- Home

- »

- Food Additives & Nutricosmetics

- »

-

North America & Oceania Industrial Hemp Market Report, 2025GVR Report cover

![North America And Oceania Industrial Hemp Market Size, Share & Trends Report]()

North America And Oceania Industrial Hemp Market Size, Share & Trends Analysis Report By Product (Seeds, Fiber, Shivs), By Application (Textile, Animal Care), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-597-7

- Number of Report Pages: 127

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

Report Overview

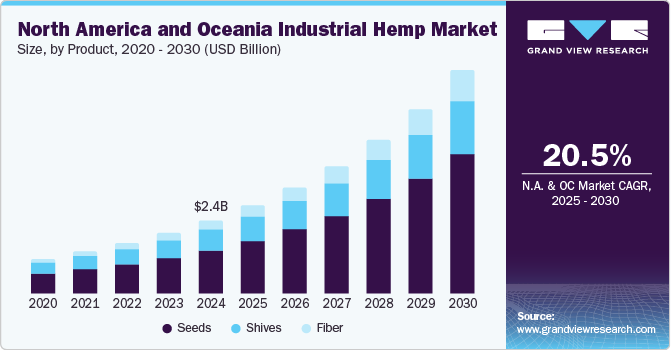

The North America and Oceania industrial hemp market size was valued at USD 2.6 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 23.4% from 2019 to 2025. Rising demand for industrial hemp-based products such as fibers, seeds, and oil in textiles, animal care, and personal care industries is expected to propel market growth over the forecast period.

The industrial hemp market in North America and Oceania is gaining momentum on account of rising consumer awareness pertaining to the benefits of industrial hemp products. The products are rich sources of proteins, nutrients, omega-3, and omega-6. These nutrients aid in insulin balance, cardiac function, mood stability, and skin and joint health, which, in turn, is expected to complement the market growth.

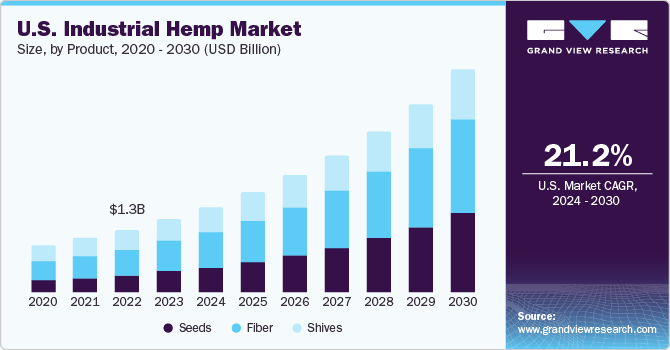

In the U.S., the seeds segment was the dominant segment in 2018 and accounted for over 80.7% of the market revenue share. The growth can be attributed to the increasing recognition of the nutritional properties of seeds, which aid in reducing the risk of heart-related diseases, promoting healthy digestion, and improving nail, hair, and skin health.

Industrial hemp fibers exhibit excellent length, durability, strength, absorbency, anti-mildew, and anti-microbial properties compared to other bast fibers such as kenaf, flax, jute, or ramie. The high absorbency offered by industrial hemp fiber is beneficial for oil & gas cleanup, livestock bedding, and personal hygiene. As a result, the demand for industrial hemp fibers is high as compared to other natural fibers.

Lack of harvesting innovations and processing facilities, low yield availability, and difficulties in transporting the product is highly regulated markets are some of the factors hampering the North America and Oceania industrial hemp market growth. In addition, the lack of awareness among key players pertaining to the benefits of industrial hemp in application industries such as food & beverages, textiles, and animal care in the North America and Oceania regions is expected to restrain the market growth.

The rising demand for recyclable cold chain packaging materials is creating new opportunities for industrial development owing to increasing environmental concerns among consumers. Manufacturing trends such as extensive R&D to obtain high yields from agricultural fields and enhancing the quality of industrial hemp are expected to propel its demand in North America and Oceania.

Product Insights

Seeds were the dominant segment in 2018 and accounted for a revenue share of 79.5% in the market for industrial hemp in North America and Oceania. This can be attributed to the rising demand to obtain seed and seed oil for food and personal care products. The adoption of seeds is high as they are also used to derive protein-rich flour, which is widely used in nutraceutical products.

Seed oil is used for treating eczema owing to the presence of essential fatty acids in the product. In addition, it aids in improving itchiness, relieving dry skin, and other skin-related problems such as dermatitis, psoriasis, lichen planus, and acne rosacea. Hempseed oil nourishes the skin and protects it from oxidation, inflammation, and aging, which is a major factor driving its demand in the personal care industry.

The fiber segment is expected to grow at the highest rate, in terms of both volume and revenue, over the forecast period on account of rising demand from textile industries across the globe for producing spun fibers, yarns, and other industrial textiles. In addition, the fibers contain a high amount of hemicellulose and have a high absorbent capacity, which renders them highly desirable for use in the textile industry.

Shivs segment is expected to progress at a growth rate of 21.8%, in terms of revenue, over the forecast period owing to its rising use in animal bedding materials on account of its high absorption ability. In addition, the material can be degraded to produce quality compost by rotting technique. Shivs are also used in combination with lime in manufacturing construction materials (block and Crete), which is likely to drive its demand in North America and Oceania over the projected period.

Application Insights

The personal care segment accounted for the largest market revenue share of over 38.3% in 2018 and is expected to continue its dominance over the forecast period. Cosmetics and personal care products consume a significant amount of oil and fibers, which help in increasing the skin’s natural ability to retain moisture and slow down the aging process.

Key players in cosmetics and personal care industries in Oceania and North America such as L’Oreal, Dr. Bronner’s Hippie Butter, and The Body Shop consume seed oil on account of its high and well-balanced essential fatty acid content, which makes it an ideal ingredient for use in body care products. Industrial hemp oil also contains rare gamma-linolenic acid (GLA) that functions as a UV skin protector.

The food & beverages segment is the second-largest segment and accounted for a revenue share of over 31.5% in the market for industrial hemp in North America and Oceania in 2018. The growth of the segment can be attributed to the rising use of derived oil in manufacturing food & beverages owing to its high nutritional, proteins, and fatty acid content. Hemp protein powder, which offers around 15 grams of protein per offering, is widely consumed by athletes in North America and Oceania regions.

The textiles segment is expected to witness the fastest growth rate over the forecast period. Hemp fabric is strong, hypo-allergic, and naturally resistant to UV light, mildew, and mold. BambroTex, Liahren, EnviroTextiles, LLC, and Hemp Fortex are among the textile manufacturers offering eco-friendly fabrics and fashion clothing and consume a significant amount of the product.

Regional Insights

North America emerged as the dominant region in 2018 with 97.8% of the market revenue share. Factors attributable to the high market growth rate in North America include rising demand for eco-friendly and natural products from the U.S. and Canada. Canada has commercially legalized the production of industrial hemp as it is the largest exporter of seed and oilcake to the U.S.

The demand for industrial hemp is expected to witness rapid growth in the U.S. owing to the legalization of hemp cultivation and processing in the country. In addition, growing demand for the product in industrial and medical applications is expected to propel market growth in the country in North America over the forecast period.

The demand for seeds in Australia in Oceania is anticipated to witness a significant growth rate on account of its increasing application in food & beverage and beauty products such as makeup, creams, and soaps owing to legalization in the country. Furthermore, the rising demand for shivs in preparation of hempcrete, plaster, and insulation panels is expected to have a positive influence on the overall market growth in Oceania.

Product cultivation in New Zealand was permitted only for therapeutic use, scientific research, and clinical trials under a medicinal cannabis cultivation license. Changing regulations pertaining to the consumption of seeds and other food products derived from the product have aided the growth of the market for industrial hemp in the Oceania region.

Key Companies & Market Share Insights

Hemp, Inc.; Marijuana Company of America Inc.; Kazmira LLC; The Cannabis Co.; Hemp Foods Australia; Hemptech; Valley Bio Limited; and Parkland Industrial Hemp Growers Co-op. Ltd. (PIHG) are the prominent players in the product market in North America and Oceania regions. These companies are focusing on new joint ventures, collaborations, agreements, and strategies to advance their production facilities and gain a larger share in the North America and Oceania market.

Elixinol LTD.; Terra Tech Corp.; Hemp, Inc.; and Parkland Industrial Hemp Growers Co-op Ltd. are some of the major players in the market involved in the research & development of perfect agronomy and varieties of industrial hemp. Moreover, companies are engaged in regional expansion to augment the market scope of hemp-derived products. Some of the prominent players in the North America and Oceania industrial hemp market include:

-

Hemp, Inc.

-

Marijuana Company of America Inc.

-

Kazmira LLC

-

The Cannabis Co.

-

Hemp Foods Australia

-

Hemptech

-

Valley Bio Limited

-

Parkland Industrial Hemp Growers Co-op. Ltd. (PIHG)

-

Elixinol LTD.

-

Terra Tech Corp.

North America & Oceania Industrial Hemp Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.98 billion

Revenue forecast in 2025

USD 11.50 billion

Growth Rate

CAGR of 23.4% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2019 to 2025

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Oceania

Country scope

U.S.; Canada; Mexico; Australia; New Zealand

Key companies profiled

Hemp, Inc.; Marijuana Company of America Inc.; Kazmira LLC; The Cannabis Co.; Hemp Foods Australia; Hemptech; Valley Bio Limited; Parkland Industrial Hemp Growers Co-op. Ltd. (PIHG); Elixinol LTD.; Terra Tech Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America and Oceania industrial hemp market report on the basis of product, application, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Seeds

-

Oil

-

Flour

-

Others

-

-

Fiber

-

Shivs

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Animal Care

-

Textiles

-

Automotive

-

Furniture

-

Food & Beverages

-

Paper

-

Construction Materials

-

Personal Care

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Oceania

-

Australia

-

New Zealand

-

-

Frequently Asked Questions About This Report

b. The global north america and oceania market size was estimated at USD 2.83 billion in 2019 and is expected to reach USD 2.98 billion in 2020.

b. The global north america and oceania market is expected to grow at a compounded annual growth rate of 23.4% from 2019 to 2025 to reach USD 11.50 billion in 2025.

b. U.S. dominated the north america and oceania market with a share of 69.6% in 2019. The share can be attributed to the increasing recognition of nutritional properties of seeds, which aid in reducing the risk of heart-related diseases, promoting healthy digestion, and improving nail, hair, and skin health.

b. Some key players operating in the north america and oceania market include Hemp, Inc.; Marijuana Company of America Inc.; Kazmira LLC; The Cannabis Co.; Hemp Foods Australia; Hemptech; Valley Bio Limited; and Parkland Industrial Hemp Growers Co-op. Ltd. (PIHG).

b. Key factors driving the north america and oceania market growth include rising demand for industrial hemp-based products such as fibers, seeds, and oil in textiles, animal care, and personal care industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."