- Home

- »

- Backup Power Solutions

- »

-

North America Lithium-ion Battery Market Size, Report, 2030GVR Report cover

![North America Lithium-ion Battery Market Size, Share & Trends Report]()

North America Lithium-ion Battery Market Size, Share & Trends Analysis Report By Product (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Cobalt Aluminum Oxide), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-247-0

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

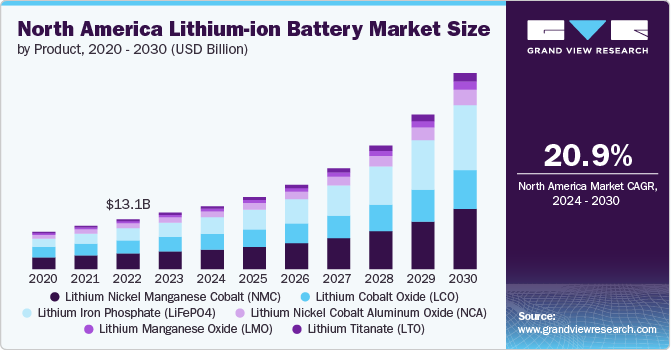

The North America lithium-ion battery market size was estimated at USD 14.8 billion in 2023 and projected to grow at a CAGR of 20.9% from 2024 to 2030. Rechargeable batteries are being used more frequently as a result of the rise in portable consumer electronics that use batteries. Portable electronic gadgets including MP3 players, digital cameras, laptops, and smartphones require rechargeable batteries to provide efficient and effective power. Battery technology continues to evolve to meet high performance and power density requirements for devices.

In the U.S., the mercury-containing and rechargeable battery management act has been introduced to reduce the use of mercury in single-use batteries and toxic metals such as lead and cadmium in rechargeable batteries. This has enabled market players to increase investment in R&D to gain a competitive advantage in the market. The advancement in technologies is providing ample products for consumers such as wearables devices, virtual and augmented reality, 4k televisions, 3D printers, drones, and communication robots to name a few, which are likely to find a foothold among tech-savvy consumers over the forecast period. Since the development of new technologies reduces the product’s life cycle, consumer interests have altered accordingly, thus, companies must be agile in their responses to stay competitive in the market space.

Drivers, Opportunities & Restraints

The registration of electric vehicles (EVs) in North America is anticipated to increase significantly over the forecast period. The rising availability of charging outlets and financial incentives have emerged as crucial factors for the development of this market, bolstered by the lower running cost of EVs compared to conventional ICE-operated vehicles. In February 2022, the U.S. Departments of Energy and Transportation jointly announced that approximately USD 5 billion is expected to support the nation's electric vehicle (EV) charging stations under the National Electric Vehicle Infrastructure Formula Program. The program was created under the bipartisan infrastructure laws. In October 2023, LG Energy Solution announced an investment of USD 3 billion in the U.S. market for battery manufacturing in Holland, Michigan, U.S. This new investment is likely to help Toyota (automaker) supply lithium-ion batteries.

The cost of lithium-ion batteries is estimated to decrease over the next seven years owing to the increasing number of manufacturing facilities in North America of companies such as Samsung, LG Chem, and Tesla. The low weight of lithium-ion batteries, along with its excellent energy-to-weight performance, is predicted to fuel its demand over the forecast period. Major technological advancements in lithium-ion batteries, in terms of the use of electrolytes, increase in voltage capacity due to changes in silicon anode material, and use of lithium-air flow and Li-S batteries that exhibit high-energy density, are anticipated to bolster the demand for the product in the near future.

The rising demand for substitutes of lithium-ion batteries, including sodium nickel chloride batteries, lithium-air flow batteries, lead-acid batteries, and solid-state batteries, in electric vehicles, energy storage systems, and consumer electronics is expected to restrain the market growth in North America over the forecast period. Lithium-air flow batteries use oxygen as an oxidizer. The result is that these batteries are five times cheaper and lighter than lithium-ion batteries. Thus, lithium-air flow batteries can make phones and cars equipped with them last five times longer than the ones incorporated with lithium-ion batteries.

Product Insights

The lithium nickel manganese cobalt (NMC) segment led the market with the largest revenue share of 31.32% in 2023. Lithium nickel manganese cobalt (NMC) batteries offer enhanced overall performance, excel on specific energy, and have high capacity and power. Increasing adoption of these batteries in power tools, e-bikes, and electric powertrains due to their high energy density, low costs, and long cycle life is anticipated to fuel the demand for lithium NMC batteries in North America over the forecast period. Moreover, lithium NMC batteries are highly preferred in electric vehicles, thereby leading to their surged demand in North America.

The market for lithium NMC batteries is growing in North America owing to the surged electric vehicle (EV) production in the region. Major automakers, including Tesla, General Motors, and Ford, are increasingly adopting these batteries in their electric vehicles (EVs) due to their high energy density and long cycle life. This trend is further bolstered by government policies that promote clean energy and offer incentives for electric vehicle (EV) purchases in North America. The increasing consumer shift toward eco-friendly vehicles is expected to propel the demand for lithium NMC batteries in the region in the coming years.

Application Insights

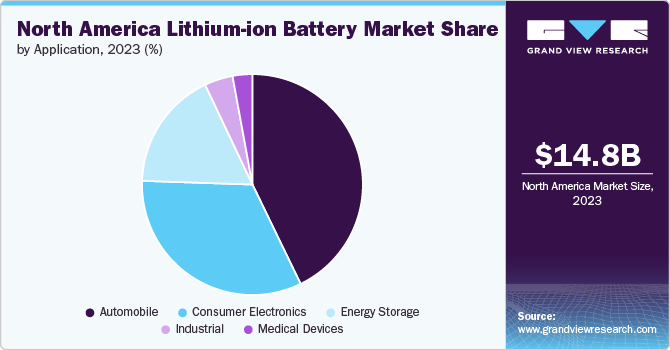

Based on application, the automobile segment led the market with the largest revenue share of 42.81% in 2023. Electric and hybrid electric vehicles are expected to be the major consumers of lithium-ion batteries in the coming years. Rising awareness about the benefits of battery-powered vehicles along with the rising fossil fuel prices, especially in the U.S. and Canada, are expected to aid the demand for lithium-ion batteries for automotive applications over the forecast period.

The rise in environmental concerns regarding the harmful impact of carbon emissions from fossil-fuel-based vehicles has prompted research and development activities related to electric vehicles equipped with lithium-ion batteries. Incentives and subsidies offered by governments worldwide to encourage consumers to opt for electric vehicles have considerably brought down their prices. Besides, the increasing availability of publicly accessible electric charging booths for these vehicles has also increased their popularity, particularly in U.S. These factors are expected to contribute to the market growth over the forecast period.

Country Insights

U.S. Lithium-ion Battery Market Trends

The U.S. dominated the North America lithium-ion battery market with the largest revenue share of 74.97% in 2023. The demand for lithium-ion batteries is anticipated to increase in the U.S. in the coming years, due to rising sales of electric vehicles in the country as a result of favorable federal legislation and the presence of market players in lithium-ion battery in the country. Federal policies formulated in the country include the American Recovery and Reinvestment Act of 2009, which provides tax credits for consumers who buy electric vehicles. The implementation of a new corporate average fuel economy (CAFE) standard that governs the fuel economy of passenger cars and light commercial vehicles plying on roads in the U.S. has led to a surge in the adoption of electric vehicles in the country.

Canada Lithium-ion Battery Market Trends

The lithium-ion battery market in Canada is anticipated to grow at the fastest CAGR during the forecast period. The increasing adoption of renewable energy sources for power generation in Canada is expected to enhance the utilization of frequency regulation and energy storage systems in the country. This, in turn, is anticipated to surge the demand for lithium-ion batteries market in Canada, thereby leading to the market growth over the forecast period.

Key North America lithium-ion Battery Company Insights

The market is characterized by a competitive landscape featuring key players include Tesla, Panasonic, LG Chem, Samsung SDI, and Duracell, all contributing to innovations in battery technology to meet increasing demand from electric vehicles and renewable energy sectors. The automotive segment is particularly prominent, driven by the shift towards electric vehicles and government incentives promoting cleaner energy solutions. This market is characterized by ongoing technological advancements that enhance battery performance and reduce costs.

Key North America Lithium-ion Battery Companies:

- A123 Systems

- Duracell Inc.

- Tesla Inc.

- Saft America

- Johnson Controls

- CANBAT Technologies Inc.

- Electrochem, an Integer company (Integer Holdings Corporation)

- Corvus Energy

- Prime Power

- Panasonic Corporation

Recent Developments

-

In April 2024, Green Li-ion launched North America's first commercial-scale plant in Atoka, Oklahoma, dedicated to producing recycled lithium-ion battery materials using its patented Green-hydrorejuvenation technology. This facility will convert unsorted black mass from spent batteries into battery-grade precursor cathode active material (pCAM) within approximately 12 hours, significantly reducing greenhouse gas emissions by up to 90% compared to traditional methods

-

In July 2023, Saft America with Stellantis’ engineers revealed an innovative prototype of an energy storage battery that assimilates the inverter and charger functions. This collaborative research project is known as the Intelligent Battery Integrated System (IBIS). With IBIS, the electronic conversion boards that perform the power inverter and charger functions are straddling as close as possible to the lithium-ion battery cells. This refined control system allows the current of the electric motor to be directly produced from the battery

North America Lithium-ion Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.49 billion

Revenue forecast in 2030

USD 51.44 billion

Growth rate

CAGR of 20.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

A123 Systems; Duracell Inc.; Tesla Inc.; Saft America; Johnson Controls; CANBAT Technologies Inc.; Electrochem, an Integer company (Integer Holdings Corporation); Corvus Energy; Prime Power; Panasonic Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Lithium-ion Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented North America lithium-ion battery market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium Cobalt Oxide (LCO)

-

Lithium Iron Phosphate (LiFePO4)

-

Lithium Nickel Cobalt Aluminum Oxide (NCA)

-

Lithium Manganese Oxide (LMO)

-

Lithium Titanate (LTO)

-

Lithium Nickel Manganese Cobalt (NMC)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Automobile

-

Energy Storage

-

Industrial

-

Medical Devices

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America lithium-ion battery market was valued at USD 14.8 billion in the year 2023 and is expected to reach USD 16.48 billion in 2024.

b. The North America Battery market is expected to grow at a compound annual growth rate of 20.9% from 2024 to 2030 to reach USD 51.43 billion by 2030.

b. Lithium nickel manganese Cobalt (NMC) emerged as a dominating segment in the market share of 31.32% in 2023 due to to the overall performance, outshining specific energy, and high power that is offered by NMC.

b. The key market player in the North America lithium-ion battery market includes A123 Systems; Duracell Inc.; Tesla Inc.; Saft America; Johnson Controls; CANBAT Technologies Inc.; Electrochem, an Integer company (Integer Holdings Corporation); Corvus Energy; Prime Power; and Panasonic Corporation.

b. The key factors that are driving the North America Lithium-ion battery market include, considerable demand for owing to the rising demand for electric vehicles and consumer goods sales.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."