- Home

- »

- Green Building Materials

- »

-

North America Steel Roofing Market Size, Share Report,2030GVR Report cover

![North America Steel Roofing Market Size, Share & Trends Report]()

North America Steel Roofing Market Size, Share & Trends Analysis Report By Application (Residential, Commercial, Industrial), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-201-3

- Number of Report Pages: 78

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

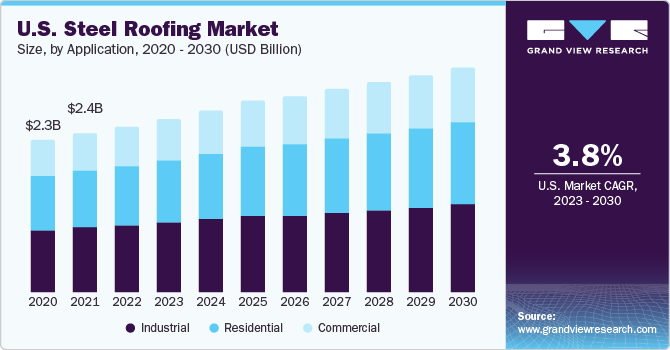

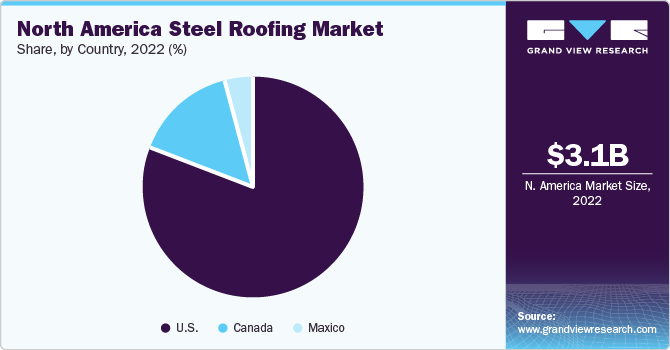

The North America steel roofing market size was valued at USD 3.07 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. Increasing awareness regarding green building products in the construction industry is anticipated to positively impact growth. Steel roofs are long-lasting and durable building materials that provide significant energy savings to end-use applications. In addition, they are made from a high percentage of recycled steel, which, in turn, plays a significant role in attaining sustainable roofing. Increased consumption of flexible, lightweight, and recyclable roofing materials is expected to fuel the demand for steel roofs in North America.

Increasing GDP coupled with the trend of single-family houses in North American countries is expected to propel construction activities, thus, positively influencing the demand for steel roofing. Rising demand for high-tech office buildings and sophisticated housing systems is expected to drive renovation activities in Canada, thereby, impacting the product demand significantly.

North America's construction industry is anticipated to witness rapid growth on account of the rising number of people migrating from developing regions to North America. In addition, increasing construction spending in Mexico owing to population expansion and strong economic and industrial developments is expected to boost the product demand in North America.

The factors hampering market growth include fluctuating steel prices globally as well as the susceptibility of structures to corrosion and low thermal resistivity. Furthermore, the unavailability of skilled labor and advanced technologies is projected to restrict market growth over the forecast period.

The demand for steel roofing is anticipated to be augmented by the growth of the building and construction industry on account of its increasing penetration in the industry. The attributes of steel roofs, including high durability, low maintenance, fire resistance, energy efficiency, and fast installation are expected to further boost market growth.

The construction industry in the U.S., Canada, and Mexico is expected to witness growth over the forecast period due to increasing construction spending led by population expansion and strong economic and industrial development.

Application Insights

The industrial segment held the largest revenue share of 39.3% in 2022. Steel roofing is known for its exceptional durability, which makes it a reliable option for industrial buildings. Steel roofing is highly cost-effective, due to low maintenance requirements and longer lifespan. Steel roofing materials can be recycled easily, which makes them environmentally friendly and helps companies to reduce their carbon footprint.

The commercial segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. Commercial constructions require a large number of roofing products for thermal insulation and to enhance the aesthetic appeal of the building. These buildings require durable materials to tackle extreme weather conditions, and hence, steel roofing is extensively used owing to its properties such as lightweight, durability, and flexibility.

Country Insights

The U.S. dominated the market and accounted for the largest revenue share of 81.0% in 2022. The country is anticipated to continue its dominance over the forecast period. The growth can be attributed to increasing population and life expectancy. Furthermore, the U.S. construction industry is experiencing growth on account of increasing residential and non-residential renovation and new construction activities.

Mexico is expected to grow at the fastest CAGR of 4.7% during the forecast period, owing to the continuous growth in the industrial sector, and factories. The trend of more people moving to cities and the development of new buildings for business and living also contribute to this growth. Additionally, the need to handle tough weather conditions like heavy rain, hurricanes, and high temperatures is a big reason for this growth. Steel roofs are seen as a smart and environmentally friendly choice to deal with these challenges, as they are both cost-effective and eco-friendly.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach.

Key North America Steel Roofing Companies:

- Metal Sales Manufacturing Corporation

- Reed's Metals

- Ideal Roofing

- ATAS International, Inc.

- CertainTeed

- Owens Corning

- TAMKO Building Products LLC

- American Buildings Co.

- BlueScope

- DECRA Roofing Systems, Inc.

- OmniMax International, Inc.

- Sunlast Metal

- Coastal Metal Service

- Worthouse

- Boral North America

Recent Developments

-

In August 2020, Reed's Metals unveiled its merger with Oakland Metal Buildings. The united entity will bear the name Reed's Metals, a reflection of the company's collective dedication to effectively serving customers and communities throughout the Southeastern U.S. The integration of Oakland Metal Buildings into Reed's Metals is anticipated to yield a surge in sales, customer contentment, and operational efficiencies. This synergy will be fueled by a comprehensive product lineup and an expanded presence, encompassing a total of nine locations, among which two possess the distinction of being IAS-certified metal building plants. These two IAS plants are strategically situated in Mississippi, Alabama, Florence, and Brookhaven. This strategic expansion enhances the company's capacity to consistently fulfill its customers' demands for building deliveries.

-

In August 2020, Oak Ridge National Laboratory (ORNL) a laboratory devoted to conducting research for the U.S. Department of Energy finished a study on stone-coated steel roofs of DECRA Roofing Systems, Inc. The study provided the verification that these stone-coated steel roofs come up to a good amount of energy saving and high thermal performance.

North America Steel Roofing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.21 billion

Revenue forecast in 2030

USD 4.17 billion

Growth Rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in million square meters, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Metal Sales Manufacturing Corporation; Reed's Metals; Ideal Roofing; ATAS International, Inc.; CertainTeed; Owens Corning; TAMKO Building Products LLC; American Buildings Co.; BlueScope; DECRA Roofing Systems, Inc.; OmniMax International, Inc.; Sunlast Metal; Coastal Metal Service; Worthouse; Boral North America

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Steel Roofing Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America steel roofing marketbased on application, and country:

-

Application Outlook (Volume in Million Square Meters & Revenue in USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Volume in Million Square Meters & Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America steel roofing market size was estimated at USD 3.07 billion in 2022 and is expected to reach USD 3.22 billion in 2023.

b. The North America steel roofing market is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 4.17 billion by 2030.

b. Industrial segment dominated the North America steel roofing market with a share of 39.3% in 2022 owing to increasing manufacturing facilities in Mexico on account rapid industrialization

b. Some of the key players operating in the North America steel roofing market include Metal Sales Manufacturing Corporation, Reed's Metals, Ideal Roofing, ATAS International, Inc., CertainTeed, Owens Corning, TAMKO Building Products LLC, American Buildings Co., and BlueScope

b. The key factors that are driving the North America steel roofing market include growing awareness of green building products in the construction sector and rapidly increasing industrialization in Mexico

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."