- Home

- »

- Consumer F&B

- »

-

North America Savory Snacks Market, Industry Report, 2030GVR Report cover

![North America Savory Snacks Market Size, Share & Trends Report]()

North America Savory Snacks Market Size, Share & Trends Analysis Report By Product, By Flavor (Roasted/ Toasted, Barbeque, Spice, Meat, Others), By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-368-0

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

North America Savory Snacks Market Trends

The North America savory snacks market size was valued at USD 46.40 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. Changing lifestyles of consumers in this region have encouraged on-the-go snacking habits and driven the trend of replacing meals with smaller nutritional snacks. The regional market has witnessed a sharp growth in the demand for nutritional snacks in recent years, generating new revenue sources for companies. Consumers are increasingly seeking healthier snack options, driving the consumption of snacks made with clean ingredients, having minimal artificial additives, and offering functional benefits such as boosting energy or supporting digestion.

The North America savory snacks industry is heavily influenced by changing consumer preferences and the globalization of flavors and cuisines. Consumers are showing substantial interest in new and exotic flavors, such as spicy, tangy, and ethnic-inspired options, leading to the launch of a wider range of products. Snacks have become an integral part of the diet for a large proportion of individuals in this region and can contribute to daily nutritional requirements. The rapidly expanding consumption of extruded snacks such as Cheetos and Pirate’s Booty is another notable factor aiding market expansion. These snacks are made using the extrusion process, which results in products with a light, airy, and crispy texture. As these snacks are puffed, they typically have a lower calorie density than their traditional fried counterparts, making them appealing to people seeking healthier options. Increasing concerns regarding unhealthy snacking have compelled industry players to introduce products that promote health and wellness, such as baked and roasted offerings.

Convenience has become an important aspect of this market, with many regional consumers opting for portable, ready-to-eat snack options. Single-serving packs, resealable bags, and easy-to-carry snack bars are in high demand, particularly as people lead busier lifestyles. Furthermore, as more people adopt low-carb or grain-free diets, there has been a steady launch of snacking items designed to meet the needs of keto and paleo consumers. These include snacks made from almond flour, coconut flour, or other non-grain-based ingredients. For instance, Hilo Life, a brand of PepsiCo, specializes in making keto snacks, with their range including HiLo Life Nacho Cheese, HiLo Life Ranch, HiLo Life Spicy Salsa, and HiLo Life Ultimate Taco. Products such as protein-packed popcorn, edamame snacks, and protein crisps have also gained noticeable traction as consumers seek to balance snacking with higher protein intake for muscle recovery and satiety. These factors are anticipated to create major growth opportunities for companies in the North America savory snacks industry.

Product Insights

The potato chips segment accounted for a leading revenue share of 32.7% in the North American market for savory snacks in 2024. These snacks are widely popular among regional consumers as they can be paired with various fast food items such as sandwiches and burgers, creating a more fulfilling eating experience. Companies are launching products in different shapes and forms, as well as unique flavors such as cheddar cheese and sour cream, condiment-inspired flavors, and herb-based versions, which have helped drive innovations in this segment. Trends such as kettle-cooked chips, perceived as higher quality and with a crunchier texture and more robust flavor, have become popular. These items are made using a slower, small-batch cooking process in oil at a lower temperature, leading to a more flavorful and crispy product. Potato chips infused with added protein through ingredients such as peas, lentils, or chickpeas have witnessed high demand among health-conscious consumers looking to increase their protein intake without turning to meat-based snacks.

The nuts & seeds segment is expected to grow at the highest CAGR from 2025 to 2030. These products are witnessing strong sales, particularly among consumers looking for healthy snacking options. To meet a variety of tastes and preferences, manufacturers are offering a range of options, including roasted almonds, cashews, chestnuts, pine nuts, and mixed nuts, among others. Nuts and seeds are packed with healthy fats, protein, fiber, vitamins, and minerals, making them a nutrient-dense snack. They provide essential nutrients such as omega-3 fatty acids, magnesium, vitamin E, and antioxidants. As more people adopt plant-based diets, nuts, and seeds have become a staple for those seeking vegan-friendly and protein-rich snacks. Premium varieties of roasted nuts, such as flavored pistachios, spiced pecans, and gourmet mixed nuts, are also becoming more popular, which presents another growth avenue for the North America savory snacks industry.

Flavor Insights

The roasted/toasted flavor segment accounted for a leading revenue share in the regional savory snacks market in 2024. The demand for roasted/flavored savory snacks is driven by increasing consumer preference for healthy, oil-free products as a result of rising health awareness. As consumers move away from extremely sweet snacks and prefer savory and more complex flavors, roasted and toasted options are gaining popularity. These flavors offer a unique, rich, and savory profile that appeals to a broad range of consumers. Roasting and toasting enhance the natural flavors of ingredients such as nuts, seeds, grains, and vegetables, creating a deeper, smokier, and nuttier taste that provides a more satisfying experience.

The spice-flavored segment is expected to grow at the highest CAGR during the forecast period. Spicy snacks are highly popular in economies such as the U.S. and Canada, with many manufacturers introducing unique spicy options to appeal to a wider range of consumers. A number of established snack brands are introducing spice-infused variations of traditional snacks, such as spicy popcorn, spicy chips, or spicy pretzels, combining globally popular flavors with well-known snack formats. This flavor profile is particularly in demand among younger generations in this region, such as Millennials and Gen Z. These demographics are more agreeable to experimenting with novel flavors, fueling the demand for spice-based options.

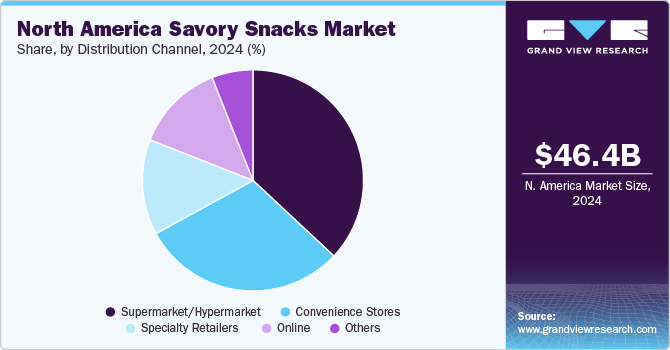

Distribution Channel Insights

The supermarket/hypermarket segment accounted for a leading revenue share in the North America savory snacks industry in 2024. The increasing market competition and constant launch of newer flavors have compelled snack manufacturers to boost their presence across grocery and food aisles in major retail stores. Additionally, growing demand for healthier options, the popularity of global flavors, and the continued preference for convenient, on-the-go snacks are expected to help drive substantial sales through this segment. Functional snacks, such as those fortified with added protein, fiber, or probiotics, are becoming more widely available in supermarkets and hypermarkets. Many retail chains run promotions combining savory snacks with complementary items such as beverages, dips, or party foods, which can drive higher product sales.

The online segment is anticipated to expand at the highest CAGR from 2025 to 2030 in the regional market. Online sales of savory snacks have continued to grow steadily as consumer habits shift toward convenience, variety, and personalized shopping experiences. The rise of e-commerce platforms, subscription services, and social media influence, combined with the increased demand for healthier and premium snack options, has forced companies to strategize innovative ways to drive sales. The presence of features such as customer reviews and ratings enables consumers to make more informed decisions based on the experiences of others with specific savory snacks. Many brands encourage customers to share photos, recipes, or personal experiences with products, which helps boost user trust and engagement, positively influencing purchasing decisions.

Country Insights

U.S. Savory Snacks Market Trends

The U.S. savory snacks market accounted for a dominant revenue share of 88.1% in the North American region in 2024. The high population in the economy, the presence of a large customer base, and intensifying competition among industry players have helped create a notable market for snacking items. With a noticeable growth in migration that has led to the expanded presence of Middle Eastern, Asian, and Latin American populations in the country, companies are introducing regional variants of traditional snacks that can appeal to these demographics. Products with labels such as non-GMO, zero preservatives or additives, vegan, and high protein content are finding increasing acceptance among American citizens, further aiding the launch of new offerings.

Mexico Savory Snacks Market Trends

Mexico is expected to advance at the highest CAGR from 2025 to 2030 in the North America savory snacks industry. The increasing urbanization and growing prevalence of busy lifestyles in the country have driven the demand for food items that can be consumed on the go. Moreover, major snacking companies are strengthening their presence in the economy to address the rising popularity of potato chips, popcorn, and extruded snacks. Spicy snacks are extremely popular, with flavors such as chili, lime, and tamarind being widely consumed by Mexicans. As a result, companies are introducing products that incorporate strong, bold, and spicy flavors and appeal to local tastes. Sabritas and Gamesa, both subsidiaries of PepsiCo, are major names with a large consumer following and a strong distribution channel in Mexico.

Key North America Savory Snacks Company Insights

Some major companies involved in the North America savory snacks industry include PepsiCo, Mondelēz International, and LINK SNACKS, among others.

-

PepsiCo is a multinational food and beverage company known for its wide portfolio of brands across various categories, including soft drinks, water, snacks, and nutrition products. The company has several snacking brands, including Doritos, Cheetos, Lay’s, and Tostitos, along with country-specific options such as Sabritas and Gamesa (both in Mexico). Lay’s emerged as the leading potato chip brand in the U.S. in 2023, aided by the strong sales of its product range, which includes Lightly Salted, Baked, Classic, Kettle Cooked, Stax, and Poppables. Cheetos is another notable offering with options such as Crunchy, Popcorn, Puffs, Pretzels, and Fantastix.

-

LINK SNACKS is a manufacturer and distributor of snack foods known for specializing in healthy, high-protein snack products. The company primarily focuses on high-protein, on-the-go snack foods, most notably Jack Link’s Beef Jerky, available in multiple flavors, including Original, Teriyaki, Peppered, Mild, and Spicy. Besides its beef-based products, the company has expanded to include pork, turkey, and chicken meats in its portfolio. Jack Link’s is a leading jerky brand in the U.S., and the company has made notable efforts to expand its presence in global markets, including Canada and various European countries.

Key North America Savory Snacks Companies:

- PepsiCo

- Mondelēz International

- THE HERSHEY COMPANY

- The Kraft Heinz Company

- General Mills Inc.

- Kellanova

- Utz Brands, Inc.

- WISE

- LINK SNACKS, INC.

- Conagra Brands, Inc.

Recent Developments

-

In October 2024, PepsiCo signed an acquisition agreement with Garza Food Ventures LLC, dba Siete Foods. Siete is a Texas-based company that specializes in authentic and heritage-inspired snacks, salsas, tortillas, sauces, seasonings, and cookies, among other products. Its products are extensively available across grocery stores, organic food retail outlets, and club stores throughout the U.S. Through this acquisition, PepsiCo could complement its portfolio by adding a Mexican-American brand and ensuring the expansion of its healthy food offerings.

-

In August 2024, Lay’s announced the limited-time launch of its Wavy Tzatziki, Honey Butter, and Masala potato chip flavors for its U.S. consumers. These products, inspired by flavors from Greece, Korea, and India, are part of the company’s Global Flavors portfolio and were made available at retailers countrywide and the Snacks.com platform. Lay’s simultaneously announced an event where one follower, through a lucky draw, would get to experience a trip to one of these three countries.

North America Savory Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.25 billion

Revenue forecast in 2030

USD 67.33 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel, country

Country scope

U.S., Canada, Mexico

Key companies profiled

PepsiCo; Mondelēz International; THE HERSHEY COMPANY; The Kraft Heinz Company; General Mills Inc.; Kellanova; Utz Brands, Inc.; WISE; LINK SNACKS, INC.; Conagra Brands, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Savory Snacks Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America savory snacks market report based on product, flavor, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Potato Chips

-

Extruded Snacks

-

Nuts & Seeds

-

Popcorn

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted/ Toasted

-

Barbeque

-

Spice

-

Meat

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Specialty Retailers

-

Convenience Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."