- Home

- »

- Consumer F&B

- »

-

Oat-based Snacks Market Size, Share & Trends Report 2030GVR Report cover

![Oat-based Snacks Market Size, Share & Trends Report]()

Oat-based Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Oat-based Bakery And Bars, Oat-based Savory), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-517-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oat-based Snacks Market Size & Trends

The global oat-based snacks market size was valued at USD 22.43 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The market growth is attributed to the rising demand for healthy and nutritious snacks among consumers, who are increasingly aware of the health benefits of oats. Oats are a rich source of fiber, protein, and antioxidants, making them an ideal snack ingredient that promotes weight management, lowers blood sugar levels, and reduces the risk of heart disease.

The growing trend towards plant-based and gluten-free diets has further boosted the popularity of oat-based snacks. The convenience and versatility of oat-based snacks, which can be easily incorporated into various product types such as bars, chips, and crackers, also contribute to their market growth. Additionally, the increasing penetration of oat-based snacks in developing countries, where there is a rising middle class with greater disposable income, supports the market expansion.

High prevalence of chronic diseases such as obesity, diabetes, and cardiovascular diseases has fueled the demand for oats in daily meals as it is a rich source of beta-glucan - an essential soluble fiber for the human body. This helps lower bad cholesterol and blood sugar levels and boosts the good bacteria vital to improve the digestive system of the body. According to the Centers for Disease Control and Prevention and Control (CDC), in the U.S., around 95 million people above 30 years of age have total cholesterol levels higher than 200mg/dL. Increasing concerns over such high cholesterol levels are projected to promote the demand for healthy foods and snacks.

Product Insights

Oat-based bakery and bars dominated the market with the largest revenue share of 71.7% in 2024. Oat-based bakery products and bars have gained immense popularity due to their health benefits, convenience, and versatility. Consumers are increasingly seeking nutritious snack options that fit into their busy lifestyles, and oat-based bars and bakery items, such as cookies, muffins, and granola bars, provide an ideal solution. These products are rich in fiber, protein, and essential nutrients, making them a preferred choice for health-conscious individuals. The growing trend of on-the-go snacking and the rising awareness about the benefits of oats in promoting heart health, digestion, and overall wellness has further fueled the demand for these products. Additionally, the expansion of product varieties and flavors has attracted a wider consumer base, contributing to the significant revenue share held by oat-based bakery and bars in the market.

Oat-based savory is expected to grow at the fastest CAGR of 4.6% over the forecast period. The rising consumer demand for healthier snack alternatives has driven interest in savory oat-based products. These snacks are seen as a nutritious option that offers the benefits of oats, such as high fiber content, in a savory form. Secondly, the increasing popularity of plant-based diets has boosted the demand for oat-based savory snacks, which cater to vegetarians and vegans looking for tasty and nutritious options. Additionally, expanding product varieties and introducing innovative flavors have attracted a wider consumer base. As consumers become more adventurous with their snacking choices, savory oat-based products such as crisps, crackers, and seasoned oat bites are gaining traction.

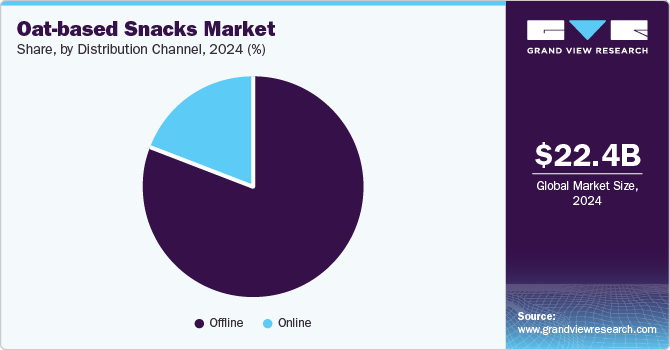

Distribution Channel Insights

The offline channel dominated the market with the largest revenue share in 2024. Traditional brick-and-mortar stores, including supermarkets, hypermarkets, and specialty health food stores, continue to be the primary points of purchase for oat-based snacks. These physical stores allow consumers to see, touch, and evaluate products before buying, which is especially important for food items. In-store promotions, discounts, and the immediate availability of products also contribute to the popularity of the offline channel. Furthermore, the established distribution networks of offline retailers ensure wide accessibility and availability of oat-based snacks to a broad consumer base. The presence of dedicated sections for healthy snacks in physical stores has also significantly attracted health-conscious consumers.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping allows consumers to browse and purchase products from the comfort of their homes, making it a popular choice for busy individuals. The increasing penetration of e-commerce platforms and the expansion of online grocery delivery services have made it easier for consumers to access various oat-based snacks. Additionally, digital marketing strategies, such as targeted ads and social media campaigns, have significantly boosted the visibility and appeal of these products. Online channels often offer detailed product descriptions, customer reviews, and competitive pricing, which help consumers make informed purchasing decisions. The availability of exclusive online deals and promotions further attracts consumers to shop through digital platforms.

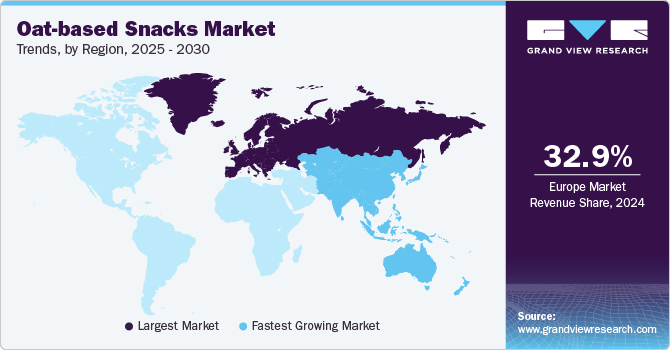

Regional Insights

Europe oat-based snacks industry dominated the global industry with the largest revenue share of 32.9% in 2024. Europe has a long-standing tradition of consuming oat-based products, contributing to the widespread acceptance and popularity of oat-based snacks. The region's focus on healthy eating and nutrition has further propelled the demand for such snacks, which are seen as wholesome and beneficial for health. Additionally, the rise of organic and natural food trends in Europe has favored the growth of oat-based snacks, as they align with consumer preferences for clean and nutritious ingredients. The presence of well-established brands and a strong regional distribution network also supports the market's dominance. Furthermore, the increasing number of health-conscious consumers and the influence of food safety regulations promoting high-quality standards have contributed to the robust growth of the European oat-based snacks market.

North America Oat-based Snacks Market Trends

North America's oat-based snacks industry was identified as a lucrative region in 2024 owing to the region's increasing health consciousness and demand for nutritious snack options. Consumers are becoming more aware of the health benefits of oats, including their high fiber content and ability to support heart health, which has led to a surge in the popularity of oat-based snacks. The market is characterized by a diverse range of products, from granola bars and oatmeal cookies to savory oat crisps and crackers. The rise of plant-based diets and the growing interest in gluten-free products are further fueling the demand for oat-based snacks. Additionally, the strong presence of major oat snack brands and the expansion of online retail channels have made these products more accessible to a wide audience, contributing to the market's expansion.

U.S. Oat-based Snacks Market Trends

The U.S. oat-based snacks industry is expected to grow significantly over the forecast period. Busy lifestyles have led consumers to seek quick, nutritious snack options, and oat-based products fit perfectly into this trend. The market is seeing a significant demand for oat-based bars ideal for on-the-go consumption. Additionally, the influence of health and wellness trends and the popularity of functional foods have boosted the market. The innovation in product offerings, such as high-protein oat bars and oat-based snacks with added superfoods, is also attracting health-conscious consumers. The U.S. market benefits from a well-developed retail infrastructure and the widespread availability of oat-based snacks in supermarkets, health food stores, and online platforms.

Asia Pacific Oat-based Snacks Market Trends

The Asia Pacific oat-based snacks industry is expected to grow at the fastest CAGR of 5.2% over the forecast period.The region is witnessing a shift towards healthier eating habits, and oats, known for their nutritional benefits, are becoming a popular ingredient in various snack products. The market is characterized by a growing demand for oat-based bakery products and bars, which are perceived as healthier alternatives to traditional snacks. The influence of Western dietary trends and the rising disposable income in emerging economies are also contributing to the market's expansion. Additionally, the innovation in product flavors and the incorporation of local ingredients into oat-based snacks are attracting a diverse consumer base. The expansion of e-commerce and improved distribution networks are making oat-based snacks more accessible to consumers across the region.

Key Oat-based Snacks Company Insights

Some key companies in the oat-based snacks market include General Mills Inc., Mondelēz International, Nairn's Oatcakes Limited, WK Kellogg Co, The Quaker Oats Company, and others.

-

General Mills Inc. is a prominent player in the oat-based snacks industry. The company has leveraged its extensive experience in the food industry to develop a range of popular oat-based products, including cereal, granola bars, and snack bars. General Mills has capitalized on the growing consumer demand for healthy and convenient snack options by offering products that are rich in fiber, protein, and essential nutrients. The company's commitment to innovation and quality has helped it maintain a strong market presence. General Mills continues to expand its product portfolio and explore new opportunities in the oat-based snacks market, catering to the evolving preferences of health-conscious consumers.

-

Mondelēz International has a diverse range of snack products, including cookies, crackers, and granola bars, many of which incorporate oats as a key ingredient. Mondelēz International has focused on meeting consumer demand for healthier snack options by developing products that are not only nutritious but also delicious. The company's global reach and strong distribution network have enabled it to effectively market and sell its oat-based snacks to a wide audience.

Key Oat-based Snacks Companies:

The following are the leading companies in the oat-based snacks market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills Inc.

- Mondelēz International

- Nairn's Oatcakes Limited

- WK Kellogg Co

- The Quaker Oats Company

- Bobo's Oat Bars

- Britannia Industries

- Abbott

- Seamild food Group

- Pamela's Products

Recent Developments

-

In September 2024, Glebe Farm Foods, the UK's leading producer of gluten-free British oats, launched a groundbreaking oat drink, PureOaty Tea-rrific, designed specifically for tea enthusiasts. This innovative product addresses the market's need for suitable oat-based alternatives for tea, where milk is predominantly used. Extensive research indicates that concerns about taste, color, and splitting have hindered the adoption of milk alternatives. PureOaty Tea-rrific has been developed to ensure optimal flavor and stability, delivering a consistent and enjoyable tea experience.

-

In July 2024, Tata Soulfull unveiled its latest offering, the Masala Oats+ Dal Shakti, which brilliantly combines the nutritional advantages of Moong dal with the beloved Mast Masala flavor. This innovative snack, prepared in just four minutes, caters to health-conscious consumers seeking convenient options. Renowned for its non-sticky texture and 25% millet content, Tata Soulfull's Masala Oats + range innovatively integrates traditional ingredients, ensuring a nutritious and culturally significant evening snack that resonates with the essence of Indian cuisine.

-

In May 2024, Graze introduced two innovative products: the Snack Pack Crunch multipack and Honeycomb Oat Boosts flapjack, aimed at promoting healthier on-the-go snacking for consumers in the UK. The snack packs, available in smoky barbecue and marmite flavors, are designed for convenience, containing 30% less fat than traditional crisps and under 100 calories per portion. Additionally, Graze's Honeycomb Oat Boosts feature 50% less sugar. Committed to sustainability, the packaging for these products is fully recyclable, increasing the overall recyclability of their range to 94%.

Oat-based Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.46 billion

Revenue forecast in 2030

USD 29.12 billion

Growth Rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa

Key companies profiled

General Mills Inc.; Mondelēz International; Nairn's Oatcakes Limited; WK Kellogg Co; The Quaker Oats Company; Bobo's Oat Bars; Britannia Industries; Abbott; Seamild food Group; Pamela's Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oat-based Snacks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oat-based snacks market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oat-based Bakery and Bars

-

Oat-based Savory

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.