- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Beta Glucan Market Size And Share, Industry Report, 2030GVR Report cover

![Beta Glucan Market Size, Share & Trends Report]()

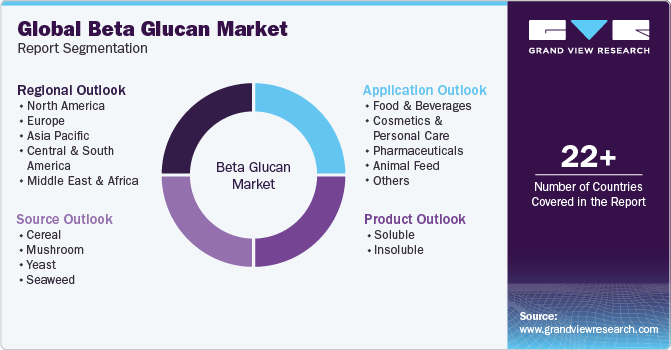

Beta Glucan Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Cereal, Mushroom, Yeast, Seaweed), By Product, By Application (Food & Beverages, Cosmetics & Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-056-9

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beta Glucan Market Summary

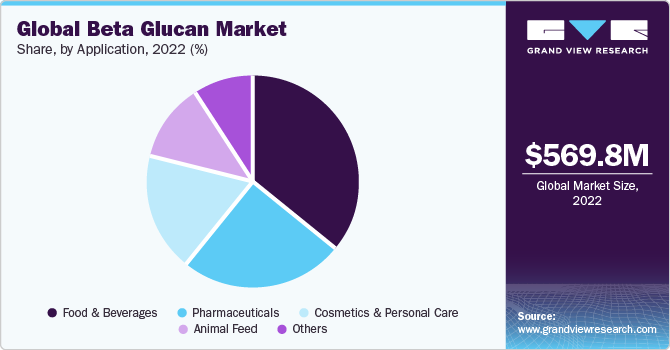

The global beta glucan market size was valued at USD 569.8 million in 2022 and is projected to reach USD 1,055.4 million by 2030, growing at a CAGR of 8.0% from 2023 to 2030. The increasing usage of the product as an immunity booster in the pharmaceutical and nutraceutical industry is anticipated to drive growth.

Key Market Trends & Insights

- Europe dominated the market and accounted for the largest revenue share of 36.6% in 2022.

- The Asia Pacific region, on the other hand, is expected to expand at the fastest CAGR of 9.5% during the forecast period.

- By application, the food & beverages application segment held the largest revenue share of 35.5% in 2022.

- By product, the soluble segment accounted for the larger revenue share of around 61.4% in 2022.

- By source, the cereal segment held the largest revenue share of 34.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 569.8 Million

- 2030 Projected Market Size: USD 1,055.4 Million

- CAGR (2023-2030): 8.0%

- Europe: Largest market in 2022

Changing consumer preferences toward the use of nutritious food supplements over synthetic ingredients are also expected to propel industry growth. The industry is likely to grow on account of increasing awareness among manufacturers regarding the use of multiple sources, as well as different harvesting, processing, and extraction methods. Manufacturers use innovative patented technologies in a bid to improve market share and increase overall sales.

Factors such as growing awareness about the sustainable sourcing of products and the use of organic substitutes in medicines are expected to drive the global production. Producers are adopting various regulations and certifications, namely FSSC 22000, GRAS, USDA Organic, Fairtrade, Kosher, HACCP, and GMP, to ensure the quality and salability of products in an attempt to lure a large base of customers.

The industry is moderately affected by the presence of substitutes, namely guar gum and other natural compounds that are used as immune modulators. Factors such as the increased number of advertisements and the marketing of substitutes are anticipated to hamper industry growth. Technologies used for beta-glucan extraction process include amniotic membrane extraction, dry & wet fractionation process, and chemical extraction process using acids and bases. The yield of the extraction for the product depends on the type of extraction process employed.

Application Insights

The food & beverages application segment held the largest revenue share of 35.5% in 2022 and is further expected to expand at the fastest CAGR of 9.7% over the forecast period. The increased manufacturing of beverages containing beta-glucan due to growing consumer preference towards these health supplements is expected to drive the global industry growth.

Other perceived health benefits linked with the consumption of this product, including cardiovascular health improvement, cognitive improvement, and cancer prevention, are presumed to drive beta-glucan demand. Besides food & beverages, the pharmaceuticals and cosmetics & personal care segments also accounted for substantial shares in the global market in 2022.

Product Insights

The soluble segment accounted for the larger revenue share of around 61.4% in 2022. Soluble fibers easily dissolve in water and are transported through the digestive tract, becoming gelatinous in nature and removing cholesterol from the body by balancing the blood glucose in this process. The rising demand for beta-glucan in pharmaceutical formulations is presumed to be a major factor in increasing the market for soluble products over the forecast period.

The insoluble segment is expected to expand at the fastest CAGR of 8.7% through 2030. Insoluble compounds are mixed with methyl sulfoxide and urea, or partially sulfated with sulfuric acid. The product is widely used in pharmaceutical and biofuel manufacturing, which is expected to benefit the market. Insoluble beta-glucan powder is inert in nature, making it compatible with numerous ingredients used in the production of cosmetics. The cosmetics sector uses this product for manufacturing antifungal creams, antimicrobial creams, deodorants, and other oral care products, thus driving industry growth.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 36.6% in 2022. The presence of a number of major players in Europe, coupled with high disposable income and changing consumer preferences towards the consumption of nutraceutical supplements, is likely to drive product growth over the next eight years. A large number of companies are focusing on using innovative techniques for manufacturing products customized exclusively for end-use industries, which is likely to drive regional growth.

The Asia Pacific region, on the other hand, is expected to expand at the fastest CAGR of 9.5% during the forecast period. Asia Pacific is expected to be a key industry for beta-glucan due to the presence of a significant base of consumer industries. China is anticipated to be the leading economy that drives the demand for the product’s consumption and production in the coming years.

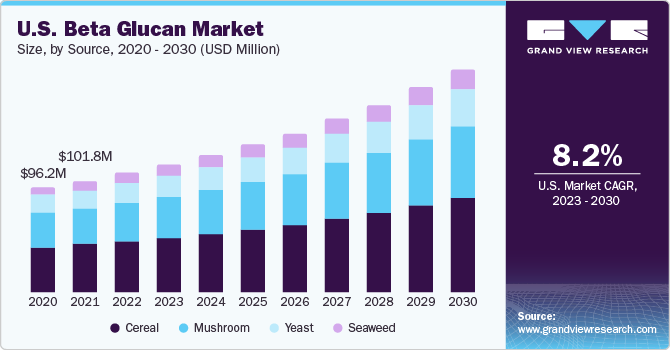

Source Insights

The cereal segment held the largest revenue share of 34.1% in 2022. Cereals are known to have a positive impact on bodily functions and thus are one of the major sources of raw material for product extraction. The mushroom segment is expected to expand at a CAGR of 9.0% during the forecast period. Mushroom-based products are anticipated to cater to several end-use industries. Specific types of mushroom or fungi such as shiitake, reishi, maitake, and turkey tail are used in the manufacturing of beta-glucan, which are further used in cosmetics formulations and animal feed applications.

Baker’s yeast is a widely used source for the product on account of its economical availability. It is used largely in the food and beverage industry, as well as a cheap animal feed. In addition, yeast has higher active linkages when compared to mushroom-sourced products, which makes it very suitable in the pharmaceutical industry for cancer treatment procedures.

Seaweed-sourced beta-glucan is extensively consumed in the production of dietary supplements in the food and beverage sector, which is anticipated to drive industry growth in this segment over the forecast period. Major manufacturers adopted advanced algae-based technology for the extraction of beta-glucan, which is anticipated to drive beta-glucan market expansion over the forecast period.

Key Beta Glucan Company Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are some of the important business strategies used by market participants to maintain and expand their global reach.

Key Beta Glucan Companies:

- Biotec Pharmacon ASA

- Biothera Pharmaceticals

- Ceapro Inc.

- Immunomedics

- Super Beta Glucan Inc.

- DSM NV

- Tate & Lyle plc (Tate & Lyle Oat Ingredients)

- Groupe Soufflet SA (AIT Ingredients)

- Zilor Inc (Biorigin)

- Cargill Incorporated

- Frutarom

- GlycaNova AS

- Lesaffre Human Care

- Garuda International, Inc.

- Millipore Sigma

Recent Developments

-

In November 2022, Ceapro Inc. initiated an advanced phase aimed at expanding its revolutionary Pressurized Gas eXpanded (PGX) technology for the creation of pharmaceutical and nutraceutical offerings. Within the framework of this technology, Alginate and yeast beta-glucan stand as the pioneering bio-actives undergoing processing. This endeavor is poised to enhance the company's portfolio of innovative products

-

In July 2023, BENEO announced the launch of the company’s first barley beta-glucan ingredient, the Orafti β-Fit, for heart health and blood sugar management. This new launch is expected to improve BENEO’s global market reach in the fiber and cardio-metabolic health markets

Beta Glucan Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 610.0 million

Revenue forecast in 2030

USD 1,055.4 million

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Biotec Pharmacon ASA; Biothera Pharmaceticals; Ceapro Inc.; Immunomedics; Super Beta Glucan Inc.; DSM NV; Tate & Lyle plc (Tate & Lyle Oat Ingredients); Groupe Soufflet SA (AIT Ingredients); Zilor Inc (Biorigin); Cargill Incorporated; Frutarom; GlycaNova AS; Lesaffre Human Care; Garuda International, Inc.; Millipore Sigma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beta Glucan Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global beta glucan market report on the basis of source, product, application, and region:

-

Source Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Cereal

-

Mushroom

-

Yeast

-

Seaweed

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Soluble

-

Insoluble

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beta glucan market size was estimated at USD 569.8 million in 2022 and is expected to reach USD 609.9 million in 2023.

b. The global beta glucan market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 1,055.4 million by 2030.

b. Europe dominated the beta glucan market with a share of 36.6% in 2022. This is attributable to the presence of a number of major players in Europe coupled with high disposable income and changing consumer preferences towards the consumption of nutraceutical supplements.

b. Some key players operating in the beta glucan market include Biotec Pharmacon ASA, Biothera Pharmaceuticals, Inc, Ceapro Inc, Super Beta Glucan Inc, DSM NV, Tate & Lyle Plc, AIT Ingredients.

b. Key factors that are driving the market growth include the increasing usage of the product as an immunity booster medicine in pharmaceutical and nutraceutical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.