- Home

- »

- Food Additives & Nutricosmetics

- »

-

Oat Beta Glucan Market Size & Share, Industry Report, 2033GVR Report cover

![Oat Beta Glucan Market Size, Share & Trends Report]()

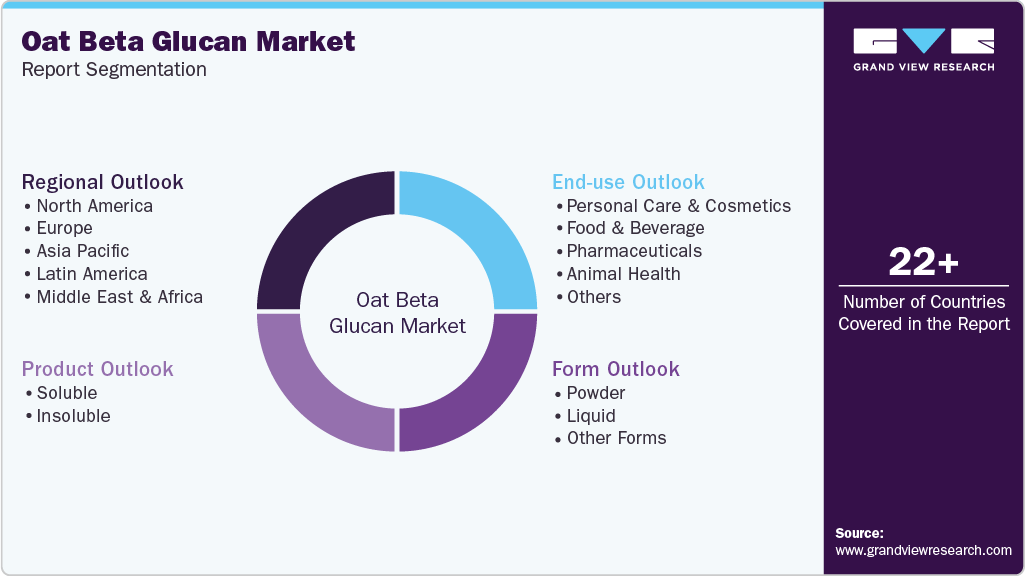

Oat Beta Glucan Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Soluble, Insoluble), By Form (Powder, Liquid), By End-use (Personal Care & Cosmetics, Food & Beverage, Pharmaceuticals, Animal Health), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-739-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oat Beta Glucan Market Summary

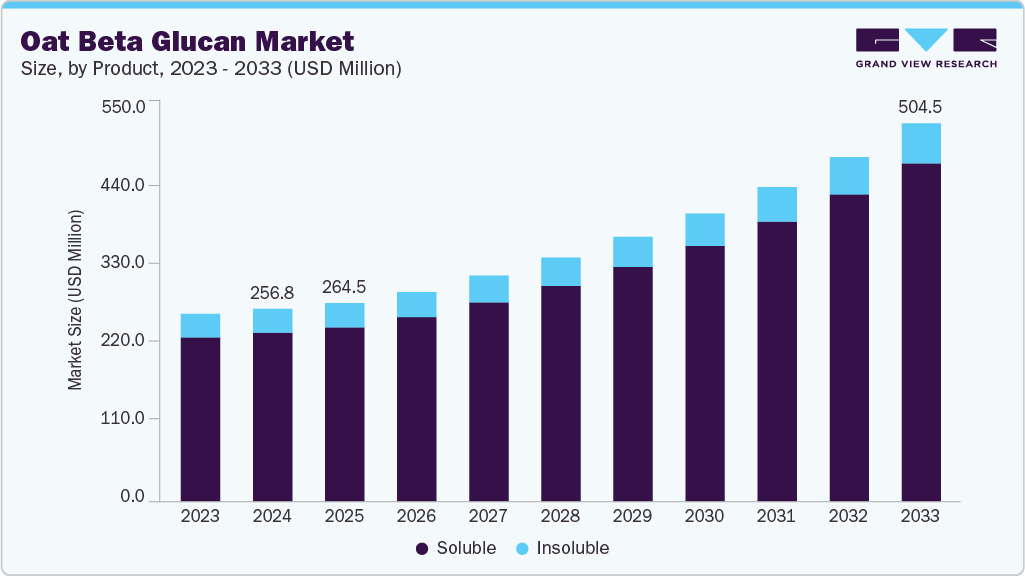

The global oat beta glucan market size was estimated at USD 256.8 million in 2024 and is projected to reach USD 504.5 million by 2033, growing at a CAGR of 8.4% from 2025 to 2033. The industry is driven by increasing consumer awareness of its scientifically backed health benefits, including cholesterol reduction, glycemic control, and gut health improvement.

Key Market Trends & Insights

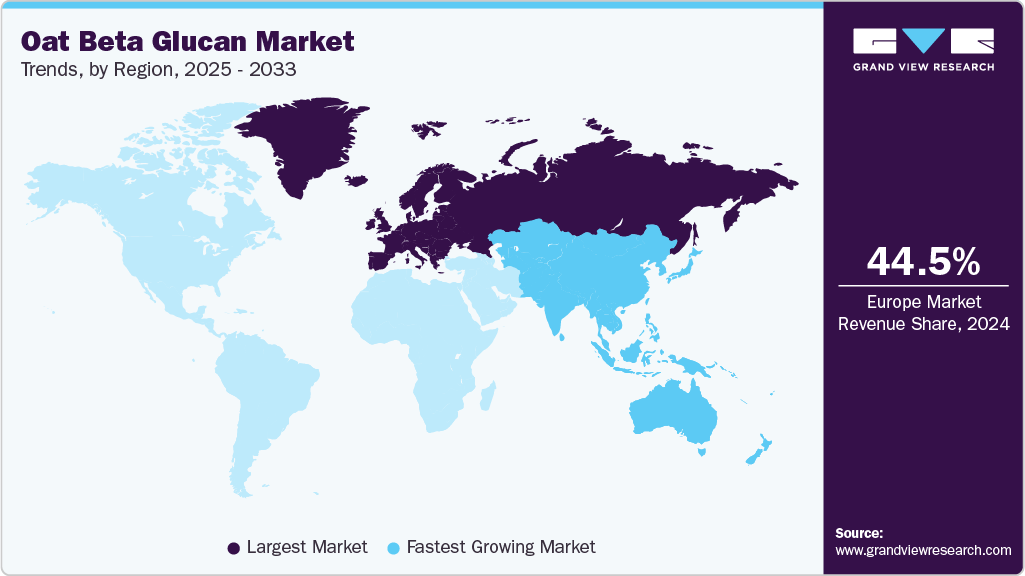

- Europe dominated the oat beta glucan market with the largest revenue share of 44.5% in 2024.

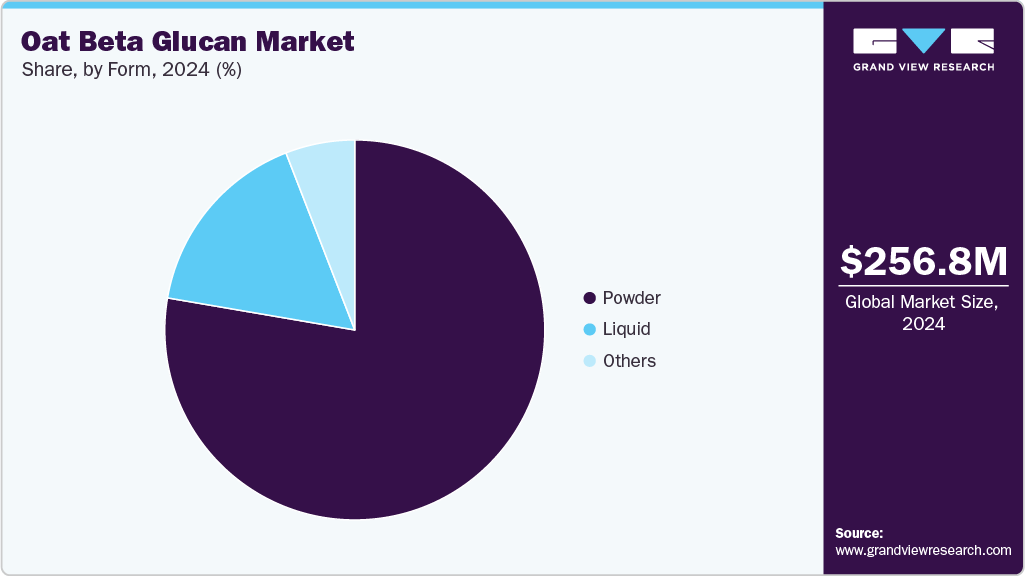

- By form, the powder segment captured the largest revenue share of 77.7% in 2024.

- By product, the soluble segment held the largest revenue share of 87.6% in 2024 in terms of value.

- By end-use, the food and beverage segment held the largest revenue share of 56.9% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 256.8 million

- 2033 Projected Market Size: USD 504.5 million

- CAGR (2025-2033): 8.4%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing region

The rising prevalence of lifestyle-related disorders such as cardiovascular diseases and diabetes has further fueled demand for functional ingredients like oat beta-glucan. Additionally, the growing trend toward clean-label, plant-based, and fiber-enriched products in the food and beverage industry, coupled with expanding applications in nutraceuticals, personal care, and premium pet nutrition, is accelerating market growth. Supportive regulatory approvals for health claims in key markets and heightened focus on preventive healthcare are also contributing significantly to demand expansion.Emerging opportunities in the industry stem from the rapid expansion of functional beverages, dairy alternatives, and beauty-from-within products, where beta-glucan serves as both a health-enhancing and texture-modifying ingredient. The growing consumer shift toward natural, multifunctional ingredients opens new avenues in dermo cosmetics and premium animal nutrition. Moreover, advancements in extraction technologies enabling higher purity, tailored molecular weight, and improved solubility present significant potential for premiumization and market differentiation. Expansion into developing regions with rising health consciousness and increasing investments in product innovation, clinical research, and sustainability-driven sourcing strategies is expected to unlock new revenue streams.

The industry faces challenges related to raw material price fluctuations due to oat harvest variability, which impacts production costs and supply stability. Ensuring consistent molecular weight and viscosity across batches to meet application-specific requirements remains a key technical hurdle. Regulatory complexities around health claims, particularly varying dosage requirements across regions, can delay market entry and increase compliance costs. Additionally, sensory limitations such as oat flavor and texture alterations at higher inclusion rates, coupled with competition from alternative dietary fibers like inulin and resistant starch, pose obstacles to broader adoption in certain product categories.

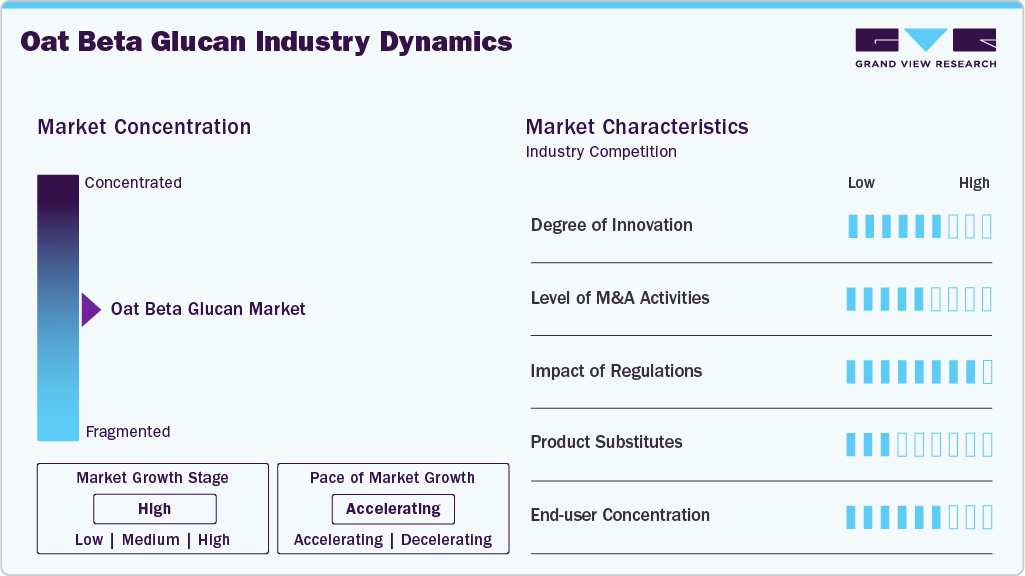

Market Concentration & Characteristics

The industry is moderately fragmented, with a few global players, such as Cargill, Tate & Lyle, DSM-Firmenich, and Kerry Group, dominating the competitive landscape. These companies dominate the market through their extensive product portfolios, well-established supply chains, and strong customer relationships across the food and beverage, nutraceutical, and personal care industries. Their focus lies in delivering high-purity oat beta-glucan with tailored molecular weights and superior solubility to meet diverse application requirements. Additionally, strategic collaborations with food manufacturers, cosmetic brands, and research institutions enable them to co-develop application-specific formulations and accelerate product adoption in emerging segments such as functional beverages, dairy alternatives, and beauty-from-within products.

To strengthen their position, leading players are actively investing in R&D, capacity expansion, and sustainability initiatives. They are leveraging advanced extraction technologies to enhance yield, improve cost efficiency, and offer clean-label, non-GMO, and organic-certified solutions. Many are also pursuing mergers, acquisitions, and partnerships to expand their geographic reach and diversify their customer base, particularly in high-growth regions such as the Asia Pacific and South America. Furthermore, these companies emphasize clinical research and regulatory compliance to substantiate health claims, thereby increasing consumer trust and enabling premium pricing. By integrating digital marketing strategies and direct-to-consumer channels, they are also tapping into the rising demand for nutraceuticals and functional ingredients in the e-commerce sector.

Product Insights

The soluble segment dominated the global industry with the largest revenue share of 87.6% in 2024, primarily due to its superior functional and health-promoting properties. Soluble oat beta-glucan is widely recognized for its clinically proven benefits, including cholesterol reduction, glycemic control, and enhancement of gut health, making it a preferred choice in functional foods, beverages, and nutraceuticals. Its ability to form viscous solutions allows it to deliver desirable texture, mouthfeel, and stability in a wide range of applications such as ready-to-drink (RTD) beverages, dairy alternatives, soups, and nutrition bars. Regulatory approvals supporting heart-health claims for soluble beta-glucan in major markets, coupled with growing consumer demand for fiber-enriched and clean-label products, have further propelled its adoption across key end-use industries.

The insoluble segment, while comparatively smaller, plays an essential role in applications focused on satiety, digestive health, and textural enhancement, particularly in bakery, snacks, and animal nutrition. Insoluble oat beta-glucan is valued for its ability to improve stool bulk, enhance dough structure, and support gut motility, making it suitable for fiber fortification where viscosity is not a critical factor. However, its lower solubility and limited health claim approvals relative to its soluble counterpart have restrained its widespread use in high-value segments such as functional beverages and pharmaceuticals. Despite this, the segment is expected to witness moderate growth in the coming years, driven by increasing utilization in cost-sensitive markets and its compatibility with high-fiber formulations aimed at promoting digestive wellness.

End-use Insights

The food and beverage segment dominated the global oat beta-glucan market with the largest revenue share of 56.9% in 2024, driven by its extensive utilization in functional foods, beverages, and dairy alternatives. Oat beta-glucan is highly valued in this segment for its clinically proven benefits in cholesterol reduction, glycemic control, and digestive health, aligning with the growing consumer demand for clean-label, fiber-enriched, and heart-healthy products. Its functional properties, including viscosity enhancement, fat-mimicking behavior, and ability to improve texture and mouthfeel, make it a preferred ingredient in ready-to-drink (RTD) health beverages, yogurts, plant-based milk, soups, sauces, and nutrition bars. The segment's growth is further supported by increasing regulatory approvals for health claims, rising prevalence of lifestyle-related disorders, and the expansion of fortified and functional food categories across both developed and emerging markets.

The other end-use segments, including pharmaceuticals, personal care & cosmetics, animal health, and others, are witnessing steady growth, albeit at a smaller scale. Pharmaceuticals and nutraceuticals leverage oat beta-glucan for its clinically substantiated benefits in cholesterol management, immune modulation, and prebiotic support, primarily in the form of capsules, powders, and tablets. The personal care and cosmetics segment is expanding due to increasing use of oat beta-glucan in skincare products, where it supports skin barrier repair, moisturization, and soothing properties. In animal health, the ingredient is gaining traction in premium pet food and livestock nutrition, driven by rising pet humanization trends and demand for functional feed additives. The “others” category includes applications in medical nutrition, elderly care, and clinical food formulations, contributing to niche but promising opportunities for market expansion.

Form Insights

The powder segment captured the largest revenue share of 77.7% in 2024, owing to its versatility, ease of incorporation, and widespread application across food and beverage, nutraceutical, and personal care industries. Powdered oat beta-glucan is preferred for its high concentration, stability during processing, and compatibility with various product formats such as bakery premixes, dairy alternatives, dietary supplements, and powdered beverages. Its longer shelf life, cost-effectiveness in transportation and storage, and ability to retain functional properties during thermal and mechanical processing have further strengthened its dominance. Additionally, manufacturers favor powdered forms for their flexibility in blending, dosing accuracy, and scalability in both large-scale food production and nutraceutical formulations.

The liquid and other forms of oat beta-glucan collectively account for a smaller share but serve specialized market needs. The liquid form is increasingly utilized in ready-to-drink (RTD) functional beverages, syrups, and dairy-based drinks due to its convenience and reduced processing requirements for liquid applications. However, its higher transportation and storage costs, coupled with shorter shelf life, limit its broader adoption. The “others” category, which includes granules, pastes, and concentrates, caters to niche industrial applications where high-solids content or specific handling characteristics are required. While these segments are growing gradually, their adoption is expected to remain secondary compared to powder, as they primarily target specialized or high-value formulations rather than mainstream mass-market products.

Regional Insights

Europe oat beta glucan market held the largest share of 44.5% of total revenue in 2024, driven by high consumer awareness regarding functional fibers and their health benefits, particularly for cholesterol reduction and digestive health. Strong regulatory support for health claims by the European Food Safety Authority (EFSA), coupled with the widespread adoption of fiber-enriched foods, plant-based beverages, and fortified bakery products, has further strengthened regional demand. The market is also benefiting from the rising popularity of clean-label and organic products, with key players actively investing in innovation and sustainable sourcing initiatives to meet stringent European standards.

The oat beta glucan market in Germany represents one of the leading markets within Europe, supported by a mature functional food and nutraceutical industry, high prevalence of lifestyle-related disorders, and strong consumer preference for natural, scientifically validated ingredients. The country has witnessed substantial uptake of oat beta-glucan in functional beverages, dietary supplements, and bakery applications, alongside increasing penetration in dermo cosmetic formulations. Leading manufacturers and research institutions in Germany are focusing on clinical studies and product development to enhance market credibility and expand application areas, particularly in preventive healthcare and personalized nutrition.

North America Oat Beta Glucan Market Trends

The oat beta glucan market in North America accounted for 29.3% of the global market in 2024, driven by robust demand for functional and fortified food products, particularly in the United States and Canada. Growing consumer awareness of heart health, diabetes management, and gut wellness, combined with an expanding nutraceuticals market, has boosted the adoption of soluble oat beta-glucan in ready-to-drink beverages, plant-based dairy alternatives, and dietary supplements. The region also benefits from well-established supply chains, supportive labeling regulations, and rising innovation in beauty-from-within products, particularly in the premium segment.

U.S. Oat Beta Glucan Market Trends

The oat beta glucan market in the United States is driven by increasing consumer preference for functional ingredients in beverages, snacks, and dietary supplements. High rates of cardiovascular and metabolic disorders have accelerated demand for oat beta-glucan as a natural cholesterol-lowering solution, while growing e-commerce channels are expanding access to nutraceutical and functional food products. U.S.-based manufacturers are focusing on R&D investments, partnerships with food and beverage brands, and clinical substantiation to strengthen product claims and expand penetration in mainstream consumer categories.

Asia Pacific Oat Beta Glucan Market Trends

The oat beta glucan market in Asia Pacific captured 20.9% of the global market in 2024 and is projected to witness the fastest growth during the forecast period. Rising health consciousness, urbanization, and a growing middle-class population are driving demand for fiber-enriched and functional foods, particularly in China, Japan, South Korea, and Australia. The region is witnessing increasing adoption of oat beta-glucan in glycemic control products, beauty-from-within supplements, and premium pet nutrition. Expanding distribution networks and growing domestic production capacities are further supporting market expansion in this region.

China oat beta glucan market is emerging as a key market in Asia Pacific, driven by the increasing incidence of diabetes and cardiovascular diseases, coupled with a rapid shift toward functional foods and dietary supplements. The country is experiencing strong demand for soluble oat beta-glucan in fortified beverages, plant-based milk, and nutraceutical capsules, while the beauty-from-within trend is also creating opportunities in collagen-alternative and skin health formulations. The government's focus on preventive healthcare and rising local manufacturing investments are further accelerating market growth in China.

Latin America Oat Beta Glucan Market Trends

The oat beta-glucan market in Latin America is driven by increasing awareness of dietary fibers and their role in cardiovascular and digestive health. Brazil and Mexico are the leading contributors, with demand primarily concentrated in bakery, beverages, and dietary supplements. However, price sensitivity and limited local production capacities have led to a reliance on imports, creating opportunities for international players to establish stronger distribution networks and introduce cost-effective, application-ready solutions.

Middle East & Africa Oat Beta Glucan Market Trends

The oat beta-glucan market in the Middle East & Africa remains in its nascent stage but is gaining traction due to rising health awareness, increasing prevalence of lifestyle-related diseases, and government-led initiatives promoting fortified foods. Demand is emerging in clinical nutrition, infant foods, and premium health beverages, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. Limited local production presents an opportunity for global suppliers to expand their presence through partnerships with regional distributors and food manufacturers.

Key Oat Beta Glucan Company Insights

Key players operating in the oat beta-glucan market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Oat Beta Glucan Companies:

The following are the leading companies in the oat beta glucan market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated

- Kerry Group plc.

- Tate & Lyle

- Lantmännen Biorefineries

- Swedish Oat Fiber AB

- COSCIENS BIOPHARMA

- Oy Karl Fazer Ab

- Guangzhou Sinocon Food Co., Ltd.

- L&P Food Ingredient Co., Ltd.

- Nova Laboratories

Global Oat Beta Glucan Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 264.5 million

Revenue forecast in 2033

USD 504.5 million

Growth rate

CAGR of 8.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil

Key companies profiled

Cargill, Incorporated; Kerry Group plc.; Tate & Lyle; Lantmännen Biorefineries; Swedish Oat Fiber AB; COSCIENS BIOPHARMA; Oy Karl Fazer Ab; Guangzhou Sinocon Food Co., Ltd.; L&P Food Ingredient Co., Ltd.; Nova Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oat Beta Glucan Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global oat beta glucan market report based on material, form, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Soluble

-

Insoluble

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Powder

-

Liquid

-

Other Forms

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Personal Care & Cosmetics

-

Food and Beverage

-

Pharmaceuticals

-

Animal Health

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Latin America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global oat beta glucan market size was estimated at USD 256.8 million in 2024 and is expected to reach USD 264.5 million in 2025.

b. The oat beta glucan market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2033 to reach USD 504.5 million by 2033.

b. The global oat beta-glucan market is driven by rising demand for functional and clean-label ingredients in food, beverages, and nutraceuticals, coupled with increasing consumer awareness of heart health, cholesterol management, and gut wellness benefits. Supportive regulatory approvals for health claims further enhance market growth.

b. The soluble segment dominated the market with the largest revenue share of 87.6% in 2024 due to its superior functional properties, including high solubility, cholesterol-lowering effects, and ease of incorporation into a wide range of functional foods, beverages, and nutraceuticals. Its regulatory-approved health claims and strong consumer preference for heart and gut health solutions further accelerated its adoption.

b. Some of the key players operating in the oat beta glucan market include Cargill, Incorporated, Kerry Group plc., Tate & Lyle, Lantmännen Biorefineries, Swedish Oat Fiber AB, COSCIENS BIOPHARMA, Oy Karl Fazer Ab, Guangzhou Sinocon Food Co., Ltd., L&P Food Ingredient Co., Ltd., and Nova Laboratories.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.