumps. The increase in the prevalence of cancer is expected to propel the overall market for intravenous infusion pumps.

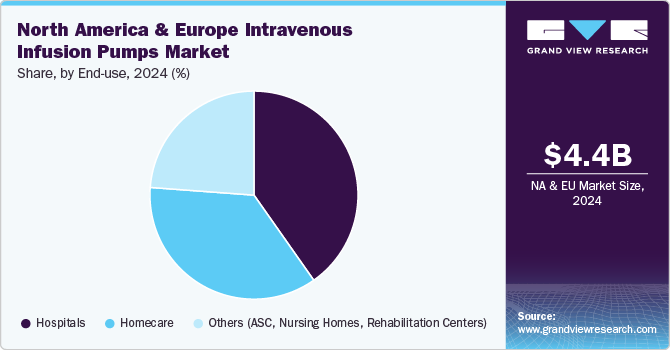

End-use Insights

Hospitals held the largest market share of 40.3% in 2024, owing to the use of intravenous infusion pumps in delivering medications, fluids, and nutrients to patients. In a hospital setting, IV infusion pumps are essential for managing various medical conditions, from administering chemotherapy to providing hydration and electrolyte balance in critically ill patients. Infusion pumps are commonly used in emergency departments, intensive care units (ICUs), operating rooms, and patient wards to deliver fluids, medications, and nutrition. For instance, according to the American Hospital Association, currently, there are 6,093 hospitals in the U.S. The need for precise and controlled administration of medications such as antibiotics, pain management drugs, and chemotherapy agents drives the demand for these pumps.

Homecare settings are expected to grow at the fastest CAGR of 8.45% and have become essential for using intravenous (IV) infusion pumps, allowing patients to receive necessary medical treatments in the comfort of their homes. These pumps are essential for administering medications, especially for patients who require long-term, consistent therapies. Homecare patients benefit from IV infusion pumps by having access to precise, controlled drug delivery without frequent hospitalizations, making the treatment process more comfortable and convenient. Moreover, homecare settings benefit significantly from the flexibility offered by various types of infusion pumps. For instance, ambulatory infusion pumps are designed for portability, allowing patients to maintain their daily activities while receiving treatment. This adaptability is crucial for chronic illness management, where long-term therapy is required. For instance, Micrel Medical Devices SA offers Micropump MP mlh+ Multi Syringe, an infusion pump suitable for homecare treatments for pain management and immunoglobulin therapy.

Regional Insights

North America intravenous infusion pump market held the largest share of 56.6% in terms of revenue in 2024 and is expected to maintain its growth rate over the forecast period. This can be attributed to factors such as robust medical infrastructure, rising prevalence of chronic diseases, and advancements in infusion technology. Moreover, factors such as favorable insurance & medical device reimbursement policies, strong local presence of key manufacturers, and major exporters of infusion pumps are anticipated to propel the regional market over the coming years.

U.S. Intravenous Infusion Pump Market Trends

The intravenous infusion pumps market in the U.S. is growing as the government is expected to introduce stricter regulations and adopt new standards for safer & efficient practices. This progress is being achieved by improving national standards of care via the Infusion Therapy Standards of Practice and the Policies and Procedures for Infusion Nursing, along with upgrading policies of individual care providers. Moreover, new product launches and FDA approvals significantly contribute to market growth. For instance, in April 2024, Baxter received U.S. FDA clearance for its Novum IQ large volume infusion pump and Dose IQ safety software. This advancement enhances connected and intelligent infusion therapy, improving patient safety and care efficiency.

Key North America And Europe Intravenous Infusion Pumps Company

Some of the key players operating in the industry include Baxter B. Braun Melsungen AG, and BD among others. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, companies such as Micrel Medical Devices SA are emerging players in the intravenous infusion pumps market. These industry players are continuously focused on leveraging specialized technologies to differentiate themselves.

Key North America And Europe Intravenous Infusion Pumps Companies:

- Baxter

- B. Braun Melsungen AG

- Fresenius Kabi AG

- ICU Medical, Inc. (Smiths Medical)

- Micrel Medical Devices SA

- Boston Scientific Corporation

- BD

- Terumo Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Moog Inc.

- IRadimed Corporation

- CODAN Companies

- Arcomed

Recent Developments

-

In November 2024, ICU Medical, Inc. and Otsuka Pharmaceutical Factory, Inc. announced a joint venture to enhance supply chain resiliency and innovation in the North American IV solutions market. Combining Otsuka’s extensive global manufacturing capabilities with ICU Medical’s strong North American production and distribution, the partnership aims to deliver advanced IV pumps and consumables to healthcare providers. The agreement includes a USD 200 million upfront payment from OPF to ICU Medical, with additional performance-based milestones and long-term collaboration plans.

-

In January 2024, Lemer Pax, a global leader in radiation protection, signed a partnership with ICU Medical, a leader in infusion systems, to distribute the Plum 360 pump in the French nuclear medicine sector to expand its sales in the European market.

North America And Europe Intravenous Infusion Pumps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.78 billion

Revenue forecast in 2030

USD 7.06 billion

Growth Rate

CAGR of 8.10% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease indication, end-use, region

Regional scope

North America, Europe

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway.

Key companies profiled

Baxter, B. Braun Melsungen AG, Fresenius Kabi AG, ICU Medical, Inc. (Smiths Medical), Micrel Medical Devices SA, Boston Scientific Corporation, BD, Terumo Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. , Moog Inc. , IRadimed Corporation, CODAN Companies, Arcomed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe Intravenous Infusion Pumps Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America and Europe intravenous infusion pumps market report on the basis of product, disease indication, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Volumetric Infusion Pumps

-

Syringe Infusion Pumps

-

Ambulatory Infusion Pumps

-

Patient-Controlled Analgesia Infusion Pumps

-

Implantable Infusion Pumps

-

Others

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Diabetes

-

Gastroenterology

-

Analgesia/Pain Management

-

Pediatrics/Neonatology

-

Hematology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The North America and Europe intravenous infusion pumps market size was estimated at USD 4.45 billion in 2024 and is expected to reach USD 4.7 billion in 2025.

b. The North America and Europe intravenous infusion pumps market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 7.06 billion by 2030.

b. The volumetric infusion pumps segment held the largest share, over 27.44%, in 2024. Many critical conditions require an intravenous infusion of medication, which is regulated and error-free.

b. Some of the key players operating in the industry include Baxter B. Braun Melsungen AG, and BD among others.

b. The growth is attributed to the increase in the prevalence of chronic diseases such as respiratory diseases, stroke, diabetes, cancer, and cardiovascular diseases, wherein cardiovascular disease is the major cause of death in Europe and North America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.