- Home

- »

- Advanced Interior Materials

- »

-

North America Sheet Metal Fabrication Equipment Market Report, 2030GVR Report cover

![North America Sheet Metal Fabrication Equipment Market Size, Share & Trends Report]()

North America Sheet Metal Fabrication Equipment Market Size, Share & Trends Analysis Report By Type (Cutting, Shearing), By Application (Job Shops, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-188-3

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

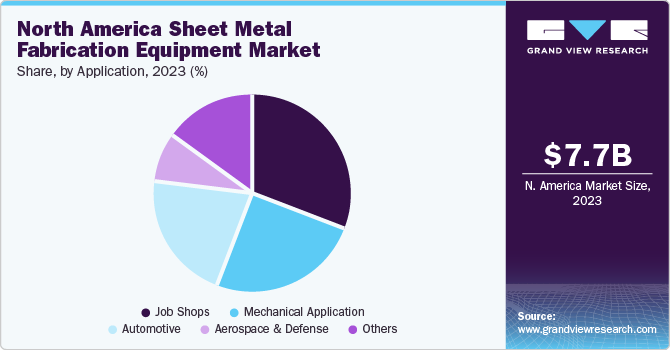

The North America sheet metal fabrication equipment market size was estimated at USD 7.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. Technological developments and growing end-use industries, such as automotive, construction, and aerospace, are likely to drive the growth of the market. Further, continuous advancements in metal-cutting machinery, along with the development of laser cutting and waterjet technologies by key companies, are expected to drive the sheet metal fabrication equipment market growth. The automotive industry plays a crucial role in stimulating demand, owing to its ongoing advancements in vehicle design and the introduction of novel material combinations in automobile manufacturing.

The sheet metal fabrication equipment is extensively used in the automotive industry for manufacturing vehicle parts and components. These aforementioned factors are anticipated to drive the market growth over the forecast period.The construction industry in North America is experiencing growth due to population expansion, urbanization, infrastructure development, and the need for modern buildings and structures. This growth has been continuously increasing the demand for various metal components used in construction. Moreover, modern construction projects often involve intricate architectural designs that require custom-made sheet metal components such as decorative panels and roofing materials. Advanced sheet metal fabrication equipment can produce these components with precision and flexibility.

Furthermore, the demand for advanced mechanized sheet metal cutting machines is on the rise due to factors such as their ability to fabricate sheet metal components with precision, automation, mass customization in diverse applications, and the need to replace aging machinery. This trend is expected to further continue as industries seek to improve their production processes and meet the evolving demands of the market.

The North America market is highly competitive and concentrated, with numerous players having expertise in product design and development. Moreover, the major players are launching new products to cater to the needs of end-use industries. The companies in the North American market are actively focusing on investing in research and development activities, which enables them to retain their market share, thereby further penetrating into the market.

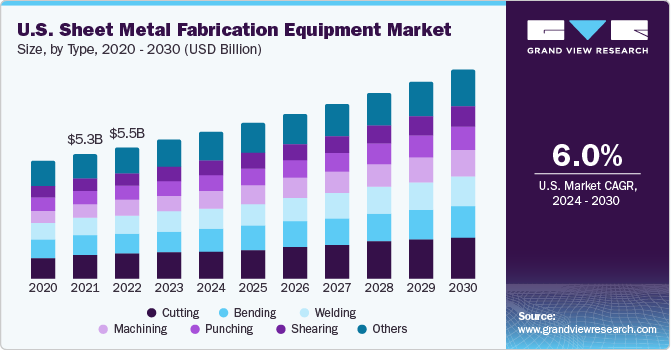

Type Insights

The others segment which includes plate rolls, drilling, polishing, and stamping, held the largest revenue share of 20.9% in 2023. Plate roll machines are a type of sheet metal fabrication equipment used to bend or roll flat metal plates into curved shapes. These machines are commonly used in metalworking, construction, manufacturing, and other industries.

The polishing machines are used to polish the sheet metal components and ducts made up of stainless steel and zinc-coated steel in the HVAC industry. The plate rolls can manufacture the intricate shaped cylindrical, conical, and other conical shapes, required in the construction industry.

The cutting segment is anticipated to register the fastest CAGR of 8.0% over the forecast period. In sheet metal fabrication processes, cutting is the most fundamental process, which involves the use of hand-held plasma torches and Computer Numerical Control (CNC) cutters to manufacture the required dimensional sheet metal parts. These parts generated after the cutting process are then allowed to pass through different processes, such as polishing and bending to produce the final product. Hence the demand for cutting machines is expected to rise continuously.

Moreover, the increasing implementation of industry 4.0 technologies such as the Industrial Internet of Things (IIoT), and automation is maximizing the productivity of sheet metal-cutting machines through real-time data exchange, which enables optimum production. Hence the sheet metal fabricators are aiming to improve production, decrease downtime, and operate cost-efficiently, which is likely to positively influence the sheet metal fabrication equipment market growth.

Application Insights

The job shops segment held the largest revenue share of 31.4% in 2023. Job shops are specialized small-to-medium-sized businesses that focus on crafting distinctive, one-of-a-kind products. They excel in the development of products that have low manufacturing volume, and as such, manufacture products on a made-to-order (MTO) basis. Different tools and machines enable job shops to cut, shape, and assemble sheet metals to create a wide range of products.

Job shops in North America strive to offer unique, specialized sheet metal fabrication services to end users while adopting eco-friendly manufacturing practices. In most cases, job shops are used to manufacture the sheet metal components as per the customers’ requirements, which require machines that can adjust as per their requirements, thereby reducing power consumption. Hence, the surging adoption of power-efficient manufacturing practices is expected to lead to a high demand for environmentally responsible sheet metal fabrication equipment in job shops.

The mechanical application segment is anticipated to register the fastest CAGR of 7.5% during the forecast period. Sheet metal fabrication equipment has different uses in mechanical applications and is used to manufacture customized metal components. They are crucial for manufacturing a wide range of components and products. In addition, the advent of advanced technologies such as electric vehicles (EVs), and autonomous systems drives the demand for customized metal components that can be produced using sheet metal fabrication equipment.

In addition to that, the development of energy generation and storage solutions, such as wind turbines, solar panels, and batteries, requires components that are manufactured using sheet metal fabrication equipment. Thus, the increasing number of energy generation projects in North America is anticipated to fuel the demand for sheet metal fabrication equipment over the forecast period.

Regional Insights

The U.S. held the largest revenue share of 75.2% in 2023 owing to increasing government efforts for the development of public infrastructures in the U.S. These equipment are crucial for developing structural steel components such as beams, columns, and trusses used in buildings and bridges.

Growing defense expenditure by the federal government of the country is expected to augment the production of naval ships, patrol vehicles, and submarines at a domestic level in the U.S. The surging usage of mega-ships as they are outsize old models is expected to positively impact the growth of the shipbuilding industry in the country. These trends are anticipated to drive the demand for sheet metal fabrication equipment in the U.S. as they play a key role in manufacturing critical ship components.

Mexico is anticipated to grow at the fastest CAGR of 7.6% due to its ability to manufacture and export major and critical components used in the manufacturing of automobiles. Furthermore, the ease of doing business, geographical proximity, and supply source for distributors & retailers make it one of the most preferred locations for sheet metal component manufacturers. The government is engaged in developing infrastructure to compete with the developing economies globally.

Mexico holds a prominent position as a primary manufacturing center for numerous U.S.-based companies, capitalizing on its strategic geographical location bridging Central and South America with the U.S. In addition, Mexico provides access to shelter services through the maquiladora system. This market dynamic is expected to drive the demand for sheet metal fabrication equipment in Mexico over the forecast period.

Key North America Sheet Metal Fabrication Equipment Company Insights

The manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new material developments, and geographical expansions, to enhance market penetration and cater to the changing requirements of various application industries.

Some of the major companies have undertaken measures such as technological upgrades and investment in research and development activities to penetrate the market. In March 2023, TRUMPF started expanding its sheet metal assembly of fabricating machine tools in Connecticut, U.S. This expansion is expected to add 55,800 Square Feet to its production facility with an estimated investment of USD 40 million. This expansion is expected to facilitate the manufacturing of welding, laser cutting, and bending machinery.

Key North America Sheet Metal Fabrication Equipment Companies:

The following are the leading companies in the North America sheet metal fabrication equipment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America sheet metal fabrication equipment companies are analyzed to map the supply network.

- Trumpf

- DMG Mori Co. Ltd.

- Salvagnini

- AMADA Co. Ltd.

- Coherent Corp.

- Flow International Corporation

- Koike Aronson, Inc.

- Bystronic Laser AG

- Winbro

- Mazak

- Prima Power

- Mitsubishi

- The Lincoln Electric Company

- ESAB Corporation (Colfax Corporation)

- Komatsu Industries Corp.

- WARDJet

- Omax Corporation

North America Sheet Metal Fabrication Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.2 billion

Revenue forecast in 2030

USD 11.9 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Key companies profiled

Trumpf, DMG Mori Co. Ltd.; Salvagnini; AMADA Co. Ltd.; Coherent Corp.; Flow International Corporation; Koike Aronson, Inc.; Bystronic Laser AG; Winbro; Mazak; Prima Power; Mitsubishi; The Lincoln Electric Company; ESAB Corporation (Colfax Corporation); Komatsu Industries Corp.; WARDJet; Omax Corporation

Regional Scope

North America

Country Scope

U.S.; Canada; Mexico

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Sheet Metal Fabrication Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America sheet metal fabrication equipment market report based on type, application, and region:

-

Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Cutting

-

Shearing

-

Punching

-

Machining

-

Welding

-

Bending

-

Others

-

-

Application Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Job Shops

-

Automotive

-

Aerospace & Defense

-

Mechanical Application

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America sheet metal fabrication equipment market size was estimated at USD 7.7 billion in 2023 and is expected to reach USD 8.2 billion in 2024.

b. The North America sheet metal fabrication equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 and reach USD 11.9 billion by 2030.

Which region accounted for the largest North America sheet metal fabrication equipment market share?b. U.S. dominated the North America sheet metal fabrication equipment market in 2023 with a share of 75.1%, owing to the increasing investments in job shops and continuous growth in automobile industry.

b. Some of the key players operating in the North America sheet metal fabrication equipment market include, Trumpf, DMG Mori Co. Ltd., Salvagnini, AMADA Co. Ltd., Coherent Corp.,Flow International Corporation, Koike Aronson, Inc., Bystronic Laser AG, Winbro, Mazak, Prima Power, Mitsubishi, The Lincoln Electric Company, ESAB Corporation (Colfax Corporation), Komatsu Industries Corp., WARDJet, Omax Corporation.

b. The increasing technological developments and growing end-use industries such as automotive, construction, and aerospace, are likely to drive the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."