- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Trail Running Shoes Market, Industry Report 2030GVR Report cover

![North America Trail Running Shoes Market Size, Share & Trend Report]()

North America Trail Running Shoes Market (2024 - 2030) Size, Share & Trend Analysis Report By Type (Light Trail Running Shoes, Rugged Trail Running Shoes, Off-Trail Running Shoes), By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-280-5

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

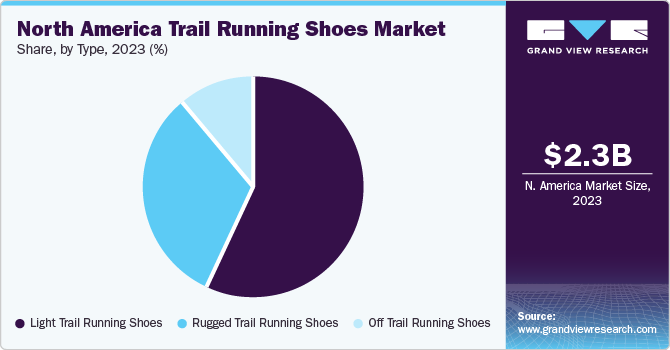

The North America trail running shoes market size was estimated at USD 2.31 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. Increasing participation in trail running and high spending on trial sports are significant drivers contributing to the market demand for trail running shoes in North America.

As more individuals embrace trail running as a preferred outdoor activity, there is a corresponding surge in demand for high-performance footwear tailored to the unique challenges of off-road terrain. The growing popularity of trail sports fuels consumer interest in investing in specialized gear, including trail running shoes designed to provide optimal traction, stability, and durability on rugged trails.

The willingness of trail enthusiasts to allocate significant budgets towards their passion for outdoor recreation further amplifies the demand for premium-quality trail running shoes, driving innovation and competition among brands to meet the evolving needs and preferences of North American trail runners.

As health and wellness trends continue to surge, an increasing number of individuals are seeking outdoor activities that offer both physical exertion and mental rejuvenation. Trail running, with its blend of challenging terrain and natural landscapes, has emerged as a favored pursuit among fitness enthusiasts and nature lovers alike. This surge in interest is further fueled by the pervasive influence of social media, where outdoor adventures, including trail running escapades, are widely shared and celebrated.

The continuous innovation in trail running shoe design, characterized by advanced materials and ergonomic features, has captured the attention of consumers seeking high-performance footwear for rugged terrains. Popular brands such as Salomon, Brooks, Merrell, Altra, Nike, and Hoka One One have become household names among North American trail runners, offering a diverse range of options to cater to varying preferences and needs. For instance, in July 2022, Merrell, a leading outdoor footwear brand, unveiled its latest elite trail running shoe collection, including the MTL Long Sky 2 and MTL MQM. Designed through the Merrell Test Lab (MTL), these shoes are engineered for athletes embracing the unpredictability of the trail. Lab-verified and athlete-validated, the MTL collection guarantees agility, versatility, and trail-specific performance, even in challenging off-road conditions.

The trail running shoe market in the U.S. and Canada is expected to witness growth in terms of product sales and adoption, as these countries have seen an increase in the number of individuals participating in trail running over the past few years. Participation in trail running in the U.S. is growing at an annual rate of 5.0% to 7.0%, while in Canada, participation is growing at an annual rate of 6.0% to 10.0%.

Technological advancements stand out as a driving force in global trail running shoes market, with consumers gravitating toward shoes that integrate features like advanced cushioning technologies, lightweight materials, and superior traction for optimal performance on varied terrains. Moreover, brands are innovating to meet the demand for shoes that strike a balance between durability and agility, enhancing the overall trail running experience.

Sustainability has also emerged as a prominent trend, influencing consumer preferences for eco-friendly materials and sustainable manufacturing practices. Brands incorporating recycled materials and adopting ethical production processes are gaining traction among environmentally conscious consumers.

According to a 2020 survey conducted by the International Trail Running Association, 40.8% of individuals consider using two pairs of trail running shoes a year, followed by 23.3% who use three pairs of trail running shoes annually. Furthermore, around 37% of trail running participants spend approximately €200 to €400 (USD 218 to USD 437) on trail running equipment, and 18% allocate approximately €400 to €600 (USD 437 to USD 656) on equipment. Over 75% of trail running participants spend more than €200 (USD 218) on trail running equipment each year.

Moreover, the influence of social media has further supported the increased participation in trail running in the U.S. and Canada, further boosting the demand for trail running shoes. Social media plays a crucial role in promoting trail running events, with extensive coverage of races, participant stories, and behind-the-scenes content. This has led to an increase in excitement surrounding trail running and a medium of attracting new participants, inspiring them to take part in the sport.

Market Characteristics & Concentration

In North America, trail running shoes exhibit a high degree of innovation, with manufacturers constantly pushing the boundaries of design and technology to meet the evolving needs of trail runners. Innovations include advanced cushioning systems for enhanced comfort and shock absorption, lightweight yet durable materials to optimize performance on rugged terrain, and specialized traction patterns for superior grip on varied surfaces. In addition, brands are incorporating sustainable materials and manufacturing processes to reduce environmental impact.

Regulations in North America play a crucial role in ensuring the safety, quality, and performance of trail running shoes. Compliance with regulations helps build consumer trust and confidence in the products while also fostering fair competition and market transparency. In addition, regulations may influence innovation by setting benchmarks for sustainability, environmental responsibility, and ethical manufacturing practices within the trail running shoe industry in North America.

Type Insights

Based on type, the light trail running shoes segment led the market with the largest revenue share of 55.81% in 2023. The demand for light and safe running shoes has increased due to the growing popularity of trail running. Consumers are more inclined to wear light and fashionable trail running shoes owing to their multi-functionality. These can be used for both daily jogging and trail running and are highly preferred by consumers as they balance comfort, safety, design, and agility. The lightweight design of these shoes is a key draw, providing runners with enhanced agility and responsiveness on uneven surfaces, contributing to a faster and more comfortable experience. A broader trend toward outdoor activities and a desire for a closer connection to nature further fuel the demand for footwear that complements these pursuits.

The rugged trail running shoes segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. A surge in outdoor activities, coupled with a growing interest in health and wellness, has led consumers to embrace trail running as a favored fitness pursuit. This shift is further fueled by the rise of trail running events and communities, creating a demand for specialized footwear capable of navigating challenging terrains. The overarching athleisure trend, emphasizing comfortable and functional footwear for both exercise and daily wear, has also contributed to the popularity of rugged trail running shoes. Manufacturers are responding to this demand by introducing innovative materials and construction techniques that enhance durability, performance, and versatility.

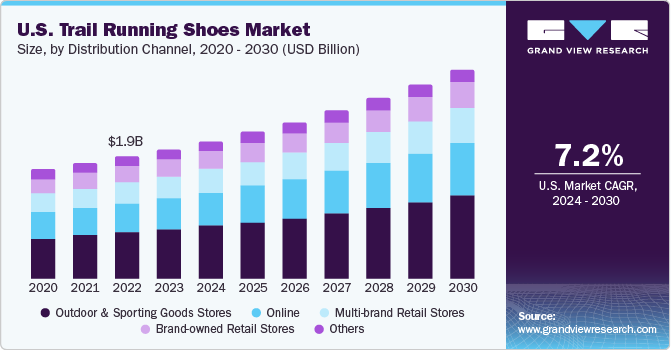

Distribution Channel Insights

Based on distribution channel, the outdoor & sporting goods stores segment led the market with the largest revenue share of 38.14% in 2023. In North America, consumers favor buying shoes from outdoor and sporting goods stores for several reasons. As these stores offer a specialized and curated selection of footwear tailored to specific activities such as hiking, running, or sports. The presence of knowledgeable staff, often enthusiasts or experts in outdoor pursuits, provides customers with valuable guidance and recommendations, enhancing their decision-making process.

In November 2023, Academy Sports + Outdoors, a sporting goods and outdoor recreation retailer, announced new store openings with the launch of seven outlets across five U.S. states. The Academy plans to sustain its expansion momentum, aiming to open 120 to 140 additional stores by the end of 2027.

The online segment is expected to grow at the fastest CAGR of 8.2% from 2024 to 2030. The convenience of online shopping allows customers in the U.S. and Canada to browse a vast array of trail running shoes from the comfort of their homes, eliminating the need to visit physical stores. This convenience appeals to busy parents and working individuals seeking a hassle-free shopping experience. Consumers prefer to purchase trail running shoes through online portals and official websites as they receive value-added services such as cash on delivery, return policy, and after-sales service.

Country Insights

U.S. Trail Running Shoes Market Trends

The U.S. dominated the trail running shoes market with a revenue share of 78.6% in North America market in 2023. The market is witnessing significant expansion, propelled by a convergence of factors and trends that align with the changing preferences of consumers. Growing interest in outdoor activities, particularly trail running, has emerged as a key catalyst, with individuals increasingly embracing fitness and wellness as integral components of their lifestyles. Notably, consumers are prioritizing comfort in their footwear choices, prompting a demand for trail running shoes designed with advanced cushioning and support.

In December 2023, Nike announced two trail running shoes that will be available in 2024: the Nike Zegama 2 and the Nike Pegasus Trail 5. The Zegama 2 boasts features such as cushioning, stability, and overall support. The shoe's upper section is crafted from mesh, complemented by a Nike ZoomX midsole and a Vibram outsole. Notably, the Zegama 2 is designed to be slightly wider than its predecessors, accommodating the natural expansion of runners' feet throughout their run.

The trail running shoes market in Canada is expected to grow at the fastest CAGR of 6.1% from 2024 to 2030. Canadians are increasingly embracing outdoor activities, with trail running gaining popularity as a favored choice for fitness enthusiasts seeking to combine exercise with a connection to nature. This shift toward an active lifestyle, coupled with a heightened focus on health and wellness, has spurred a growing demand for specialized footwear like trail running shoes. In addition, manufacturers are responding to this surge by introducing new shoes with enhanced flexibility, recognizing the need for adaptability to diverse terrains commonly encountered in trail running.

For instance, in July 2023, Canada Goose announced its inaugural sneaker, the Glacier Trail Sneaker, signaling the Toronto-based luxury outerwear brand's expansion into the footwear category. Initially venturing into this space with a collection of boots in 2021, Canada Goose introduced a waterproof and meticulously crafted sneaker designed for diverse terrains. The Glacier Trail Sneaker caters to walking, hiking, exploring, and urban strolling, epitomizing rugged luxury suitable for various activities.

Key North America Trail Running Shoes Company Insights

North America market is witnessing dynamic growth driven by several key factors that are reshaping consumer preferences and industry dynamics. As outdoor activities gain popularity, particularly among health-conscious individuals and adventure enthusiasts, the demand for high-performance trail running shoes is on the rise. With the advent of social media and digital connectivity, the influence of trends and innovations spreads rapidly, prompting consumers, especially the younger demographic, to seek out trail shoes that not only offer superior functionality but also reflect their style and values.

Major athletic footwear brands, along with specialized trail running shoe manufacturers, are engaged in fierce competition to capture a larger share of this expanding market. These brands invest heavily in research and development to introduce cutting-edge materials, technologies, and designs that enhance the performance and comfort of trail shoes. Furthermore, collaborations with athletes, outdoor influencers, and environmental organizations play a pivotal role in shaping brand identity and customer loyalty.

Nike, Inc. New Balance, Adidas Outdoor, and Brooks Sports, Inc (Berkshire Hathaway) are some of the dominant players operating in North America market.

-

Nike, Inc. offers a selection of trail running shoes designed for off-road running and challenging terrains. These shoes typically feature durable outsoles, enhanced traction, and supportive designs to handle the demands of trail running

-

Brooks Running has a global footprint, with a widespread presence in North America, Europe, Asia, and beyond. The company has strategically expanded its distribution channels to meet the diverse needs of runners worldwide, making its products accessible through authorized retailers, specialty running stores, and online platforms

Merrel, Saucony, La Sportiva, and Salomon are some of the emerging market players functioning in North America market.

-

Salomon is a French outdoor sports equipment and apparel company that boasts a comprehensive product portfolio catering to outdoor enthusiasts, encompassing trail running shoes, hiking boots, skiing and snowboarding equipment, as well as a range of apparel and accessories

-

Merrell is an American footwear company specializing in outdoor and performance-oriented products

Key North America Trail Running Shoes Companies:

- Salomon

- Nike, Inc.

- Brooks Sports, Inc (Berkshire Hathaway)

- Hoka One One

- New Balance

- Merrel

- Saucony

- The North Face (Americas)

- ALTRA RUNNING (Outdoor Segment)

- Adidas Outdoor

- La Sportiva

Recent Developments

-

In February 2024, Merrell, a brand by Wolverine World Wide, Inc., introduced two innovative trail running shoes, the Matryx MTL Skyfire II and the MTL Long Sky II Matryx, featuring a novel fabric infused with Kevlar. This advanced material, woven from yarn combining individually coated polyamide fibers and Kevlar, produces an upper that excels in both lightweight design and exceptional durability. The incorporation of Kevlar enhances the toughness of the upper, making these trail running shoes resilient for rugged terrains while maintaining a featherlight feel

-

In July 2023, Nike introduced the Ultrafly Trail Racing Shoe, a high-performance runner designed for speed, sleekness, and exceptional grip. With a carbon Flyplate embedded in the sole, the Nike trail shoes deliver impressive performance. Developed in collaboration with Vibram, renowned for its cutting-edge rubber soles, the Ultrafly incorporates Vibram's agile outsole design and lug technology, ensuring lightweight traction and optimum performance on varied terrains

-

In June 2022, Salomon unveiled the latest iteration of its renowned trail running shoes, the Speedcross 6, continuing the legacy established in 2006. The Speedcross 6 boasts a lighter design at 298g and a more robust, grippy connection to the ground, particularly in wet conditions. This improved grip is attributed to a revamped outsole featuring Y-shaped lugs designed to expel mud more efficiently

North America Trail Running Shoes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.45 billion

Revenue forecast in 2030

USD 3.70 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, country

Regional scope

North America

Country scope

U.S; Canada

Key companies profiled

Salomon; Nike, Inc.; Brooks Sports, Inc (Berkshire Hathaway); Hoka One One; New Balance; Merrel, Saucony; The North Face (Americas); ALTRA RUNNING (Outdoor Segment); Adidas Outdoor; La Sportiva

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Trail Running Shoes Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America trail running shoes market report based on type, distribution channel, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Trail Running Shoes

-

Rugged Trail Running Shoes

-

Off Trail Running Shoes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Outdoor & Sporting Goods Stores

-

Brand-owned Retail Stores

-

Multi-brand Retail Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America trail running shoes market size was estimated at USD 2.31 billion in 2023 and is expected to reach USD 2.45 billion in 2024.

b. The North America trail running shoes market is expected to grow at a compounded growth rate of 7.1% from 2024 to 2030 to reach USD 3.70 billion by 2030.

b. The rugged trail running shoes accounted for a share of 32.8% in 2023. Rugged trail running shoes are equipped with aggressive tread patterns and grippy outsoles that offer superior traction on varied surfaces, including loose gravel, wet rocks, and slippery slopes. The enhanced traction helps runners maintain stability and control, reducing the risk of slips, falls, and injuries on rugged terrain.

b. Some key players operating in the North America trail running shoes market include HOKA ONE ONE, Salomon, Brooks Sports, Inc., New Balance, ALTRA RUNNING, Adidas Outdoor, and La Sportiva, among others.

b. Key factors that are driving the market growth include the increasing participation in trail running and high expenditure on trail sports

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.