- Home

- »

- Clinical Diagnostics

- »

-

North America Molecular Diagnostics Market Size, Report, 2030GVR Report cover

![North America Molecular Diagnostics Market Size, Share & Trends Report]()

North America Molecular Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Others), By Test Location, By Technology (PCR, ISH, INAAT, Sequencing), By Application, By Country, And Segment Forecasts

- Report ID: GVR-1-68038-073-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The North America molecular diagnostics market size was estimated at USD 5.97 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. Rising COVID-19 vaccination rate and decreasing demand for COVID-19 testing are expected to negatively impact market growth. However, advancements in molecular diagnostic technology enabled early detection of numerous diseases, reducing possibility of severe economic, and social burdens.

Increasing demand for advanced molecular diagnostic methods, a growing need for point-of-care facilities, and rising external funding for research and development are key factors driving the market.

Molecular diagnostics enable early diagnosis of cancer, genetic disorders, and infectious diseases by using PCR, sequencing, & genetic technologies. Furthermore, the region's high prevalence of infectious and chronic diseases such as genetic diseases, STIs, and cancer among others, is projected to support the market expansion. For instance, according to a report published by the CDC, congenital heart defects are most prevalent birth defects in the U.S., impacting around 1% of births annually.

Increasing demand for patient-centric healthcare services and growing adoption of technologically advanced testing products at point-of-care facilities such as clinics, retail pharmacies, physician offices, and others are further projected to drive the market expansion over the forecast period. Moreover, market players are continuously involved in developing novel POC testing products to capture market opportunities. For instance, in February 2023, Huwel Lifesciences developed a portable RT-PCR instrument to test different types of viruses. The company claimed that the test takes around 30 minutes and can be used to conduct the test for respiratory and other infections using blood and gastrointestinal samples. Such initiatives are projected to drive the market in the coming years.

Additionally, growing funding from the government to enhance development of novel test kits is anticipated to drive the market. For instance, in September 2022, Redbud Medicine raised USD 10 million in Series A funding. Federal funding also helps local and state laboratories increase their capacity and allows them to keep up with increasing demand. Similarly, in June 2023, Accelerate Diagnostics, Inc. received USD 24 million to accelerate development of Wave platform and novel rapid testing. Molecular diagnostics test menus for infectious diseases cannot afford to be static or superficial due to diverse nature of infectious diseases and building resistance of causative agents.

Market Dynamics

Operating players in market are launching innovative products owing to increasing demand for molecular diagnostics in North America. For instance, in January 2023, F. Hoffmann-La Roche Ltd.introduced the COVID-19 RT PCR test for fast-spreading COVID-19 Omicron sub-variant, XBB.1.5. Similarly, in November 2022, Cepheid, a Danaher subsidiary, launched launched Xpert GBS LB XC, which uses enriched Lim broth cultures for molecular diagnostics. Hence, continuous technological advancements in products and instruments are boosting the adoption of molecular diagnostics tests in North America region, as they provide portability, greater accuracy, and cost-effectiveness.

Moreover, increasing penetration of molecular diagnostics tests at home-based health services is further projected to support market expansion. As of May 2023, there were 302 molecular diagnostics tests approved for COVID-19 infection detection by the U.S. FDA. Out of 302 molecular tests available in the market, around 78 tests can be used with home-collected samples. The market is flooded with new molecular diagnostics tests for detection of SARS-CoV-2, making it saturated. Furthermore, increasing availability and access to faster PoC molecular diagnostics in North America is expected to act as a driver for demand for PoC diagnostics.

However, increasing approval of rival technologies such as immunoassays and others due to technological advancements, POC and automation in these technologies are affecting market uptake of molecular diagnostics over forecast period. In December 2022, BioMérieux announced approval of its automated immunoassay system “Vidas Kube,” which can be used in critical care emergency settings for detection of infectious diseases, immunochemistry, and food pathogens. Such initiatives are expected to decrease market growth over forecast period.

Product Insights

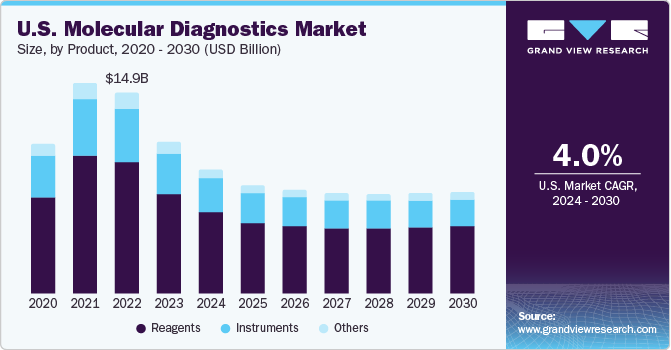

The reagents segment accounted for largest revenue share of 62.70% in 2023 and is anticipated to grow at a fastest CAGR over the forecast period. Reagents offer standardized results, improved efficiency, and cost-effectiveness are anticipated to support market growth. Furthermore, commercialization & introduction of new tests and reagents are expected to boost market growth. For instance, in October 2021, Eurofins Genomics received funding of USD 30 million from the United States Department of Health and Human Services and United States Department of the Air Force for expansion of manufacturing capacity of reagents used in COVID-19 diagnostics.

Moreover, instruments segment also accounted for a significant share in 2023. Segment growth is attributed to robust machine structure, user-friendly software, and excellent support services are anticipated to drive the market. Moreover, in May 2023, Sansure Biotech presented its comprehensive range of IVD products, including iPonatic III portable molecular workstation, at EuroMedLab Rome 2023. Industry key leaders are engaged in launching novel instruments for molecular diagnostics and expanding their product portfolios. For instance, in April 2023, ELITechGroup revealed plans for its upcoming innovation: The introduction of a high throughput sample-to-result molecular diagnostics equipment.

Test Location Insights

Central laboratories segment accounted for largest revenue share of 75.32% of the market in 2023. Owing to high market procedure volumes and penetration. Increasing favorable government initiatives to provide various services, such as reimbursement for diagnostic tests, is another major factor anticipated to drive market. Hospitals, academic institutions, or reference laboratories that service several healthcare facilities are frequently linked to central laboratories. These laboratories have cutting-edge equipment and technology to process numerous samples effectively.

Self-test or over-the-counter segment is expected to grow at a significant CAGR during forecast period. Self-testing assays are minimally dependent on electricity, refrigeration, cost-effective, and are culture-independent. In addition, intensified focus of regulatory bodies on OTC or self-test molecular diagnostics to decrease burden on laboratories is propelling segment growth. For instance, in February 2023, initial over-the-counter (OTC) home diagnostic test that can detect and distinguish influenza A and B, commonly referred to as flu, and SARS-CoV-2 received EUA by the FDA. Lucira COVID-19 & Flu Home Test is a one-time use at-home test kit that offers outcomes from user-collected nose swab samples in around 30 minutes.

Technology Insights

Polymerase chain reaction (PCR) segment held a high revenue share of 46.12% of the market in 2023 and is estimated to maintain its dominance throughout forecast period. the Rising use of high-throughput polymerase chain reaction techniques for the detection of cancer is anticipated to drive market. In addition, increasing adoption of molecular assays for diagnosis of infectious diseases is expected to drive growth of this segment during forecast period.

Sequencing technology is anticipated to grow with a significant CAGR over the forecasted years. Despite being in its infancy, NGS technology is anticipated to broaden the applications of DNA sequencing. Due to the rising number of genome profiling activities, R&D for novel medications, and declining costs and sizes of DNA sequencers, it is anticipated that the combined sequencing technology sector will experience the highest growth throughout the projection period. The expansion of the industry is accelerated through strategic alliances and collaboration among important players in the sector. For instance, QIAGEN and Helix established an exclusive agreement in January 2023 to improve next-generation sequencing companion testing in genetic illnesses.

Application Insights

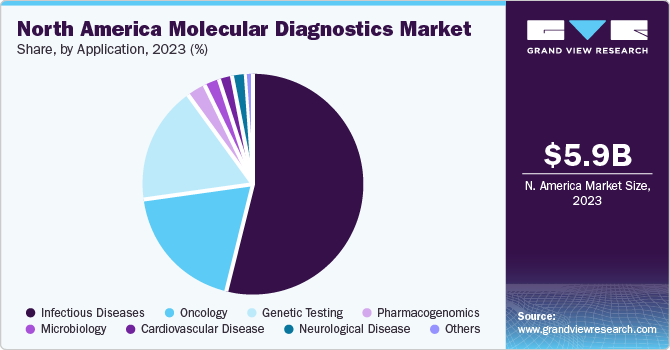

Infectious disease segment accounted for largest revenue share of 53.79% of the market in 2023. Rising prevalence of drug-resistant infections is opening doors for cost-effective tests to gain a larger market share. Furthermore, a surge in investments from both governmental and non-governmental entities in the region is expanding accessibility and bolstering the increasing demand for molecular diagnostics used in identification of various pathogens. In addition, companies are receiving approvals to enhance their market presence by introducing innovative and technologically advanced products. For instance, in October 2022, Abbott received EUA for its Alinity m MPXV monkeypox test kit. The kit employs a PCR system and is expected to boost the throughput of infectious disease testing.

Oncology segment is anticipated to grow at fastest CAGR during projected timeframe. Growing incidence of cancer plays a key role in propelling market expansion. As per estimates by the American Cancer Society in 2022, the U.S. reported around 1,918,030 new cancer cases, leading to approximately 609,360 fatalities due to cancer. According to a report from the International Agency for Research on Cancer, it's projected that roughly one in six women and one in five men may face a cancer diagnosis during their lifetime. Therefore, this substantial prevalence of cancer is expected to drive the adoption of cancer molecular diagnostic products in North America.

Country Insights

U.S. dominated overall share in a regional market, owing to increasing adoption of molecular diagnostics due to rising incidence of infectious and chronic diseases such as cancer. For instance, in 2022, according to the American Cancer Society, approximately 1,918,030 new cases of cancer and about 609,360 cancer deaths were reported in the U.S. In addition, reimbursement & regulatory landscape in North America is continuously progressing to adapt to fast-paced research progress in this sector. Moreover, FDA is developing new regulatory strategies regarding NGS to boost innovation in tests while ensuring that data produced by these tests are accurate and reliable. These factors are expected to contribute to continued dominance of the U.S.

However, increasing incidence of cancer is expected to boost the market growth in Canada over projected timeframe. According to data published by Globocan, in 2020, an estimated 274,364 new cancer cases were diagnosed in Canada; cancer incidence is expected to increase to around 342 thousand by 2030. Furthermore, increasing awareness programs in Canada is likely to boost segment growth. For instance, the Public Health Agency of Canada, National Molecular Microbiology Diagnostics User Group, and Canadian Public Health Association are actively involved in generating awareness about target diseases and providing pertinent diagnostic support.

Key North America Molecular Diagnostics Company Insights

Key players in North America molecular diagnostics are adopting strategies such as partnerships, mergers and acquisitions, product and service launches, joint ventures, agreements, expansion, and collaboration to strengthen their position in the market.

-

In May 2023, Cepheid received the CE certification for Xpert NPM1 Mutation, an IVD test in Acute Myeloid Leukemia. The test uses automated real-time reverse transcription polymerase chain reaction (RT-PCR) and reports the percent ratio of mutant NPML1 to ABL1 endogenous control mRNA transcripts.

-

In March 2023, F. Hoffmann-La Roche Ltd. and Lilly announced their partnership to improve early Alzheimer’s disease diagnosis.

-

In February 2023, Thermo Fisher Scientific, Inc. announced release of QuantStudio, Applied Biosystems, and Absolute Q AutoRun dPCR Suite, a new digital PCR research tool. These PCR are only digital PCR available in market that allows lab automation, lowers administrative costs, and maintains consistency, flexibility, & usability.

Key North America Molecular Diagnostics Companies:

The following are the leading companies in the North America molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America molecular diagnostics companies are analyzed to map the supply network.

- BD

- Bio-Rad Laboratories, Inc.

- Abbott

- Agilent Technologies, Inc.

- Danaher

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- Johnson & Johnson Services, Inc.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche, Ltd.

North America Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.64 billion

Revenue forecast in 2030

USD 7.23 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test location, technology, application, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

BD; Bio-Rad Laboratories, Inc.; Abbott; Agilent Technologies, Inc.; Danaher; Hologic Inc. (Gen Probe); Illumina, Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche, Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Molecular Diagnostics Market Report Segmentation

This report forecasts regional and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America molecular diagnostics market report based on product, test location, technology, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-Care

-

Self-test or Over the Counter

-

Central Laboratories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

PCR, by Type

-

Multiplex PCR

-

Other PCR

-

-

PCR, by Procedure

-

Nucleic Acid Extraction

-

Others

-

-

PCR, by Product

-

Instruments

-

Reagents

-

Others

-

-

-

In Situ Hybridization

-

Instruments

-

Reagents

-

Others

-

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Instruments

-

Reagents

-

Others

-

-

Chips and Microarrays

-

Instruments

-

Reagents

-

Others

-

-

Mass spectroscopy

-

Instruments

-

Reagents

-

Others

-

-

Sequencing

-

Instruments

-

Reagents

-

Others

-

-

Transcription Mediated Amplification (TMA)

-

Instruments

-

Reagents

-

Others

-

-

Others

-

Instruments

-

Reagents

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Kidney Cancer

-

Liver Cancer

-

Blood Cancer

-

Lung Cancer

-

Other Cancer

-

-

Pharmacogenomics

-

Infectious Diseases

-

Methicillin-resistant Staphylococcus Aureus (MRSA)

-

Clostridium Difficile

-

Vancomycin-resistant Enterococci (VRE)

-

Carbapenem-resistant Bacteria

-

Flu

-

Respiratory Syncytial Virus (RSV)

-

Candida

-

Tuberculosis and Drug-resistant TBA

-

Meningitis

-

Gastrointestinal Panel Testing

-

Chlamydia

-

Gonorrhea

-

HIV

-

Hepatitis C

-

Hepatitis B

-

Other Infectious Disease

-

-

Genetic Testing

-

Newborn Screening

-

Predictive and Presymptomatic Testing

-

Other Genetic Testing

-

-

Neurological Disease

-

Cardiovascular Disease

-

Microbiology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America molecular diagnostics market size was estimated at USD 5.97 billion in 2023 and is expected to reach USD 5.64 billion in 2024.

b. The North America molecular diagnostics market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 7.23 billion by 2030.

b. The U.S. dominated the North America molecular diagnostics market with a share of 91.07% in 2023. This is attributable to the increasing focus on market strategies, such as partnerships between diagnostic companies, fast-paced research progress in this sector.

b. Some key players operating in the global North America molecular diagnostics market include Roche Diagnostics; Qiagen N.V.; Danaher; Hologic, Inc.; Johnson & Johnson; Becton, Dickinson and Company; Abbott laboratories; bioMérieux SA; Illumina, Inc.; Novartis AG; and Cepheid, Inc.

b. Key factors that are driving the market growth include increased adoption of molecular diagnostics (MDx) for infectious diseases, coupled with the advent of new cancer diagnostic solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.