- Home

- »

- Advanced Interior Materials

- »

-

North America HVAC Filter Change Service Market Report, 2030GVR Report cover

![North America HVAC Filter Change Service Market Size, Share & Trends Report]()

North America HVAC Filter Change Service Market Size, Share & Trends Analysis Report By Type (Product, Service), By Filter Type (HEPA Filters, Washable Filters), By Equipment Type, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-157-5

- Number of Report Pages: 169

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

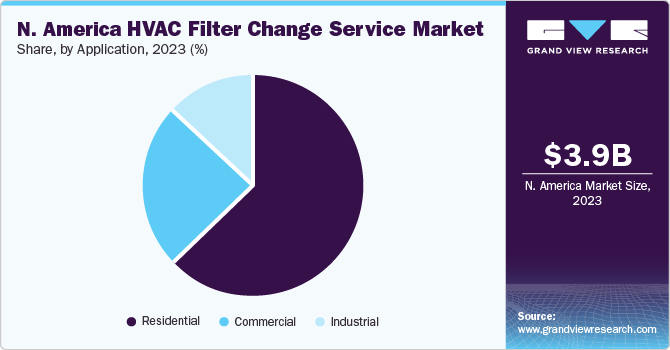

The North America HVAC filter change service market size was estimated at USD 3.9 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. The adoption of air-cleaning and filtration devices helps reduce indoor air pollution. Moreover, outdoor air pollution sources such as wildfires, pollens, wind-blown dust particles, industrial activities, and motor vehicles cause an increase in indoor air pollution with a significant impact on the health and wellness of individuals. The government and environmental authorities in the U.S. and Canada are taking proactive initiatives and introducing new rules and regulations to reduce indoor air pollution to ensure the quality of the air that is safe for breathing and lowers the risk of respiratory diseases in inhabitants. These factors are expected to drive the demand for HVAC filter change services over the forecast period.

New technological advancements are shaping the filter technology and air filtration process in the HVAC systems for residential, commercial, and industrial purposes. Technological advancements are performed with incorporation of certain features or characteristics for final air filtration. For example, primary issues that exist with air filters include lower energy consumption, longer filter life, easier maintenance, greater dust load capacity, and cost-efficiency. Such issues form the basis for technological improvements by most filter manufacturers. These aforementioned factors are anticipated to propel the market demand over the forecast period.

As the population in urban areas increases, there is a higher concentration of buildings, both residential and commercial. This higher population density leads to the installation of more HVAC systems to meet the heating and cooling needs within these structures. Furthermore, growing population results in increased construction activity to accommodate housing and infrastructure needs. New buildings, whether residential or commercial, are likely to be equipped with HVAC systems, contributing to the overall demand.

The need for HVAC systems in different U.S. states is influenced by the diverse climate conditions and temperature variations. For instance, heating is a critical component of HVAC systems in northern states, including Minnesota and North Dakota, due to cold temperatures. Furnaces and other heating systems are essential in maintaining indoor temperature for comfortable living. These aforementioned factors are anticipated to augment the demand for market over the forecast period.

Moreover, with a larger population, there are generally high concerns regarding environmental and health issues, including indoor air pollution. HVAC systems play a crucial role in maintaining good indoor air quality by filtering out dust, allergens, and pollutants. Regular filter changes are necessary to ensure effective functioning of these systems. Furthermore, with a larger population, there is often a higher level of awareness regarding the importance of HVAC system maintenance. People are more likely to understand the role of air filters in maintaining system efficiency and indoor air quality, leading to an increased demand for filter change services.

In addition, regular maintenance, including filter changes, is essential for maintaining the energy efficiency of HVAC systems. As energy costs rise and people become more conscious of their environmental impact, there is a growing demand for services that help optimize the performance of HVAC systems. These factors are anticipated to drive the demand for the market over the forecast period. Overall, increasing population contributes to the demand for HVAC systems in various settings. As these systems become more prevalent, the need for maintenance services, including filter changes, will grow. This creates a ripple effect, driving the demand for HVAC filter change services in response to the expanding market for heating and cooling solutions.

Application Insights

The residential application segment led the market in 2023 with the largest revenue share of 63.4%. According to the U.S. Census Bureau, in September 2023 the federal government gave 1.47 million residential building construction permits in the country, while the construction of 1.45 million houses was completed in September 2023. Moreover, in the U.S., the construction completion rate of privately owned houses in September 2023 was 6.6% above the housing construction completion rate witnessed in August 2023. With the rising level of pollution, the demand for filter change services is anticipated to surge in the U.S. and Canada to ensure the efficient supply of filtered air to residential buildings.

The surging health consciousness among the masses and the increasing awareness among them about the benefits of maintaining indoor air quality are anticipated to drive the growth of this segment of the market in both countries during the forecast period. Moreover, with rise in construction of residential buildings and increase in pollution levels in the U.S. and Canada, the demand for HVAC filter change services is expected to remain high in these countries over the forecast period.

Commercial application segment is anticipated to witness a CAGR of 4.2% over the forecast period. HVAC systems are used in commercial establishments to supply contaminant-free air with effective control over its temperature and humidity. Commercial buildings have more air ventilation requirements than residential buildings due to their larger spaces. Moreover, in hospitals and healthcare facilities, the demand for high-purity air is critical. Due to these factors, the filters used in commercial settings generally have more airflow filtration capacity and higher MERV value than residential places.

Manufacturing, chemical processing, warehousing, and food processing facilities require industrial HVAC systems for heating, cooling, and ventilation purposes. Although these systems operate on the same principles as residential HVAC units, their capacity, and complexity are higher than the residential HVAC systems. HVAC system used in the industrial sector is designed to handle more airflow and hence has more equipment placed in the system. Air filters are essential components in these systems for ensuring the required air quality.

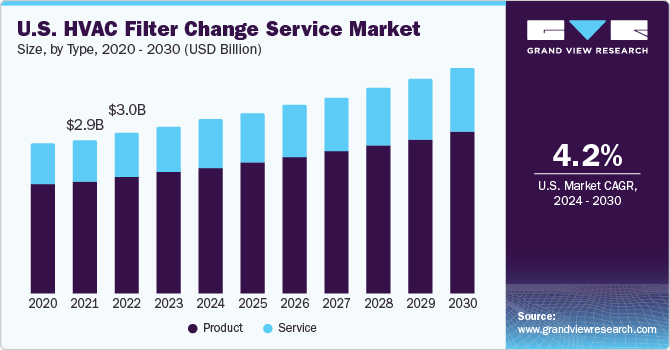

Type Insights

Product type segment led the market in 2023 with a revenue share of 72.9%. According to the Canadian Institute for Health Information’s report, healthcare spending in Canada is expected to reach 344 billion USD in 2023, USD 9 billion higher than that in 2022. Furthermore, hospital expenditures were projected to increase by 11.1% in 2022 and 4.1% in 2023. This increase in healthcare spending is expected to fuel the demand for air filters in the U.S. and Canada to supply purified air.

Air filters are further classified based on their life span. Fiberglass disposable filters are designed to be replaced after 30-60 days based on the external environment where they are placed. The pleated disposable filters are more efficient than the fiberglass filters and can be replaced after three months. UV light filters have a maximum life span and require less maintenance as compared to other air filters. Air filters with a higher life span are used in the HVAC systems that are required to work continuously. The higher life span air filters are more costly than the conventional air filters.

Service type segment is anticipated to witness a CAGR of 4.7% over the forecast period. After the installation of HVAC systems, regular maintenance of air filters is necessary to maintain their effectiveness. In an HVAC system, surrounding atmospheric air is allowed to pass from air filters to remove the suspended air particles and odor. As a result, air filters play a critical role in maintaining the purified air supply, hence their timely inspection is necessary.

According to the Environmental Protection Agency data published in July 2023, the Air Quality Index (AQI) in 17 states of the U.S. is observed to be very unhealthy, and code red conditions were observed in 12 states during May and June 2023. Such a high level of pollution is further propelling the demand for timely inspection of air filters in the U.S. and Canada, as the level of particulate matter has been continuously increasing and getting deposited over the filters. These aforementioned factors are anticipated to augment the market demand over the projected period.

Filter Type Insights

Based on filter type, the pleated filters segment led the market in 2023 with a revenue share of 32.8%. The pleated filters are designed to capture a wide range of solid particulates, such as pollens, dust, and mold, depending on their MERV rating. The pleated filters are not reusable. Hence, to maintain the filtration efficiency, they are required to be replaced after a certain time interval. The pleated filters are generally placed inside the HVAC system ducts and air handling units (AHUs). In residential buildings, they are used to filter the solid particulates from the air to help maintain the indoor air quality.

In the HVAC system, HEPA filters capture the particles through three simultaneous processes. Factors such as filter thickness, velocity of the incoming air, and fiber diameter are critical for the filtration process in any HVAC system. As HEPA filters can capture a wide range of airborne particles, they are considered the best option to improve indoor air quality. In addition to that, as they can filter infectious bacteria and mold, they are used to improve the overall air quality required for lung function.

Ultraviolet light filters segment is anticipated to witness the fastest CAGR of 5.2% over the forecast period. These are used in the HVAC system to improve air quality by controlling the growth rate of hazardous bacteria and microorganisms. The UV light filter does not kill the microorganisms but rather prevents microorganisms from functioning and reproducing. There are two types of UV light filters used in HVAC systems, namely air sterilization and coil sterilization. In coil sterilization, a UV light filter is placed inside the heating coil or evaporator coil. Here, the air is passed through germicidal UV light, which neutralizes the microorganisms. In air sterilization, UV light lamps are installed in air ducts where the UV light neutralizes the airborne microorganisms.

Washable filters are not required to be purchased frequently as they offer an easy-to-use reasonably priced option for protecting HVAC systems. Furthermore, as these filters can be reused, they reduce the carbon footprint and are considered a more environmentally friendly air filtration solution. Depending on their design and type of material used, their effectiveness in filtering small particles varies. They have minimum efficiency reporting values MERV rating lying between 1 and 4, hence they are preferred to filter large-size particles (whose size remains greater than 10 microns).

Equipment Type Insights

In terms of equipment type, the central AC filters segment led the market in 2023 with a revenue share of 37.9%. Central air conditioning cools and removes moisture from the air of an entire building by supplying the conditioned air with the help of ducts and vents. It is a convenient and cost-effective method by which uniform temperature and moisture can be maintained in commercial, residential, and industrial spaces. Moreover, air filters are used in the central AC systems to improve the air quality.

Air handling unit (AHU) is an integral part of the HVAC system. This large indoor unit collects the surrounding air, removes the dust and other harmful contaminants such as pollen and mold, adjusts the temperature and moisture content of the air, and supplies that air to the rooms through ducts. AHUs consist of an air filter, humidifier, heat exchanger fins, and blower. Air filters used in the air handling units are designed as per the end-use application. The thickness and type of filter used in AHUs are determined by factors such as end-use application and particle size to be removed from the surrounding air.

Air purifier filter equipment type segment is anticipated to witness a CAGR of 5.3% over the forecast period. Air purifiers use a fan and internal filter to draw impurities out of the air in a finite space. The filtration procedure improves indoor air quality continuously by repeating the filtering process multiple times per hour. The air purifier filters use mechanical filtration and electrostatic precipitation to separate the particles from the air. They are classified into two types, fixed units and portable units.

The primary function of furnace filters is to shield the blower fan of the furnace from dirt and contaminants entering through the return duct. They also protect respiratory health by maintaining indoor air quality (IAQ) and filtering out suspended air particles. The size of the air filter used in furnace filters is determined by the size and operating cycle of the furnace. The most common thickness of the furnace filter is 1 inch in dimension. These aforementioned factors are anticipated to propel the demand for furnace filters over the forecast period.

Country Insights

The U.S. dominated the market in 2023 with a revenue share of 79.6%. The rising demand for HVAC filter change services is a clear reflection of the growing awareness about indoor air quality and the importance of maintaining efficient heating, ventilation, and air conditioning systems. Consumers are becoming more conscious of the benefits of clean air on health, and businesses are recognizing the benefits of having properly functioning HVAC systems. Therefore, as manufacturing continues to expand in the U.S., the HVAC filter change service industry is likely to see a continued boost.

Canada is anticipated to witness a CAGR of 4.7% over the forecast period. The increasing number of food processing facilities and escalating government measures undertaken by the Canadian government necessitate the demand for the HVAC filter change service industry in Canada. For instance, in 2023, the Canadian Food Innovation Network financed USD 2.5 million via the Food Innovation Challenge and Innovation Booster Programmes in eight projects, with a total value of more than USD 5.0 million.

Key Companies & Market Share Insights

Key manufacturers use a range of strategies, including geographic expansions, product launches, and mergers and acquisitions, to broaden their market penetration and adapt to shifting technical demands. For instance, In June 2023, American Residential Services consolidated five of its distinct enterprises in the Salt Lake City region in the U.S. into a single brand, namely Yes! Heating, Air Conditioning, Plumbing, and Electric. These enterprises include ARS/Rescue Rooter; Captain Electric; Absolute Air; ESCO Heating, Air Conditioning, Plumbing, and Electrical; and OyBoy Heating and Cooling. Yes! Heating, Air Conditioning, Plumbing, and Electric is a longstanding name that has been part of the ARS/Rescue Rooter family since 2008.

Furthermore, in September 2023, Sensirion AG collaborated with AirTeq to launch the AirCheq Pro Series indoor air quality meter. This collaboration combines the precision and quality of the Swiss-made sensors of Sensirion with the commitment of AirTeq to provide superior indoor air quality solutions for business and residential establishments.

Key North America HVAC Filter Change Service Companies:

- Hyland Filter Service

- Snappy Services

- Aire Serv (Neighborly Company)

- JOE FILTER, LLC

- Commercial Filter Service, Inc.

- Plumbing & Air Conditioning Company

- Grande Air Solutions

- Joe W. Fly Co. Inc.

- American Residential Services LLC.

- National Air Filter

- Bradbury Brothers Cooling, Heating, Plumbing & Electrical

- FilterPro USA LLC

- AAA Filter Service

- Murphy & Miller, Inc.

- Carolina Filters, Inc.

- Filter Sales and Service, Inc.

- Filtra Systems

- Filtration Plus

- Filtration Technology Systems

- Fresh Air Filter Service

- Pure Filtration Products

- Advanced Filtration Concepts

- Kariterra

- Sensirion AG

- Air Filter Super Store

- DL Sales Corp

North America HVAC Filter Change Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.1 billion

Revenue forecast in 2030

USD 5.2 billion

Growth rate

CAGR of 4.3 from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, filter type, equipment type, application, region

Regional scope

North America

Country Scope

U.S., Canada

Key companies profiled

Hyland Filter Service; Snappy Services; Aire Serv (Neighborly Company); JOE FILTER, LLC; Commercial Filter Service, Inc.; Plumbing & Air Conditioning Company; Grande Air Solutions; Joe W. Fly Co. Inc.; American Residential Services LLC;

National Air Filter; Bradbury Brothers Cooling; Heating; Plumbing & Electrical; FilterPro USA LLC; AAA Filter Service; Murphy & Miller, Inc.; Carolina Filters, Inc.; Filter Sales and Service, Inc.; Filtra Systems; Filtration Plus; Filtration Technology Systems; Fresh Air Filter Service; Pure Filtration Products; Advanced Filtration Concepts; Kariterra; Sensirion AG; Air Filter Super Store; DL Sales Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America HVAC Filter Change Service Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America HVAC filter change service market report based on type, filter type, equipment type, application, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product

-

Service

-

-

Filter Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

HEPA Filters

-

UV light Filters

-

Washable Filters

-

Pleated Filters

-

Electrostatic Filters

-

Others

-

-

Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Handling Units

-

Furnace Filters

-

Central AC Filters

-

Air purifier Filters

- Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

-

Canada

-

Frequently Asked Questions About This Report

b. Due to a larger population, there is generally high concerns regarding environmental and health issues, including indoor air pollution. HVAC systems play a crucial role in maintaining good indoor air quality by filtering out dust, allergens, and pollutants. Regular filter changes are necessary to ensure effective functioning of these systems. These aforementioned factors are expected to increase the market demand in the coming years.

b. North America HVAC filter change service market size was estimated at USD 3.9 billion in 2023 and is expected to be USD 4.1 billion in 2024.

b. North America HVAC filter change service market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 5.2 billion by 2030.

b. Pleated filters filter type segment led the market and accounted for 32.8% of the total market share in 2023. The pleated filters are designed to capture a wide range of solid particulates, such as pollens, dust, and mold, depending on their MERV rating.

b. Some of the key players operating in the North America HVAC filter change service market include Hyland Filter Service, Snappy Services, Aire Serv (Neighborly Company), JOE FILTER, LLC, Commercial Filter Service, Inc. , Plumbing & Air Conditioning Company, Grande Air Solutions, Joe W. Fly Co. Inc., American Residential Services LLC., National Air Filter, Bradbury Brothers Cooling, Heating, Plumbing & Electrical, FilterPro USA LLC, AAA Filter Service, Murphy & Miller, Inc., Carolina Filters, Inc., Filter Sales and Service, Inc., Filtra Systems, Filtration Plus , Filtration Technology Systems, Fresh Air Filter Service, Pure Filtration Products, Advanced Filtration Concepts, Kariterra, Sensirion AG, Air Filter Super Store, DL Sales Corp.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."